Author: KarenZ, Foresight News

Original title: Aave vote during the Christmas holidays: a trap or a turning point for governance?

Throughout the development of DeFi, Aave has always been the undisputed king of the lending sector. However, the Aave community has been anything but peaceful recently. From massive sell-offs by on-chain whale to founder Stani outlining an ambitious vision for 2026, to a "governance bombshell" involving IP and revenue distribution, and a hasty vote on a token alignment proposal, Aave is undergoing the most dramatic reshaping of its production relations since its inception.

Are whale reducing their holdings in an attempt to circumvent potential governance risks?

On December 22, an on-chain anomaly attracted the attention of the community. A whale address sold all of its 230,350 AAVE tokens in batches, worth $37.8 million, in exchange for 5,869.46 stETH (worth $17.52 million) and 227.8 WBTC (worth $20.07 million). According to Lookonchain monitoring, this sale resulted in a paper loss of approximately $13.45 million for the whale.

The market reaction was immediate, with the price of AAVE tokens falling by 10% to a low of $156.

The whale's actions are not simply market behavior. The wallet's remaining asset portfolio after the sell-off shows a shift towards stETH and WBTC, reflecting a preference for the Ethereum ecosystem. However, the timing of the sell-off coincides with a heated debate within the Aave community governance, with the conflict between Aave DAO and Aave Labs becoming public. This may have prompted large holders to avoid potential governance risks.

It's worth noting that the behavior of major AAVE holders has exhibited a starkly contrasting trend over the past few months. Some whale have accumulated over 330,000 AAVE tokens through recursive lending strategies; on the other hand, institutional capital has continued to increase its holdings. For example, Multicoin Capital purchased 60,000 AAVE tokens (worth approximately $10.68 million) through over-the-counter trading in November at nearly $178 per token, bringing its total holdings to 338,000 tokens in just a month and a half. Meanwhile, founder Stani has also increased his AAVE token holdings by $10 million through the open market, highlighting the market's tug-of-war between bulls and bears and the divergence in confidence.

Governing disputes

Dispute over fee flow after front-end integration with CoW Swap

In late 2025, the implicit rivalry between Aave DAO and Aave Labs suddenly intensified. The controversy stemmed from a seemingly technical decision: Aave Labs integrated the Swap aggregator CoW Swap into the front end of the Aave application, claiming it would provide users with better price execution and MEV protection.

However, a key issue lies behind this integration decision—the flow of fees. The integration of CoW Swap redirects fees to a private address, with approximately $200,000 per week flowing from the DAO treasury to Aave Labs (estimated by community member EzR3aL). Aave token holder EzR3aL launched an inquiry on the governance forum, directly pointing out that the decision was made without discussion and approval from the DAO, lacking transparency in core business decisions and seriously harming the interests of token holders.

Radical opposition to the "poison pill" proposal

The controversy reached its climax in mid-December when a major AAVE holder named tulipking made a highly disruptive proposal on the Aave DAO governance forum. This proposal demanded that Aave DAO immediately:

They have filed a lawsuit against Aave Labs, demanding all code, intellectual property, and brand ownership.

They demanded 100% ownership of Aave Labs.

Recover all revenue that Aave Labs previously earned from Aave-branded products.

However, EzR3aL later closed the proposal post in accordance with forum rules. According to The Block, Marc Zeller, founder of the Aave Chan Initiative, called tulipking's post "the most important proposal in Aave governance history," noting that it will have a lasting impact on the DAO model and how tokens are valued.

AAVE alignment scheme

In response to the radical claims of the "poison pill" proposal, Ernesto Boado (co-founder of BGD Labs and former CTO of Aave Labs) released a relatively mild but equally profound proposal on December 16: "[ARFC] $AAVE Token Alignment Phase 1: Ownership".

This proposal avoids a direct attack on Aave Labs, instead focusing on achieving "token alignment." Its core demand is that AAVE token holders gain control over Aave brand assets (domain names, social media accounts, naming rights, etc.) held in a DAO-controlled entity. The proposal approves the intention to establish strict mechanisms to prevent any third party from abusing or profiting from these assets, whether explicitly or implicitly, allowing the DAO to take legal action should such actions occur. Specific core demands include:

The DAO decides the naming rights for products and organizations using the "Aave" name, not any third party. This includes names like "Aave Labs," "Aave App," "Aave Web App," "Aave Pro," or "Aave Horizon."

The DAO owns and controls all communication channels that use "Aave" or its implicitly associated names. This includes, but is not limited to, X accounts, Discord servers, Instagram accounts, and any other social or public channels.

The DAO has control and ownership over domain names, including but not limited to aave.com, and any other domain names directly associated with it (such as onaave.com).

DAOs have control over related online organizations, including but not limited to GitHub or npm.

