In the realm of crypto-native services, Robinhood is actively challenging Coinbase's market position and holds a leading edge in tokenization strategies.

Article by Michael Nadeau

Article Source: Investment Banking VCPE Blog

In this market cycle, the most outstanding performers were not traditional tokens, but crypto stocks. Among them, Robinhood performed the strongest. The stock rose 17 times in less than two years, turning one of our most contrarian investments (HOOD's stock price fell 80% from its IPO price in 2022) into a major victory for our portfolio.

We first bought the company's stock during the last bear market (at an average cost of $21.49) and sold it all in October, ultimately locking in a gain of over 550%.

Currently, with the product development trend continuing to improve and the revenue structure becoming more diversified compared to two years ago, Robinhood has officially returned to the "watch list" (i.e., the investment candidate list we prepared during the bear market).

This report, released today, is a comprehensive update on the company’s fundamentals, valuation, and ambitious plans for deep expansion in the cryptocurrency and prediction markets, based on detailed data.

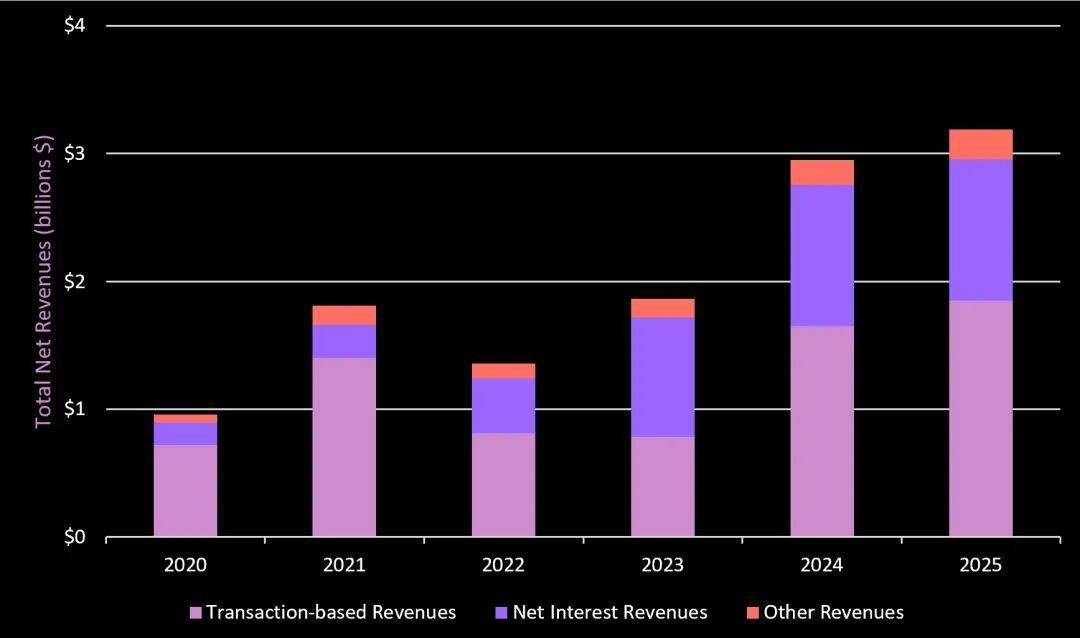

Revenue and Revenue Growth

Data source: Yahoo Finance, Robinhood

Robinhood projects its 2024 revenue to reach $2.95 billion, a 58% increase from 2023. As of the third quarter of this year, its revenue had already reached $3.19 billion, exceeding its total revenue for the entire previous year.

Over the past 12 months, the company's revenue reached $4.2 billion (a 31% increase year-over-year).

Below, we will break down the revenue sources and growth of each business line.

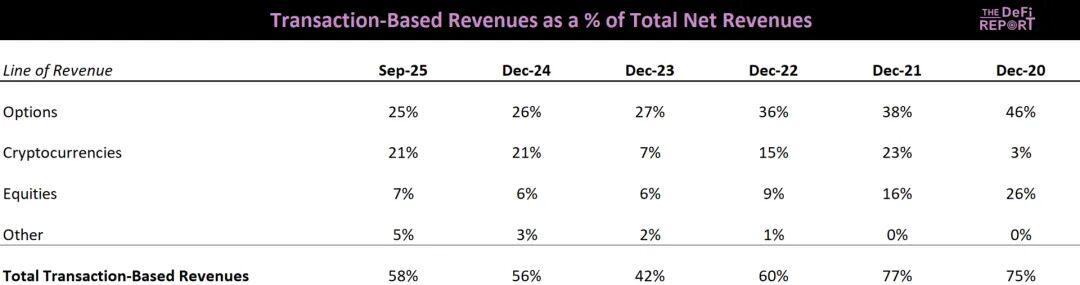

Income details

Data source: Robinhood 10 Q

Key points summary

Robinhood's revenue has grown at a compound annual growth rate (CAGR) of 34% over the past five years. The company reported a record net income of $565 million in the third quarter (a 271% increase year-over-year).

Cryptocurrency business accounts for 21% of Robinhood’s total revenue year-to-date (YTD) (the same as last year).

Year-to-date, transaction-based revenue is $1.85 billion (up from $1.65 billion in the same period of 2024). Overall, transaction-based revenue accounts for 58% of total revenue (down from 77% in 2021).

This indicates that: 1) transaction-based revenue is growing (covering stocks, options, and cryptocurrencies); and 2) Robinhood is continuously adding new revenue streams.

What are these new revenue streams? Prediction Markets (via Kalshi) has generated $100 million in annualized revenue, making it the company's fastest-growing business line ever.

Robinhood Gold currently has 3.9 million paid subscribers (costing $5 per month) and annual subscription revenue of $234 million.

Instant withdrawal fees, futures market fees, and swap revenue (Robinhood credit card business) are recorded as "Other Revenue".

In addition to transaction-based revenue and new revenue streams, Robinhood generated over $1.1 billion in net interest income (35% of total revenue) by the end of the third quarter.

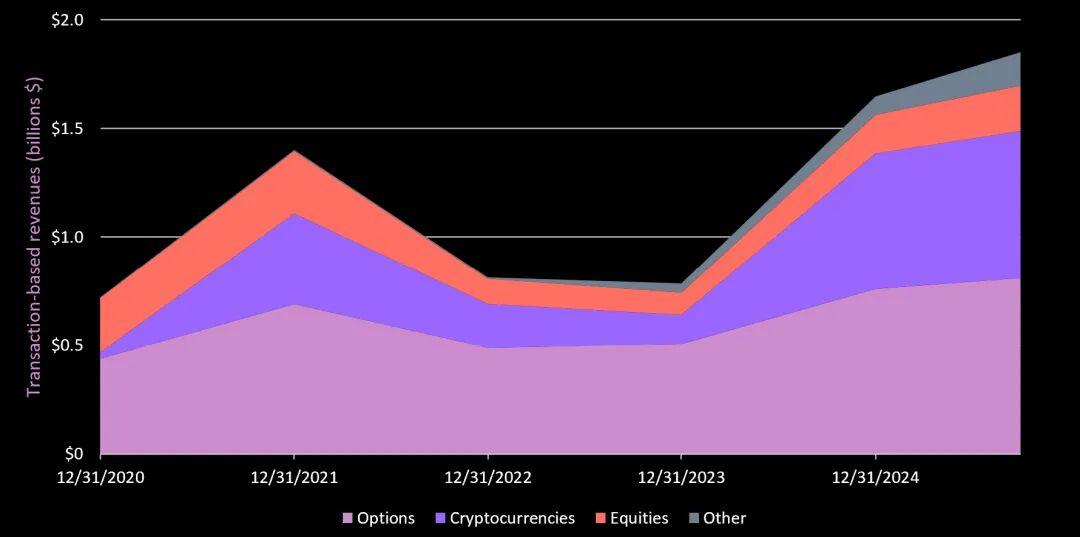

Revenue based on transactions

Key points summary

Options are Robinhood's "cash cow".

The cryptocurrency business ranks second, although it only accounts for 12% of stock trading volume.

This highlights Robinhood's superior business model in the cryptocurrency trading space.

Stock trading volume accounts for 88% of total trading volume, but trading revenue accounts for only 7%.

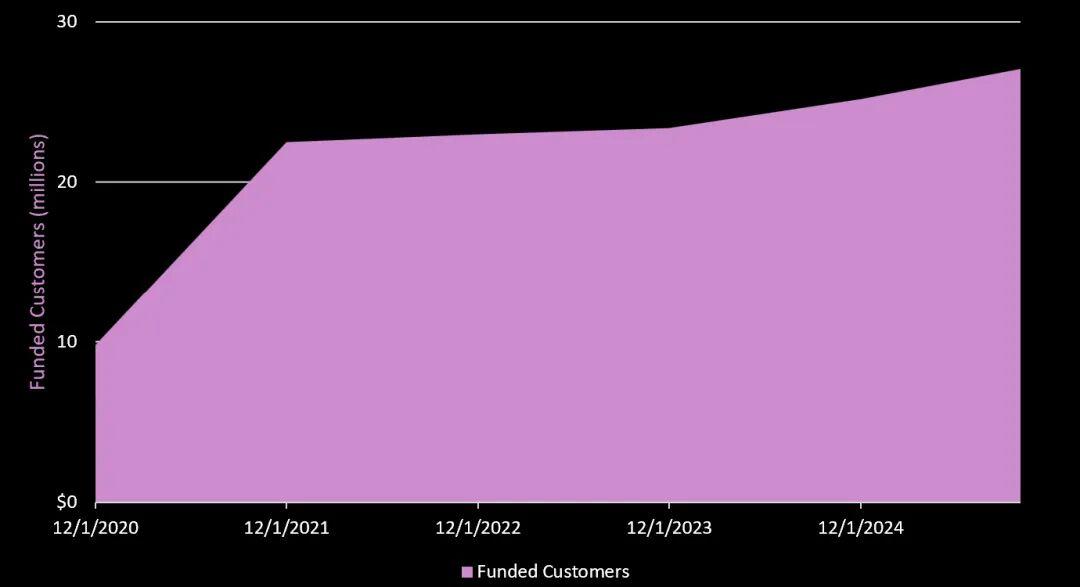

Fundamentals

user

As of September 30, 2025, Robinhood had 27.1 million paid subscribers. Its user growth rate over the past five years was 22.6%, with most of that growth occurring in 2020.

Valuation comparison

Some thoughts:

High liquidity (malicious trading + spot trading) dwarfs all other platforms in terms of trading volume, but generates the least revenue.

Uniswap faces its biggest challenge in user monetization because historically 100% of transaction fees were paid to liquidity providers (a situation that has changed with recent governance proposals).

Coinbase vs Robinhood

Coinbase has only one-third the user base of Robinhood, but its revenue is almost twice that of Robinhood. Meanwhile, Coinbase trades at 53% less by market capitalization than Robinhood.

Why?

We believe the market favors Robinhood for the following reasons:

The business is diversified, covering stocks, options, prediction markets and cryptocurrencies.

Robinhood is positioned by the market as a "super app" that has entered the consumer/retail finance sector; while Coinbase is still regarded as a "cryptocurrency exchange" (although its business is much more than that).

Regulatory Licensing: Robinhood is registered as a broker-dealer and regulated by FINRA and the SEC. Coinbase does not have such qualifications, meaning it cannot offer services such as stocks, options, or margin lending.

Robinhood has a larger and more active user base. However, Coinbase has struggled with user growth since 2021.

Furthermore, in terms of traditional financial platforms, Robinhood's revenue over the past twelve months accounted for 18% of Charles Schwab's. Charles Schwab has 38 million active accounts (Robinhood has 27.1 million).

Product Roadmap (Cryptocurrency Focus)

A brief history of Robinhood's cryptocurrency business.

2018

Robinhood has officially launched cryptocurrency trading in select states, initially supporting Bitcoin and Ethereum transactions.

2019

Robinhood has obtained a BitLicense from New York State, enabling it to offer cryptocurrency trading services in New York State.

2020

Robinhood has seen a significant increase in cryptocurrency trading volume. This coincides with the substantial growth of Robinhood's user base—the COVID-19 pandemic reignited retail investor interest in stock and cryptocurrency trading, driving the company's user expansion.

2021

Robinhood reported that cryptocurrency revenue accounted for 41% of its total revenue in the first quarter, primarily driven by Dogecoin trading (which accounted for 25% of total revenue). Later that year, Robinhood filed for an IPO, noting that cryptocurrency trading was a significant part of its business.

