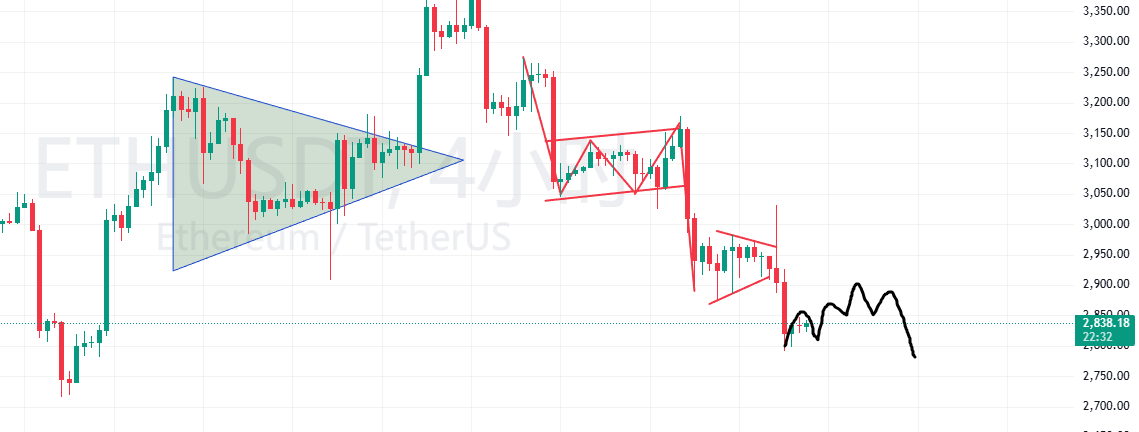

Everyone says the market hasn't been fun lately, so I'll summarize the strategies and reasons:

This is how everyone plays now.

- The main strategy is to leverage small investments for big returns . When the market is down, you have to use your resources sparingly and not waste them.

- For those using alpha strategies with contracts, it's essential to calculate the odds before following up, and to specifically target assets with high trading volume. When encountering sudden price spikes, pre-calculate the stop-loss range for smoother trading.

- The BSC blockchain remains unchanged. Given the current market downturn, I'm not particularly optimistic about Binance Life. It's too difficult for large investors to collectively pump the price. However, if Bitcoin drops again, I'll look for an entry point to buy some. For other cryptocurrencies, I'll only trade low-market-cap coins, either opening contracts or buying spot.

- Abandon KAITO-related projects and don't put your investment money on the blockchain—if the bull market really comes, the biggest fear is encountering project teams running away with your money.

- Keep a close eye on the news feed , quickly analyze the market capitalization of the corresponding cryptocurrency after seeing the news, judge the degree of positive or negative impact, and then make a decisive decision.

Timeline

In late December, I will gradually enter the market to select projects, either those that can yield high returns or those that are suitable for profiting from rebounds. At the same time, I will also buy the dips, waiting for the market trend in the first quarter of next year.

Note : Strategies will be adjusted according to market conditions. The core premise of operation is that a high safety factor and a favorable odds will be taken before taking action.

Contract password:

ICNT: The price action clearly indicates a need for a pullback. Consider shorting for a short-term opportunity. I suggest using 10x leverage with a small position. Open a short position around the current price of 0.4315. Don't set stop-loss and take-profit levels yet; wait for my instructions. If you feel that low leverage won't withstand volatility, you can set a 15-point stop-loss first. Important reminder : Manage your position size carefully; don't over-leverage!

ACT: It also looks like it's trending downwards, so you could try shorting it!