The proposal also suggests that entities with a direct conflict of interest should abstain from voting or vote abstain from voting. ACI founder Marc Zeller has explicitly stated that he will abstain and has called on community members to take the same stance.

Aave CEO's Response and Stance

In response to escalating governance pressure, Aave founder and CEO Stani Kulechov issued a formal statement clarifying that discussions on "token alignment" should not become a trigger for conflict between service providers and DAOs. He also acknowledged oversights in communication by Aave Labs and pledged to make improvements.

While Stani acknowledges the importance of defining brand ownership and optimizing the DAO structure, he strongly opposes the current version of the token alignment proposal. He argues that the proposal simplifies complex legal and operational issues into a binary "yes/no" vote, lacking a clear implementation path and potentially leading the Aave ecosystem in a dangerous direction. He emphasizes that such core issues require a specialized, structured process and multiple rounds of phased review to develop a truly feasible solution.

Stani further pointed out that Aave Labs is pushing forward with key projects such as Aave V4, Aave App, and Horizon, aiming to attract trillions of dollars and millions of users to the on-chain ecosystem. Forcibly pushing forward the controversial proposal at this time will seriously slow down or even destroy the development achievements accumulated over the years, ultimately harming the long-term interests of the protocol, DAO, and all token holders.

To this end, he explicitly stated that he would vote against the proposal, while also increasing his holdings of AAVE tokens by $10 million through the open market, and issuing a concise and powerful statement on the X platform: "$AAVE aligned" to demonstrate his alignment with the community's interests.

Dramatic Behavior: Controversy Over Hasty Voting During the Christmas Holidays

On December 22, the situation took a dramatic turn—Aave Labs proactively created a voting page for the "token alignment" proposal on the Snapshot platform and announced that voting would officially open on December 23. This timing was highly controversial: it coincided with the Christmas holidays, when many community members were on vacation, which could lead to a significant drop in attention and participation.

However, the most dramatic twist comes from the proposal's originator, Ernesto Boado, who stated, "Aave Labs unilaterally and hastily submitted the proposal for a vote without my prior notification. If I had been consulted, I would never have approved it. Submitting a vote at a time when the community is engaged in healthy discussions and valuable insights are constantly emerging violates all the principles of trust between us and the community." He bluntly stated, "This hasty voting is shameful."

The community immediately erupted with widespread criticism: "Why push forward with a proposal that is clearly detrimental to Aave Labs during the Christmas holidays?"

In response, Stani defended the proposal on procedural compliance, stating that the discussion of the proposal had met the minimum time limit stipulated by the governance framework, and that other service providers in the industry had similar precedents for rapid on-chain implementation, making voting the best way to resolve the dispute.

So why is Aave Labs actively pursuing a proposal that seems detrimental to itself? I believe there may be the following underlying intentions:

1. Strategic concessions to defuse the crisis: Recent tensions between the DAO and Aave Labs have escalated (including disputes over front-end fees, accusations of brand privatization, and even a "poison pill" proposal (demanding the confiscation of all Labs' IP and historical revenue). Aave Labs may have judged that if it doesn't actively push for a vote, community pressure will continue to build, leading to more radical proposals. By submitting its own vote, Labs can:

Stani demonstrated a "alignment" stance by publicly buying large amounts of AAVE and emphasizing that "voting is the best way to resolve disputes."

Controlling the pace: If the vote fails, Labs can retain brand control and counter criticism by saying "the community has voted."

If the deal goes through unexpectedly, Labs can also retain influence through subsequent Phase 2 negotiations (e.g., service provider contracts).

2. Preventing extreme proposals: Once Phase 1 is passed, the community's anger will have some outlet, and support for extreme proposals will drop significantly.

3. The cooling-off period during the Christmas holidays: Voting during the holidays means that if a proposal passes, it may appear to represent a "high consensus," but in reality, it is just a relative majority with low participation.

4. Not entirely detrimental to Labs: After the brand transfer to the DAO, Labs can still continue to operate the front-end and develop products as the main service provider. Stani emphasized that Labs is one of the largest AAVE holders, and its long-term interests are aligned with the DAO.

5. The current proposal appears stringent, but it is actually highly controllable. Aave Labs is making a "limited concession," relinquishing legal ownership of the brand assets, but failing to clarify key rights such as the protocol's development direction, front-end commercialization, and integration with third parties. This could be a typical power separation strategy—giving the DAO a symbolic victory in exchange for protection of real power.

Aave Protocol Fundamentals: A Steady and Reliable Leader

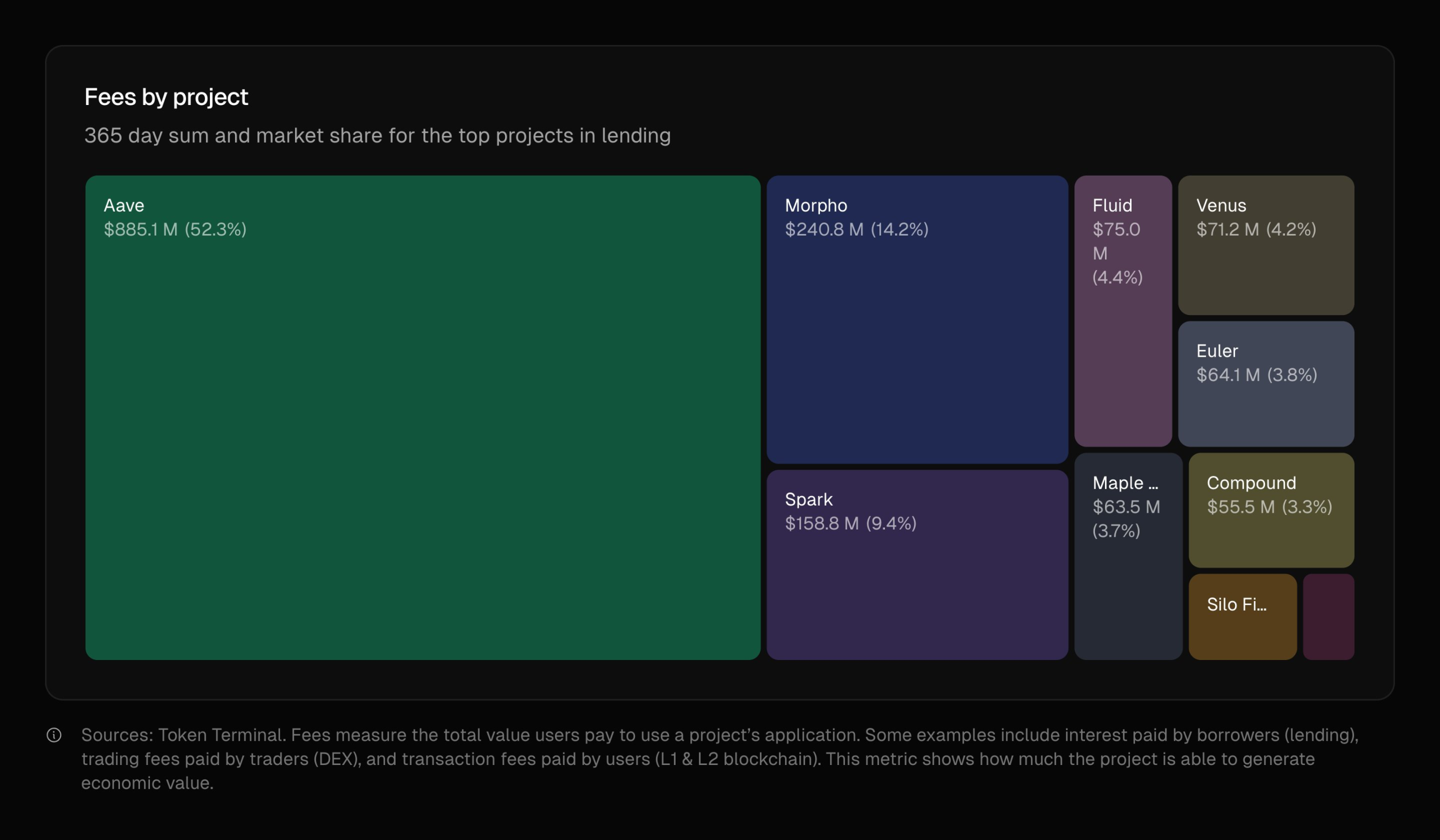

Despite ongoing governance controversies, the Aave protocol maintains its dominant position in the DeFi lending sector. According to a report by Stani, citing data from Token Terminal, Aave generated $885 million in fees in 2025, accounting for 52.3% of the DeFi lending industry.

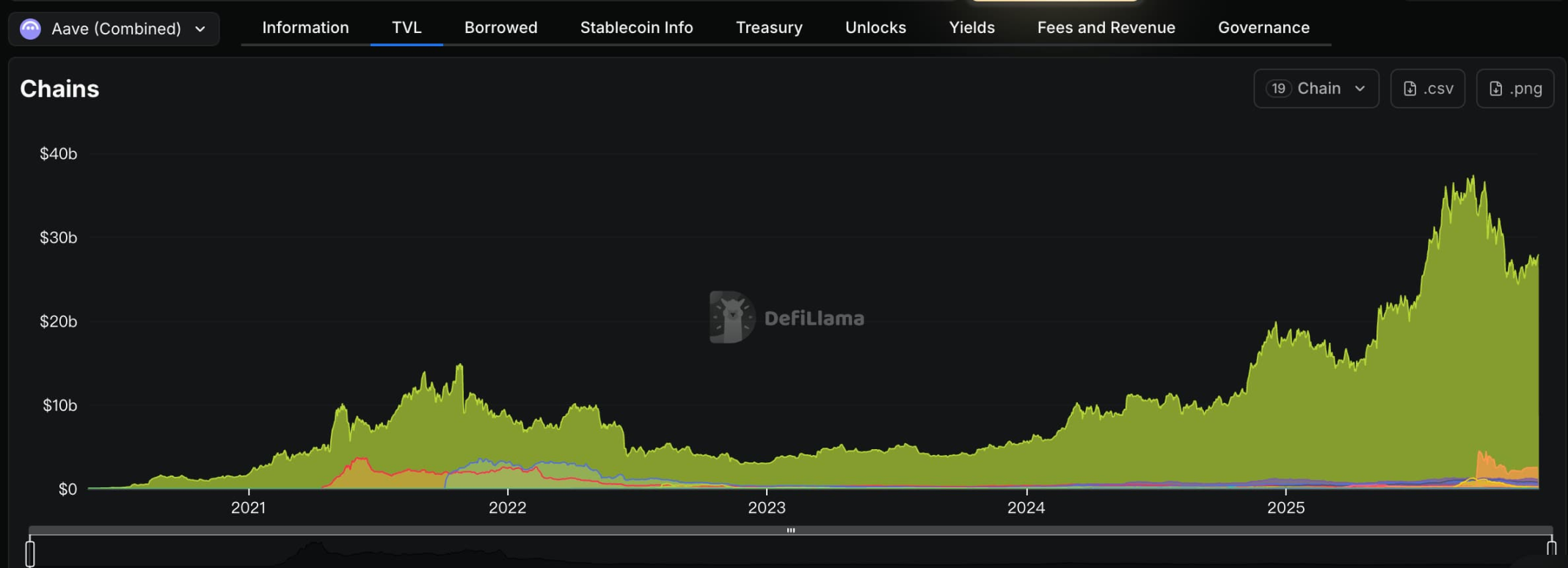

Meanwhile, Aave's net deposits peaked at $75 billion. Since its founding five years ago, Aave has processed a cumulative $3.33 trillion in deposits and issued nearly $1 trillion in loans.

As of December 22, 2025, Aave's total value locked reached $53.8 billion, mainly distributed across networks such as Ethereum, Plasma, Arbitrum, and Base.

In terms of news, in December 2025, the U.S. Securities and Exchange Commission announced the end of its four-year investigation into Aave Protocol without taking enforcement action, clearing a major regulatory hurdle for the protocol. Additionally, Stani recently announced its three major strategic directions for 2026, including:

1. Aave V4: The testnet was launched in late November 2025. V4 adopts a Hub-Spoke architecture to unify cross-chain liquidity and aims to achieve a fund scale of trillions of dollars.

2. Horizon RWA Expansion: Horizon allows eligible institutions to borrow stablecoins using tokenized assets such as U.S. Treasury securities and other credit instruments as collateral. Horizon currently has $550 million in net deposits, and in 2026, Aave plans to expand its partnerships with institutions such as Circle, Ripple, Franklin Templeton, and VanEck, bringing major global asset classes to the Aave platform and rapidly increasing this figure to $1 billion or more.

3. Aave App: The Aave App will be fully launched early next year, turning the "on-chain currency market" into a "savings application".

summary

On the surface, this wave of governance is a dispute over the flow of fees; at a deeper level, it reflects a fundamental tension in DeFi governance—the boundary between the rights of token holders and the autonomy of development companies.

Aave Labs, the primary company developing the Aave protocol, is controlled by Avara (its parent company). Aave Labs holds most of the development rights to the protocol, but the Aave DAO is governed on-chain via the AAVE token. This dual structure functioned smoothly during Aave's growth, but problems arose when conflicts of interest emerged.

As Zeller et al. pointed out in their argument, contributors such as the Aave Chan Initiative (ACI) and BGD Labs have made significant contributions to the maintenance and upgrades of the protocol and should rightfully share its value. However, the current structure allows Aave Labs to reap excessive benefits alone. Some have countered, "Who owns the Aave trademark? Who has the right to profit from the Aave IP and brand?" These questions touch upon the core anxieties of DAO governance: how to define the value attribution and rights boundaries of different participants in balancing decentralized principles with commercial operations.

In the short term, the hasty vote during the Christmas holidays may exacerbate community divisions and further impact market sentiment; however, in the long term, this controversy also provides a crucial opportunity for the Aave ecosystem to streamline its governance framework and clarify the boundaries of its rights. Stani's increased stake and 2026 strategic plan demonstrate the core team's long-term confidence in the ecosystem; while the DAO's demands for rights will drive the protocol towards a more decentralized and equitable direction.

For the entire DeFi industry, Aave's governance restructuring practices will have significant reference value.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush