To many, Magic Eden is known as the leading NFT marketplace on Solana. However, Magic Eden has already evolved beyond a marketplace into a crypto entertainment platform. Let’s examine the changes that have shaped this transition.

Key Takeaways

Magic Eden has shifted from a simple NFT marketplace to a “crypto entertainment platform” by integrating gaming elements.

Features like “Lucky Buy” and “Pack Ripping” focus on user fun, successfully rebranding the platform’s image.

The platform allocates 30% of its revenue to buy back $ME tokens and NFTs, creating a strong link with its holders.

1. Magic Eden: Not Just NFTs

Magic Eden, founded in 2021, quickly disrupted the “NFT Marketplace War.” Magic Eden rose as a key player on Solana by offering low fees and creator-friendly tools. To date, Magic Eden has facilitated $15-20 billion in NFT trading volume over the past four years.

However, this strong first impression has led to a low valuation for the project.

This is because many investors still view Magic Eden only as the “top NFT exchange on Solana.” Consequently, fears regarding the broader NFT market lead to fears about Magic Eden itself.

However, Magic Eden moved past being a simple NFT marketplace long ago. It has already built a diverse set of revenue streams.

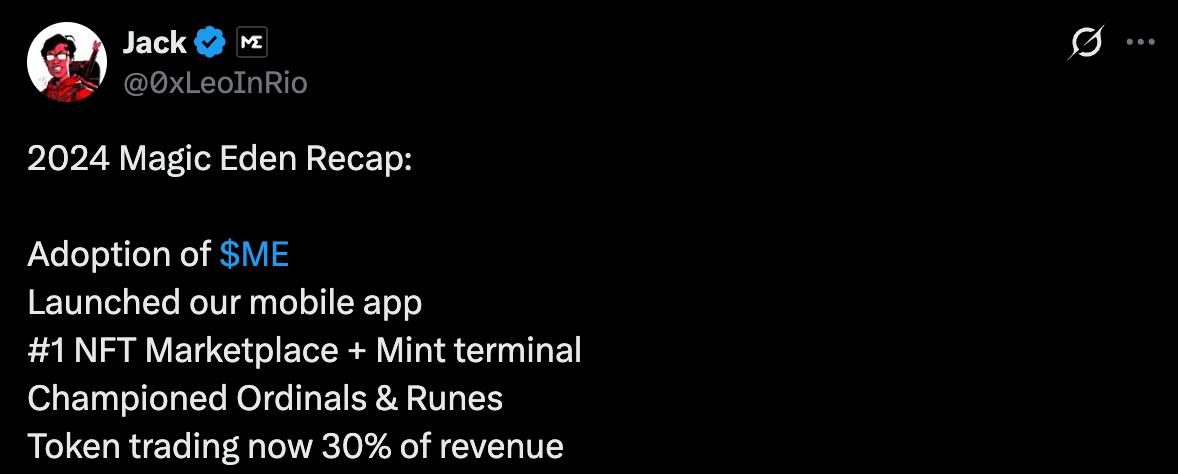

Jack, the co-founder, stated on X that token trading now accounts for over 30% of total revenue as of 2024. This marks a clear shift from the past when the firm relied solely on NFT fees. The change continues in 2025 as Magic Eden adds gaming features to evolve into an entertainment platform.

