Authors: AJC, Drexel Bakker, Youssef Haidar; Source: Messari 2026 Crypto Theses ; Translated by: Jinse Finance

Key points

1. BTC has clearly distinguished itself from all other crypto assets and is undoubtedly the dominant form of cryptocurrency.

2. BTC underperformed in the second half of 2025, partly due to increased selling pressure from early large holders. We believe this underperformance will not become a long-term structural problem, and we expect Bitcoin's monetary narrative to remain intact for the foreseeable future.

3. L1 valuations are increasingly detached from their fundamentals. The significant year-on-year decline in public chain revenue means their valuations are becoming increasingly reliant on expectations of currency premiums. With a few exceptions, we expect public chains to underperform Bitcoin.

4. ETH remains the most controversial asset. Concerns about value capture have not completely subsided, but its performance in the second half of 2025 proves that the market is willing to treat it as a cryptocurrency, just like Bitcoin. If a cryptocurrency bull market returns in 2026, Ethereum digital asset treasuries (DATs) may experience a "second spring."

5. ZEC is gradually being priced as a privacy cryptocurrency rather than a niche privacy coin, making it a complementary hedging tool to Bitcoin in an era of increased surveillance, institutional dominance, and financial repression.

6. Applications may begin to adopt their own proprietary currency systems, rather than relying on the native assets of their host network. Applications with social attributes and strong network effects are the most likely candidates to achieve this shift.

introduction

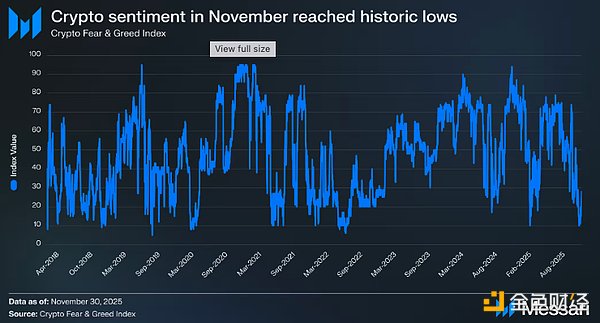

It's no coincidence that the 2026 Messari Crypto Thesis begins with the most fundamental and important part of the cryptocurrency revolution—currency. When we initially planned this report this summer, we never imagined that market sentiment would turn so drastically negative.

In November 2025, the Cryptocurrency Fear & Greed Index will fall to 10 (“Extreme Fear”). Prior to this, the index has only fallen to 10 or lower on a few previous occasions:

- The collapse of Luna and the chain reaction triggered by the crisis of 3AC Capital in May-June 2022;

- The massive liquidation wave in May 2021;

- The collapse caused by the COVID-19 pandemic in March 2020;

- Several key moments during the 2018-2019 bear market.

The cryptocurrency industry has only experienced a few periods of lower sentiment in its history, and these only occurred when the industry was truly on the verge of collapse and the future was shrouded in uncertainty. But this is clearly not the case today: no major exchanges have absconded with user funds, no blatant Ponzi schemes have reached valuations of tens of billions of dollars, and the total market capitalization has not fallen below the highs of the previous cycle.

Conversely, cryptocurrencies are gaining recognition and integration at the highest levels of global institutions. The U.S. Securities and Exchange Commission (SEC) has publicly stated that it expects all U.S. markets to be on-chain within two years; stablecoin circulation has reached an all-time high; and the "someday in the future" application narrative we've repeatedly mentioned for the past decade is finally becoming a reality—yet, industry sentiment has almost never been worse. Almost every week, a trending post appears on social media platform X, with people convinced they've wasted their lives on cryptocurrencies or claiming that everything the industry has built will be forked, misappropriated, and controlled by traditional institutions.

The disconnect between collapsing market sentiment and the rise of institutional applications presents an excellent opportunity to re-examine cryptocurrencies from a first-principles perspective. The original principle that gave rise to the chaotic yet wonderful industry we love today is actually quite simple: to build an alternative monetary system superior to the current fiat currency system. This ideal has been deeply embedded in the industry's DNA since the Bitcoin Genesis Block—a block famously containing the message: "The Times, January 3, 2009: Chancellor of the Exchequer is on the verge of a second bailout of banks."

This origin is crucial because, in the course of its development, many have forgotten the original purpose of cryptocurrencies. Bitcoin was not created to provide banks with better clearing channels, nor to reduce the cost of foreign exchange transactions by a few basis points, nor to drive an endless speculative token "slot machine." The birth of BTC was a response to a failing monetary system.

Therefore, to understand the current situation of cryptocurrencies, we need to return to the core question of the entire industry: Why are cryptocurrencies so important?

I. What is Cryptocurrency?

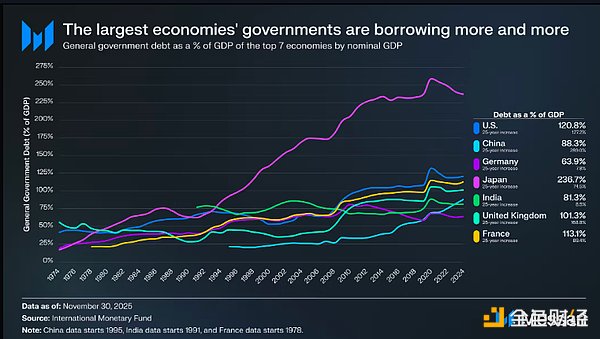

For much of modern history, people have had virtually no real choice over the currency they use. Under the current fiat-based global monetary order, people are effectively subject to their own currency and the decisions of its central bank. The state determines the currency you earn, save, and pay taxes in—whether that currency is inflated, devalued, or mismanaged—and you have no choice but to accept it. And in almost all political and economic systems—whether free markets, authoritarian regimes, or developing countries—the same pattern exists: government debt is a one-way street.

Over the past 25 years, the debt levels of major global economies have increased significantly relative to GDP. As the world's two largest economies, the US and China have seen their government debt-to-GDP ratios grow by 127% and 289%, respectively. Regardless of political system or growth model, rising government debt has become a structural feature of the global financial system. When debt growth outpaces economic output, the costs are primarily borne by savers—inflation and low real interest rates erode the value of fiat currency savings, shifting wealth from individual savers to the state.

Cryptomoney separates the state from the currency, offering an alternative to this system. Historically, governments have altered monetary rules through inflation, capital controls, or restrictive regulations when it serves their own interests. Cryptocurrencies, by entrusting monetary governance to decentralized networks rather than a central authority, reclaim the power to choose money. Savers can choose monetary assets that align with their priorities, needs, and desires, rather than being trapped in a monetary system that often contradicts their long-term financial well-being.

However, the power of choice only makes sense when the chosen option possesses a genuine advantage. This is precisely the case with cryptocurrencies; their value stems from several core attributes that distinguish them from all previous forms of currency:

First, the core value of cryptocurrencies lies in their predictable, rules-based monetary policy. These rules are not commitments from institutions, but rather software attributes run by thousands of independent participants. Modifying these rules requires broad consensus, not subjective decisions by a few, making arbitrary changes to the monetary rules extremely difficult. Unlike the fiat currency system—where the money supply expands with political and economic pressures—the rules governing cryptocurrencies are public, predictable, and enforced through consensus, and cannot be quietly altered behind the scenes.

Secondly, cryptocurrencies are reshaping how personal wealth is safeguarded. In the fiat currency system, true self-custody has become impractical: most people rely on banks or other financial intermediaries to store their savings. Even traditional non-sovereign asset alternatives like gold typically end up in centralized vaults, reintroducing trust-based risks. In practice, this means that if a custodian or state decides to take action, your assets could face delayed payments, restrictions on use, or even complete freezing.

Cryptocurrencies enable direct ownership, allowing individuals to hold and secure their assets without relying on custodians. This capability is becoming increasingly important as financial restrictions such as bank withdrawal limits and capital controls become more prevalent globally.

