Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author: Chang

Article source: ME

On December 18th, according to SoSoValue data, most sectors in the crypto market declined, with 24-hour drops generally ranging from 2% to 7%. The Layer 2 sector fell 6.71%, with Zora (ZORA), Linea (LINEA), and Movement (MOVE) falling 10.39%, 10.41%, and 13.61% respectively. Additionally, Bitcoin (BTC) fell 1.71%, dropping below $87,000; Ethereum (ETH) fell 4.27%, reaching around $2,800.

In other sectors, the PayFi sector fell 3.27% in the last 24 hours, with Ultima (ULTIMA) down 11.88%; the CeFi sector fell 3.68%, but Canton Network (CC) bucked the trend, rising 8.54%; the Layer 1 sector fell 3.78%, with Zcash (ZEC) down 7.36%; the Meme sector fell 4.65%, with MemeCore (M) and PIPPIN (PIPPIN) rising 3.14% and 16.61% respectively; and the DeFi sector fell 5.65%, with Hyperliquid (HYPE) down 7.91%.

The crypto sector indices, which reflect the historical performance of the sector, show that the ssiAI, ssiDePIN, and ssiLayer2 indices fell by 8.39%, 7.14%, and 7.06%, respectively.

ETF Directional Data

According to SoSoValue data, the XRP spot ETF saw a net inflow of $18.99 million yesterday (December 17, Eastern Time).

Yesterday (December 17, Eastern Time), the XRP spot ETF with the largest single-day net inflow was the 21Shares XRP ETF TOXR, with a single-day net inflow of $5.49 million and a historical cumulative net inflow of $5.67 million.

The second largest inflow was the Canary XRP ETF (XRPC), with a single-day net inflow of $5.19 million and a total historical net inflow of $382 million.

As of press time, the XRP spot ETF has a total net asset value of $1.14 billion, an XRP net asset ratio of 0.98%, and a cumulative net inflow of $1.03 billion.

According to SoSoValue data, the Solana spot ETF saw a total net inflow of $10.99 million yesterday (December 17, Eastern Time).

Yesterday (December 17, Eastern Time), the SOL spot ETF with the largest single-day net inflow was the Bitwise SOL ETF BSOL, with a single-day net inflow of $6.96 million and a historical total net inflow of $613 million.

The second largest inflow was into the Fidelity SOL ETF (FSOL), with a single-day net inflow of $2.89 million and a total historical net inflow of $96.42 million.

As of press time, the Solana spot ETF has a total net asset value of $900 million, a Solana net asset ratio of 1.30%, and a historical cumulative net inflow of $726 million.

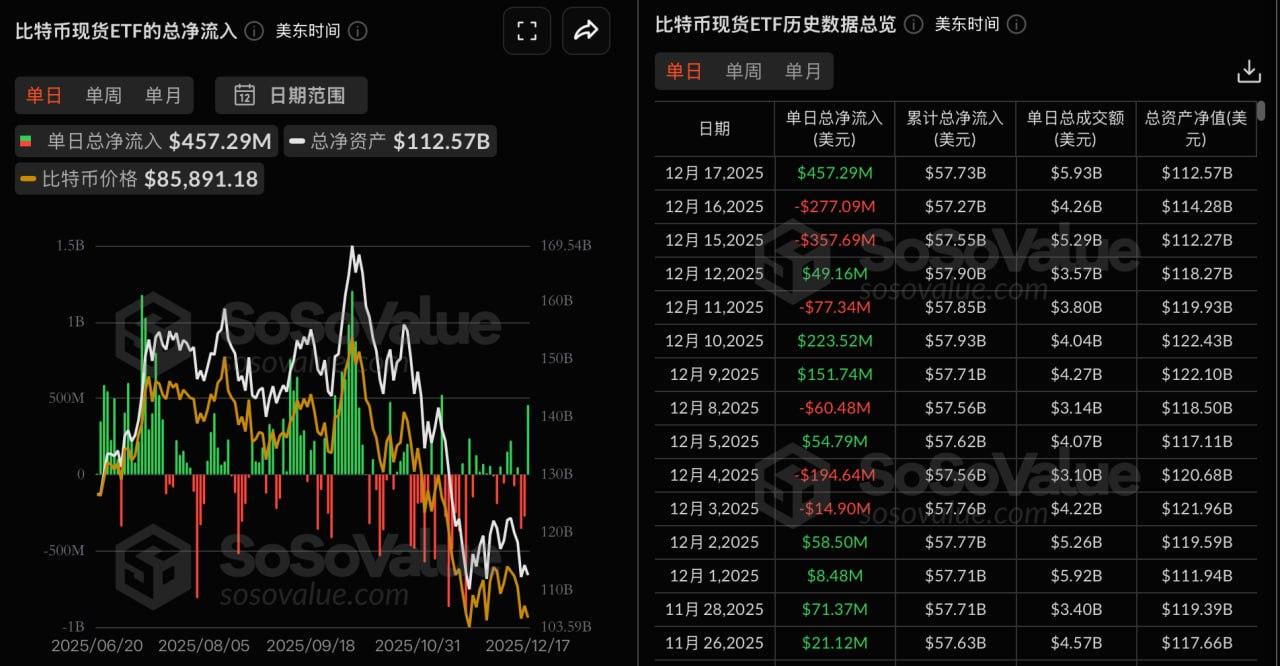

According to SoSoValue data, Bitcoin spot ETFs saw a total net inflow of $457 million yesterday (December 17, Eastern Time).

The Bitcoin spot ETF with the largest single-day net inflow yesterday was the Fidelity ETF FBTC, with a single-day net inflow of $391 million. The current total historical net inflow of FBTC is $12.363 billion.

The second largest inflow was the BlackRock ETF IBIT, with a net inflow of $111 million in a single day. IBIT's total historical net inflow has reached $62.632 billion.

The Bitcoin spot ETF with the largest single-day net outflow yesterday was ARKB, an ETF from Ark Invest and 21Shares, with a net outflow of $36.9629 million. ARKB's total historical net inflow has reached $1.651 billion.

As of press time, the total net asset value of Bitcoin spot ETFs was $112.574 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.57%, and a cumulative net inflow of $57.727 billion.

According to SoSoValue data, the Ethereum spot ETF saw a total net outflow of $22.4264 million yesterday (December 17, Eastern Time).

The Ethereum spot ETF with the largest single-day net outflow yesterday was the BlackRock ETF ETHA, with a single-day net outflow of $19.6119 million. Currently, the total historical net inflow of ETHA is $12.85 billion.

The second largest outflow was from the Fidelity ETF (FETH), with a net outflow of $2.8145 million in a single day. The total historical net inflow for FETH is currently $2.641 billion.

As of press time, the Ethereum spot ETF has a total net asset value of $17.344 billion, with an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 5.09%, and a historical cumulative net inflow of $12.617 billion.

