The Bitcoin market is entering a sensitive phase of its growth cycle towards the end of 2025. After a long period of maintaining an upward trend, on-chain data shows that investor behavior is beginning to diverge significantly, especially between short-term and long-term holders.

Despite increasing selling pressure, core indicators still suggest that the overall market structure has not been broken. This is more likely a rebalancing phase than a trend reversal.

Realized profits increased significantly.

A notable point in the current period is the increasing amount of profit-taking. This reflects the cautious sentiment of the market as Bitcoin prices remain at high levels.

Key features include:

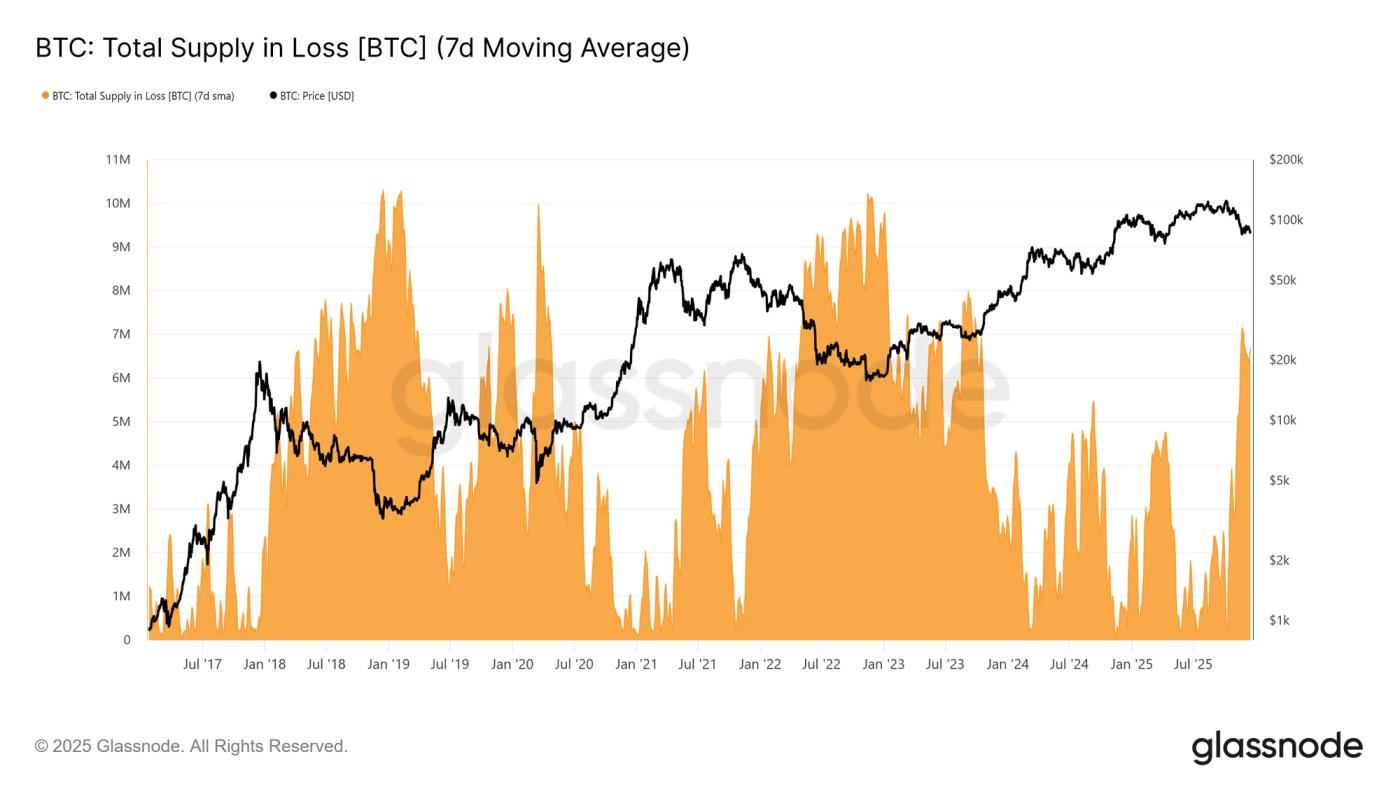

Profit-taking activity mainly comes from short-term positions.

Investors take advantage of rallies to lock in profits.

Selling pressure appeared in waves, rather than a massive sell-off.

This is typical behavior when the market enters the latter half of an uptrend.

Long-term investors remain firmly in their positions.

In contrast to the short-term group, the long-term investor group continues to show a high degree of steadfastness.

The data shows that:

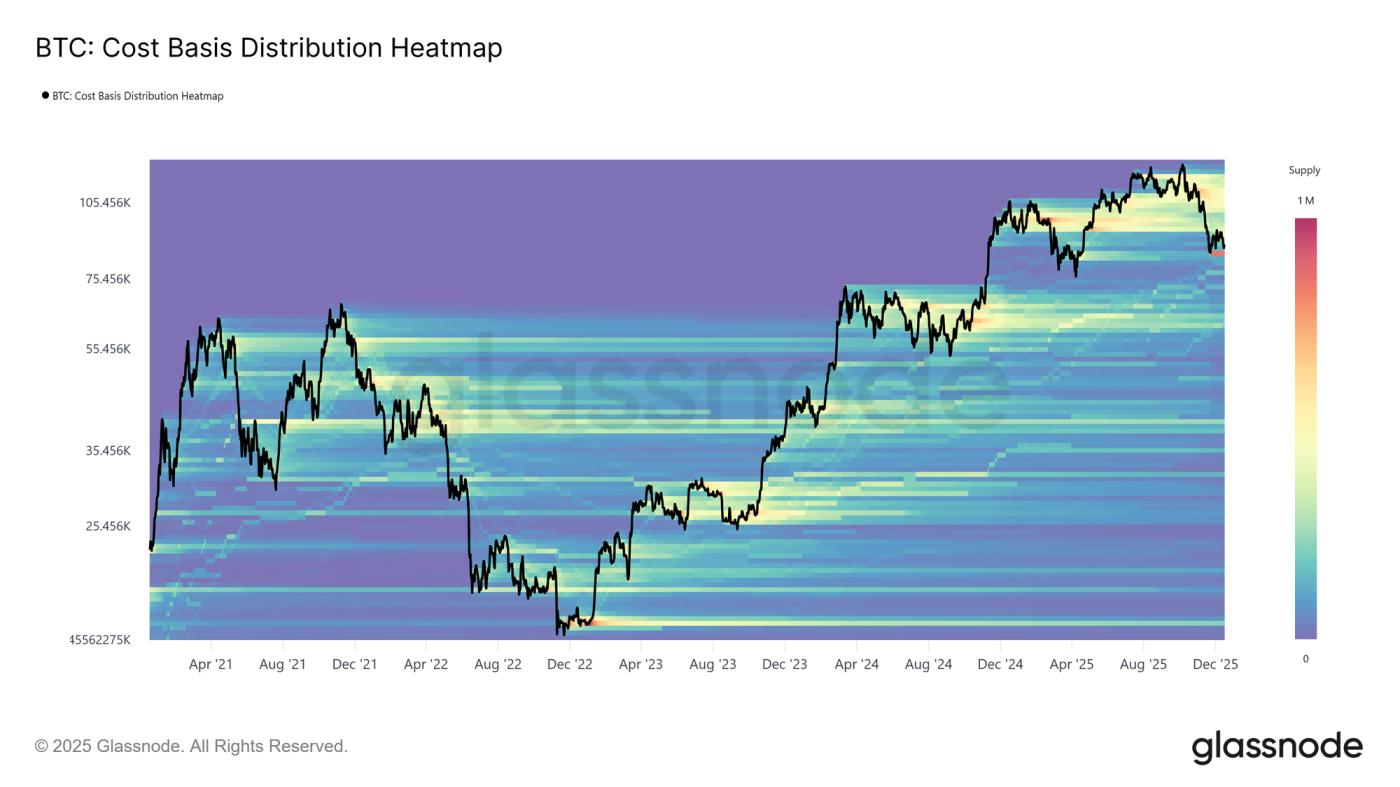

A large amount of Bitcoin remained unmoved for an extended period.

Distribution from the long-term group is slow and controlled.

The accumulated supply at low price levels has not yet returned to the market strongly.

This indicates that confidence in Bitcoin's long-term trend remains strong.

Selling pressure increased, but demand continued to absorb it well.

Despite increased profit-taking pressure, the market has not yet shown signs of panic.

Several factors support the pricing structure:

Prices remain above key on-chain support zones.

The flow of Bitcoin to exchanges did not increase dramatically.

Volatility is increasing but has not yet exceeded historical levels.

This indicates that demand remains strong enough to absorb the supply being offered for sale.

What stage of the cycle is Bitcoin currently in?

Summary of current signals:

The market has moved away from its strong acceleration phase.

No signal confirming the cycle peak has appeared yet.

Bitcoin is most likely in a local accumulation-distribution phase.

This is a phase where cash flow becomes more selective, short-term risks increase, but the long-term trend has not yet been negated.

Bitcoin is facing significant profit-taking pressure at the end of 2025, primarily from short-term investors. However, the holding behavior of long-term investors, along with the market's ability to absorb supply, suggests that the fundamentals remain stable.

In this context, the appropriate strategy lies not in chasing short-term fluctuations, but in risk management and carefully observing key on-chain support zones.

Follow CoinMoi to stay updated on the hottest issues in the crypto market. Okay!!!

The article "Year-end profit-taking pressure on Bitcoin increases, but market structure remains stable" first appeared on CoinMoi .