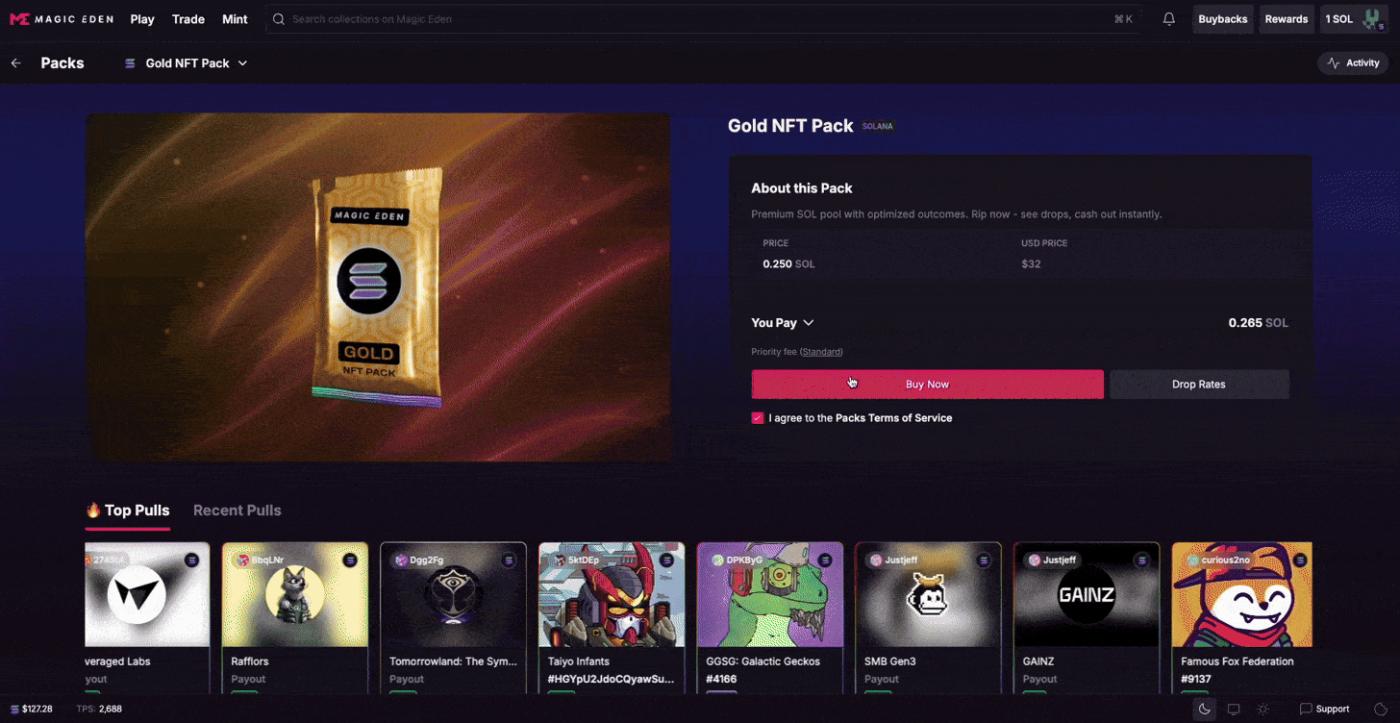

The “Packs” feature is a prime example. This is a chance-based mechanic similar to the existing “Lucky Buy” tool. Data proves its success. According to a podcast with Presto Research, “Packs” earned about $15 million in its first week.

Magic Eden is no longer just an NFT marketplace. It is now a “crypto entertainment platform” that focuses on user fun.

Dive deep into Asia’s Web3 market with Tiger Research. Be among the 22,000+ pioneers who receive exclusive market insights.

2. Magic Eden = Crypto Entertainment

Since its start, Magic Eden has pursued bold and fun ideas. Its core target has always been the “Crypto Normie.” This refers to the retail user rather than the pro trader. The mass market seeks intuitive fun instead of complex trading tools.

Most exchanges and token trading tools compete in the “PvP” (Player vs Player) market with low fees and pro-level tools. This is an overcrowded “Red Ocean” with low expected returns. Much of the crypto industry focuses on this segment and chases pro trading trends.

Instead, Magic Eden focuses on “Fun.” While others chase whales, Magic Eden is adopting a “Zig while others zag” strategy to capture the vast consumer market.

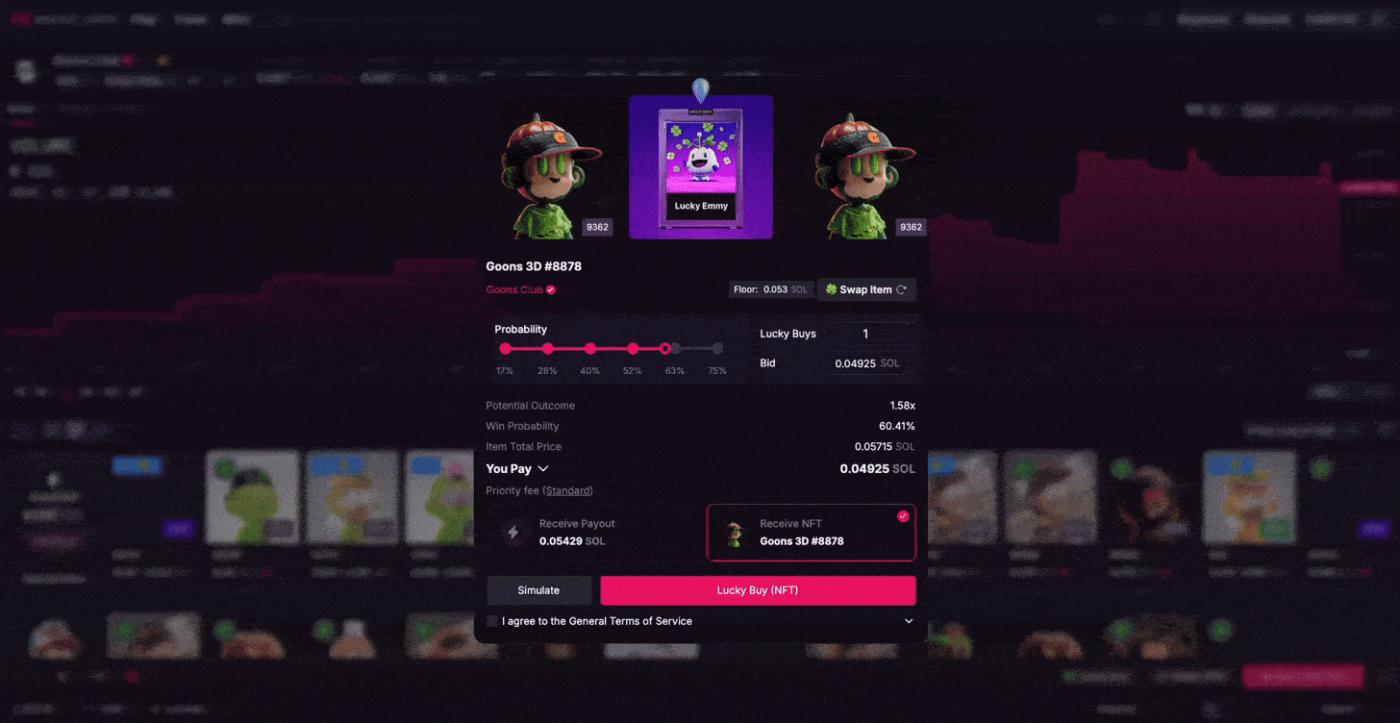

2.1. Lucky Buy

The best case of this strategy is “Lucky Buy.” This product was launched in September 2023. Users can try to win high-value NFTs with small commitments via roulette, without paying the full price.

Users can set their probability 1% or as high as 75%, depending on how much they want to pay. But this also sets their chances. This product offers a chance to win for users with less capital and provides additional liquidity to sellers.

Turning the purchase process into a game triggered a huge response. Despite service blocks in the US due to regulations. And with only organic demand, Lucky Buy became Magic Eden’s fastest growing product lines .

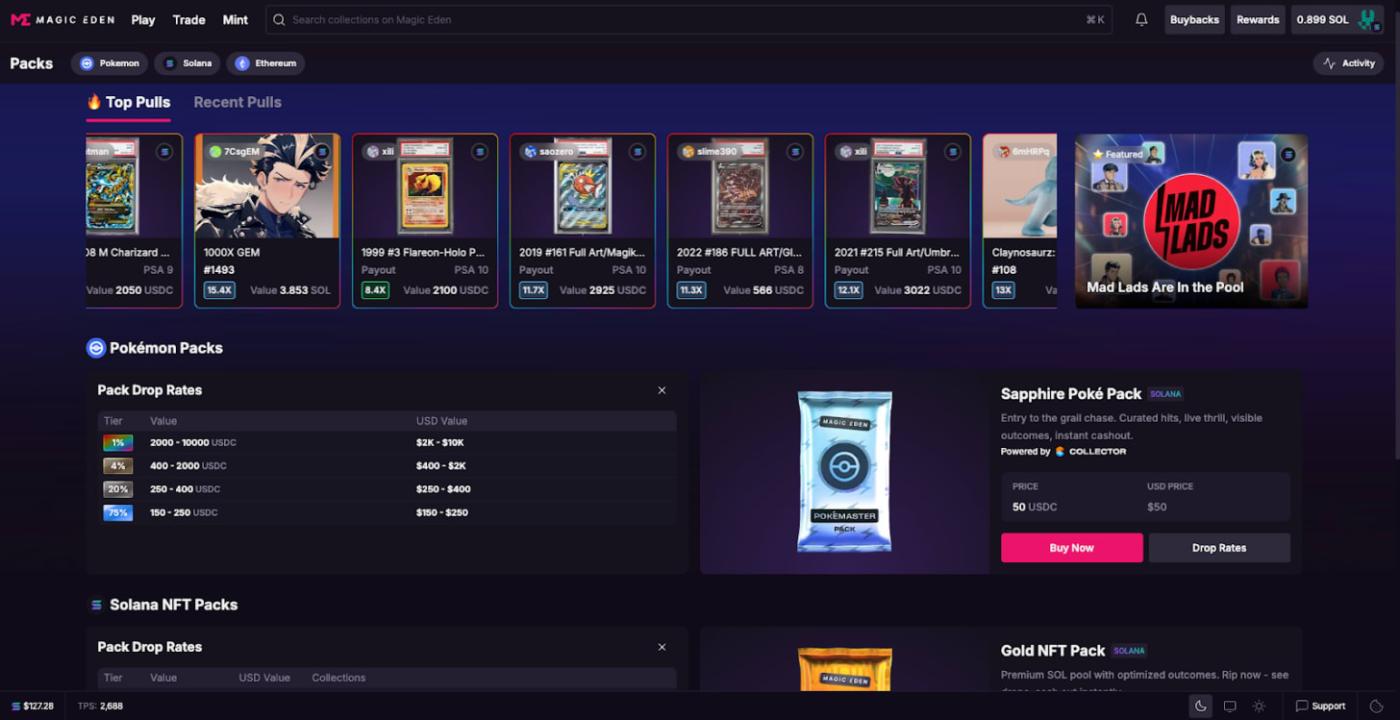

2.2. Packs

Launched in late October 2025, “Packs extends this strategy. It brings the thrill of opening physical card packs to the digital realm. Users “rip” digital packs earned from app activity to find rare digital collectibles: from NFTs across top Solana and Ethereum collections to tokenized, graded Pokémon cards.

In the first week of launch, Packs generated around $15 million - more than the entire NFT industry combined, highlighting strong user demand.

Magic Eden is now doubling down on this product: adding multi-pack ripping, expanding digital collectible categories, and even more novel game mechanics like pack battles, gifting, and richer gameplay effects.

This serves as a strong retention tool. While users on rival platforms analyze complex charts, Magic Eden users find joy in ripping packs. This is the essence of crypto entertainment.

3. Inevitable Regulatory Constraints and a Head-On Breakthrough

Strategies based on fun and speculation face strict rules. Under the SEC and the Biden administration, the US held a harsh stance on crypto.

Most firms would retreat or cut features in this climate. Magic Eden did not hide. It employs sophisticated “Geo-blocking” to restrict US access technically, and leverages its large global user base to grow. At the same time, operating at the highest standards to comply with all regulations .

Magic Eden prioritized providing permissionless, experimental products to users in regions outside the US, like Korea.

While others shrink before regulations, Magic Eden confronts them to supply what the public wants. This approach treats regulation not as a passive constraint, but as “Operational Alpha” to boost global market share.

4. Buybacks: What the Public Really Wants

High corporate revenue means little to investors if it does not raise the price of tokens in their wallets. Many crypto projects fail to link platform revenue with token value.

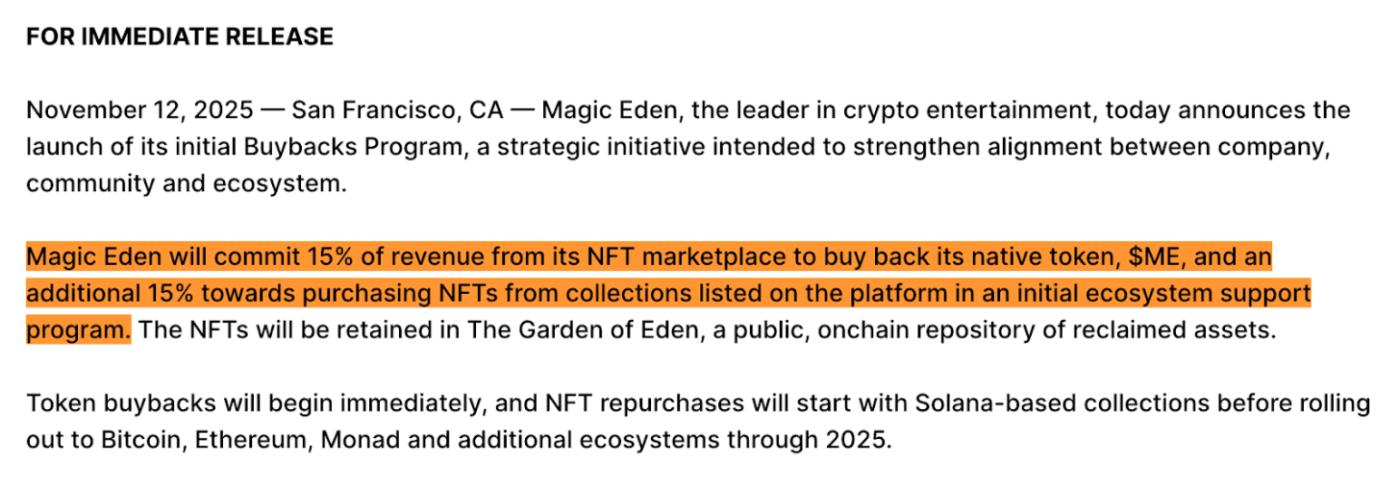

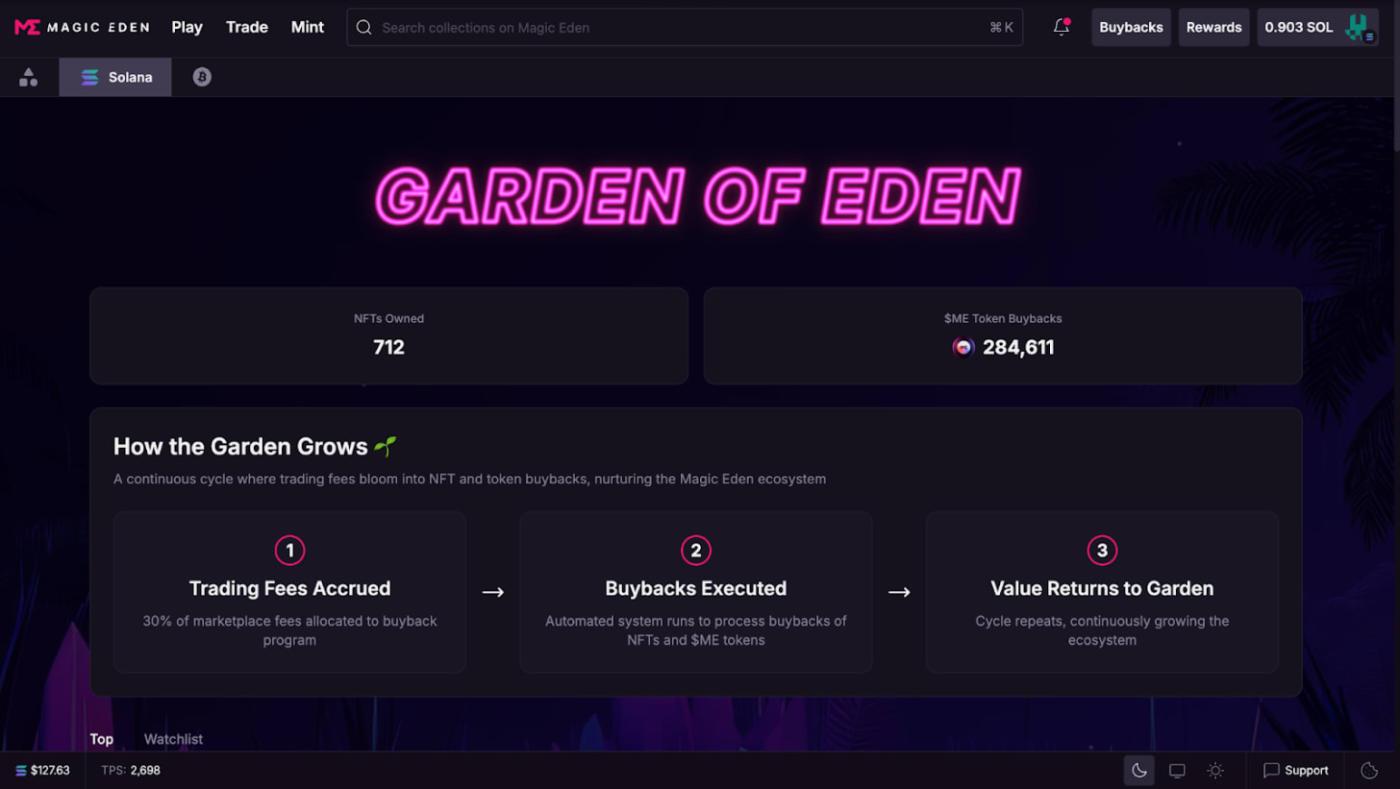

Magic Eden addressed this on November 13, 2025, by announcing a “Buyback Program.” The concept is simple: the firm reinvests profits to support ecosystem value. Magic Eden pledged to return 30% of NFT marketplace revenue through the following structure:

$ME Token Buyback (15% of revenue): The firm buys $ME tokens directly from the market. This mirrors stock buybacks. Reducing circulating supply exerts upward pressure on token value.

NFT Collection Buyback (15% of revenue): The remaining 15% funds the purchase of key NFT collections. These assets are permanently stored in an on-chain vault called “The Garden of Eden.” By directly defending the Floor Price, the firm strengthens the ecosystem.

This program starts on Solana and will expand to Bitcoin, Ethereum, Monad, and more. Magic Eden’s tokenomics surpass simple governance. Company success directly drives token buying and NFT price support. This systematizes the phrase “Project success equals community success,” delivering what the public truly wants.

5. The Completion of Crypto Entertainment for the Masses

Magic Eden is no longer just an NFT marketplace. It is now a crypto entertainment platform give fun to the masses.

Magic Eden first built a solid financial base. Its wallet and swap tools link assets across fragmented chains. It then added features like Lucky Buy and Pack to gain mass users. To sustain this, a buyback program using 30% of revenue provides clear economic rewards.

The edge for Magic Eden lies in speed and market insight. While peers stall due to rules or complex tech, Magic Eden delivers the engagement and “dopamine” users crave. It used bold geo-blocking to move fast while others paused.

But still large gaps remain in the crypto entertainment space. High-value sectors like prediction markets offer multi-billion dollar growth that is largely untapped. Magic Eden seeks to lead this shift and capture this value. To this end, it is now incubating independent arms such as Dicey, an iGaming platform. These new ventures will drive the next phase of growth.

The final step is to fit these tools into a mobile wallet. When finance and fun meet in one app, Magic Eden will serve as the main gateway to the Web3 world.

Dive deep into Asia’s Web3 market with Tiger Research. Be among the 22,000+ pioneers who receive exclusive market insights.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Magic Eden. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others’ views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.