In the wave of deep integration between Web3 and artificial intelligence, AI agents have become one of the fastest-growing and most promising sub-sectors in the crypto market. As a pioneer in this field, Owl AI is committed to solving the industry pain point of insufficient transparency in decentralized AI investment decisions through innovative products, opening up new possibilities for smart finance.

What is Owl AI?

Owl AI is a decentralized AI intelligent agent system built on the Ethereum ERC-4626 protocol, aiming to promote the deep implementation of intelligent agent autonomy and provide personalized investment support for Web3 users. The system integrates artificial intelligence decision-making models with on-chain verification logic to ensure decentralized and transparent operations, building a permissionless, non-custodial smart asset management ecosystem.

Currently, Owl AI has two core functions: AI agents and an information aggregation engine. Users can invest funds in AI agents with different strategies based on their own risk tolerance to obtain passive investment returns; they can also use the intelligent information aggregation engine to efficiently assist in trading decisions.

Owl AI Agent

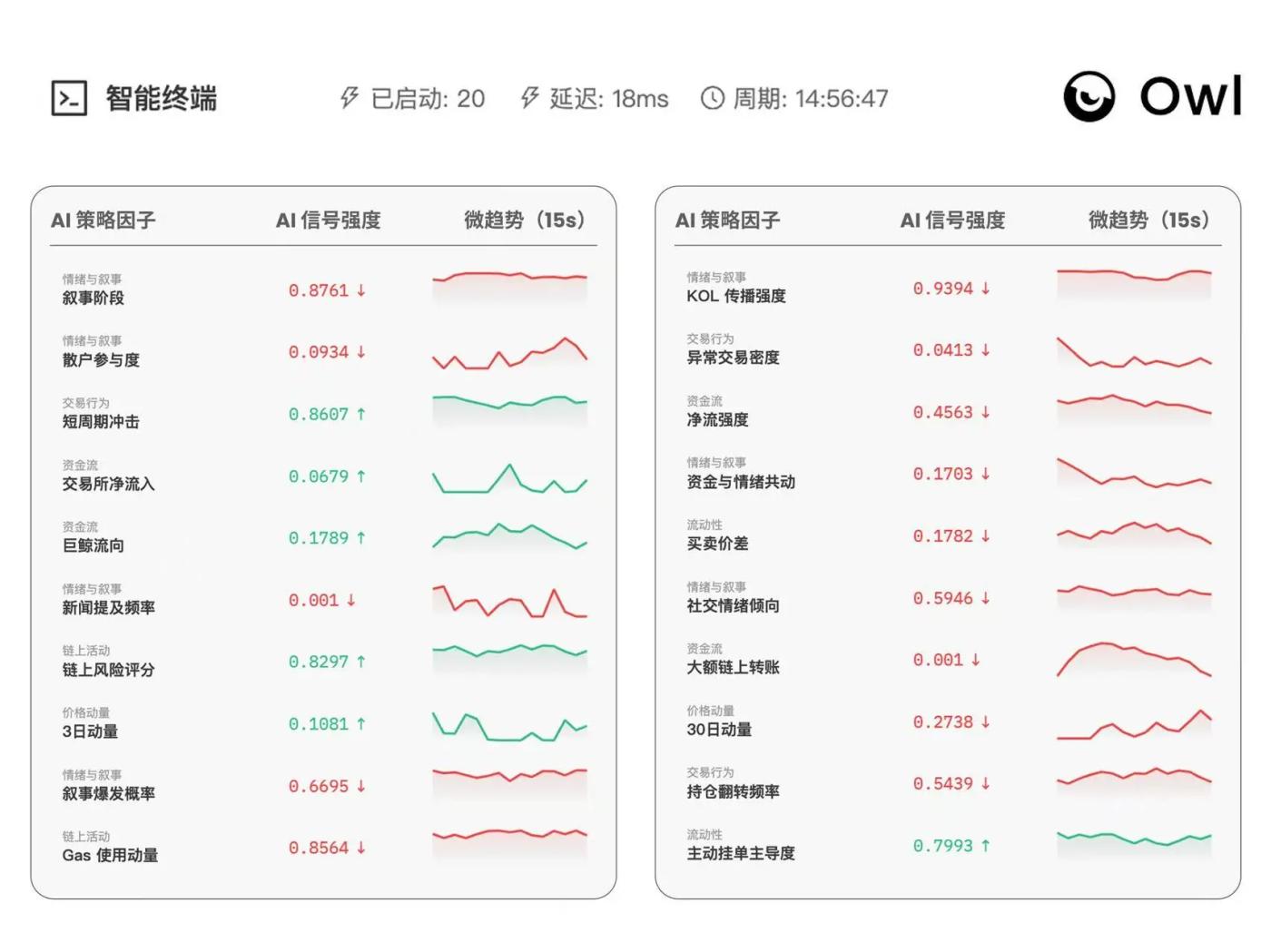

Owl AI agent operates based on institutional-level quantitative strategies, monitoring over 50 core market indicators in real time, covering multiple key dimensions of the market:

- On-chain contract holdings: Track the dynamics of on-chain holdings of mainstream tokens and analyze the behavioral patterns of large funds.

- Order book flow: Monitors order book depth, fund flows, and liquidity changes to accurately capture market trend signals.

- Whale Address Dynamics: Monitor unusual activity in wallets with large amounts of funds, such as whether the inflow of whale funds into exchanges indicates increased selling pressure in the market.

- Market sentiment data: Integrates on-chain transaction data and news updates to assess market sentiment and provide decision-making reference indicators.

- Volatility monitoring: Calculate indicators such as historical volatility and implied volatility to provide data support for risk assessment.

Meanwhile, the Owl AI agent continuously optimizes strategy models through deep learning, automatically adjusts investment parameters, and has the ability to adapt to market changes, helping users achieve precise risk control and maximize returns.

Intelligent Information Aggregation Engine

Owl's AI-powered intelligent information aggregation engine supports real-time retrieval of on-chain data and news events worldwide, covering over 50 information sources. Users can query various information in the cryptocurrency field through the interactive interface, obtain professional analysis and advice, quickly grasp market dynamics, and assist in investment decisions.

Owl AI 1.5: The Transparency and Interactive Revolution of AI Agents

For a long time, the quantitative investment field has suffered from a lack of transparency in decision-making. After investing funds, users often cannot clearly understand the specific execution logic of investment decisions. The upcoming version 1.5 of Owl AI will completely solve this problem through brand-new deep interactive features, promoting a more transparent and explainable investment process.

Users can ask the AI agent multi-dimensional questions through the dialogue interface, covering topics such as the triggering and execution reasons for a single transaction, the return structure of the investment portfolio, the overall strategy status, and market assessment. The AI agent will then match the user's current holdings and risk parameters based on the actual running strategy modules, combined with real-time market and on-chain data, ensuring the consistency and traceability of the responses. For example:

Q: What is the current asset allocation status of the strategy?

A: Our current asset allocation remains neutral to conservative, with 60% allocated to highly liquid mainstream assets, 23% to low-correlation or defensive assets, and the remaining 17% as funds for flexible adjustments. Compared to last month, our overall risk exposure has decreased by approximately 9%, primarily due to the market's annualized volatility climbing from 41% to 56% in the past 10 trading days. In this more volatile market environment, our strategy prioritizes drawdown control.

Q: What are the main sources of my current income?

A: Currently, about 71% of the account's profits come from short-to-medium-term range trading, with an average holding period of 3.6 days. There is no concentrated betting on a single direction. The remaining profits mainly come from improved capital utilization efficiency after position adjustments and risk optimization.

Q: Why was this transaction executed?

A: This trade was executed when the price broke through the upper limit of the previous consolidation range by approximately 1.3%, while the 15-minute trading volume increased by approximately 24% compared to the average of the past 40 periods, and the bid-ask depth narrowed from -6% to +4%. The system completed this operation provided that the liquidity and momentum conditions were met and the risk limit for a single trade was not exceeded.

This transparent data attribution mechanism helps users clearly understand the strategy execution logic of AI agents, completely breaking the "black box" dilemma of traditional quantitative investment.

Early participation, co-building and sharing the ecological dividends

Owl AI offers a clear path to benefit for early participants. Version 1.0 is currently available for free trial, allowing users to accumulate points through the aggregation engine, investing in AI agents, or inviting friends. These points will serve as core credentials for enjoying platform benefits, ecosystem development rewards, and token incentives in the future. Furthermore, in the upcoming version 1.5, user subscription fees will be fully refunded as strategy trial funds, depending on certain conditions, and can be used to invest in high-quality portfolios within the strategy marketplace.

On the eve of the explosive growth of the global decentralized AI intelligent agent track, Owl AI sincerely invites users to join hands and seize the first wave of ecological dividends in smart investment.