This article is machine translated

Show original

[Market Anxiety Spreads Regarding AI Bubble Theory: From Nvidia to Oracle]

Yesterday, the market experienced a complete collapse, stemming from the news that Blue Owl, one of the world's largest alternative asset management firms, suddenly withdrew from a $10 billion financing round for Oracle's Michigan data center project. Oracle issued an urgent clarification stating that "negotiations are progressing as planned and other partners have been selected," but the market still views this as the beginning of an AI infrastructure bubble.

As I analyzed before, with increased uncertainty in funding, market concerns about an AI bubble have become increasingly nitpicky. Previously, there was harsh scrutiny of Nvidia's financial statements; now, the focus has shifted to uncovering financial loopholes in mid-sized AI companies. Yesterday's news of Oracle's breakdown in negotiations with its financing partner is a prime example of this logic.

The immediate trigger was Blue Owl Capital, Oracle's largest data center partner, announcing it would no longer provide $10 billion in financing for a 1-gigawatt (1GW) data center project in Surrey, Michigan. This project was originally intended to provide computing power support for OpenAI.

The core reason for the breakdown in negotiations lies in the lease terms. Blue Owl believes the project's financial returns and leasing terms are inferior to Oracle's previous projects. This reflects a structural shift in financial institutions' attitudes towards AI infrastructure: funding is no longer unconditionally provided, and lenders are beginning to rigorously scrutinize projects' return on investment (ROI) and risk margins. While Oracle attempted to bring in Blackstone as a backup, this cannot mask the rising financing costs for AI infrastructure.

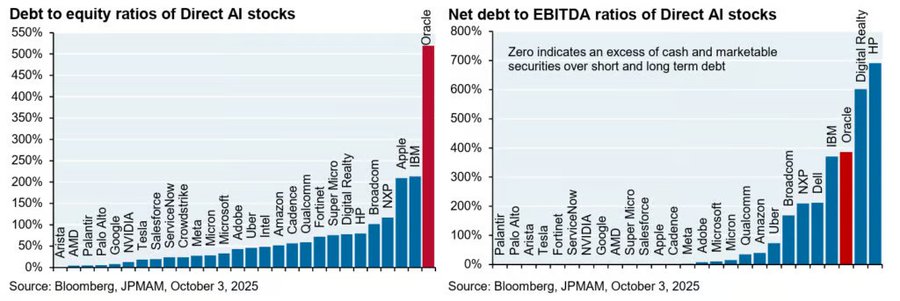

The market's strong reaction to this change stems primarily from Oracle's extremely strained financial situation.

Debt Size: Oracle's total debt is currently close to $130 billion. Its debt-to-EBITDA ratio is approaching the 4x threshold, a crucial reference point for rating agencies to downgrade its investment-grade credit rating.

Cash Flow Bottleneck: To maintain its position in the computing power race, Oracle's annual capital expenditures (CAPEX) have soared to around $50 billion. High hardware investments have severely squeezed free cash flow (FCF), making it difficult to maintain its current construction intensity without external financing.

For giants like Microsoft and Google with ample cash reserves, financing difficulties are merely a matter of timing; however, for mid-sized infrastructure companies like Oracle, which rely heavily on external financing and operate with high leverage, this directly impacts the safety of their balance sheets.

Oracle's predicament will quickly spread throughout the entire AI infrastructure chain.

First, data centers are the physical carriers of the AI industry chain. If financing difficulties lead to construction delays, orders for downstream liquid cooling, power equipment, network switches, and memory chips will face uncertainty. Many companies that rely on AI growth to mask weakness in their traditional businesses will face a reshaping of their revenue logic.

Second, valuations will be restructured. Even if market demand remains strong, increased uncertainty regarding financing risks and delivery cycles will make investors less willing to pay the high premiums of the past. This "valuation killing" will affect all segments, including TSMC, Broadcom, and Arista Networks, as the market shifts from "looking at order volume" to "looking at cash recovery capabilities."

Finally, this will affect the spending confidence of tech giants. When financing and construction bottlenecks appear in the infrastructure sector, and the industry anticipates a slowdown in spending, giants will become more restrained in order to protect their profit margins. If the spending growth of industry leaders slows, demand expectations for the entire industry will revert from "exponential growth" to "linear growth."

The sharp drop on December 17th was not simply a negative factor, but rather a turning point in the AI narrative, shifting from a pure competition of computing power to a competition of financial sustainability.

When the cost of capital is no longer cheap, the market's performance requirements for mid-sized AI companies will become more stringent. Investors will no longer focus on chip shipments, but rather on the health of the balance sheets of companies at each stage. The end of this crisis will depend on whether AI applications can generate sufficient profits and whether infrastructure providers can complete the next stage of capital closure without damaging their credit ratings.

Come and support Teacher Jiang!

Thank you, boss.

x.com/qinbafrank/status/200151...…跟蒋老师在这点上一致,未来AI标的会分化,市场也有业绩,公司质量的要求会越来越高,本来也不是所有的玩家都会成为最终的赢家

qinbafrank

@qinbafrank

12-18

聊聊Blue owl退出甲骨文在密歇根州100亿美金数据中心项目融资的影响,这也是昨晚美股大跌的主要原因。市场既担心资本开支大债务高是否能赚回来,有担心没有资金支持新的资本开支大量的芯片厂商未来业绩的可持续性。从个人的角度来看,也是上周到聊到的回踩的逻辑延续。 x.com/qinbafrank/sta…

Oracle and NeoCloud have too much leverage! Micron's earnings were good yesterday, and the market still seems to be reacting positively, so it feels like there's a chance to buy on the buy the dips!

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content