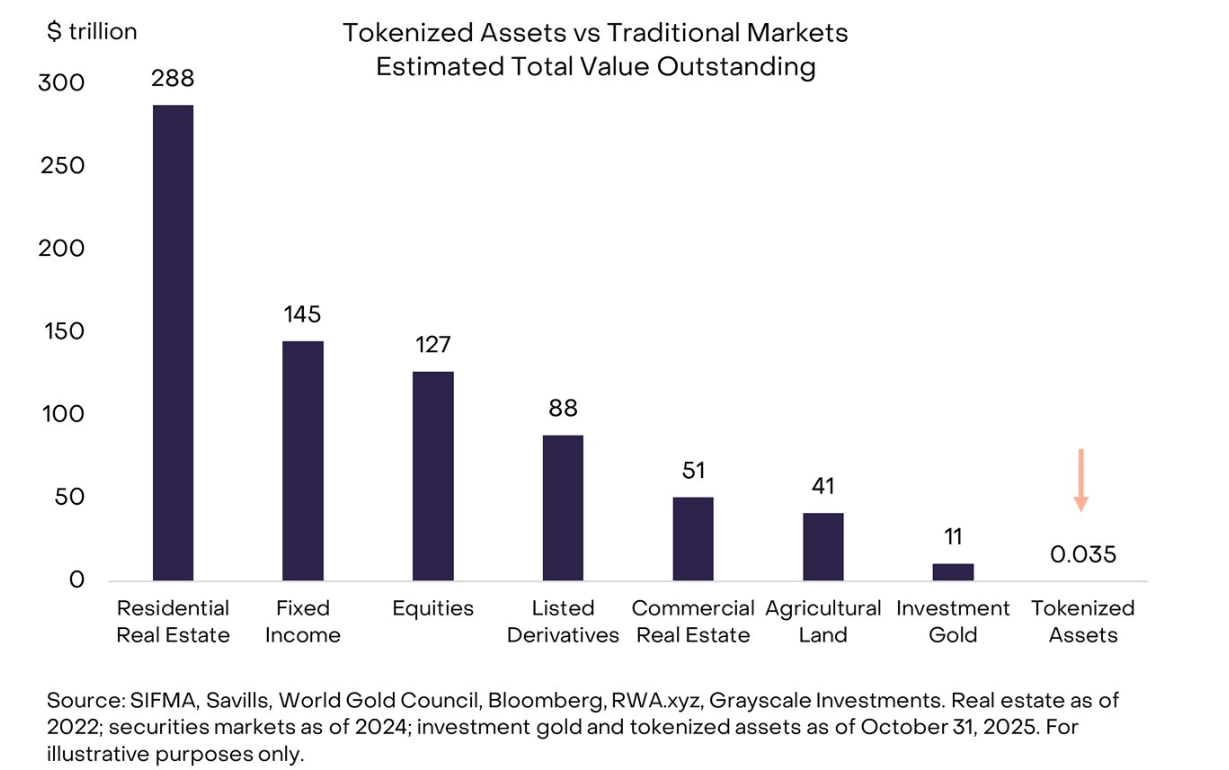

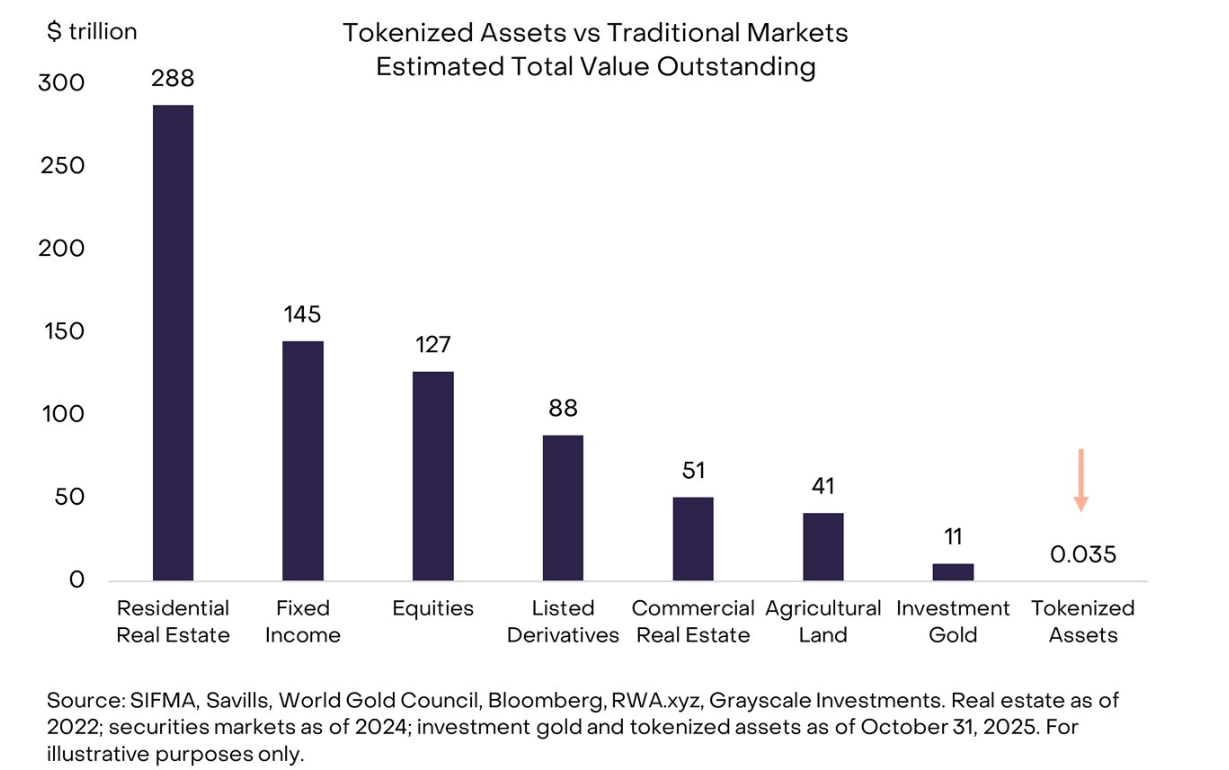

Grayscale released its "2026 Digital Asset Outlook," stating that 2026 will be a year of accelerated institutional growth in crypto, driven by two core factors: rising demand for macro-level value storage and significant regulatory improvements. The report predicts Bitcoin will reach new highs in 2026, and the US may advance bipartisan market structure legislation in 2026, promoting the deep integration of stablecoins, RWAs, on-chain securities, and traditional finance. Simultaneously, asset tokenization may reach an inflection point, with a potential for 1000-fold growth by 2030. Grayscale points out that stablecoins, DeFi, on-chain revenue, and sustainable cash flow will become core indicators for institutional investors, further exacerbating structural differentiation within the industry.