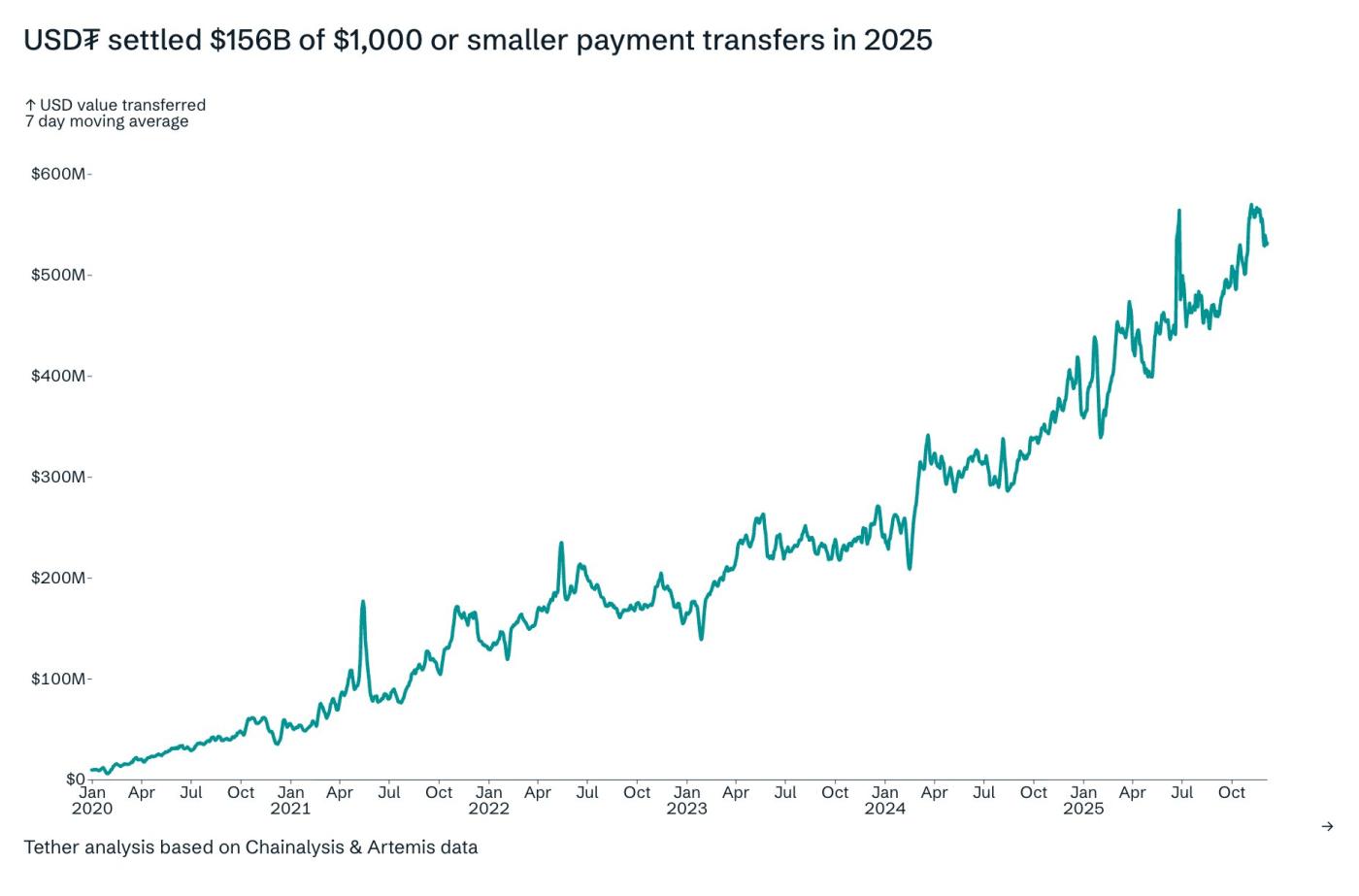

According to figures Chia today by CEO Paolo Ardoino, based on data from Chainalysis and Artemis, Tether's USDT processed $156 billion worth of payments of $1,000 or less in 2025.

This figure highlights an aspect of cryptocurrency adoption that price charts and ETF flows often miss – its use in day trading.

USDT is being used as a replacement for banks and cash.

Small-value transactions now account for a significant proportion of USDT activity . Data shows that from 2020 to the present, the number of these transactions has steadily increased, particularly rapidly in 2024 and into 2025. The Medium daily volume of transactions under $1,000 has exceeded $500 million.

This shows that USDT is increasingly playing the Vai of a digital payment tool, rather than just a trading tool as it was before.

USDT payment data Chia by Tether CEO. Source: X/Paolo Ardoino

USDT payment data Chia by Tether CEO. Source: X/Paolo ArdoinoThe key lies in who uses stablecoins and for what purpose. Transactions under $1,000 typically represent remittances, payroll payments, retail payments, savings transfers, and person-to-person transactions, especially in emerging markets.

Unlike large transactions on the exchange, these transactions are usually repetitive and not speculative in nature.

In fact, USDT is increasingly being used as a replacement for cash and bank transfers in places where access to USD is difficult or expensive.

This trend aligns with the overall picture for USDT in 2025. The amount of USDT in circulation reached a record high this year, indicating demand for USD not only for crypto transactions but also for real-world liquidation .

At the same time, legal factors are also reshaping where and how USDT is used.

In the US, the GENIUS Act clarified the legal framework for stablecoins used for payments, thereby strengthening institutional confidence in USD-backed Token that comply with regulations.

In Europe, MiCA tightened licensing regulations , causing some platforms to shift their operations away from USDT, but global USDT usage on the blockchain remains undiminished.

Capital of stablecoins in 2025. Source: defillama

Capital of stablecoins in 2025. Source: defillamaTether has also expanded its infrastructure. New investments in Lightning-based payment systems demonstrate its goal of pushing USDT onto faster, lower-cost payment networks.

Collaborating with partners in Africa and the Middle East also demonstrates Tether 's focus on supporting payments and financial access for users, rather than solely concentrating on transaction liquidation on exchanges.

Overall, this $156 billion figure reflects a new perspective on the adoption of cryptocurrencies. While market cycles continue to make headlines, stablecoins are quietly becoming an important financial platform.

The continuous growth of small payments in USDT suggests that, in 2025, the adoption of cryptocurrency will no longer be for speculation, but rather for practical purposes, making the global community more flexible and accessible to the USD. This could be a more sustainable shift than a bull market.