Get the best data-driven crypto insights and analysis every week:

Crypto Trends To Watch in 2026

Introduction

Last week, we released our 2025 Digital Assets Report, breaking down the structural developments and trends shaping the crypto ecosystem from institutional adoption and regulatory breakthroughs to onchain expansion. Building on the momentum 2025 set into motion, this issue of State of the Network highlights several key areas to watch going into 2026.

Wider Universe, Fewer Winners

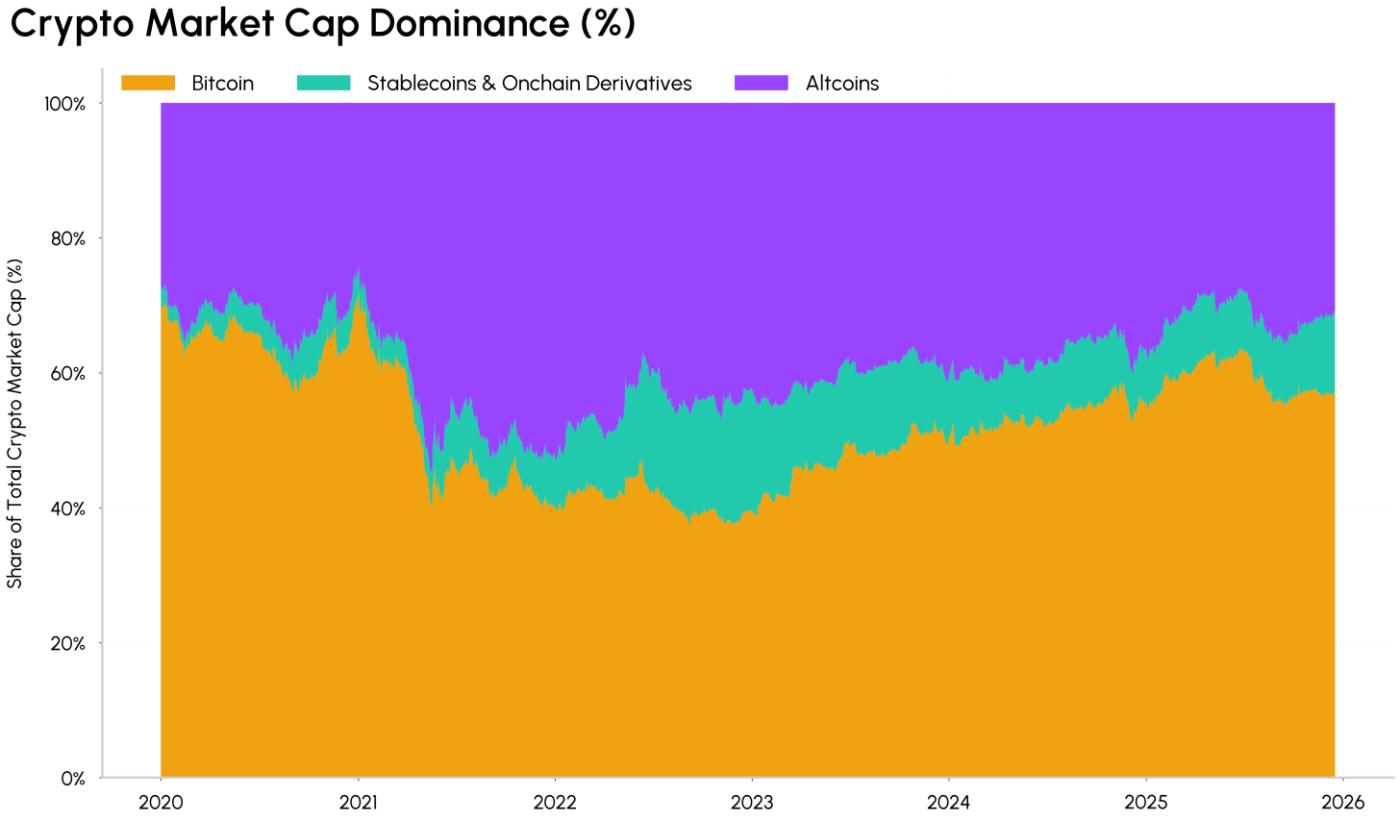

The crypto investment universe continues to expand, but capital is becoming increasingly selective. Competition for liquidity now spans not only a growing number of tokens, but also crypto equities tied to digital asset businesses and tokenized stocks bringing equities exposure onchain.