2022

Robinhood has announced plans to launch a cryptocurrency wallet feature, allowing users to deposit and withdraw crypto assets.

2023

Robinhood announced the addition of several new crypto assets for trading on its platform and plans to expand into the EU market.

2024

Robinhood announced a partnership with Arbitrum (an Ethereum Layer 2 platform), enabling users to exchange cryptocurrencies through the Arbitrum decentralized exchange (DEX). Subsequently, the Robinhood team announced an integration with MetaMask, allowing users to purchase cryptocurrencies on Robinhood and top up their wallets via debit cards, bank transfers, or funds from their existing Robinhood accounts.

The team then launched a staking service for European clients, as well as a cryptocurrency trading API that provides access to market data and programmatic orders.

Acquire Bitstamp, a global cryptocurrency exchange with 4.4 million users and annual revenue of $200 million.

Support for Base (Coinbase's L2 project) has been launched.

Become the primary cryptocurrency gateway for retail traders (covering more assets, wallet access, integrated services, and low fees).

2025

Complete the full integration of the Bitstamp exchange;

Robinhood releases its cryptocurrency wallet v2 (cross-chain swaps, DeFi connectivity, Arbitrum functionality, potential Base and Solana swaps, and a web3 wallet experience).

Awaiting approval for US cryptocurrency staking business;

Providing institutional cryptocurrency services through Bitstamp;

Announced plans to build L2 links on Arbitrum;

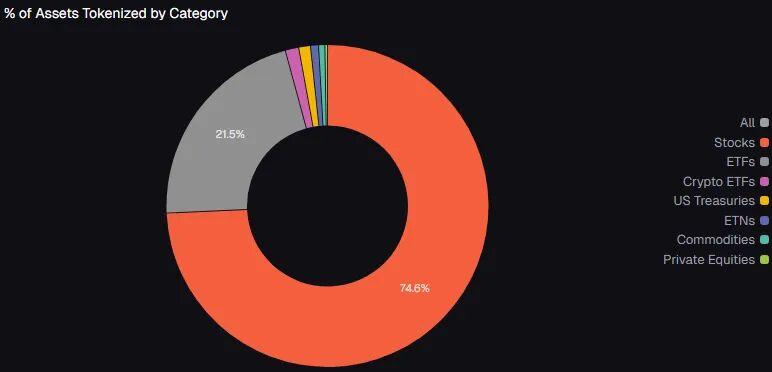

The company announced plans to tokenize public and private equity (offering 24/7 trading, instant settlement, DeFi integration, global access for users outside the US, and a lower cost structure than traditional brokerage channels).

Finally, this marks the beginning of Robinhood's full-scale foray into the cryptocurrency space. Leveraging its existing infrastructure (Bitstamp, Robinhood Crypto, Arbitrum) and user base, it has strategically positioned itself in the following areas:

- Regulated global exchanges

- Custody solution with integrated staking functionality

- Tokenization and integration of DeFi

- Wallets and payment services

- Deposit/Withdrawal Channels

What's the key point?

Robinhood is building a full-stack platform encompassing tokenization, cryptocurrency trading, and financial services.

Future Roadmap

Phase 1 (in progress)

The EU currently has nearly 800 tokenized listed stocks and is expanding into the private equity space.

Transactions are conducted solely through the Robinhood app (no external transfers are allowed).

Built on Arbitrum

Phase Two (Early 2026)

Bitstamp enables 24/7 trading and replicates cryptocurrency trading patterns;

Enable global access and continuous liquidity.

Phase Three (End of 2026?)

Tokenized stocks can be extracted and combined across DeFi platforms;

Users can use tokenized equity as collateral in DeFi (such as Aave);

Ultimate Vision: Completely permissionless, programmable assets that go beyond brokerages.

Why choose cryptocurrency?

Unlike its stock business (where Robinhood heavily relies on order flow payments), cryptocurrency trading employs a completely different and more profitable profit model. Because the cryptocurrency market lacks NBBO (National Best Bid and Offer), Robinhood doesn't need to sell order flow to market makers. Instead, it profits through spreads and routing revenue—earning the difference between the price it quotes to users and the price at which they acquire liquidity (through internal market makers or Bitstamp).

This means Robinhood has greater control over the economics of transactions and can retain a higher percentage of revenue from each cryptocurrency transaction. The end result is significantly improved profit margins, higher average revenue per user (ARPU), and better operational leverage.

Globally accessible markets: Cryptocurrency trading is available 24/7, across different jurisdictions and time zones.

Staking, tokenized stocks, swaps, wallet fees, L2 fees, and programmatic cryptocurrency order flow can all increase profit margins and revenue.

User base: Robinhood primarily serves millennials and Gen Z, who will inherit the wealth of the baby boomers in the coming years and are increasingly inclined to use cryptocurrency-native services and Robinhood's top-notch mobile experience.

Cryptocurrency infrastructure can reduce costs, create new revenue streams, and increase operational leverage. As the infrastructure matures, Robinhood is poised to become an "entry point" for DeFi, staking, trading, and payments.

Robinhood has been a pioneer in the cryptocurrency space, building a strong competitive advantage with its massive user base, comprehensive service portfolio, and cryptocurrency infrastructure. We believe that as the customer demographics evolve, traditional platforms like Charles Schwab will find it increasingly difficult to compete.

risk

competition

Currently, all major brokerage firms and trading platforms offer cryptocurrency trading services. These include Charles Schwab, Fidelity, Interactive Brokers, Webull, and E*Trade.

They all want to capture the high transaction fees in cryptocurrency trading. This competition is likely to squeeze Robinhood's profit margins.

At the same time, Coinbase is a leader in crypto-native infrastructure and product suites.

Execution risk

The team faced a daunting task: seamlessly integrating Robinhood's user experience and mobile app with the cryptocurrency platform. This was no easy feat.

Risks of tokenization strategies

The real value of tokenization lies in the fact that actual shares are tokenized.

Why?

This means that the shareholder's crypto wallet (which has completed KYC verification) will become the official record of ownership, meaning that dividends will be paid directly into that wallet.

Currently, Robinhood does not have the authority to decide which stocks can be tokenized and which cannot. Only the issuer (company) has that decision.

Do they have any incentive to tokenize now?

We believe this remains to be seen. If possible, they would like to tokenize it.

- Reduce issuance costs

- Expanding the distribution

- Improve liquidity

- Reduce settlement friction

- Expanding new investor groups globally

Currently, these advantages are insufficient to prompt large, existing companies to tokenize, especially before new regulations are introduced.

Furthermore, shareholders have not yet requested tokenization, and we believe that existing traditional service providers (such as transfer agents, prime brokers, custodians, clearing networks, market makers, and fund administrators/middleware) are opposed to tokenization.

What's the key point?

Robinhood has a strong incentive to push for tokenization. However, they have limited control over issuers' decisions regarding tokenization. We believe this will take longer than the market currently expects.

Conclusion

Robinhood has achieved a compound annual growth rate of 34% in revenue over the past five years. In recent years, the platform has made significant progress across its various trading business lines, with new revenue streams from Robinhood Gold, prediction markets, and a range of crypto services (wallets, staking, transfers, European expansion, crypto co-branded cards, Arbitrum Layer 2) all pointing to a bright future.

We acknowledge its leadership team's proven track record of delivering excellent user experiences and their vision of a full-fledged foray into cryptocurrency. From a personal user experience perspective, the asset migration process is convenient and efficient. It's worth noting that Robinhood's "transfer asset cash rewards (2-4% cash reward of the transfer value)" is essentially a "vampire attack" against companies like Charles Schwab, Fidelity, and Coinbase. (Note: A "vampire attack" is a competitive strategy where a new protocol attracts liquidity, users, and trading volume from existing dominant protocols by offering significantly more attractive incentives (such as higher yields or token rewards).)

Meanwhile, Robinhood is challenging Coinbase in the crypto-native services space and is a leader in tokenization strategies. Therefore, we believe Robinhood has the potential to become a leading financial institution in the future.

However, Robinhood's current price-to-earnings ratio (P/E) is as high as 56. Our analysis suggests that its cryptocurrency revenue (currently accounting for 21% of total revenue, a significant component) may face some pressure in the short term, while retail investors' risk appetite is also showing signs of cooling.

Given the precedent of a 25% revenue decline and an 80% stock price pullback in 2022, we expect the company's stock price to experience a similar significant correction in the current risk-averse market environment. However, from another perspective, this could also present an excellent buying opportunity for long-term investors.