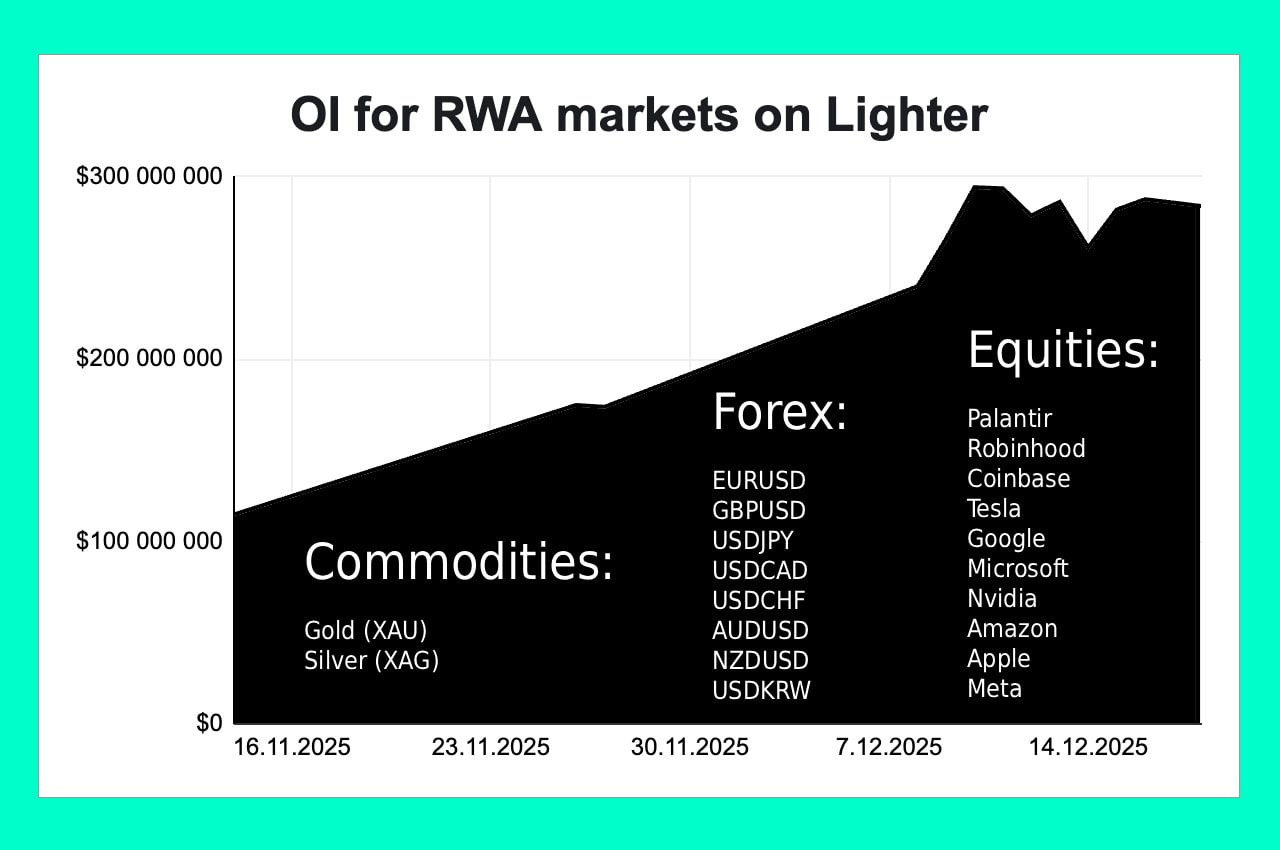

Lighter Update: RWA Perps → Capturing the Next Generation of PMFs ❌ Original Text Lighter is clearly opening up a new PMF that could drive massive growth in 2026. On-chain and tokenization of RWA assets are shaping up to be key trends that will dominate 2026, and Lighter is positioned at the center of this shift. Just two months after the launch of RWA Perps, Ostium surpassed Hyperliquid to emerge as the category leader. OI grew to approximately $300 million. RWA trading volume is approaching $1 billion per day. On yesterday's podcast, @vnovakovski confirmed that he is actively preparing for tokenized asset trading and is in meaningful discussions with Robinhood. Lighter is highly likely to be the first to launch RWA spot trading, and this could be an event that could reshape the Web3 market structure itself. Currently, it's only in the preparatory phase. Actual explosive growth remains to be seen. It's likely to unfold in the 2026–2027 period. What makes Lighter special? It's not about building a fast exchange. It's relentlessly exploring where real-world demand exists. It's focused on changing the market structure itself, rather than short-term revenue. It's actually implementing continuous feedback gathering and iterative improvements. While RWA is still an underrated trend, demand for direct on-chain trading in 🟢 stocks, 🟢 Web2/Web3 company shares, 🟢 commodities, and 🟢 FX is rapidly growing. The platform that first captures this gap is likely to achieve a new level of network effects and market dominance. Lighter is currently laying the groundwork.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content