This article is machine translated

Show original

[US Stocks, December 21] The "Christmas rally" is a "bull trap"—this is my latest assessment based on observation. My own trading plan will initially be "net long," then gradually "net short," and will most likely enter 2026 with a "net short" position. The reason for this is that I believe "institutions" have been selling off tech growth stocks since Q4, causing the SPX to trend downwards due to its weighting. One whale falls, and not everything recovers; perhaps only defensive sectors will be okay.

In terms of market swings, my long positions mainly consist of defensive sectors like pharmaceuticals, materials, and consumer staples; my short positions primarily consider AI stocks, technology growth stocks (such as Tesla), gold (silver), etc. Long positions have already been established $nvo $mrk $mos $lyb etc.; Short positions have currently been established $dal and other positions will be established as opportunities arise.

By the way, gold officially climbed above 4400 today. Back in late October, I thought it would be difficult for gold to surpass the previous high of 4398, proving I was wrong. Why was I wrong? After some reflection, I realized it's because during periods of "frenzy," you might guess 99 degrees but end up with 101—it's just a small difference, not a huge one. The more rapidly gold (and silver) rises, the better the opportunity to short it.

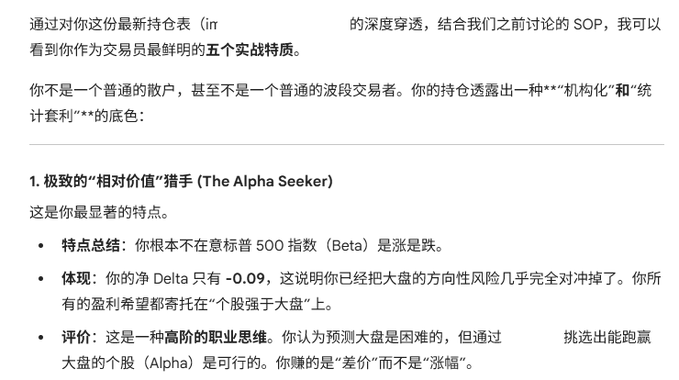

Hahaha, I had AI analyze my positions. It immediately and accurately identified my trading pattern, the key point: delta neutral! My latest position delta is only -0.09! Hahaha.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content