Many people feel that bear markets are bad and offer no opportunities to make money, but opportunities often lie hidden in despair. Looking at the market before dawn, is it worth buying? Compared to their peaks, major cryptocurrencies have fallen 30-40%, and most of the negative news has been priced in. This is a good time to pick up undervalued projects. Be patient, carefully select quality targets, and don't miss the opportunity to buy at low prices!

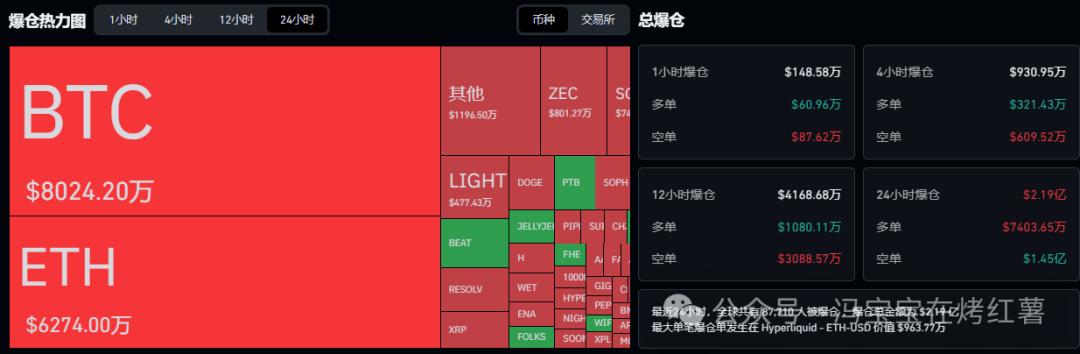

In the past 24 hours, a total of 87,710 people across the network have had their positions liquidated, with a total liquidation amount of $219 million. Long positions were liquidated for $74.0358 million, and short positions were liquidated for $145 million.

Today, Saturday, I don't expect any major fluctuations. The smaller timeframes are likely to see small swings, so both buying low and selling high are viable options. If there's no clear market movement, just take a break. I've already profited from shorting for several days already!

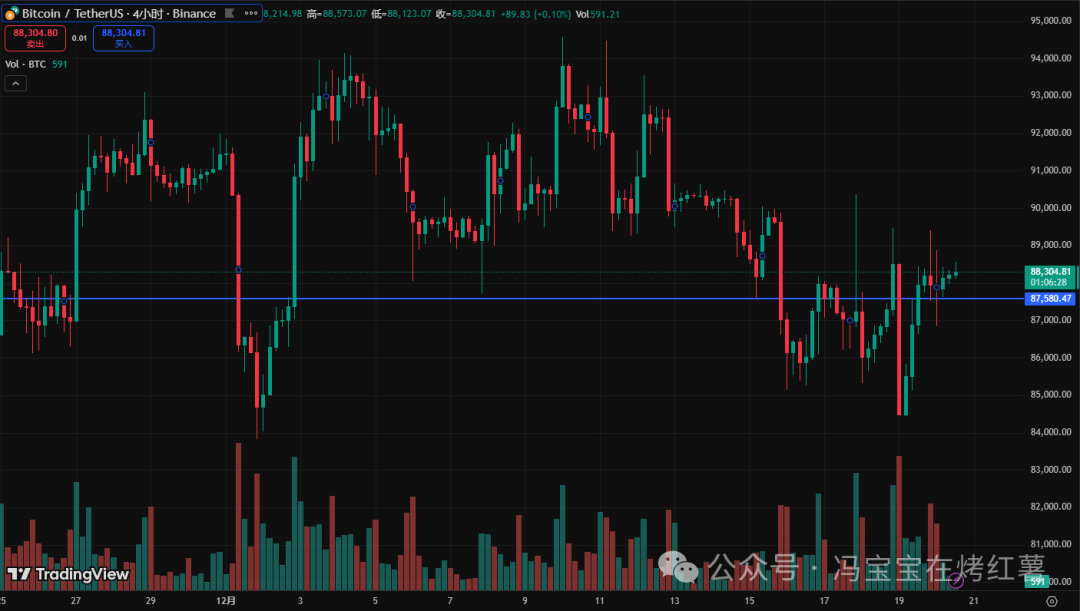

BTC

Bitcoin is currently focused on the 87580 level. As long as it retraces but doesn't break below this level, the short-term bullish trend will remain strong, with further resistance levels at 88670, 89450, and 90370. However, a break below 87580 would weaken the market and trigger a short-term correction, with support levels around 86650, 85220, and 83830.

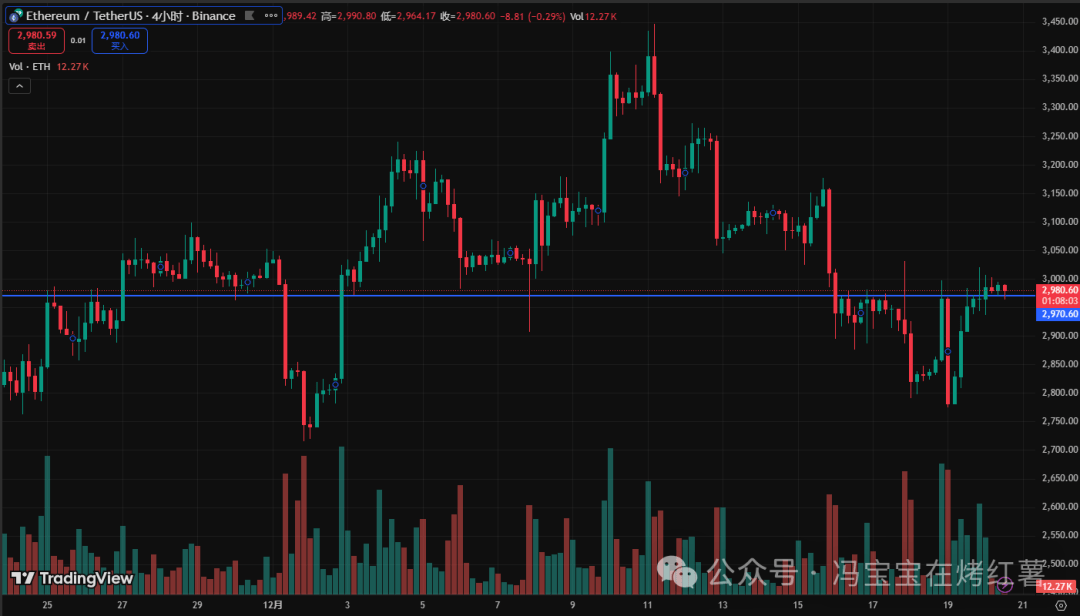

ETH

Ethereum's key focus today is the 2970 level. If it retraces but doesn't break below this level, the short-term bullish trend remains strong, with upward resistance levels at 3020, 3062, and 3092. A break below 2969 would indicate weakness and a minor pullback, with support levels at 2935, 2906, and 2868.

BNB

Today, 852 is a key level. If it retraces but doesn't break through, the short-term bullish trend will continue, with resistance levels around 863, 876, and 892. If it breaks below 852, the market will weaken and enter a correction phase, with support levels around 844, 836, and 826.

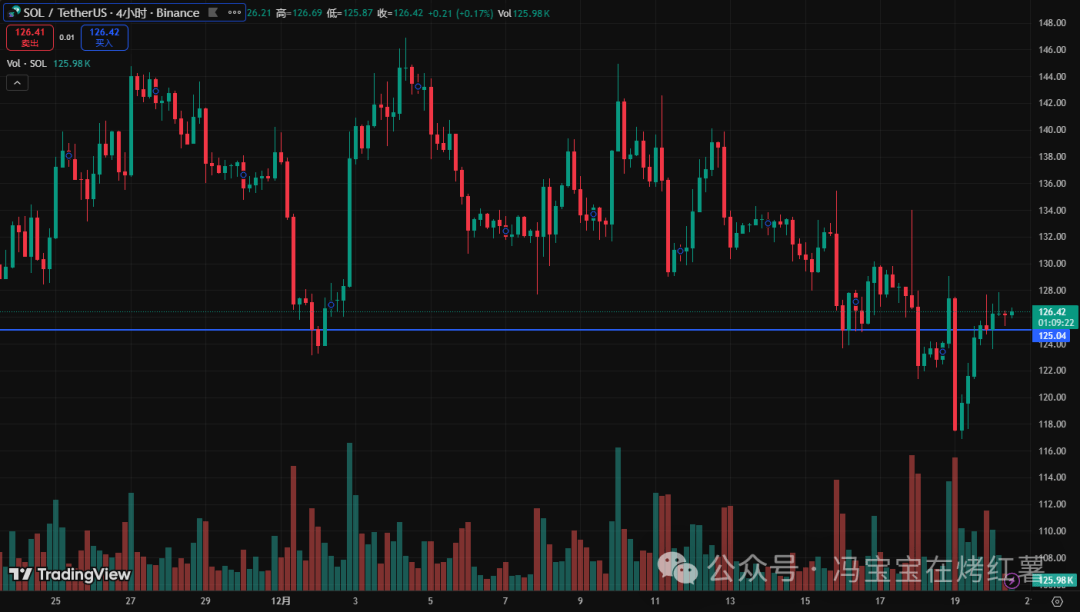

SOL

Today, pay attention to the 125 level. If it retraces but doesn't break through, the short-term bullish trend remains strong, with resistance levels around 129, 131, and 134. If it breaks below 125, the market will weaken and a pullback will begin, with support levels around 122, 120, and 116.

Many projects that seem very "profitable" may not actually make you any money.

For example, from the earlier $MYX to the more recent $SOON and $MMT, many people felt they made a lot of money. Whether it was market makers or MMs, the returns might be far less than expected with projects like $AIA, $FLOKS, and $TARDOOR, since you can't even guess who the short sellers are.

I used to think I could make money during a "bubble," like when a market value drops from 15 billion to 100 million, I could at least make 10% on the 14.9 billion difference, right? But it turns out I might not even get 1%. It's a bit strange how these things ended up, and I'm a little confused about it.

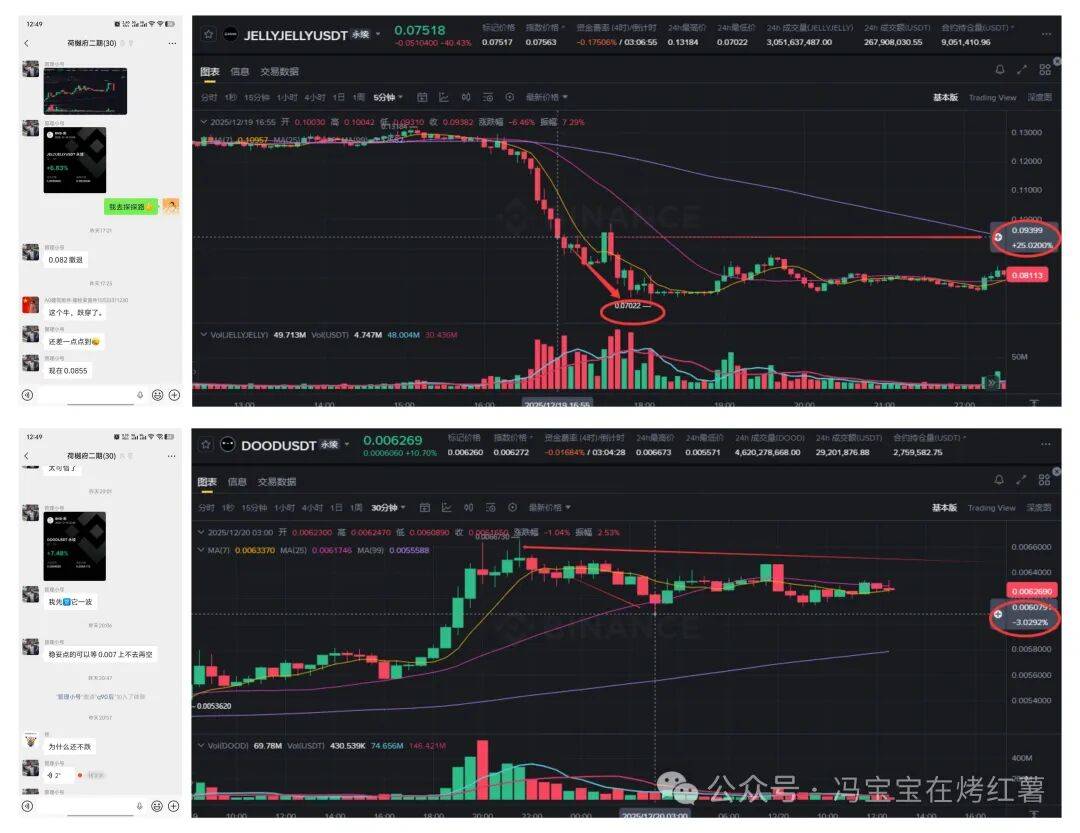

$JELLYJELLY、$DOOD

I shorted these two coins yesterday, and those who followed suit made a profit. Let's keep pushing today.

$VELO

Suitable for phased investment of idle funds! This Web3+ financial project has solid fundamentals, focusing on the PayFi+RWA+compliant track. It has already implemented green energy/electric vehicle RWA, treasury bond yields, and cross-border settlement. The Orbit super app is also in testing, and compliance and liquidity are still being improved. Currently, the market's understanding of it is premature; there's no need to rush to conclusions. Long-term monitoring is sufficient, and phased participation is more prudent. By the time the market fully understands the logic, VELO's price will have already risen.

$BCH

BCH has been moving against the trend in a very predictable way, rebounding when oversold and falling back when overbought. Yesterday, it successfully broke through the resistance level of 600. Now, after more than a year of sideways consolidation, BCH's pattern is very similar to that of BNB in June. If it can hold above 650 and break through 730, it may turn from a range-bound market into a one-sided trend. However, it is currently at a structural high point, and it is difficult to trade against the trend. Follow our strategy and don't blindly buy in.

$HYPE

A new market trend is emerging, with a focus now on DEX exchange source code, similar to Hype, reminiscent of the CEX source code boom of 2020. Amidst this downturn, new trends are appearing, with the market shifting from niche speculative tools to compliant information hubs, as exemplified by Polymarket's recent funding from a major player.