Source: Coin Metrics Network Data Pro

Bitcoin dominance climbed toward 64% in 2025, its highest level since April 2021. Meanwhile, the total altcoin market cap remains below prior cycle highs (~$1.1T), with the top 10 assets in the segment (excluding stablecoins and onchain derivatives), accounting for ~73% of the value. Going ahead, capital is likely to concentrate around more liquid, established assets with clearer fundamental demand, more robust tokenomic structures, and demonstrable product‑market fit, rather than broad exposure as the investable universe widens and markets mature.

Convergence with Capital Markets Deepens

Crypto’s convergence with capital markets deepened as ETFs and corporate treasuries solidified into structural channels of demand, reshaping how institutional capital enters and influences crypto markets.

Spot bitcoin ETFs now hold roughly 1.36M BTC (~6.8% of current supply) with more than $150B in AUM, counteracting long term holder distribution. Similar dynamics are playing out for Ethereum and Solana. A backdrop of rising US debt, gold’s strength, and the trajectory of monetary policy continue supporting demand for non-sovereign stores of value like Bitcoin. As a result, institutional participation through spot ETFs likely to broaden beyond early adopters into a deeper base of allocators, including retirement accounts and large asset managers.

Source: Coin Metrics Network Data Pro

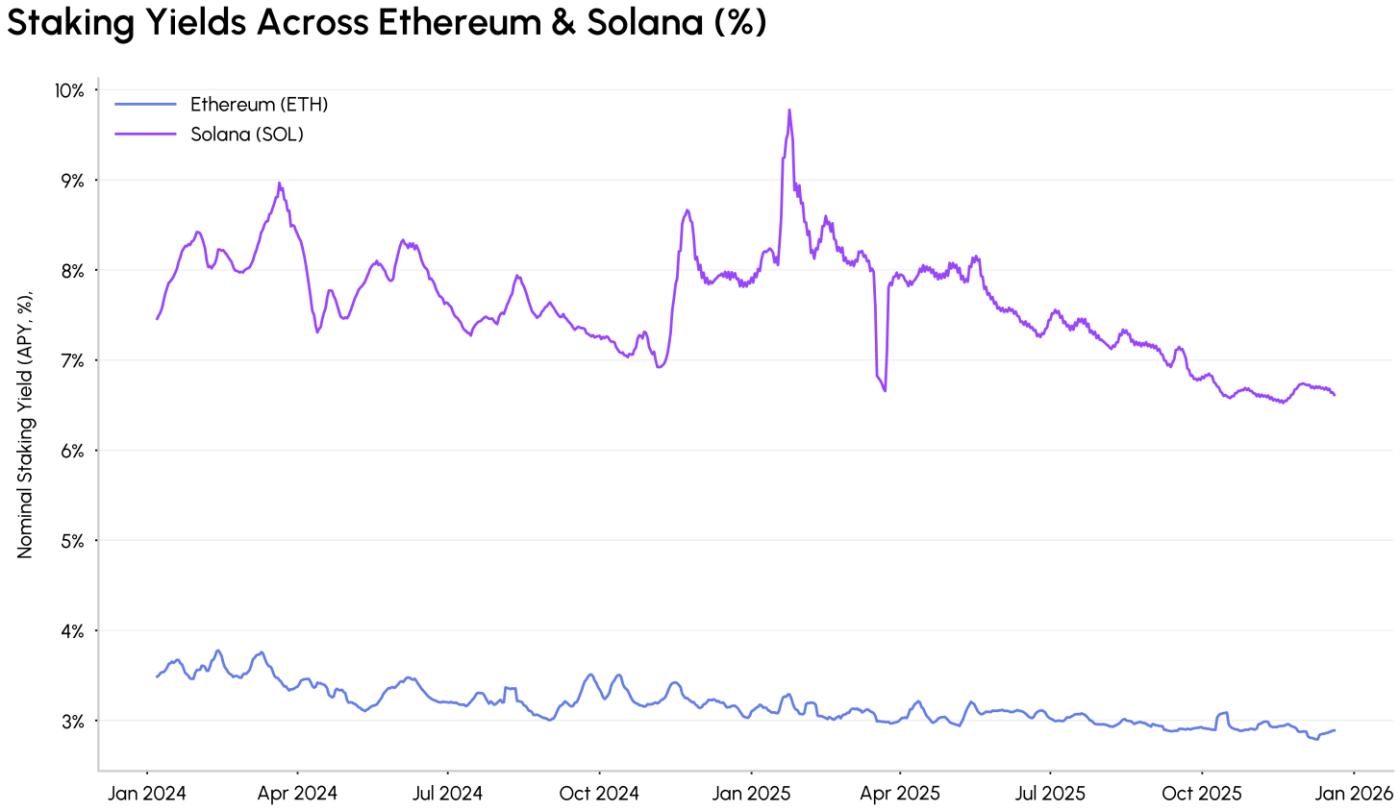

Native yield from proof-of-stake network tokens is the next step in this convergence. Staking-enabled products, from BlackRock’s staked Ethereum ETF filings to treasury strategies that actively stake assets, point toward a future combining capital appreciation with onchain yield, turning crypto exposure into a productive, income‑generating component of institutional portfolios.

