Author: Ethan

Original title: Is a "Strict Principal" Coming for BTC? If He Takes Charge of the Federal Reserve , the Crypto Boom May Come to an End

As the year draws to a close, the question of who will ultimately take over the reins of the Federal Reserve—the "gatekeeper" of global liquidity—has become the most anticipated suspense of the year.

Months ago, when the benchmark interest rate ended its long hiatus and saw its first cut, the market was convinced that Christopher Waller was the chosen one (recommended reading : "Academic Rise: Small-Town Professor Waller Becomes the Hottest Candidate for Fed Chair" ). In October, the tide turned, with Kevin Hassett emerging as the frontrunner, his odds once approaching 85%. He was seen as a "mouthpiece for the White House"; if he took office, policies might completely follow Trump's will, and he was even jokingly called a "human money-printing machine."

However, today we will not discuss the "top pick" with the higher probability of winning, but focus on the "second pick" with the greatest variables - Kevin Warsh.

If Hassett represents the market's "greedy expectations" (lower interest rates, more liquidity), then Warsh represents the market's "fear and awe" (harder currency, stricter rules). Why is the market now re-evaluating this outsider once hailed as the "golden boy of Wall Street"? If he were to actually head the Federal Reserve, what dramatic changes would occur to the underlying logic of the crypto market? (Odaily Note: The core viewpoints in this article are based on Warsh's recent speeches and interviews.)

Warsh's Evolution: From Wall Street Golden Boy to Federal Reserve Outsider

Kevin Warsh did not have a PhD in macroeconomics, and his career did not begin in academia, but in the mergers and acquisitions department of Morgan Stanley. This experience gave him a mindset completely different from Bernanke or Yellen: in the eyes of academics, a crisis is just a data anomaly in a model; but in Warsh's eyes, a crisis is the second when a counterparty defaults, a life-or-death moment when liquidity goes from "existing" to "non-existent".

In 2006, when 35-year-old Warsh was appointed to the Federal Reserve Board of Governors, many questioned his lack of experience. But history is ironic; it was precisely this hands-on experience as an "insider on Wall Street" that made him an indispensable figure in the subsequent financial crisis. In the darkest moments of 2008, Warsh's role transcended that of a regulator; he became the sole "translator" between the Federal Reserve and Wall Street.

Excerpt from Walsh's interview with the Hoover Institution at Stanford University

On the one hand, he had to translate the toxic assets of Bear Stearns that had vanished overnight into language that academic officials could understand; on the other hand, he had to translate the Fed's obscure intentions for market rescue into the panicked market. He personally witnessed the frantic negotiations of the weekend before Lehman Brothers collapsed, and this close-quarters combat gave him a physiological sensitivity to "liquidity." He saw through the essence of quantitative easing (QE): central banks do indeed act as "lenders of last resort" during crises, but this is essentially a transaction of overdrawing future credit to buy current survival time. He even pointed out sharply that long-term post-crisis bailouts are actually a "reverse Robin Hood" effect, robbing the poor to enrich the rich by artificially inflating asset prices, which not only distorts market signals but also plants even bigger time bombs.

It was precisely this keen sense of systemic vulnerability that became his core bargaining chip in Trump's selection of a new Federal Reserve Chairman candidate. In Trump's list, Warsh stood in stark contrast to another leading candidate, Kevin Hassett, leading the media to jokingly refer to this contest as the "Battle of the Two Kevins."

Federal Reserve Chair Candidates: Hassett vs. Warsh (Image source: Odaily Original)

Hassett is a typical "growth-first" advocate. His logic is simple and direct: as long as the economy is growing, low interest rates are reasonable. The market generally believes that if Hassett comes to power, he will likely cater to Trump's desire for low interest rates, even initiating rate cuts before inflation is fully under control. This also explains why long-term bond yields surge whenever Hassett's chances of winning increase, because the market fears runaway inflation.

In contrast, Warsh's logic is far more complex, making it difficult to simply categorize him as either a "hawk" or a "dove." While he also advocates for interest rate cuts, his reasons are entirely different. Warsh argues that current inflationary pressures are not due to excessive buying, but rather to limited supply and the excessive money supply of the past decade. The Federal Reserve's bloated balance sheet is actually "crowding out" private credit and distorting capital allocation.

Therefore, Warsh's prescription was a highly experimental combination of measures: aggressive quantitative easing (QT) coupled with moderate interest rate cuts. His intention was clear: to control inflation expectations and restore the purchasing power of the dollar by reducing the money supply—in other words, to drain some of the money; and at the same time, to ease corporate financing costs by lowering nominal interest rates. This was a hardcore attempt to get the economy running again without injecting liquidity.

The Butterfly Effects on the Crypto Market: Liquidity, Regulation, and Hawkish Undertones

If Powell is like a cautious, gentle stepfather to the crypto market, unwilling to wake his child, then Walsh is more like a strict boarding school principal with a ruler in hand. The storm caused by this butterfly flapping its wings may be more violent than we anticipated.

This "strictness" is first reflected in his fastidiousness regarding liquidity. The crypto market, especially Bitcoin, has, to some extent, been a derivative of the global dollar glut over the past decade. Warsh's core policy is a "strategic reset," a return to the sound monetary principles of the Volcker era. His aforementioned "aggressive quantitative tightening" is both a short-term disaster for Bitcoin and a long-term litmus test.

Warsh once stated explicitly, "If you want to lower interest rates, you have to stop the printing presses first." For risk assets accustomed to the "Fed put option," this means the disappearance of the protective umbrella. If he firmly implements his "strategic reset" after taking office, leading monetary policy back to a more prudent principle, global liquidity tightening will be the first domino to fall. As a "frontier risk asset" highly sensitive to liquidity, the cryptocurrency market will undoubtedly face pressure for valuation reassessment in the short term.

Kevin Warsh discussed Federal Reserve Chairman Jerome Powell's interest rate strategy on the "Kudlow" show, source: Fox Business.

More importantly, if he truly achieves "inflation-free growth" through supply-side reforms, keeping real yield positive in the long term, then holding fiat currency and government bonds will become profitable. This is drastically different from the negative interest rate era of 2020, where "everything is rising in price, except cash," and Bitcoin's appeal as a "zero-interest asset" may face a severe test.

But there are always two sides to every story. Warsh is a staunch believer in "market discipline," and he would never rush to bail out the market like Powell did when it fell 10%. This seemingly bottomless market environment might actually give Bitcoin a chance to prove itself: when the traditional financial system experiences credit cracks due to deleveraging (like the Silicon Valley banking crisis), can Bitcoin break free from the pull of the US stock market and truly become a safe haven for capital? This is the ultimate test Warsh has posed to the crypto market.

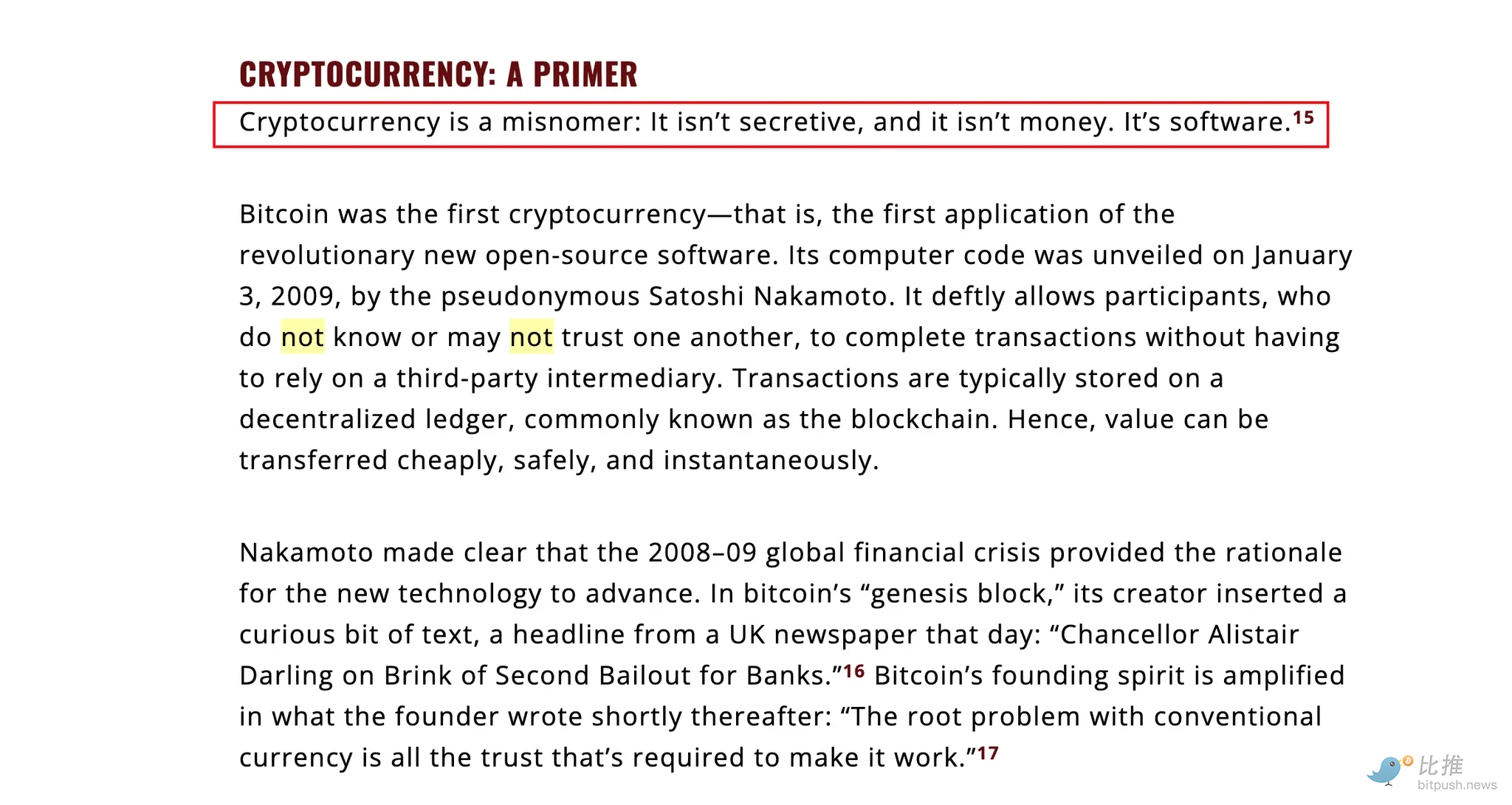

Behind this question lies Walsh's unique definition of cryptocurrency. He famously wrote in the Wall Street Journal: "Cryptocurrency is a misnomer. It's not mysterious, and it's not money. It's software."

Excerpt from Kevin Warsh's column "Money First: The Dollar, Cryptocurrency, and National Interest"

This statement may sound harsh, but a look at his resume reveals that he is not a blind opponent, but rather an insider with a deep understanding of the technical mechanisms. He is not only an advisor to the crypto index fund Bitwise, but also an early angel investor in the algorithmic stablecoin project Basis. Basis attempted to use algorithms to mimic central bank open market operations; although the project ultimately failed due to regulatory scrutiny, this experience gave Walsh a better understanding than any bureaucrat of how code generates "money."

Because he understands, he is even more ruthless. Walsh is a typical "institutionalist." He recognizes crypto assets as investment targets like commodities or tech stocks, but he has extremely low tolerance for "private coin creation," which challenges the sovereignty of the US dollar.

This binary approach will directly determine the fate of stablecoins. Warsh is highly likely to push for the inclusion of stablecoin issuers in the regulatory framework of "narrow banks": they must hold 100% cash or short-term debt reserves and be prohibited from fractional-reserve lending like banks. This is a double-edged sword for Tether and Circle; they will gain bank-like legal status, creating a very deep moat; but at the same time, they will lose the flexibility of "shadow banking," and their profit model will be completely locked into government bond interest. As for those small and medium-sized stablecoins attempting "credit creation," they will likely be eliminated under this pressure. (Recommended reading: "Saying Goodbye to the 'Agency Bank' Era? Five Crypto Institutions Obtain Keys to the Federal Reserve's Payment System" )

The same logic extends to CBDCs. Unlike many Republicans who outright oppose them, Warsh offers a more nuanced "American solution." He strongly opposes "retail CBDCs" issued directly to individuals by the Federal Reserve, arguing that they infringe on privacy and overstep power—a view remarkably aligned with the crypto community's values. However, he is a proponent of "wholesale CBDCs," advocating for the use of blockchain technology to transform interbank clearing systems to address geopolitical challenges.

Under this architecture, a fascinating fusion may emerge in the future: the underlying settlement layer will be controlled by the Federal Reserve's wholesale blockchain, while the upper application layer will be left to regulated public blockchains and Web3 institutions. For DeFi, this would mark the end of a "Wild West" era, but perhaps also the beginning of RWA's true spring. After all, in Warsh's logic, as long as you don't try to replace the dollar, technological efficiency improvements will always be welcome.

Conclusion

Kevin Warsh is more than just an option on Trump's list; he embodies Wall Street's old order's attempt at self-redemption in the digital age. Perhaps under his leadership, RWA and DeFi, built on real utility and institutional compliance, are only just beginning their true golden age.

However, just as the market was over-analyzing Walsh's resume, BitMEX founder Arthur Hayes poured a bucket of cold water on the issue. In Hayes' view, we may have all made a directional mistake. The key is not what a person "believed" before becoming chairman, but whether he understands "who he is actually working for" after taking that position.

Looking back at the Federal Reserve's century-long history, the power struggle between presidents and chairmen has never ceased. President Lyndon Johnson even physically assaulted then-Chairman William Martin on a Texas ranch to force the Fed to lower interest rates. In comparison, Trump's Twitter attacks seem child's play. Hayes' logic is harsh but true: the US president will ultimately get the monetary policy he wants. And what Trump wants is always lower interest rates, a hotter market, and a more abundant money supply. Whoever is in power will ultimately have to use the tools to accomplish this.

This is the ultimate question facing the crypto market:

Walsh was indeed a man who wanted to put his hand on the printing press and try to turn it off. But when political gravity struck, when the growth demands of "Make America Great Again" clashed with his ideals of "hard money," did he tame inflation, or did the game of power tame him?

In this game, Warsh may be a respectable "hawk" opponent. But in the eyes of a seasoned trader like Hayes, who becomes chairman is not important, because no matter how tortuous the process, as long as the political machine is still running, the liquidity valve will eventually be reopened.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush