Source: ICIJ & CNN

Authors: Ben Dooley, Majlie de Puy Kamp, Curt Devine, Yahya Abou-Ghazala, Kyung Lah , Casey Tolan

Original title: Retailers keep cashing in on cryptoATMs as scams surge

Compiled and edited by: BitpushNews

In-depth investigative reporting from the International Consortium of Investigative Journalists (ICIJ) in collaboration with CNN

In December 2024, criminals robbed Steve Beckett of thousands of dollars at a Circle K convenience store in Indiana. The robbery occurred in broad daylight.

The robbers neither used knives nor guns, and there was no getaway vehicle.

The instrument of the crime was a machine that looked very much like a regular ATM, owned by Bitcoin Depot . It was placed inside convenience stores as part of a nationwide agreement with Circle K.

66-year-old Beckett was at home paying bills when his computer suddenly crashed, and a message popped up instructing him to call a so-called "Microsoft support hotline"—which turned out to be fake.

On the phone, a man who identified himself as "Josh" told Beckett that someone had hacked his computer and used his credit cards and bank accounts to buy child pornography.

Soon, Beckett began speaking with another man who claimed to work at a bank, followed by another who claimed to represent the Federal Reserve. These men told him that his life savings were under threat and the only way to protect them was to convert his money into Bitcoin .

Over the next two days, these people used all sorts of deception and intimidation against him, warning him that he might go to jail. Although Beckett had worked in casino management for many years and had also worked in securities sales, his intuition told him that something was wrong, but he was still terrified at the time.

“I was about to have a heart attack, my blood pressure skyrocketed,” he said.

A panicked Beckett withdrew $4,000 from the bank and, following the men's instructions, drove to a Circle K convenience store with a Bitcoin Depot ATM. Beckett had never bought Bitcoin before and knew very little about it, but he didn't dare ask any questions. Over the phone, one of the men instructed him step-by-step on how to deposit the money. "I was shaking with fear," he said. The next day, he deposited another $3,000.

These machines, often called “crypto ATMs” or “Bitcoin ATMs,” convert cash into Bitcoin and transfer it to digital addresses provided by these individuals. Bitcoin Depot charges a fee of approximately $2,000 for completing the transaction.

Beckett was swindled out of everything.

[The Circle K convenience store in Indiana. Beckett, at the instigation of scammers , deposited money into a Bitcoin Depot ATM here. Image credit: CNN]

As the number of cryptocurrency ATMs has multiplied—there are currently nearly 40,000 such machines worldwide, according to industry online publication Coin ATM Radar—scams have also surged.

In 2024, the FBI received nearly 11,000 complaints of fraud involving cryptocurrency ATMs, a 99% increase from the previous year. These complaints represented approximately $247 million in losses.

And this year's figures are expected to be even higher: between January and November 2025, similar scams have already caused losses of approximately $333 million.

This surge has become a problem for the entire cryptocurrency ATM industry and has raised questions about whether the retailers hosting these machines are doing enough to protect consumers.

The deal between Circle K and Bitcoin Depot is one of the largest collaborations between a global retail chain and a Bitcoin ATM operator.

According to an investigation by the ICIJ and its media partner CNN, Circle K earned millions of dollars from the deal and continued to maintain the relationship despite increasing complaints from customers and employees.

In January 2025, Circle K extended its contract with Bitcoin Depot until mid-2026.

According to an analysis by the ICIJ and CNN of police reports, consumer complaints, court cases, news reports, and interviews, since January 2024, more than 150 victims have reported scams involving Bitcoin Depot machines at Circle K and Holiday gas stations (owned by Circle K's parent company, Alimentation Couche-Tard), with losses amounting to at least $1.5 million.

At a Circle K store in Florida, while police were handling a fraud case, a regional manager was caught on body camera telling officers, "I hate these machines. I want to get them out of the store."

Other Circle K employees interviewed by ICIJ and CNN expressed similar sentiments. One manager, who requested anonymity, recalled that a victim returned to the store with a sledgehammer, attempting to smash open a machine to retrieve his money.

"If we completely eliminated fraud, our lives would be very difficult."

