Bitcoin sentiment heading into 2026 is split between optimism and fatigue. Price action remains choppy, but the underlying setup is quietly improving. 1. Regulation is shifting from constraint to enablement. The Fed’s December rollback of restrictive 2023 guidance marks a real inflection point. Banks are no longer blanket-restricted from crypto activities and instead operate under a “same activity, same risk” framework. This opens clearer paths for custody, tokenization, stablecoins, and balance sheet participation across both insured and uninsured institutions. It’s not a short-term catalyst, but it materially lowers friction for mainstream adoption. 2. Sentiment is weak, positioning is cleaner. Late 2025 has been defined by drawdowns, frustration, and capital fatigue. Many assets are deeply underwater, scam awareness is high, and risk appetite is selective. Historically, this kind of environment tends to reward patience and quality rather than momentum chasing. 3. 2026 narratives are already forming. Real-world assets are increasingly viewed as the next structural growth leg. Privacy and zero-knowledge tech are gaining relevance as regulation tightens and onchain activity matures. At the same time, Bitcoin’s role is expanding beyond passive holding, with DeFi integrations, omnichain liquidity experiments, and protocol-level upgrades quietly progressing. 4. Ecosystem reality check. NFT volumes have collapsed, airdrop farming is losing appeal, and incentives are being questioned. This reset may be necessary. The Bottom line for investors and traders: 2026 is shaping up as a build year. Regulation is becoming clearer, leverage is more disciplined, and capital is slowly repositioning for longer-term themes. Volatility will remain, but the foundation looks stronger than sentiment suggests. Markets often turn not when optimism peaks, but when infrastructure catches up to belief.

Trireme

@triremetrading

12-18

Market Structure Update! ⚠️

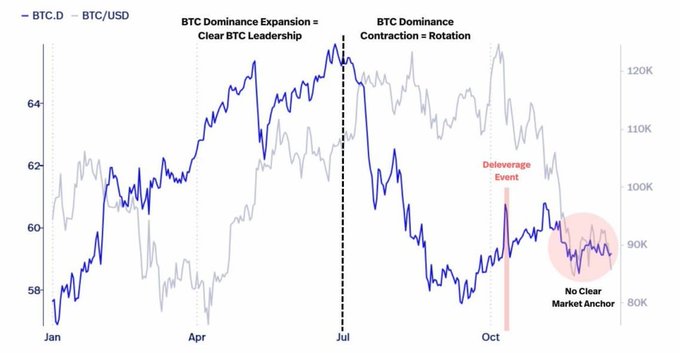

Bitcoin dominance is losing momentum after leading most of the year.

Data shows H1 was clearly $BTC-led, but in H2 dominance trended lower as $ETH rotation picked up without fully taking leadership.

That tells us the market is still searching for a

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content