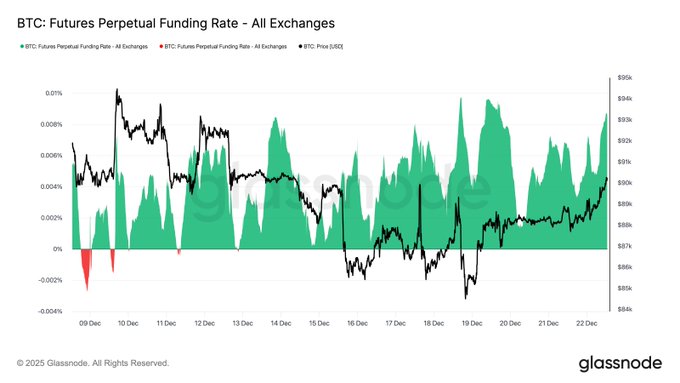

Leverage-driven pumps look great until they don’t ⚠️ When perp OI and funding ramp while spot demand stays weak: • Price is carried by leveraged longs, not real buyers • A thick liquidation stack sits right below price • One sharp wick can trigger a cascade of forced selling Healthy move: spot + ETF flows lead, dips are bought, funding normalizes. Leverage pump: perps drag price higher, funding grinds up, liquidation wall builds underneath. Leverage is a double-edged sword. These moves usually unwind faster and deeper than most expect.

glassnode

@glassnode

12-22

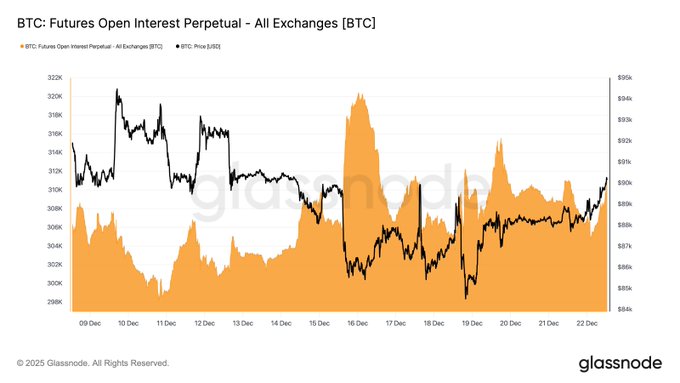

With price back above $90K, perpetual open interest has risen from 304K to 310K BTC (~2% increase), while the funding rate has heated up from 0.04% to 0.09%.

This combination signals a renewed buildup in leveraged long positioning, as perpetual traders position for a potential

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content