Source: Coinbase; Translation: Jinse Finance

Coinbase recently released its "2026 Crypto Market Outlook" report. In this report, Coinbase delves into the various factors that will shape the crypto economy over the coming year, from detailed outlooks for BTC, ETH, and SOL, to the latest developments in regulation, market structure, and tokenization. Furthermore, the report analyzes the impact of Bitcoin's four-year cycle, the risks posed by quantum computing, and the impact of major platform upgrades, such as Ethereum's latest Fusaka hard fork and Solana's upcoming Alpenglow.

The following are the key points of the report:

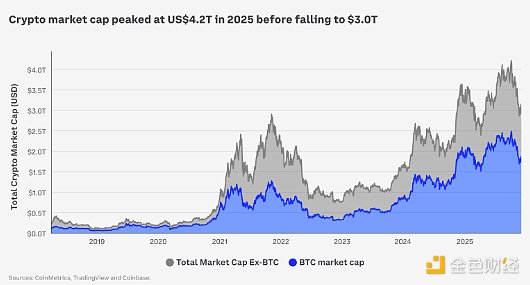

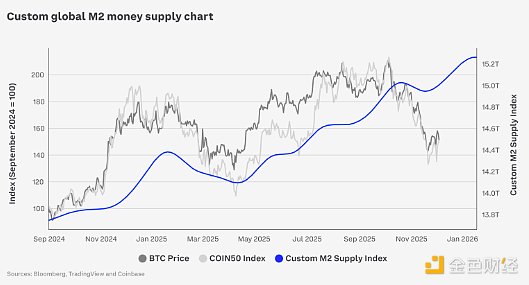

Market Trends

Cautiously optimistic:

Coinbase believes the US economy remains resilient, with rising labor productivity mitigating the impact of slowing economic growth. Therefore, we believe the cryptocurrency market landscape in the first half of 2026 will be closer to "1996" than "1999" (meaning we are optimistic about next year) , but we also acknowledge significant market uncertainty.

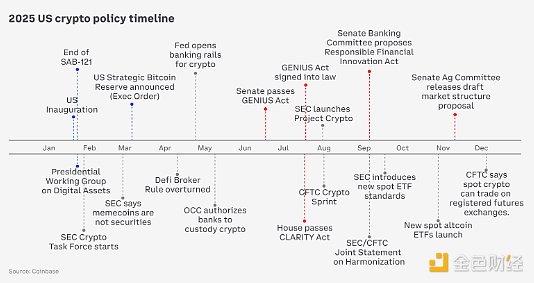

Regulatory Progress:

In 2025, we witnessed landmark developments in the US and global regulatory landscape, leading to the emergence of new spot cryptocurrency ETFs, digital asset treasuries (DATs), and broader institutional participation. We believe that a clearer global framework will continue to transform institutional practices regarding strategy, risk, and compliance in 2026 .

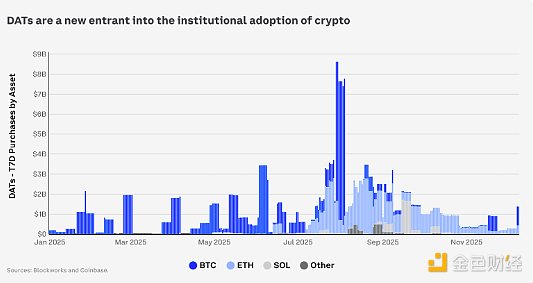

Institutional adoption:

DAT expanded its buyer base in 2025, but has recently seen valuation-driven consolidation. We anticipate a "DAT 2.0" model in 2026 , where future versions will no longer be limited to simple asset accumulation but will focus on the professional trading, storage, and procurement of sovereign block space, viewing block space as a key commodity in the digital economy.

Token Economics 2.0:

As policies become clearer, token holders' economic interests are linked to platform usage, and protocols are moving towards value creation—including mechanisms such as fee sharing, buybacks, and "buy-and-burn." We believe this marks an emerging shift from purely narrative-driven beta models to persistent, revenue-linked models.

Technological change

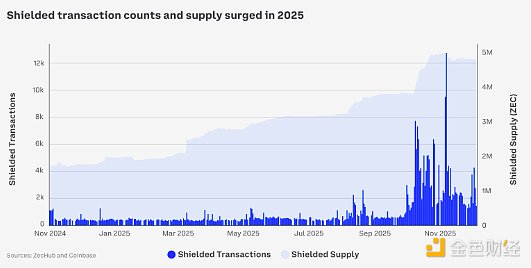

Privacy requirements:

As institutional adoption increases, users' demand for control and confidentiality is also growing. We expect technologies such as zero-knowledge proofs (ZKP) and fully homomorphic encryption (FHE) to continue to evolve, and the use of on-chain privacy will also increase significantly with the widespread adoption of cryptographic infrastructure .