Finally, cryptocurrencies are tailor-made for the globalized digital world. They can be transferred across borders instantly, with no limits on the amount, and without institutional permission. This gives them a significant advantage over gold—gold is difficult to divide, verify, or transport, especially across borders. Cryptocurrencies can be transferred globally in minutes, with no limit on the size, and without relying on centralized intermediaries. This ensures that individuals can freely transfer or allocate their wealth regardless of geographical location or political environment.

In summary, the value proposition of cryptocurrencies is clear and unambiguous: they offer individuals monetary choice, establish predictable rules, eliminate single points of failure, and enable unrestricted global flow of value. In a system where government debt continues to rise and savers bear the consequences, the value of cryptocurrencies will continue to grow.

II. BTC: The Dominant Cryptocurrency

Bitcoin pioneered the cryptocurrency category, so it's natural for us to start with it. Nearly 17 years later, Bitcoin remains the largest and most widely recognized asset in the entire industry. Since currency is essentially a product of social consensus rather than a result of technological design choices, the true standard for measuring the status of currency is whether the market assigns a long-term premium to an asset—from this perspective, Bitcoin's status as the dominant cryptocurrency is beyond doubt.

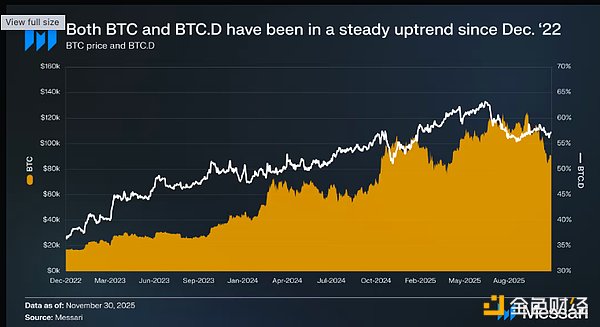

This is most evident in Bitcoin's performance over the past three years: from December 1, 2022 to December 2025, Bitcoin rose from $17,200 to $90,400, an increase of 429%, repeatedly setting new all-time highs (most recently $126,200 on October 6, 2025). At the beginning of this period, Bitcoin's market capitalization of approximately $318 billion was insufficient to rank among the world's largest assets; now, its market capitalization has reached $1.81 trillion, making it the ninth most valuable asset globally. The market not only recognizes Bitcoin's monetary attributes and assigns it a higher valuation, but has also elevated it to the top tier of global asset rankings.

But what's even more telling is Bitcoin's performance relative to other cryptocurrencies. Historically, during cryptocurrency bull markets, Bitcoin's market capitalization share (BTC.D, the percentage of Bitcoin's market capitalization to the total cryptocurrency market capitalization) shrinks as funds shift towards the lower end of the risk curve; however, in this Bitcoin bull market, this trend has completely reversed. Over the past three years, Bitcoin's market capitalization share has risen from 36.6% to 57.3%—Bitcoin is diverging from the overall cryptocurrency market.

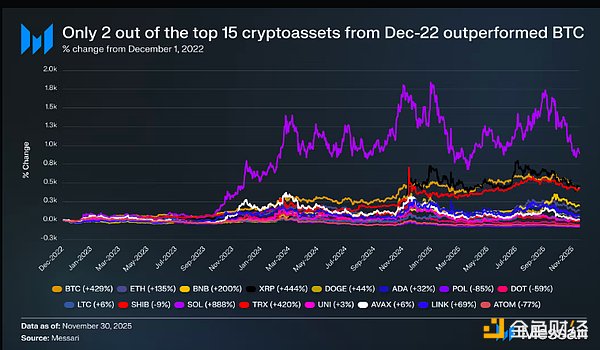

Of the top 15 crypto assets on December 1, 2022, only two (XRP and SOL) outperformed Bitcoin, with SOL showing a significant advantage (an 888% increase compared to Bitcoin's 429%). Other assets lagged far behind, with many major assets barely rising or even falling during the same period: Ethereum rose 135%, BNB rose 200%, Dogecoin (DOGE) rose 44%, while assets like POL (-85%), DOT (-59%), and ATOM (-77%) remained mired in losses. More noteworthy is Bitcoin's size—as a trillion-dollar asset, it should require the most capital to drive its price, yet it still outperformed almost all major tokens. This indicates genuine, sustained buying pressure on Bitcoin, while most other assets behaved more like beta assets, only rising when Bitcoin led the market upward.

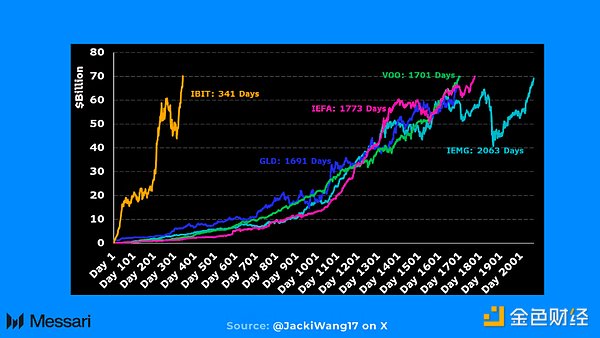

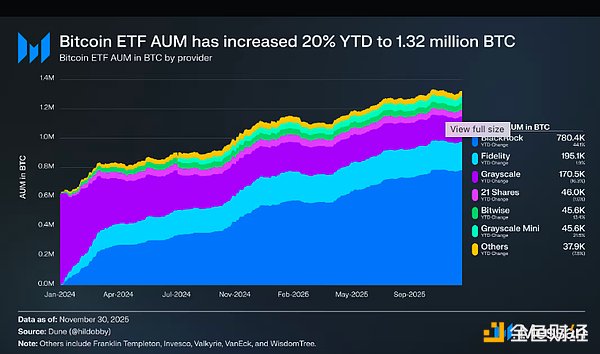

One of the main drivers of sustained buying pressure on Bitcoin is the deepening institutional adoption. A landmark event in this institutional adoption is the launch of spot Bitcoin ETFs. Market demand for such products is extremely strong, with BlackRock's iShares Bitcoin Trust (IBIT) breaking multiple ETF records and being hailed as "the most successful ETF launch in history"—IBIT achieved $700 billion in assets under management (AUM) in just 341 days, 1350 days faster than the previous record held by the SPDR Gold Shares (GLD) ETF.

The momentum of ETF launches in 2024 continued into 2025, with total ETF assets under management increasing by 20% year-on-year, from approximately 1.1 million Bitcoins to 1.32 million. At current prices, these products hold over $120 billion worth of Bitcoin, representing more than 6% of Bitcoin's maximum supply. ETF demand did not subside after the initial launch frenzy but instead became a source of sustained buying pressure, continuously accumulating Bitcoin regardless of market conditions.

Furthermore, institutional participation extends far beyond ETFs. In 2025, digital asset treasuries (DATs) became major buyers, further solidifying Bitcoin's position as a treasury reserve asset. While Michael Saylor's MicroStrategy has long been the most prominent example of corporate Bitcoin accumulation, nearly 200 companies globally now have Bitcoin on their balance sheets. Publicly traded companies alone hold approximately 1.06 million Bitcoins (5% of the total supply), with MicroStrategy holding 650,000, a dominant position.

The most significant event in 2025 that further differentiated BTC from other cryptocurrencies was the establishment of the Strategic Bitcoin Reserve (SBR). The SBR formally recognized the market's long-standing distinction between Bitcoin and other cryptocurrencies—viewing Bitcoin as a strategic monetary commodity, while placing all other digital assets in a separate reserve category for routine management. The White House, in its statement, described Bitcoin as a "unique store of value in the global financial system" and likened it to "digital gold." Finally, and most importantly, the directive requires the Treasury Department to develop a strategy for future Bitcoin acquisitions. While no such purchases have yet occurred, this option alone indicates that US federal policy is now viewing Bitcoin from a forward-looking reserve asset perspective. If implemented, such acquisition plans would further solidify Bitcoin's monetary status not only among crypto assets but across all assets.

III. Is BTC a high-quality currency?

Despite Bitcoin's solidified dominance in the cryptocurrency space, 2025 presents a host of new questions about its monetary attributes. As the largest non-sovereign monetary asset, gold remains Bitcoin's most important benchmark. With escalating geopolitical tensions and rising expectations of future monetary easing, gold has delivered one of its strongest annual performances in decades—but Bitcoin has not followed suit.

While the Bitcoin/Gold (BTC/XAU) ratio briefly hit an all-time high in December 2024, it has since fallen by about 50%. This pullback is noteworthy because it occurred against the backdrop of gold's surge to an all-time high against the US dollar—gold prices have risen by over 60% since 2025, reaching $4,150 per ounce. With gold's total market capitalization approaching $30 trillion, while Bitcoin represents only a fraction of that, this divergence raises a valid question:

If Bitcoin fails to keep pace with gold during one of its strongest cycles, how secure is its status as "digital gold"?

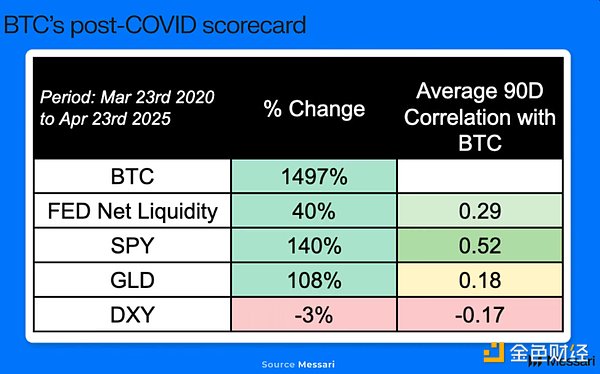

If Bitcoin's price action diverges from gold's, then its performance relative to traditional risk assets needs to be observed. Historically, Bitcoin has exhibited correlations with benchmark stock indices such as the S&P 500 ETF (SPY) and the Nasdaq 100 ETF (QQQ). For example, from April 2020 to April 2025, Bitcoin's 90-day rolling correlation with the SPY averaged 0.52, while its correlation with gold was relatively weaker (0.18). Therefore, if the stock market weakens, Bitcoin's lag relative to gold may be understandable.

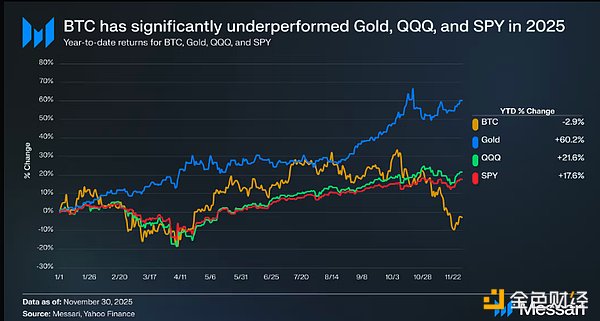

But this hasn't been the case. Since 2025, gold (XAU) has risen 60%, SPY 17.6%, QQQ 21.6%, while Bitcoin has fallen 2.9%. Given Bitcoin's smaller size and higher volatility compared to gold and major stock indices, its underperformance relative to these benchmarks in 2025 raises legitimate questions about its monetary narrative. With gold and stocks hitting all-time highs, one should expect Bitcoin to exhibit similar trends, especially considering its historical correlations—but this hasn't happened. Why?

First, it's important to note that this underperformance is a recent phenomenon, not a year-over-year trend. As of August 14, 2025, Bitcoin's year-to-date absolute return is still higher than gold, SPY, and QQQ; its relative weakness only began to emerge in October. The key concern is not how long this weakness lasted, but rather its severity.

While a number of factors may have contributed to this significant relative weakness, we believe the primary driver of Bitcoin's lackluster performance is the behavior of early large holders. Over the past two years, Bitcoin's liquidity characteristics have changed dramatically as it has become increasingly institutionalized. Now, through deep, regulated markets such as ETFs, large holders can sell their assets without causing market shocks that were unavoidable in the early stages of the cycle—creating, for many of these holders, the first genuine opportunity to lock in profits.

There is ample anecdotal and on-chain evidence that some long-dormant holders have seized this opportunity to reduce their holdings. Earlier this year, Galaxy Digital facilitated the sale of 80,000 Bitcoins by a “Satoshi-era investor”—a single transaction representing 0.38% of the total Bitcoin supply and originating from a single entity.

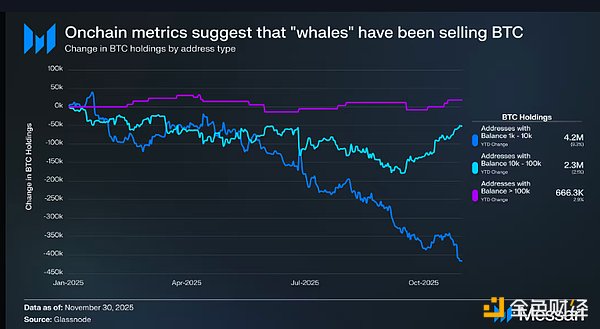

Bitcoin on-chain metrics also reflect a similar situation. Some of the largest and longest-holding holders (addresses holding 1,000-100,000 Bitcoins) were net sellers throughout 2025. These addresses held 6.9 million Bitcoins at the beginning of the year (nearly one-third of the total supply) and continued to sell throughout the year: the group holding 1,000-100,000 Bitcoins saw a net outflow of 417,300 Bitcoins (down 9% year-over-year), and the group holding 100,000-1 million Bitcoins saw an additional net outflow of 51,700 Bitcoins (down 2% year-over-year).

As Bitcoin becomes increasingly institutionalized and more funds flow off-chain, the informational value of on-chain metrics will naturally decrease. Even so, combined with evidence of rumors such as investors selling Bitcoin during the Satoshi era, this data still provides a reasonable basis for the following conclusion: In 2025, especially in the second half of the year, early large holders were net sellers.

This surge in supply coincides with a significant slowdown in the main buying activity that has driven Bitcoin's price increase over the past two years: inflows into digital asset treasuries (DATs) plummeted in October, marking the first time in 2025 that monthly net inflows into DATs have fallen below $1 billion; meanwhile, spot ETFs, which had seen continuous net buying throughout the year, turned to net selling starting in October. With the two major sources of stable demand for Bitcoin—DATs and ETFs—temporarily weakening, the market is forced to absorb the dual pressures of declining inflows and early holders reducing their holdings.

Nevertheless, is there reason to be concerned? Does the recent poor performance mean that BTC's monetary attributes have failed? In our view, the answer is no. As the old saying goes, "When in doubt, look at the long term." It's difficult to dismiss Bitcoin based on just three months of weakness—especially considering that Bitcoin has experienced much longer periods of underperformance in the past, only to subsequently rebound relative to the dollar and gold and reach all-time highs. While this current underperformance is a setback, we do not believe it is a structural problem.

Looking ahead to 2026 presents another challenge. As Bitcoin is increasingly viewed as a macro asset, traditional frameworks (such as the four-year cycle) are becoming less relevant. Bitcoin's performance will be influenced by broader macroeconomic factors, meaning the questions become: Will central banks continue to accumulate gold? Will AI-driven stock trading continue to accelerate? Will Trump fire Powell? If so, will Trump force the new Federal Reserve Chairman to start buying Bitcoin? These variables are difficult to predict, and we do not claim to know their outcomes.

However, we are confident in Bitcoin's long-term monetary trajectory. Over a period spanning years and even decades, we expect Bitcoin to continue appreciating in monetary value relative to the US dollar and gold. Holding this view ultimately boils down to a simple question: "Is cryptocurrency a superior form of currency?" If the answer is yes, then Bitcoin's long-term direction is clear.

IV. Apart from Bitcoin: What is the situation of the L1 public chain?

Bitcoin has clearly established itself as the dominant cryptocurrency, but it is not the only crypto asset with a currency premium. The valuations of several L1 public chain tokens also reflect a certain degree of currency premium, or market expectations that they may generate a currency premium in the future.

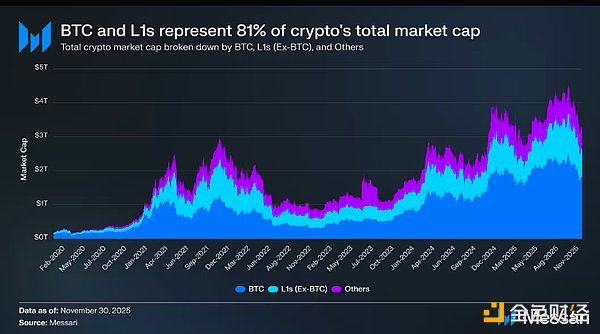

The total market capitalization of cryptocurrencies is $3.26 trillion, of which Bitcoin accounts for $1.8 trillion, and of the remaining $1.45 trillion, approximately $830 billion is concentrated on L1 public chains (non-Bitcoin public chains). In total, $2.63 trillion in market capitalization (approximately 81% of the total market capitalization) comes from crypto assets that have been regarded as currencies by the market or are considered to have the potential to generate a currency premium.

Therefore, whether you are a trader, investor, capital allocator, or industry builder, understanding how the market assigns and reclaims currency premiums is crucial. In the cryptocurrency space, nothing influences an asset's valuation more than whether the market is willing to treat it as currency. From this perspective, predicting the future flow of currency premiums is undoubtedly the most critical consideration in constructing a cryptocurrency portfolio.

As mentioned earlier, we expect Bitcoin to continue gaining market share from gold and other non-sovereign stores of value in the coming years. But what does this mean for other public blockchains? Will it be a case of "a rising tide lifts all boats," with all crypto assets benefiting? Or will Bitcoin fill the valuation gap between itself and gold by siphoning off the monetary premiums of other public blockchains?

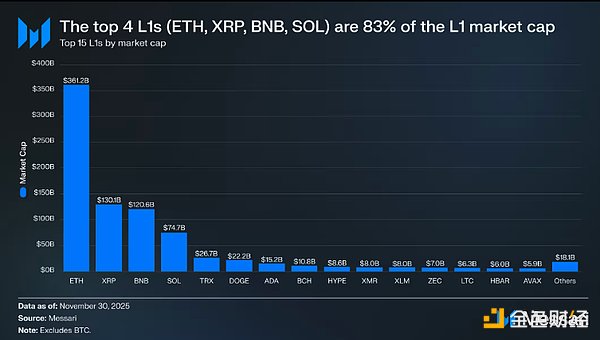

To answer this question, we first need to clarify the current valuation status of public blockchains. The top four public blockchains by market capitalization are Ethereum ($361.15 billion), XRP ($130.11 billion), BNB ($120.64 billion), and Solana ($74.68 billion), with a combined market capitalization of $686.58 billion, accounting for 83% of the L1 public blockchain market. After the top four, the market capitalization of public blockchains declines rapidly (Tron's market capitalization is $26.67 billion), but they still maintain a certain scale—Avalanche, ranked fifteenth by market capitalization, is valued at over $5 billion.

It is important to emphasize that L1 market capitalization is not solely determined by the implied currency premium. Public blockchain valuation is based on three main frameworks: (1) currency premium, (2) real economic value (REV), and (3) economic security requirements. In other words, a project's market capitalization is not solely derived from the market's expectation that it will be viewed as currency.

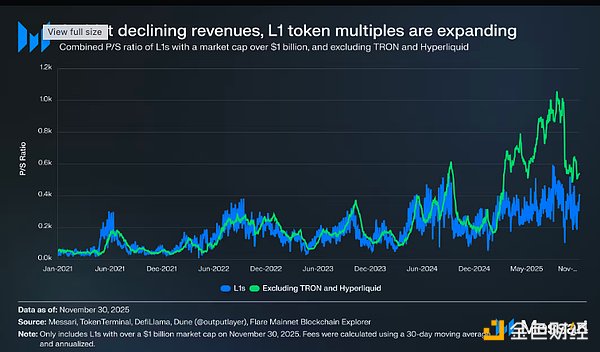

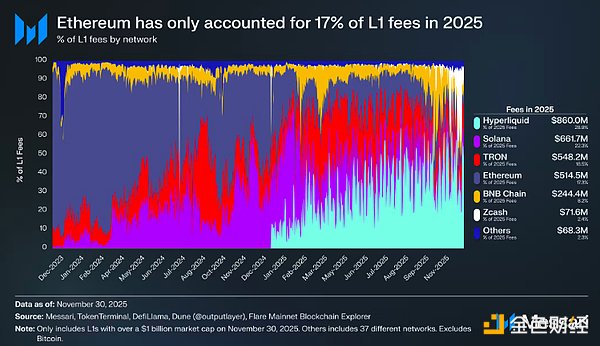

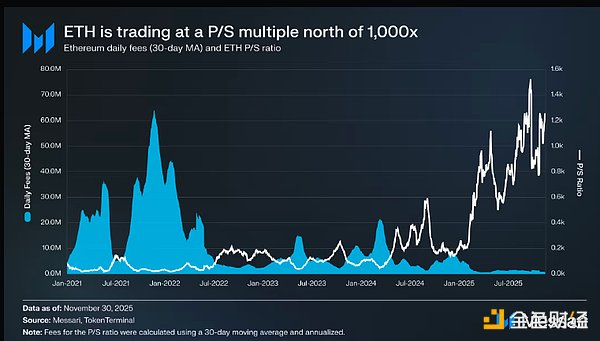

Despite the ongoing debate surrounding various valuation frameworks, the market is increasingly inclined to price L1 blockchains based on currency premiums rather than revenue-driven valuations. Over the past few years, the overall price-to-sales ratio (P/S) of all L1 public chains with a market capitalization exceeding $1 billion has slowly climbed from 200x to 400x. However, this apparent figure is misleading—it includes two special projects: Tron and Hyperliquid. In the past 30 days, Tron and Hyperliquid contributed 51% of the revenue in this group, but their market capitalization accounted for only 4%.

Once these two outliers are removed, the true valuation logic becomes clear: the valuation of the L1 public chain has risen instead of falling despite a continuous decline in revenue. The adjusted price-to-sales ratio shows a continuous upward trend.

- November 30, 2021: 40x

- November 30, 2022: 212 times

- November 30, 2023: 137 times

- November 30, 2024: 205 times

- November 30, 2025: 536 times

From a purely economic perspective, the market seems to be pricing in future revenue growth. However, this explanation doesn't hold up to scrutiny—the same public blockchain combination, after removing outliers, saw its revenue decline in all but one year:

- 2021: US$12.33 billion

- 2022: US$4.89 billion (down 60% year-on-year)

- 2023: $2.72 billion (down 44% year-on-year)

- 2024: US$3.55 billion (31% year-on-year growth)

- 2025 (annualized): US$1.7 billion (down 52% year-on-year)

In our view, the most straightforward and reasonable explanation is that the current valuation of the L1 public chain is dominated by the currency premium, rather than its current or future revenue level.