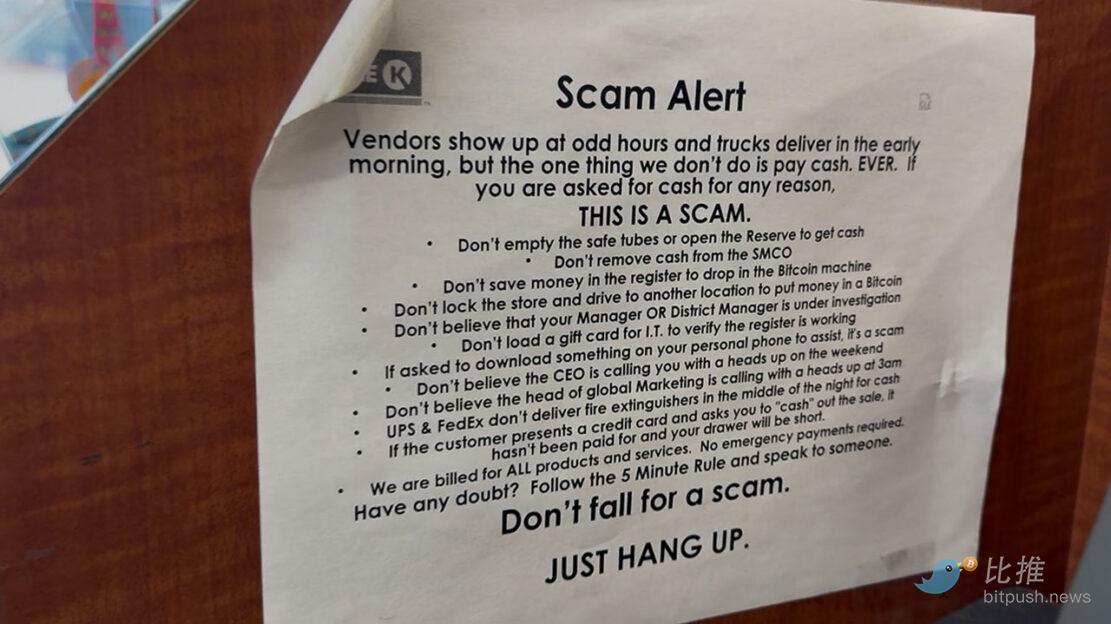

Circle K had warned its employees to be wary of scammers; employees said management sent relevant emails and provided training. At one Circle K in Indiana, a sign near the checkout warned employees not to deposit store cash into Bitcoin Depot machines.

In response to detailed questions from ICIJ and CNN, a spokesperson for Circle K stated that company employees are trained to identify common scams, but employees are not responsible for customer transactions at Bitcoin Depot ATMs because these machines are "independently owned and managed by a third party." The company stated that it works closely with Bitcoin Depot "to ensure that its services consistently meet our standards, regulatory requirements, and the needs and expectations of our customers."

In a statement, Bitcoin Depot said, "The vast majority of our customers use our racks for legitimate purposes. Protecting consumers is at the heart of our model, which is why we invest heavily in compliance, blockchain monitoring, fraud alerts, and cooperation with law enforcement."

The findings regarding Circle K and Bitcoin Depot are part of "The Coin Laundry," a multinational investigation led by the ICIJ that exposes how cryptocurrency companies profit from fraud, theft, and other criminal proceeds, leaving those who lose their savings or livelihoods with little hope of justice.

“ If we were to completely eliminate fraud, we would be in a bad situation ,” a former Bitcoin Depot employee, who requested anonymity, said while discussing the company’s situation.

In a lawsuit filed against Bitcoin Depot in early 2025, the Iowa Attorney General wrote that analysis of transactions conducted through the company's machines in the state between October 2021 and July 2024 showed that more than half of the transactions involved fraud.

Authorities also accused other cryptocurrency ATM industry giants of facilitating high levels of fraudulent transactions. According to court documents, approximately 90% of transactions on the CoinFlip ATM network, examined by the Iowa Attorney General, were related to fraud. Prosecutors in Washington, D.C., reached similar conclusions regarding Athena Bitcoin's automated transaction services. According to Coin ATM Radar, these two companies are the world's second and third largest ATM operators, respectively.

[A CoinFlip Bitcoin ATM at a gas station in Pasadena, California. Image credit: Mario Tama/Getty Images]

A CoinFlip spokesperson told the ICIJ that the company invests heavily in preventing fraud and scams. Athena did not respond to requests for comment. In court filings, Athena Bitcoin stated that it is a "neutral intermediary" and is not responsible for any misuse of its systems by criminals.

Industry representatives say their clients buy Bitcoin for purposes such as sending money to family abroad, online shopping, and investment. However, some critics of these machines question whether they have other uses besides money laundering and fraud.

“When we spoke with Bitcoin Depot and other companies, they insisted that their ATMs were investment machines designed to allow people to make legitimate investments,” said Gerard Lotz, a Louisiana police detective who investigated numerous cases involving the company’s fraud, in a recent interview. “However, I don’t know of any investment company in the world that charges a 30% commission.”

According to company documents, in 2024, Bitcoin Depot charged between 15% and 50% of each transaction made through its ATMs. Its relationship with Circle K accounted for nearly a quarter of its revenue that year.

For Bitcoin Depot and Circle K, the $7,000 Beckett lost was a fraction of their annual earnings. But for this elderly Indiana man, a certified pastor and volunteer firefighter, the money meant a sense of security.

“That money is our livelihood,” he said. “ We depend on that money to pay bills, mortgage payments, and buy birthday and Christmas presents for our daughters. Now we can’t do anything with it.”

Beckett says both cryptocurrency ATM companies and the stores that host them should be held accountable. He is suing Bitcoin Depot, one of at least three lawsuits against major players in the industry.

[Scammers convinced Steve Beckett to exchange thousands of dollars for Bitcoin at a Bitcoin Depot ATM in a Circle K store. He lost everything. Image credit: CNN]

Bitcoin Depot denies any wrongdoing, stating that it "cannot be held responsible for the criminal activities of third-party fraudsters, especially given the strong warnings and safeguards provided in our machines and transaction processes." In February, a federal judge referred one of the cases, which included allegations against Circle K, to arbitration.

Circle K was not named as a defendant in Beckett's lawsuit, but he still believes the retail chain is responsible for what happened to him and other victims.

“I think they definitely knew what was going on,” he said. They were “profiting from having these machines in the store and making a lot of money from it.”

"The biggest deal"

From the early stages of the cryptocurrency ATM industry in 2013, these machines were primarily placed in small, independent businesses such as tobacco shops, gas stations, and corner grocery stores.

Brandon Mintz, founder and CEO of Bitcoin Depot, installed the company's first ATM at an e-cigarette shop in Atlanta in 2016.

Mintz's sales strategy to retailers was simple: businesses would receive monthly rent and increased foot traffic. Customers, in turn, would gain convenience and privacy.

Mintz believes the company is also selling “trust.” At a Bitcoin conference in Atlanta in 2019, he stated that people’s skepticism about exchanging cash for virtual currencies is understandable. But he said that this will change once “you’re in a store you frequent, and you see a physical machine sitting right next to the regular ATM you always use.”

In the summer of 2021, as Bitcoin rapidly gained mainstream popularity, Bitcoin Depot signed an exclusive agreement with Circle K, a significant step toward realizing Mintz's vision.

[A Bitcoin Depot machine is placed between a regular cash ATM and a vending machine at a Circle K store in Indiana. Image credit: CNN]

“ That was the biggest deal in the space, and it still is ,” said a former Bitcoin Depot employee.

In a press release, Bitcoin Depot stated that through this transaction, Circle K becomes "the first major retail chain to deploy a Bitcoin ATM in its stores."

At the launch event, Denny Tewell, then senior vice president of Circle K, said that this gave the chain "an important early position in the rapidly growing cryptocurrency market."

The agreement with Bitcoin Depot was very lucrative for Circle K. According to two people familiar with the payment system and records reviewed by the ICIJ, the initial rental fee per machine was as high as $700 per month .

Circle K, with over 6,300 stores in the US alone, has become a potential goldmine for Bitcoin Depot. By the end of 2021, the convenience store chain's stores accounted for more than 20% of the company's transactions.

Bitcoin Depot also gained something that might be more valuable than increased revenue: the opportunity to move its business to a high-profile location.

However, problems soon surfaced. According to two sources familiar with the matter, the store manager began reporting fraudulent activities involving the machines and sought guidance from Bitcoin Depot. Fraud and money laundering have been a problem since the early days of the cryptocurrency ATM industry. In a 2018 article on its official website, Bitcoin Depot warned that it had “stopped fraudsters using many different scams to steal, and new ones are emerging every day.”

To protect customers and reduce their own liability, cryptocurrency ATM operators have placed fraud warnings on their machines and increased network monitoring. According to a copy obtained by the ICIJ, Bitcoin Depot's 2019 compliance manual required employees to document known frauds occurring on its ATM network and to file suspicious activity reports with the U.S. Treasury Department's Financial Crimes Enforcement Network (FinCEN) when the amount involved exceeded $2,000. The company blacklists known fraudsters and closes victims' accounts.

Nevertheless, the problem continues to escalate. By 2021, cryptocurrency ATMs had become the preferred tool for both technical support scams and impersonation of government officials (the kind Beckett encountered), according to Mike McGillicuddy, a special agent at the FBI who leads the task force dedicated to recovering victims' funds and specializing in financial crimes.

He said the reason scammers prefer these machines over other methods is because they eliminate the need for intermediaries. He explained, “Funds can be deposited instantly into wallets they control and transferred overseas,” places where law enforcement has no access.

Marc Grens of digital asset firm DigitalMint says the proliferation of scams clearly indicates the industry needs to reform itself. Grens has run a nationwide network of machines for nearly a decade.

Glenns attempted to establish an industry body to self-regulate the machines and raise compliance standards. However, he stated that other ATM operators were uninterested. Ultimately, only one other company joined his effort. Both DigitalMint and that other company have since abandoned the business.

Glenns concluded that it's impossible to remain profitable without facilitating fraudulent transactions. He said the more his company invests in fraud prevention, the more fraud they uncover. When it comes to the largest online transactions, " 95% of the clients you end up talking to are victims ," he said.

Moeses Streed, who worked as a customer service hotline operator for Bitcoin Depot in 2021, said that 40% of the calls he received each day were related to scams.

“Some days, you get these kinds of calls all the time,” he said. “This job feels more like on-site anti-fraud than customer service.” (Bitcoin Depot told ICIJ it disagrees with this description.)

Nevertheless, marketing materials on the Bitcoin Depot website still assure potential ATM hosting providers that these machines will generate “zero risk. zero cost. Monthly income,” according to an archived version of the website viewed by the ICIJ.

But this is not the case for Circle K.

On the surface, everything seemed to be going well: In March 2022, a vice president at Circle K told a trade publication that the machines were “a huge hit” and customer feedback was “extremely positive.” By August of that year, Bitcoin Depot reported that it had placed more than 1,900 ATMs in the chain across the U.S. and Canada.

But behind the scenes, the scale of the scam had become undeniable. According to two sources familiar with the matter, frustrated Circle K employees filed numerous complaints with Bitcoin Depot.

CNN and ICIJ interviewed 30 Circle K employees and managers who were aware of cryptocurrency ATM scams. Of these, 17 said they witnessed the scams firsthand; according to CNN's analysis, 13 employees mentioned receiving company notifications about cryptocurrency ATM scams, either via email or employee training.

An anonymous store manager stated that almost all customers using the ATM were scammed. The manager said, "98% of people are scammed over the phone using various methods."

According to interviews with current employees and police records, the scammers even targeted Circle K staff. Impersonating Circle K management, they persuaded employees at multiple locations to deposit money into Bitcoin Depot machines. The convenience store chain had to warn its employees against falling into such traps. At one store in Indiana, a sign behind the cash register reminded employees: "Don't put all the money in your cash register into Bitcoin ATMs ."

[An alert regarding scams involving Bitcoin machines was included in a notice to Circle K employees.]

According to sources familiar with the matter, employees at Bitcoin Depot had long debated how to address the broader issue of fraud. In early 2023, the company revised its refund policy on its website, stating that fraud victims might be eligible for a refund of processing fees "on a case-by-case basis." However, this text was removed by late October of that year.

In response to questions about the situation, Bitcoin Depot stated that "criminals are attempting to abuse many types of financial self-service terminals," and that "this problem is not unique to any one retailer." The company stated that it has "refunded millions of dollars in attempted fraudulent transactions" and removed that text because it "caused non-victims to also attempt to claim refunds for legitimate completed transactions."

Emails responding to consumer complaints reveal that even when refunds are possible, cumbersome procedures make them difficult to obtain. One victim in Florida said her refund request was denied because she couldn't obtain a police report by the deadline set by Bitcoin Depot. A complaint from the Connecticut Department of Banking shows that the refund instructions on the company's website pointed to a non-existent form. According to state records, Bitcoin Depot ignored a victim's refund request, while two of its competitors quickly returned the lost funds.

According to court records and materials obtained by the ICIJ through a public records request, in its responses to consumer complaints and lawsuits, Bitcoin Depot repeatedly accused victims of falling into scammers' traps, arguing that they failed to heed the company's warnings and policies. Bitcoin Depot prominently displays scam warnings on its ATMs, and users see additional prompts during deposits warning them not to send money to strangers. The company states that users must also confirm they are depositing funds into their own wallets and accept that all transactions are "final and irreversible."

But law enforcement officials, consumer advocates, and industry insiders interviewed by the ICIJ said these messages are often insufficient to deter victims because they are typically distraught and confused. Beckett was one such victim, saying he only noticed the warnings after he had already lost money.

Danny Foret was similarly tricked into depositing nearly $20,000 into a Bitcoin Depot machine at a Circle K store in Louisiana. “I was so upset at the time that I couldn’t even look at the machine,” he said.

“That’s where the victims’ vulnerability lies,” said Brad Williams, a police detective in Peachtree City, Georgia, who investigates Bitcoin ATM scams and works to regulate such machines. “These scams can go on for days,” he said, adding that when victims are psychologically broken, “what’s in front of them doesn’t matter anymore.”

Bitcoin Depot told the ICIJ that it believes scam warnings are “helpful” and reviews every scam report. The company stated, “In many cases, we are able to intercept transactions or provide mitigation measures before funds reach malicious actors.” It added that while it believes customers need to protect themselves from scams, it also “recognizes that customers should not bear this burden alone.”

Regarding refund requests, it states that this is "not intended to increase the burden on customers, but to ensure that requests are handled responsibly and in accordance with applicable legal and regulatory obligations."

"It's none of our business."

Some retailers have become disillusioned with these machines and are trying to remove them or cut off their power.

In April 2024, the supermarket chain Fareway Stores signed an agreement with Bitcoin Depot to install 66 machines in its stores in Iowa and other states. But by February of the following year, it had unplugged all the machines.

Fareway alleges that these machines have become "tools for massive fraud." By early 2025, customers were being scammed almost weekly, and shortly thereafter, Fareway found itself facing investigations by the Iowa Attorney General and the state's Gaming Authority.

Bitcoin Depot has filed a lawsuit against Fareway for breach of contract, demanding that the company reopen its ATMs and compensate for business losses and reputational damage.

[Fareway supermarket chain accused cryptocurrency ATMs of being used as tools for "massive fraud" and unplugged its Bitcoin Depot machines in February, only to turn them back on in May after laws protecting victims were passed. Image credit: Dan Brouillette/Bloomberg via Getty Images]

According to AARP, as of September, 18 U.S. states have passed laws or regulations protecting consumers from cryptocurrency ATM scams, with more states considering legislation. These changes include maximum transaction limits and, in certain circumstances, mandating operators to refund victims.

Even with strict restrictions, fraudsters have failed to stop using ATMs. Minnesota implemented a $2,000 daily transaction limit for new users in August 2024 as part of a major bill regulating these machines, but the state's Department of Commerce continues to receive related complaints. In one case, the victim wrote that criminals instructed them to make 15 transactions, each using a different name, resulting in the theft of nearly $15,000.

A new law in Iowa, where Fareway is headquartered, limits first-time users of cryptocurrency ATMs to $1,000 per day and $10,000 per month. The law also caps operator fees at $5 per transaction or 15% of the transaction amount (whichever is higher).

According to court documents, with the law set to take effect in the summer of 2025, coupled with legal pressure from Bitcoin Depot, Fareway decided to reopen ATMs at all its stores in May. It hopes the law will at least limit future harm to customers.

Fareway and Bitcoin Depot reached a settlement in November. Shortly before that, Bitcoin Depot announced it would begin requiring identity verification for every transaction and adding "additional protections for seniors." The company did not provide specific details about these measures.

Debbie Joy, an assistant manager at a Circle K store in Port Orange, Florida, told CNN that she estimates she has intervened in at least 10 scams involving in-store Bitcoin Depot ATMs during her four years at the store, and now she can spot the signs immediately.

“Usually it’s older people making phone calls with bank envelopes in their hands, but the last person was probably about my age,” Joey said . “She was only in her thirties or forties, and she got scammed too. I had just walked into the store to take over the shift, and it was already too late. She was crying outside.”

The scams were so frequent that Joey had the number of a local police investigator saved in her phone. If she encountered a problem, she wouldn't call 911, but would contact him directly.

“Thanks to my frequent interventions, my store probably wouldn’t have lost as much money,” she said. In April, the city council also awarded her a commendation for successfully preventing an elderly couple from depositing $10,000 into a Bitcoin machine. Joey estimates she has helped at least three or four other people who narrowly escaped being scammed.

Despite the company's policy that "the machines are not ours and the problems are not our responsibility," Joey told the city council, "I've seen this kind of thing happen far too often, and I just can't stand it anymore."

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush