- The Bitcoin price faces the risk of a potential drop to $80,0000 as a recent breakdown created $90,000 as a strong resistance.

- Bitcoin faces a massive $23.8 billion option expiry on December 26, signaling a heightened volatility ahead.

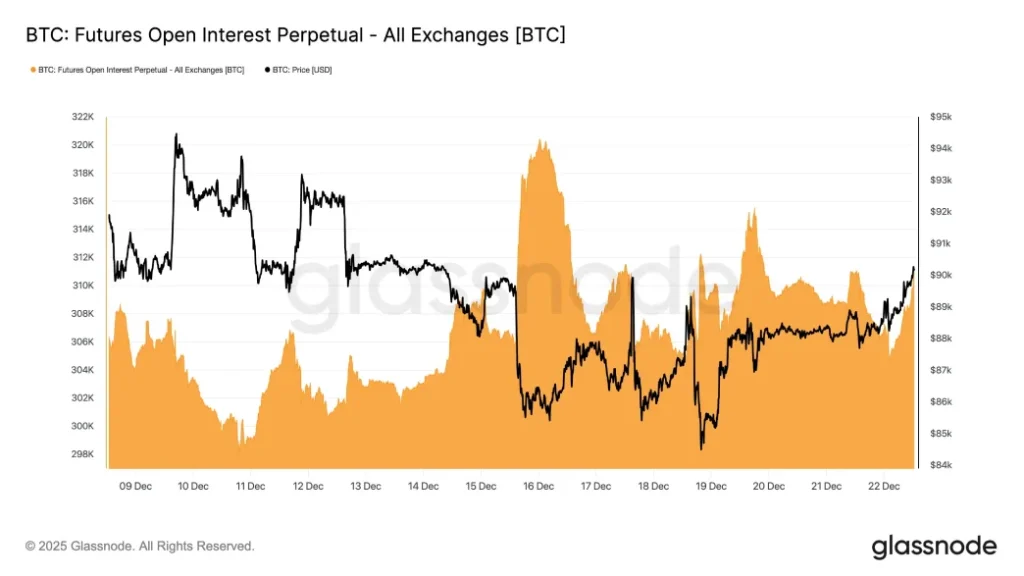

- Perpetual futures open interest climbed from 304,000 BTC to 310,000 BTC, reflecting a 2% increase.

Earlier today, the pioneer cryptocurrency showed a notable intraday gain of around 2% to reach a high of $90,530. However, the sellers returned during the U.S. market hours and pushed the price to $88,351 of current trading value. A deeper analysis shows the prior surge gained its momentum from the derivative market while spot demand stayed weak. Will the renewed selling pressure push Bitcoin price to $80,000 again?

BTC Tops $90K as Leverage-Driven Rally Quickly Fades

On December 22nd, Bitcoin price breached the $90,000 threshold in a brief-lived spike, driven by a lot of developments in the derivatives sector. Perpetual futures, open interest increased from 304,000 to 310,000 BTC, which represents a 2% increase, and funding rates rose from 0.04% to 0.09%, signaling greater dependence on leveraged positions in expectation of higher values towards the end of the year.

The upward momentum quickly waned however, taking the asset to $88,353 with a drop of 0.32% for the day.

Analyst ITTech highlighted that the surge was driven mostly by borrowed capital usually exhibit remarkable early strength but have notable weaknesses.

As the perpetuity positions and related expenditures rise without a corresponding enhancement in pure efforts of right acquisition, elevation comes not from broadly involved holders but more from highly magnified bets.

Such conditions often result in an accumulation of potential mandatory exits near and directly beneath the existing rate. Even a short sharp drop may trigger a series of automatic disposals that amplify the downfall.

On the other hand, steadier upward trends usually are indicated by solid purchases for direct markets and fund vehicles with setbacks met by constant take-up and cost levels holding steady.

Thus, the ongoing correction trade in Bitcoin price needed sufficient surge in bullish momentum.

Bitcoin Price Faces Selling Pressure at $90,000 Mark

Since last weekend, the Bitcoin price showed low volatility trading below $90,000. As mentioned by CryptoNewsZ earlier, the overhead region acts as flipped resistance after the recent breakdown from an inverted flag pattern.

From late-November to mid-December, the coin price witnessed a temporary surge between two converging trendlines of inverted flag pattern. The chart setup is commonly spotted within an established downtrend as its formation has often recuperated exhausted bearish momentum.

The price rejection has placed BTC’s sustainability in the last segment of Bollinger Band indicators accentuating the negative sentiment in the market. The trading volume in the last couple of days shows a notable drop indicating no initiation from buyers or sellers.

With sustained selling, the Bitcoin price could plunge another 9% to retest the bullish support at $80,500.

Any breakdown further would accelerate the market selling pressure and drive a prolonged downfall in BTC.

On the contrary, if the coin price managed to reclaim the $90,000, the buyers could regroup and bolster BTC for renewed price recovery.