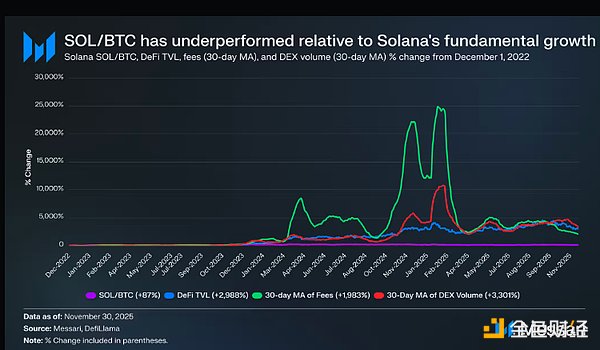

A deeper analysis of Solana's outperformance reveals that its gains have not kept pace with the growth of its ecosystem. While Solana (SOL) achieved an 87% excess return relative to Bitcoin, its ecosystem fundamentals experienced explosive growth: Decentralized Finance (DeFi) value locked increased by 2988%, transaction fee revenue increased by 1983%, and decentralized exchange (DEX) trading volume increased by 3301%. By any reasonable standard, Solana and its ecosystem have expanded 20 to 30 times since December 1, 2022. However, Solana (SOL), which should have reflected this ecosystem growth, only achieved an 87% excess return relative to Bitcoin.

Please read the data above carefully again.

For an L1 public chain to outperform Bitcoin, its ecosystem growth rate does not need to reach 200% to 300%, but rather needs to achieve an explosive growth of 2000% to 3000% to obtain excess returns of less than one time.

Based on all the above analysis, we believe that although the market is still pricing other public chains based on the expectation of a "future currency premium," confidence in this expectation is quietly eroding. At the same time, market confidence in Bitcoin's currency premium has not weakened; on the contrary, its leading advantage is continuing to widen.

From a technical perspective, cryptocurrency valuations don't necessarily require support from transaction fees or revenue, but these metrics are crucial for public blockchains. Unlike Bitcoin, the narrative of other Level 1 public blockchains is built upon an ecosystem (including applications, users, throughput, and economic activity) capable of supporting the token's value. However, if an Level 1 public blockchain experiences a year-over-year decline in ecosystem usage (directly reflected in decreased transaction fees and revenue), then that blockchain loses its only competitive advantage over Bitcoin. Lacking the support of real economic growth, the "cryptocurrency" narrative of these public blockchains will become increasingly difficult for the market to accept.

Looking ahead, we expect this trend to continue into 2026 and beyond. With a few exceptions, other L1 public chains will continue to cede market share to Bitcoin. Their valuations are primarily based on expectations of a future currency premium, and as the market gradually realizes that Bitcoin is the most competitive cryptocurrency, the valuations of these L1 public chains will continue to face downward pressure.

While Bitcoin will face numerous challenges in the future, these challenges are either too distant or dependent on many unknown variables, failing to provide substantial support for the monetary premium of other public blockchains. For other public blockchains, the responsibility of "proving themselves" has shifted—under the halo of Bitcoin, their narratives are no longer convincing, and they cannot forever rely on overall market frenzy to support their valuations.

V. Opposing Viewpoint: Can other L1 public chains challenge Bitcoin?

While we believe other Level 1 public chains are unlikely to outperform Bitcoin in the short term, it would be a grave mistake to conclude that their monetary premium will eventually disappear. The market rarely assigns hundreds of billions of dollars to an asset class without justification, and the continued existence of such valuations precisely demonstrates that investors believe certain Level 1 public chains can secure a long-term and unique place in the cryptocurrency landscape. In other words, although Bitcoin has emerged as the dominant monetary asset in the cryptocurrency space, if Bitcoin fails to properly address certain structural challenges it faces in the future, some Level 1 public chains may still have the opportunity to seize their own monetary foothold.

1. The Threat of Quantum Computing

Currently, the most pressing threat to Bitcoin's monetary status is the "quantum computing threat." Once quantum computers surpass a critical threshold in computing power, they could potentially crack the Elliptic Curve Digital Signature Algorithm (ECDSA) used by Bitcoin, thereby deriving the private key from the public key. Theoretically, this would jeopardize all on-chain addresses whose public keys have been exposed, including those that are reused, as well as old unspent transaction outputs (UTXOs) created before best security practices became widespread.

According to Nic Carter's calculations, approximately 4.8 million bitcoins (23% of the total supply) are stored in exposed addresses vulnerable to quantum attacks. Of these, 1.7 million bitcoins (8% of the total supply) are stored in early p2pk addresses, and these coins can almost be considered "dead coins"—their holders are either deceased, inactive, or have long lost their private keys. These dead coins constitute the biggest unsolved problem facing Bitcoin.

If the threat of quantum computing becomes a reality, the Bitcoin network must upgrade to support quantum-resistant signature schemes. Failure to do so would cause Bitcoin's monetary value to collapse instantly, and the widely circulated slogan would become "Your private key may not be your coin." Therefore, we believe the Bitcoin network is highly likely to address the quantum threat through an upgrade. However, the real challenge is not "whether to upgrade," but rather how to handle inactive coins that cannot be migrated. Even with a new quantum-resistant address format, these inactive coins will remain perpetually vulnerable.

Currently, there are two main solutions in the industry to this problem:

Option 1: Maintain the status quo. Ultimately, any entity with quantum computing power could potentially steal these dead coins and reintroduce 8% of the total Bitcoin supply into circulation—these coins would most likely flow to people who have never held them before. This would almost certainly depress the price of Bitcoin and weaken market confidence in its monetary attributes.

Option Two: Destroy Dead Coins. Set a specific block height, then mark all dead coins in vulnerable addresses as unspendable, effectively removing them from the circulating supply. However, this approach also has drawbacks: it violates Bitcoin's core principle of "censorship resistance" and could even set a dangerous precedent of "destroying tokens by voting."

Fortunately, quantum computing is unlikely to pose a substantial threat in the short term. While predictions vary widely, even the most aggressive estimates suggest the earliest possible window for a threat is around 2030. Based on this timeline, we anticipate no substantial progress on quantum computing by 2026—it remains a long-term governance challenge rather than an imminent technological hurdle.

However, beyond this timeline, the situation becomes unpredictable. The biggest question mark lies in how the Bitcoin community will handle those dead coins that cannot be migrated to quantum-resistant addresses. We cannot predict the final choice, but what is certain is that the community will do everything in its power to make the decision that best maintains and maximizes the value of Bitcoin.

Both of these approaches have their own merits. The first approach upholds Bitcoin's censorship resistance, but at the cost of the market needing to absorb the sudden increase in supply. The second approach, while sparking controversy regarding censorship resistance, prevents these Bitcoins from falling into the hands of criminals.

Regardless of which path Bitcoin ultimately chooses, quantum computing remains a real and long-term governance challenge. If the quantum threat materializes and the Bitcoin network fails to upgrade in time, its monetary status will collapse completely. At that point, alternative cryptocurrencies that have already implemented quantum-resistant technologies will have an excellent opportunity to absorb the lost monetary premium from Bitcoin.

2. Lack of programmability

Another major weakness of the Bitcoin network is its lack of general-purpose programmability. Bitcoin was designed not to be Turing complete—its scripting language was limited in scope from the outset, severely restricting the complexity of on-chain transaction logic. Unlike other public blockchains that support native smart contracts and can automatically verify and execute signature conditions, Bitcoin, without off-chain infrastructure support, cannot verify external information or achieve trustless cross-chain bridging. Therefore, many types of applications (such as decentralized exchanges, on-chain derivatives, and privacy tools) are virtually impossible to build on the Bitcoin mainnet.

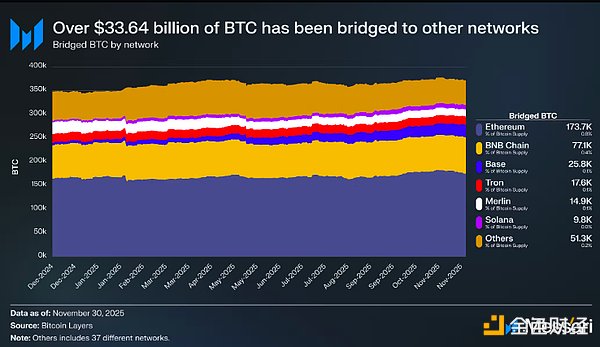

While some proponents argue that this design reduces the network's attack surface and maintains Bitcoin's simplicity as a currency, it's undeniable that a significant portion of Bitcoin holders desire to use Bitcoin in a programmable environment. As of this writing, 370,300 Bitcoins (worth approximately $33.64 billion) have been bridged to other networks. Of these, 365,000 Bitcoins (99% of all cross-chain Bitcoins) were transferred via escrow schemes or schemes that introduce trust assumptions. In other words, to use Bitcoin in a more feature-rich ecosystem, users must reintroduce the trust risks that Bitcoin originally aimed to eliminate.

The Bitcoin ecosystem is also attempting to address this issue through solutions such as consortium sidechains, early Layer 2 (L2) networks, and trustless multisignature, but these attempts have not fundamentally reduced the reliance on trust assumptions. Users are eager to use Bitcoin within a highly expressive ecosystem, but in the absence of trustless cross-chain solutions, they are forced to settle for centralized custodians.

As Bitcoin's scale continues to expand, its macro-asset attributes become increasingly prominent, and the market demand for "efficient ways to utilize Bitcoin" will continue to grow. Whether using Bitcoin as collateral, lending or borrowing with Bitcoin as the underlying asset, exchanging Bitcoin for other assets, or interacting with more feature-rich programmable financial systems, users are naturally not satisfied with simply "holding" Bitcoin. However, under the current design framework, these use cases are accompanied by extremely high long-tail risks—without entrusting assets to a centralized intermediary, it is almost impossible to use Bitcoin in programmable or leveraged scenarios.

For the reasons mentioned above, we believe that the Bitcoin network may need to fork to achieve these trustless, permissionless use cases. We are not advocating for Bitcoin to transform into a smart contract platform, but rather that introducing a specific opcode (such as OP_CAT) is the most reasonable option—it enables trustless cross-chain bridging of Bitcoin.

The appeal of OP_CAT lies in its ability to unlock Bitcoin's trustless cross-chain capabilities with only minor modifications to the consensus rules. This doesn't transform Bitcoin into a smart contract platform; rather, it uses a simple opcode, combined with Taproot and existing scripting primitives, to allow the Bitcoin mainnet to directly enforce the spending conditions for cross-chain transactions. This solution enables trustless cross-chain bridges that require no custody, no consortium, and no external validators, fundamentally addressing the core risk of hundreds of thousands of Bitcoins currently locked in custodial cross-chain encapsulated assets.

Unlike the quantum threat, the lack of programmability is not an "existential crisis" for Bitcoin's monetary attributes. However, it does limit the total potential market size of Bitcoin as a cryptocurrency. The market demand for programmable money already exists—over 370,000 Bitcoins (1.76% of the total supply) have been transferred across blockchains to other ecosystems, and the total value locked in decentralized finance (DeFi) has exceeded $120 billion. As cryptocurrencies become more widespread and more financial activities migrate on-chain, this demand will continue to rise. Currently, Bitcoin cannot provide a path to "trustless use of Bitcoin within a programmable ecosystem." If the market deems this risk unacceptable, then programmable public blockchain assets such as Ethereum and Solana will fill this demand.

3. Security budget issues

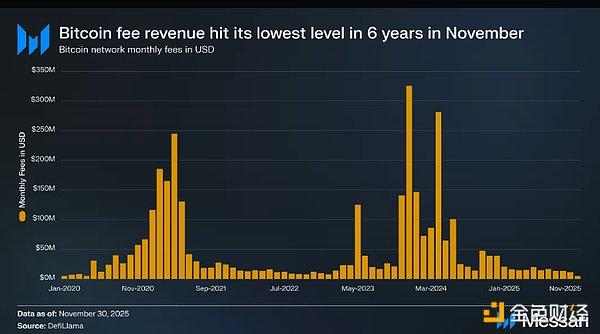

The third structural challenge facing Bitcoin is the security budget. This issue has been discussed for over a decade, and despite differing opinions on its severity, it remains one of the most contentious long-standing issues concerning the integrity of the Bitcoin currency. At its core, the security budget is the total revenue miners can earn by maintaining network security, currently comprised of block rewards and transaction fees. With block rewards halving every four years, Bitcoin will eventually rely primarily, or even entirely, on transaction fees to incentivize miners to maintain network security.

Once upon a time, with the explosive popularity of Ordinals and Runes, the market believed that transaction fees alone were sufficient to support miners' profits and ensure network security. In April 2024, Bitcoin's on-chain transaction fee revenue reached $281.4 million, marking the second-highest monthly record in history. However, a year and a half later, transaction fee revenue has plummeted—in November 2025, Bitcoin's on-chain transaction fees were only $4.87 million, the lowest monthly record since December 2019.

While the dramatic drop in transaction fee revenue is alarming, there's perhaps no need for excessive concern in the short term. Block rewards still provide substantial incentives for miners, and this will continue for decades. Even by 2050, the Bitcoin network will still produce approximately 50 bitcoins per week—a considerable mining reward for miners. As long as block rewards dominate miner revenue, the security of the Bitcoin network will not face a substantial threat. However, it's undeniable that the possibility of transaction fees completely replacing current block rewards is becoming increasingly smaller.

However, the discussion surrounding security budgets is far more complex than whether transaction fees can completely replace block rewards. Transaction fees don't need to reach the current block reward size; they only need to exceed the cost of launching a single trusted attack—a cost that is itself unknown and fluctuates significantly with changes in mining technology and the energy market. In the future, if mining costs decrease significantly, the minimum transaction fee threshold required to maintain network security will also decrease. This could be achieved through various scenarios: in mild scenarios, iterative upgrades to mining chips and the efficient use of idle renewable energy will reduce miners' marginal costs; in extreme scenarios, breakthroughs in energy production technologies (such as commercial nuclear fusion and ultra-low-cost nuclear energy) could reduce electricity prices by several orders of magnitude, fundamentally changing the economic model of mining.

While we acknowledge that there are too many unknown variables to precisely calculate the "reasonable threshold" for Bitcoin's security budget, it is still necessary to assume an extreme scenario: what would happen if miners' revenue were insufficient to cover the economic costs of maintaining network security in the future? In this case, the economic incentives supporting Bitcoin's "trust neutrality" would begin to fail, and the network's security would increasingly rely on social consensus rather than enforceable economic constraints.

One possible outcome is that certain entities (such as exchanges, custodians, sovereign states, and large holders) might engage in "loss-making mining" to protect their Bitcoin assets. However, while this "defensive mining" can keep the network running, it could weaken market consensus on Bitcoin's monetary attributes—if users realize that Bitcoin's security relies on the collaborative support of large entities, its "monetary neutrality" and even its monetary premium will face severe challenges.

Another possibility is that no entity is willing to incur losses to defend Bitcoin. In that case, Bitcoin would face the risk of a 51% attack. Although a 51% attack would not completely destroy Bitcoin (Ethereum Classic, Monero, and other proof-of-work cryptocurrencies have survived 51% attacks), it would undoubtedly raise fundamental questions about Bitcoin's security in the market.

Because numerous unknown variables influence Bitcoin's long-term security budget, no one can accurately predict how the system will evolve decades from now. While this uncertainty does not currently pose a threat, it is indeed a "long-tail risk" that needs to be priced in by the market. From this perspective, the residual currency premium of some public blockchains can be seen as a hedging tool—used to hedge against the extreme risk of potential problems with Bitcoin's future economic security.

VI. The Ethereum Debate: Is it a Cryptocurrency?

Of all the major crypto assets, none has sparked such prolonged and intense controversy as Ethereum. While Bitcoin's status as the dominant cryptocurrency is widely recognized, Ethereum's position has remained ambiguous. Some see Ethereum as the only non-sovereign currency asset besides Bitcoin with credibility; others view it merely as a "company" with declining revenue, shrinking profit margins, and fierce competition from faster and cheaper public chains.

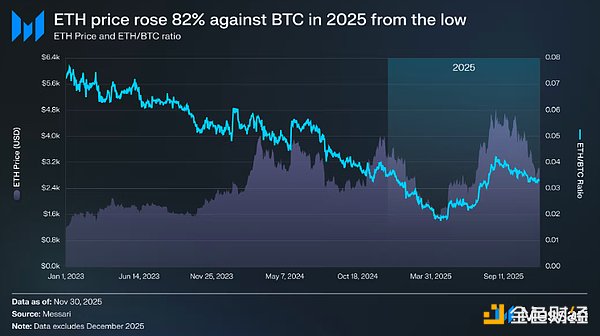

This debate seemed to reach its peak in the first half of the year. In March, Ripple's fully diluted valuation (FDV) briefly surpassed Ethereum's (it's worth noting that Ethereum's supply has been fully released, while Ripple only has about 60% of its supply in circulation).

On March 16th, Ethereum's fully diluted valuation was $227.65 billion, while Ripple reached $239.23 billion—a result almost no one could have predicted a year earlier. Then, on April 8th, 2025, the ETH/BTC exchange rate fell below 0.02, hitting a new low since February 2020. In other words, all the excess gains Ethereum accumulated relative to Bitcoin in the previous bull market had been completely wiped out. At that time, market sentiment towards Ethereum plummeted to its lowest point in years.

To make matters worse, the price slump is just the tip of the iceberg. With the rise of competing ecosystems, Ethereum's share of the public blockchain transaction fee market continues to shrink. In 2024, the Solana ecosystem made a strong comeback; in 2025, Hyperliquid emerged as a dark horse. Caught between these two, Ethereum's transaction fee market share fell to 17%, ranking fourth among public blockchains—a stark contrast to its dominant position a year earlier. While transaction fees don't tell the whole story, they are a direct signal of economic activity—and Ethereum is now facing its most intense competitive environment ever.

However, historical experience tells us that the most significant reversals in the cryptocurrency space often begin at the moment when market sentiment is at its most pessimistic. When Ethereum was labeled a "failure asset," most of the so-called "negative factors" had already been priced in by the market.

In May 2025, signs of excessive pessimism began to emerge in the market. The Ethereum/Bitcoin exchange rate and the price of the US dollar both bottomed out and rebounded during this period. The ETH/BTC exchange rate surged from a low of 0.017 in April to 0.042 in August, an increase of 139%; during the same period, the Ethereum/USD price rose from $1646 to $4793, an increase of 191%. This rally finally peaked on August 24th—Ethereum reached an all-time high of $4946.

Following this round of valuation repair, Ethereum's long-term trend has clearly returned to an upward trajectory. Leadership changes at the Ethereum Foundation and the emergence of the Ethereum-focused Digital Asset Treasury (DATs) have injected confidence into the market that had been lacking for the previous year.

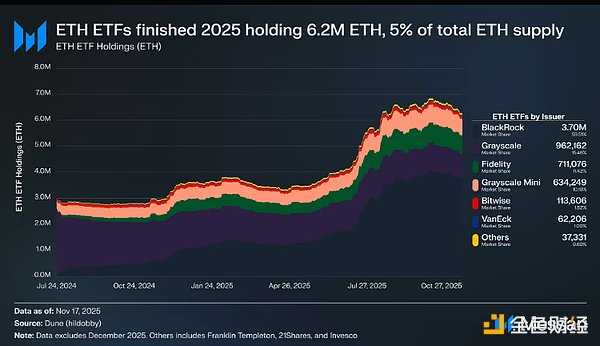

Prior to this surge, the divergence between Bitcoin and Ethereum was vividly reflected in their respective ETF markets. When the Ethereum spot ETF was launched in July 2024, inflows were dismal. In the first six months after listing, total inflows amounted to only $2.41 billion—a paltry sum compared to the record-breaking performance of Bitcoin ETFs.

However, with Ethereum's strong rebound, market concerns about its ETFs have dissipated. For the year, Ethereum spot ETFs saw inflows of $9.72 billion, while Bitcoin ETFs saw inflows of $21.78 billion. Considering that Bitcoin's market capitalization is nearly five times that of Ethereum, the difference in inflows between the two ETFs is only 2.2 times, a result far exceeding market expectations. In other words, when adjusted for market capitalization, Ethereum ETFs are even more attractive than Bitcoin—a stark contrast to the mainstream narrative of "institutional lack of interest in Ethereum." At certain times, Ethereum's advantage was even more pronounced: from May 26 to August 25, Ethereum ETFs saw inflows of $10.2 billion, exceeding the $9.79 billion inflows into Bitcoin ETFs during the same period, marking the first time institutional demand clearly shifted towards Ethereum.

From the perspective of ETF issuers, BlackRock maintained its dominant position in the Ethereum ETF market. At the end of 2025, BlackRock held 3.7 million Ethereum, accounting for 60% of the Ethereum spot ETF market. This figure represents a 241% increase from 1.1 million at the end of 2024, a growth rate far exceeding that of other issuers. By the end of the year, total holdings in Ethereum spot ETFs reached 6.2 million Ethereum, representing approximately 5% of the total Ethereum supply.

Behind Ethereum's strong rebound, the most crucial structural change is the rise of Ethereum Digital Asset Treasuries (DATs). These treasuries have created a stable and continuous source of demand for Ethereum—something never before seen in Ethereum's history—and their supporting role for Ethereum far surpasses that of narrative hype or speculative funds. If price movements are the "symptom" of Ethereum's reversal, then the continuous accumulation of treasuries is the "deep driving force" behind this reversal.

In 2025, the cumulative increase in Ethereum treasury holdings reached 4.8 million Ethereum, accounting for 4% of the total Ethereum supply, significantly impacting its price. The most representative example is Bitmine (stock code BMNR), owned by Tom Lee. This company, originally focused on Bitcoin mining, began shifting its treasury funds and capital to Ethereum in July 2025. Between July and November, BitMine purchased a total of 3.63 million Ethereum, becoming the absolute leader in the Ethereum treasury sector with a 75% holding.

Despite Ethereum's strong rebound, the rally has eventually subsided. As of November 30th, the price of Ethereum had fallen from its August high to $2991, significantly lower than the all-time high of $4878 during the previous bull run. Compared to the lows in April, Ethereum's situation has improved considerably, but the structural concerns that previously fueled the bearish narrative have not been completely eliminated. On the contrary, the debate over Ethereum's positioning is becoming more intense than ever before.

On the one hand, Ethereum is exhibiting many of the characteristics that led Bitcoin to its current status as a dominant currency: ETF inflows are no longer weak, and digital asset treasuries are becoming a pillar of sustained demand. More importantly, a growing number of market participants are beginning to differentiate Ethereum from other public blockchain tokens, viewing it as an asset belonging to the same monetary framework as Bitcoin.

On the other hand, the core issues that dragged down Ethereum in the first half of this year have not yet been fully resolved: Ethereum's fundamentals have not fully recovered, and its public chain transaction fee share still faces pressure from strong competitors such as Solana and Hyperliquid; main chain activity is far below the peak of the previous bull market; although Ethereum has rebounded significantly, Bitcoin has firmly reached a new all-time high, while Ethereum has not yet broken through its previous high. Even during Ethereum's strongest months, many holders still viewed the rebound as a good opportunity to exit, rather than an endorsement of its long-term monetary narrative.

The core issue in this debate is not "whether Ethereum has value," but rather "how Ethereum tokens capture value from the Ethereum ecosystem."

In the last bull market, the prevailing assumption was that Ethereum tokens would directly benefit from the success of the ecosystem. This is the core logic of the "Ultrasound Money" narrative: Ethereum's utility would generate massive transaction fee burning, ultimately making Ethereum tokens a deflationary asset.

Today, we have sufficient confidence to assert that this direct value capture logic will not materialize. Ethereum's transaction fee revenue has declined significantly and shows no signs of recovery; meanwhile, the fastest-growing areas of the Ethereum ecosystem (real-world asset tokenization and institutional business) primarily use the US dollar as their base currency, rather than Ethereum tokens.

In the future, Ethereum's value will depend on how it indirectly captures value from the success of its ecosystem. However, the certainty of indirect value capture is much lower—it relies on the premise that as Ethereum's systemic importance continues to grow, more and more users and capital will choose to view Ethereum tokens as both cryptocurrencies and stores of value.

However, unlike direct, institutionalized value capture, this indirect path offers no guarantees. It relies entirely on social preferences and collective consensus—which is not inherently flawed (as explained in detail earlier, Bitcoin's value capture is based on this logic), but it means that Ethereum's appreciation is no longer definitively linked to the economic activities within the Ethereum ecosystem.

All of this has brought the Ethereum debate back to its core contradiction: Ethereum may indeed be accumulating a monetary premium, but this premium consistently lags behind Bitcoin. The market is once again viewing Ethereum as a "leveraged expression" of the Bitcoin monetary narrative, rather than an independent monetary asset. Throughout 2025, Ethereum's 90-day rolling correlation with Bitcoin fluctuated between 0.7 and 0.9, while its rolling beta coefficient soared to multi-year highs, even exceeding 1.8 at times. This means that while Ethereum's price volatility is greater than Bitcoin's, its price movement remains highly dependent on Bitcoin.

This is a subtle but crucial distinction. Ethereum's current monetary value is entirely built upon the foundation of Bitcoin's monetary narrative. As long as the market believes Bitcoin is a non-sovereign store of value, some investors will be willing to extend that trust to Ethereum. Therefore, if the Bitcoin bull market continues into 2026, Ethereum will also have a clear upward trajectory.

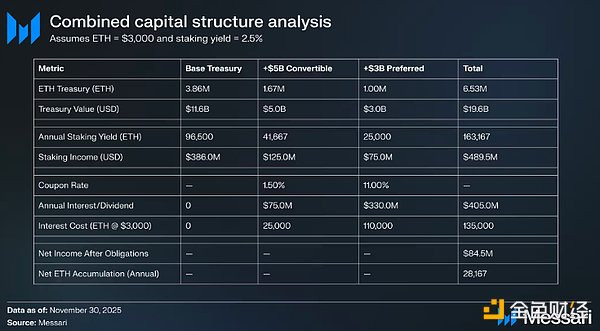

Currently, Ethereum digital asset treasuries are still in their early stages of development, and their funds for increasing Ethereum holdings mainly come from common stock issuance. However, against the backdrop of a renewed cryptocurrency bull market, these treasuries are expected to learn from the financing strategies used by companies like MicroStrategy to accumulate Bitcoin and explore more capital operation methods, such as issuing convertible bonds and preferred stock.

For example, digital asset treasuries like BitMine can raise funds by issuing a combination of low-interest convertible bonds and high-yield preferred stock, directly using the proceeds to purchase Ethereum, while simultaneously staking these Ethereum to obtain stable staking returns. Under reasonable assumptions, these returns can partially cover bond interest and preferred stock dividends, allowing the treasury to leverage and continuously increase its Ethereum holdings when market conditions are favorable. Assuming a Bitcoin bull market re-emerges in 2026, this "second growth curve" for Ethereum digital asset treasuries will become a significant force supporting Ethereum's high beta relative to Bitcoin.

Ultimately, the market still views Ethereum's monetary premium as a derivative of Bitcoin. Ethereum has not yet become an independent monetary asset with its own macroeconomic logic, but rather a "secondary beneficiary" of Bitcoin's monetary consensus. Its recent strong rebound reflects that some investors are willing to view Ethereum more as Bitcoin, rather than as a typical L1 public chain token. However, even in this relatively strong phase, market confidence in Ethereum is inextricably linked to the continued strengthening of the Bitcoin narrative.

In short, while Ethereum's monetary narrative hasn't broken down, it's far from settled. Under the current market structure, considering Ethereum's high beta relative to Bitcoin, as long as Bitcoin's bull market logic continues, Ethereum is expected to achieve considerable gains —the structural demand from digital asset treasuries and corporate treasuries will provide substantial upward momentum. However, in the foreseeable future, Ethereum's monetary trajectory will remain dependent on Bitcoin. Unless Ethereum can achieve low correlation and a low beta coefficient with Bitcoin over a longer period, its monetary premium will forever be overshadowed by Bitcoin's aura.

6. Zcash: A hedging tool for Bitcoin?

Among all crypto assets outside of Bitcoin and Ethereum, ZEC experienced the most significant shift in perception regarding its monetary attributes in 2025. For years, ZEC remained on the fringes of the cryptocurrency ecosystem, viewed as a niche privacy coin rather than a true monetary asset. However, with increasing global surveillance and the institutionalization of Bitcoin, privacy has once again become a core attribute of cryptocurrencies—rather than a marginalized ideological preference.

Bitcoin proved that non-sovereign digital currencies can circulate globally, yet it failed to retain the privacy enjoyed when people use physical cash. Every Bitcoin transaction is broadcast to a transparent public ledger, which anyone can track with a block explorer. Ironically, this tool, intended to subvert centralized power, has inadvertently created a "panopticon" of finance.

ZEC combines Bitcoin's monetary policy with the privacy of physical cash through zero-knowledge proof cryptography. Currently, no other digital asset offers the proven and deterministic privacy guarantees of ZEC's latest Shielded Pool. This makes ZEC a unique private currency whose value is difficult to replicate. In our view, the market is reassessing ZEC's value relative to Bitcoin, positioning it as a "potential privacy cryptocurrency"—an ideal tool to hedge against the rise of surveillance states and the institutionalization of Bitcoin in an era where ZEC represents two major trends.

Since 2025, ZEC has seen a 666% increase relative to Bitcoin, with its market capitalization climbing to $7 billion, briefly surpassing Monero (XMR) to become the most valuable privacy coin. This relative strength indicates that ZEC, along with Monero, is now considered by the market as a viable privacy cryptocurrency.

Privacy of Bitcoin

Bitcoin is highly unlikely to adopt a privacy pool architecture, therefore the claim that "Bitcoin will eventually swallow ZEC's value proposition" is untenable. The Bitcoin community is known for its conservatism, with its core culture being "hardening the protocol"—reducing attack surfaces and maintaining the integrity of the currency by minimizing protocol changes. Embedding privacy features at the protocol layer would require significant modifications to Bitcoin's core architecture, potentially introducing inflationary vulnerabilities and undermining its monetary foundation. ZEC, on the other hand, prioritizes privacy as a core value proposition and is therefore willing to take such technological risks.

Furthermore, deploying zero-knowledge proofs at the main chain layer reduces the blockchain's scalability. Zero-knowledge proofs require the use of nullifiers and hashed notes to prevent double spend, which introduces the long-term problem of "state bloat": nullifiers generate a persistent, append-only list that expands infinitely over time, significantly increasing the hardware resource requirements for running a full node. If nodes are forced to store massive and continuously growing sets of nullifiers, Bitcoin's decentralization will be severely compromised.

As mentioned earlier, without introducing opcodes like OP_CAT that support zero-knowledge proof verification through a soft fork, Bitcoi