BTC direction

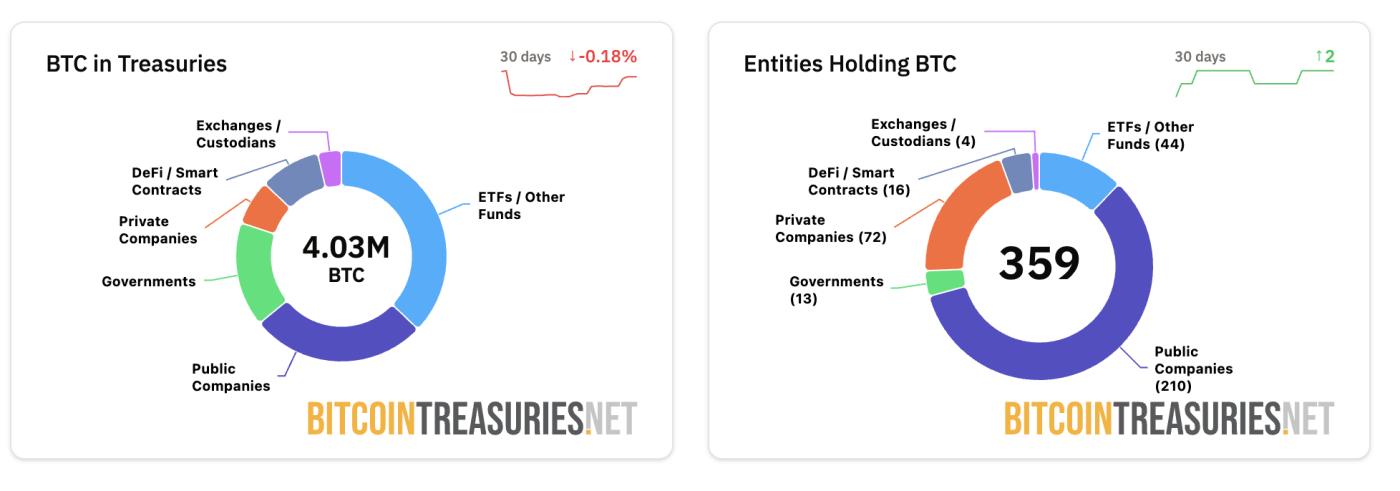

According to data from BitcoinTreasuries, 210 listed companies currently hold a total of 1,087,634 Bitcoins, accounting for 5.17% of the total Bitcoin supply. Among them, Strategy holds the largest amount, with 671,268 Bitcoins, accounting for 61.71% of the holdings of listed companies.

RWA direction

According to CoinFound data:

- Commodity market capitalization: $3.72 billion

- Market value of government bonds: US$1.21 billion

- Market capitalization of institutional funds: $2.83 billion

- Private lending market capitalization: $28.32 billion

- Market value of US Treasury bonds: $8.97 billion

- Market value of corporate bonds: $260 million

- Stablecoin market capitalization: $321.51 billion

X-Stock's market capitalization: $620 million

Market Dynamics:

Exodus partners with MoonPay to develop a USD stablecoin.

SBI Ripple Asia partners with Doppler Finance to explore XRP-based yield infrastructure and RWA tokenization, driving institutional-grade finance on XRPL with stablecoins as the core settlement layer.

The Pakistani government has granted Binance and HTX Global permission to begin exploring tokenization projects involving up to $2 billion in national assets. This represents a significant step forward in sovereign-level RWA tokenization, propelling the adoption of on-chain finance at the national level.

Summarize:

While the overall market capitalization of cryptocurrencies has declined, there has been no single explosive event in the RWA space. However, technological upgrades, institutional outlooks, and community dynamics have all reinforced the core narrative of tokenization.

Stablecoin direction

According to CoinFound data:

- USDT market capitalization: US$199.03 billion

- USDC market capitalization: $77.9 billion

- USDS market capitalization: $11.22 billion

- USDe market capitalization: $6.52 billion

- PYUSD Market Cap: $3.91 billion

- USD1 Market Cap: $2.76 billion

Market Dynamics

Coinbase launched Coinbase Custom Stablecoins, allowing businesses to create 1:1 collateralized branded stablecoins, custodied by Coinbase, supporting cross-chain interoperability and reward mechanisms, and integrated with Coinbase's global distribution network.

Grayscale's report states that 2026 marks the dawn of an institutional era, driven by clearer regulations, stablecoin infrastructure, and tokenized credit markets, as institutions build on-chain balance sheets.

Senator Tim Scott discussed ZK proofs, smart regulation, and decentralized derivatives trading, praising its leadership in stablecoin legislation and its role in advancing market structure legislation.

Summarize:

The stablecoin market as a whole has maintained stable development. Although the total market capitalization has declined slightly, the market remains calm and has maintained strong resilience.