The recent drop in Bitcoin's price below $85,000 seemed like a sign that large investors were buying more. However, on-chain data suggests a different picture.

Although prices have stabilized above key support levels, the actual behavior suggests that large investors are restructuring their balance sheets rather than injecting new Capital into the market.

Bitcoin investors are not overly optimistic.

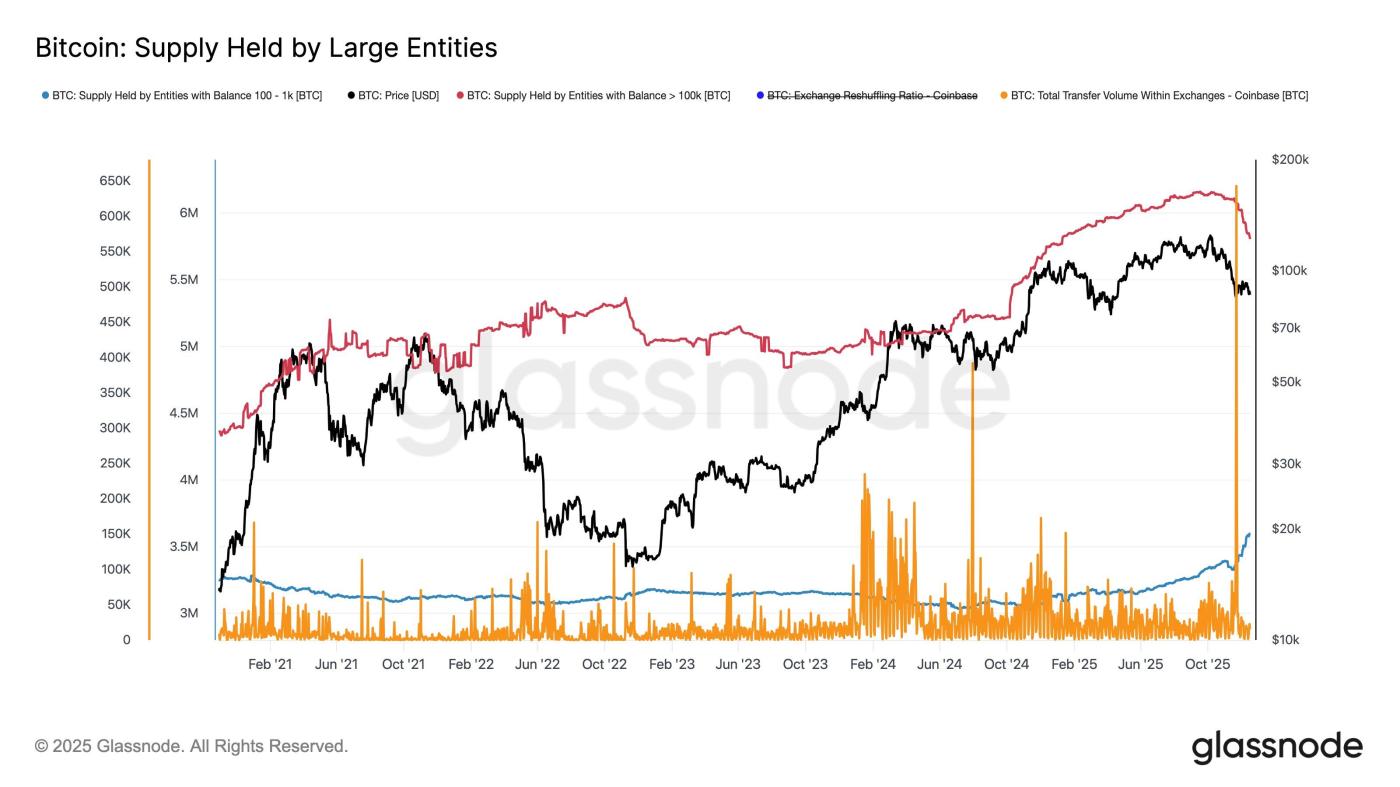

Wallets holding between 100 and 1,000 BTC have recently increased, initially thought to be a sign of whales accumulating more. However, experts from Glassnode clarified that this amount only reflects the relocation and rearrangement of wallets, not new purchases. These movements do not indicate a new influx of funds into the Bitcoin market .

Wallet rearrangements are often performed when large organizations Chia or consolidate balances across different addresses. This is done for asset management, internal risk control, or accounting convenience. The actual owners remain unchanged. Recently, Coinbase internally transferred approximately 640,000 BTC, a clear example of how this affects the figures of large holding groups.

Because this activity does not introduce any new Capital into the market, its impact on prices is negligible. This could distort accumulation figures, leading to inaccurate "bullish" signals.

Want to read more about Token like this? Sign up for Editor Harsh Notariya's Daily Crypto Newsletter here .

The amount of Bitcoin held by large institutions. Source: Glassnode

The amount of Bitcoin held by large institutions. Source: GlassnodeMacroeconomic indicators also suggest caution is needed. The current MVRV Longing/ Short Difference indicator shows that the majority of profits are going to short-term Bitcoin holders, rather than long-term holders. This imbalance increases the risk of a price drop, as short-term investors tend to react very quickly to market fluctuations.

When profits are primarily concentrated among short-term investors, selling pressure easily increases during periods of instability. They tend to take profits as soon as they perceive signs of market weakness. This stifles upward momentum and prolongs periods of sideways price movement in key areas.

Bitcoin's long-term/short-term MVRV spread. Source: Santiment

Bitcoin's long-term/short-term MVRV spread. Source: SantimentThe price of BTC may face some difficulties.

At the time of writing, Bitcoin is trading around $87,108, above the support zone of $86,361. While this area provides temporary stability, the prospect of a recovery remains quite fragile. BTC needs to reclaim higher levels for a clear trend reversal signal.

Short-term investors remain a potential factor putting pressure on the price's upward momentum. If they begin taking profits, Bitcoin could be held back around the $88,210 mark. If this structure isn't maintained, the price could fall back to the $84,698 level, a point that was tested during recent market volatility.

Bitcoin price analysis. Source: TradingView

Bitcoin price analysis. Source: TradingViewFor a stronger recovery, Bitcoin needs to convincingly break above $88,210. A rise to the $90,401 region would signal improved positive momentum. A breakthrough like this requires a return of investor capital, especially given the current attractive price levels.