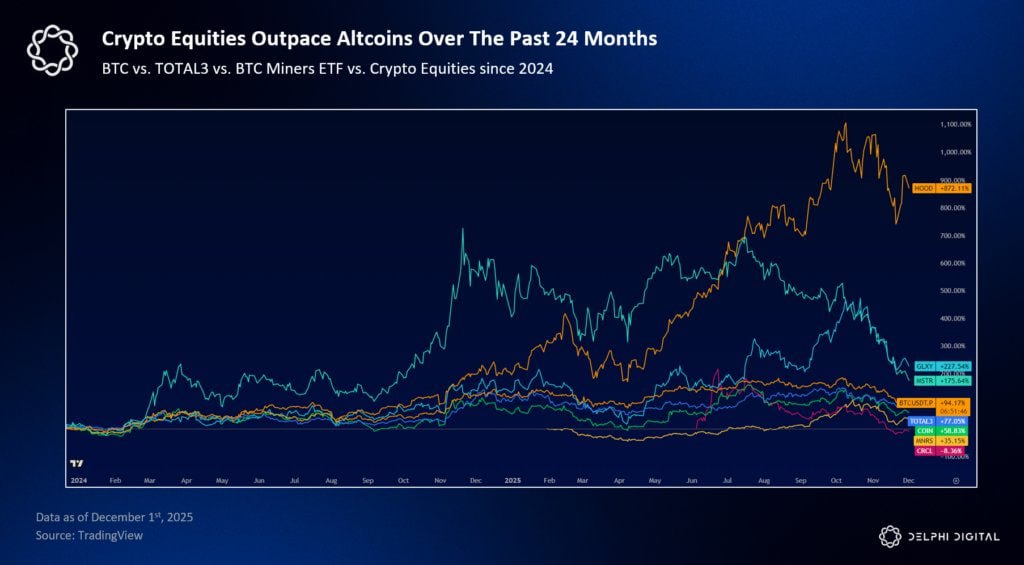

Delphi Digital: Capital Flow Changes in This Cycle It's Not Just Crypto's Game This cycle is shifting from one where all assets are rising together to one where excess returns are generated only through sector-specific rotation. Current capital flows include: 🟢$35 billion in generative AI 🟢$2 billion in robotics quarterly 🟢Solar power and biotechnology are also entering commercial growth phases Every dollar of new liquidity inflow creates more competing investment opportunities Changes are also occurring within the crypto space. Over the past two years, crypto stocks (miners, exchanges, infrastructure companies) have outperformed most altcoins. Crypto-equity has absorbed the buying power flowing into altcoins (a vampire attack). Institutional capital is also entering from all sides. 🟢ETF 🟢RWA 🟢Stablecoins 🟢Exchanges Infrastructure 🟢Corporate chain launches → Capital becomes more fragmented and distributed In conclusion, the future profit structure is likely to be closer to "stock picking" than index buying. Rather than waiting for the market to rally, it's time to see where capital is actually flowing. Delphi Digital: There's no longer a bull market for altcoins that are all bullish.

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content