To be honest, this market has been incredibly difficult. Both bulls and bears could easily be liquidated if they weren't careful. Last night saw another double whammy for both sides. Luckily, my friends and I are okay; at worst, we broke even and just sat there watching the sun. We even made a considerable profit from our ETH short positions. In this kind of volatile market, you have to observe more and act less, only seizing high-value opportunities. You must reduce trading frequency and avoid hasty, reckless actions.

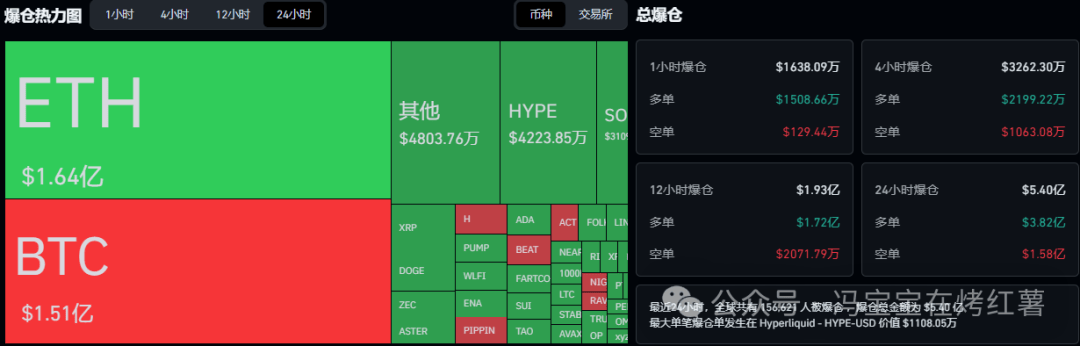

In the past 24 hours, a total of 156,621 people across the internet have had their positions liquidated, with a total liquidation amount of $540 million. Long positions were liquidated for $382 million and short positions for $158 million.

BTC

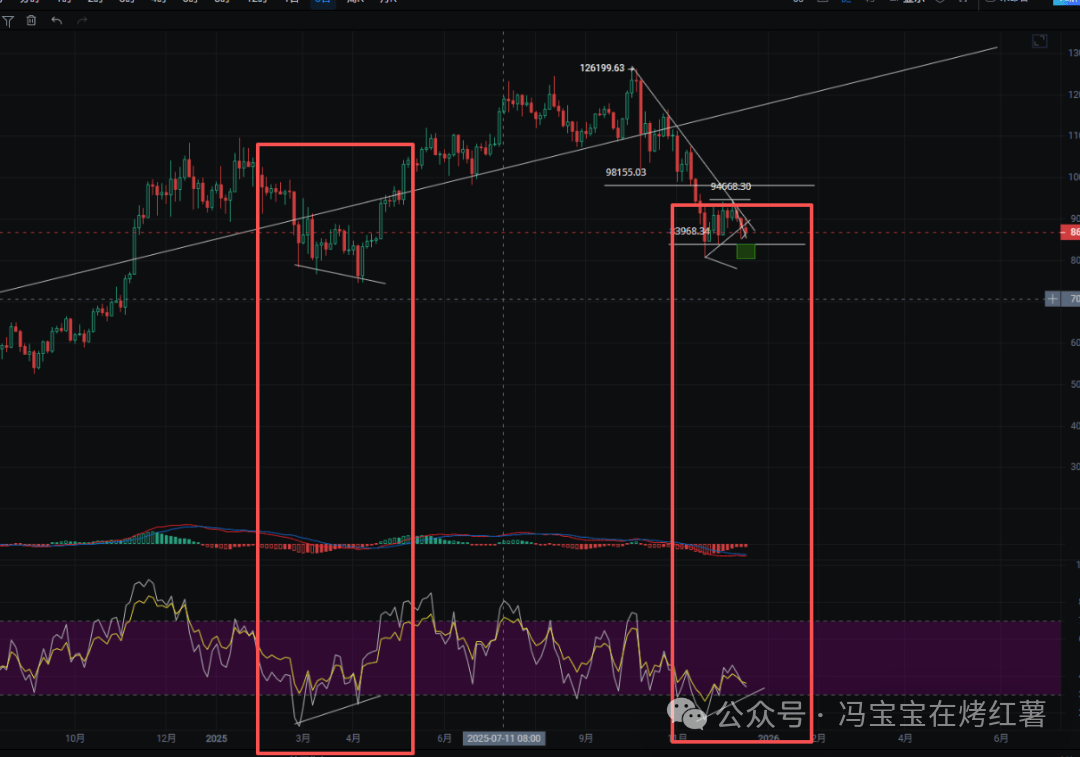

The current market's core characteristic is an extreme lack of liquidity. Funds are being drawn away by the "Seven Sisters" of the US and Cuban currencies, reducing Bitcoin's attractiveness and making the market prone to repeated price spikes and crashes that trigger stop-loss orders and liquidations for both long and short positions. For example, price spikes in the 84,000-88,700 range could trigger such price manipulation.

From a structural perspective, a rapid recovery after breaking below 84,000 could long a rebound opportunity; however, it's advisable to avoid aggressive long positions until the price stabilizes above this level. It's recommended to trade spot with small positions, using a dollar-cost averaging strategy within the 80,000-85,000 range, and reserving funds for extreme downside risks.

Today's strategy is to short: Short-term resistance is at 87000. If it fails to break through, the outlook remains bearish, with targets at 85000-84000. A long position can be taken at 81000, and additional positions can be added at 76000 in extreme cases. If it breaks through 87000, pay attention to the rebound resistance at 88000-89000.

ETH

Ethereum's overall price movement closely mirrors Bitcoin's. Technically, the potential downside target range is 2620-2820, a level that coincides significantly with previous important lows and also conforms to Fibonacci retracement patterns. Within this range, dollar-cost averaging can be considered to position for a medium-term rebound, but the premise remains the same: avoid full-position investing, avoid aggressive strategies, and avoid leverage.

Short-term strategy: Ethereum should pay attention to the 2860 level today. If it fails to rise above 2860, it indicates that the small-scale rebound is weak and the price will continue to fall. The support levels to watch are around 2790, 2761, and 2720.

Copycat

There's an unspoken truth in Web3: the token economics of many projects is basically unrelated to the project's actual business. For example, DEX tokens like UNI, 1inch, and CAKE, no matter how many people use them or how large the trading volume is, you won't make money holding those tokens; at most, you'll be given symbolic governance rights.

Recently, Uniswap's plan to use transaction fees to buy back UNI has made headlines, even though this should have been standard practice. The current popularity of AI tokens stems from their integration of tokens with projects; some use revenue to buy back and burn tokens, while others offer better services to those who hold more. This direction is correct; at least it's no longer just empty promises.

The problem is: are these promises legally binding? What if the team wants to change them? Many projects deliberately use vague language to leave themselves an escape route. In the last round, many teams used this "compliance" excuse to openly refuse dividends and buybacks, ultimately legally exploiting investors.

Therefore, I will use these three criteria to select Altcoin:

1. The more coins you hold, the higher the service privileges you enjoy (tiered usage).

2. If the project makes money, the revenue will be used to buy back tokens (the team will intervene in the market to support the project).

3. Directly use the revenue to burn tokens, creating deflation, so that the price will rise as people use them (the team earns less or nothing).

Ideally, a project should meet two of the criteria. If a project is exceptionally good, meeting only one criterion is acceptable. Ultimately, you need to research the coin's fundamentals to see if it meets the criteria. Does anyone have any Altcoin they'd like to research? I can help take a look.

$DYDX

DYDX is a painful lesson learned the hard way by experienced investors! Emerging as the leading altcoin in 2021, its popularity rivals that of HYPE today. Retail investors heavily invested, hoping it would become the decentralized BNB, only to see it plummet by 99% after launch, leaving countless investors with nothing. Altcoin evolve extremely rapidly; today's king may be worthless tomorrow. Retail investors who can't afford to lose should hoard the top ten cryptocurrencies by market capitalization during a bear market—the risk is far less!

$TAKE

Currently, there are no signs of distribution on the market; it is still accumulating and there has been no large outflow of funds. It is difficult to predict the future trend. However, the key levels for the market maker are 0.35, 0.325, and 0.281 below. Whether long or short, you must set these price levels as key stop loss levels to avoid being trapped!

Every sharp drop is followed by a period of great potential. Those who are unsure about future market strategies can follow Potato (or similar product/service): TDTB07

$HYPE

HYPE has broken below the lower boundary and is accelerating its decline. Yesterday's positive news about asset disposal only provided brief support before being quickly swallowed up by the strong selling pressure. There has been no further acceleration in the price action, and the target is around 20 to observe the market's reaction.