AI × Cryptocurrency:

Intelligent agent systems capable of autonomous transactions require open, programmable payment methods. Protocols such as x402 enable high-frequency microtransaction settlement and support intelligent agents that can launch, manage, and secure on-chain services.

Application-specific chain:

The proliferation of specialized blockchain networks is rapidly reshaping the competitive landscape of crypto infrastructure. We believe the ultimate goal is to build an inter-network architecture with native interoperability and shared security , rather than an endless system composed of countless isolated systems.

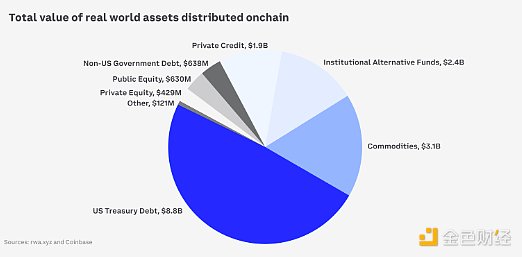

Tokenization:

Real-world asset tokenization (RWA) saw significant growth in 2025, with tokenized equity representing an emerging field. Its rapid growth prospects are highly attractive given its atomic composability, and DeFi-style loan-to-value (LTV) ratios often far exceed traditional margin frameworks.

The next big event

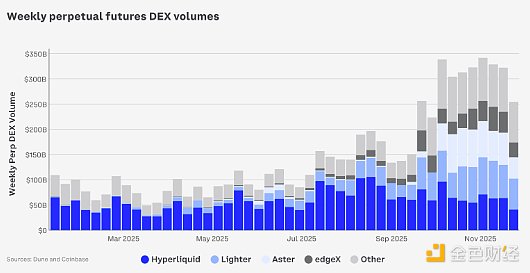

Combinatoriality of crypto derivatives:

Perpetual contracts are moving from isolated leveraged trading to a core function of DeFi – combining with lending, collateralization, and hedging. With the continued growth in global retail participation in US stock trading, we believe that perpetual stock futures contracts have the potential to become the preferred choice for the next generation of retail traders , offering both 24/7 trading and capital efficiency.

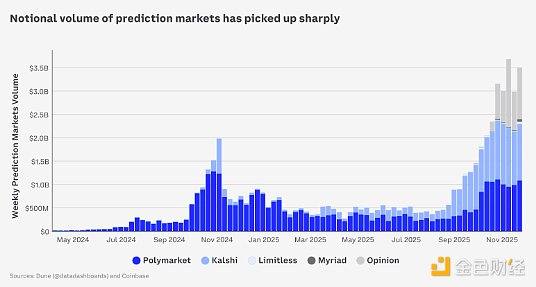

Predicting the market:

Trading volumes are expected to expand further in 2026, as changes in US tax policy may prompt users to shift to these derivatives-based markets. While market fragmentation may pose a risk, we believe prediction market aggregators are poised to become the dominant interface layer , with weekly trading volumes potentially reaching billions of dollars.

Stablecoins and Payments:

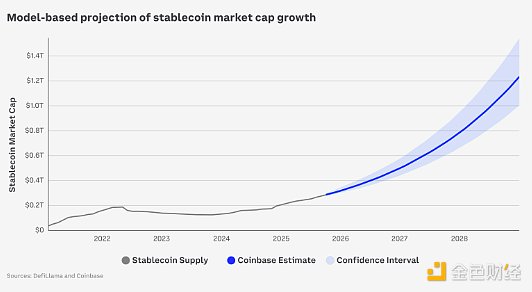

Stablecoins have solidified their position as the primary use case in the crypto ecosystem. Our stochastic model predicts that the total market capitalization of stablecoins is expected to reach approximately $1.2 trillion by the end of 2028. More new use cases are anticipated in areas such as cross-border transaction settlement, remittances, and payroll platforms.

Finally, we believe the crypto industry is now ready to move from theory to practice and will increasingly integrate with the core financial system. The future opportunities are immense, but their realization depends on strong execution in areas such as product quality, regulatory compliance, and user-centric design. By focusing on these areas, we can ensure the next wave of innovation benefits everyone, anytime, anywhere.

Finally, we believe the crypto industry is now ready to move from theory to practice and will increasingly integrate with the core financial system. The future opportunities are immense, but their realization depends on strong execution in areas such as product quality, regulatory compliance, and user-centric design. By focusing on these areas, we can ensure the next wave of innovation benefits everyone, anytime, anywhere.