Rise of Super Apps & Crypto Banks

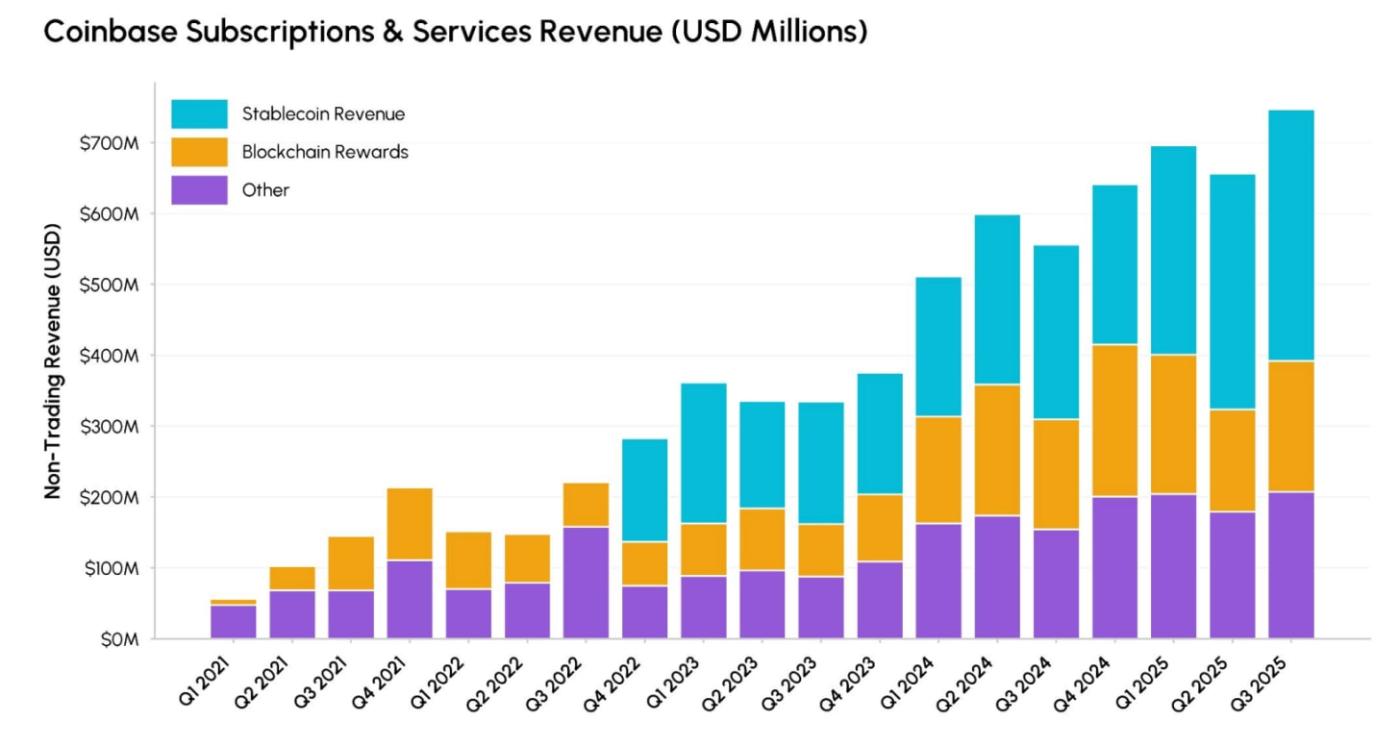

Exchanges and fintechs are converging from different starting points into full-stack crypto “super apps.” Coinbase exemplifies this shift, with subscription and services revenue growing over 7x since 2021 as it expands beyond trading into stablecoin interest, staking rewards, Base L2 revenues, and tokenized financial products. Similar moves by Robinhood and Kraken into tokenized equities, prediction markets, and embedded DeFi highlight the verticalization of crypto business models.

Source: Coinbase Quarterly Earnings Reports

At the same time, crypto-native firms are gaining deeper access to traditional financial infrastructure. In December, five firms (Circle, Ripple, BitGo, Fidelity Digital Assets, and Paxos) received conditional OCC approvals for national trust bank charters, enabling direct access to Fed payment rails and tighter integration with the banking system.

Stablecoins as The Backbone For Onchain Adoption

Stablecoins reached $300B in 2025, while transfer volumes grew over 150%. The passage of the GENIUS Act strengthened the link between digital dollars and US treasuries, reinforcing their role as a distribution layer for the dollar. This is sparking a wave of new entrants from traditional financial, payments and crypto-native companies, and catalyzing competition around various layers of the stack, from issuance, to settlement and payments.

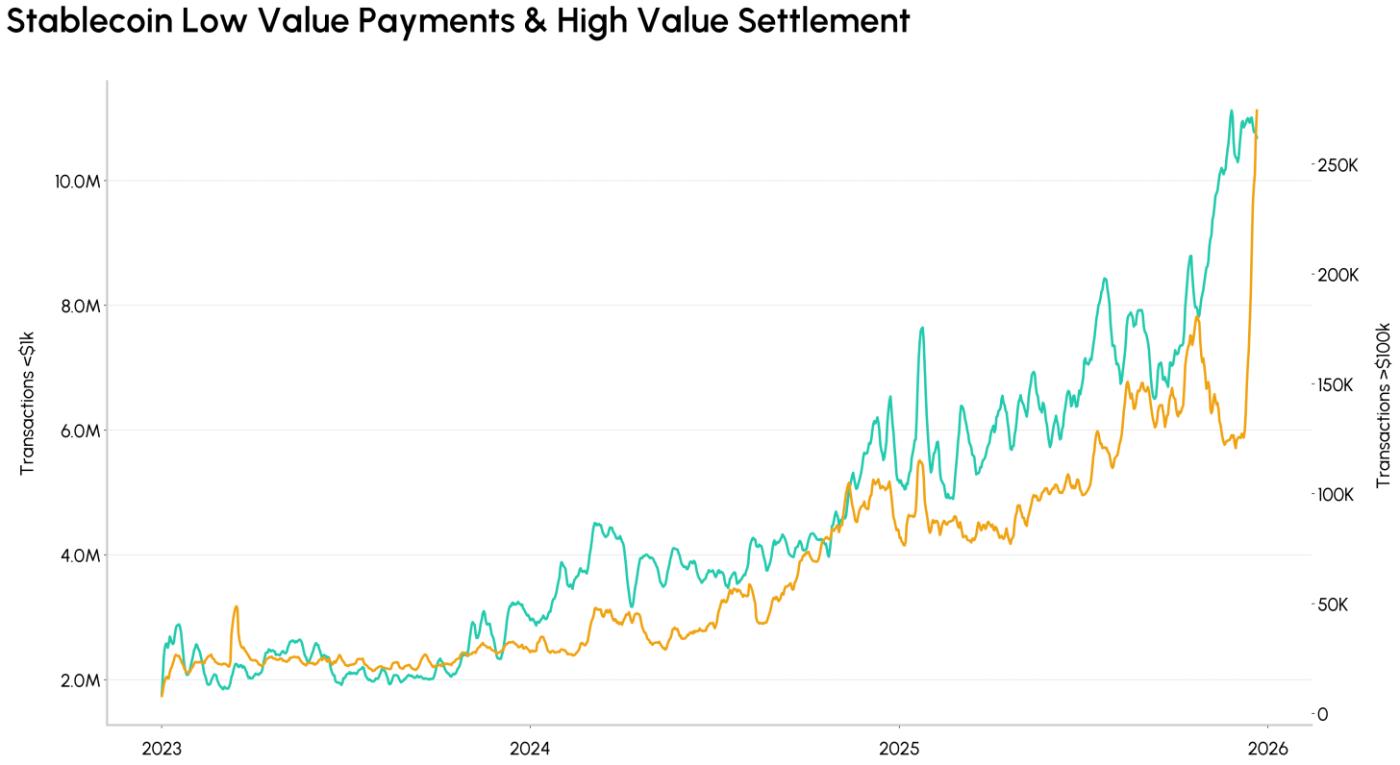

Source: Coin Metrics Network Data Pro

Transaction costs are compressing to sub-cent levels across major chains, unlocking a new scale of adoption. Small-value stablecoin transfers under $1,000 tripled year-over-year, exceeding 10M transactions, while high value transaction settlement crossed 250k transactions. As integration with traditional rails deepens, stablecoins are likely to expand further into cross-border remittances, consumer and B2B payments, micropayments, and savings products. Stablecoins are shaping up to underpin the next phase of onchain economic activity.

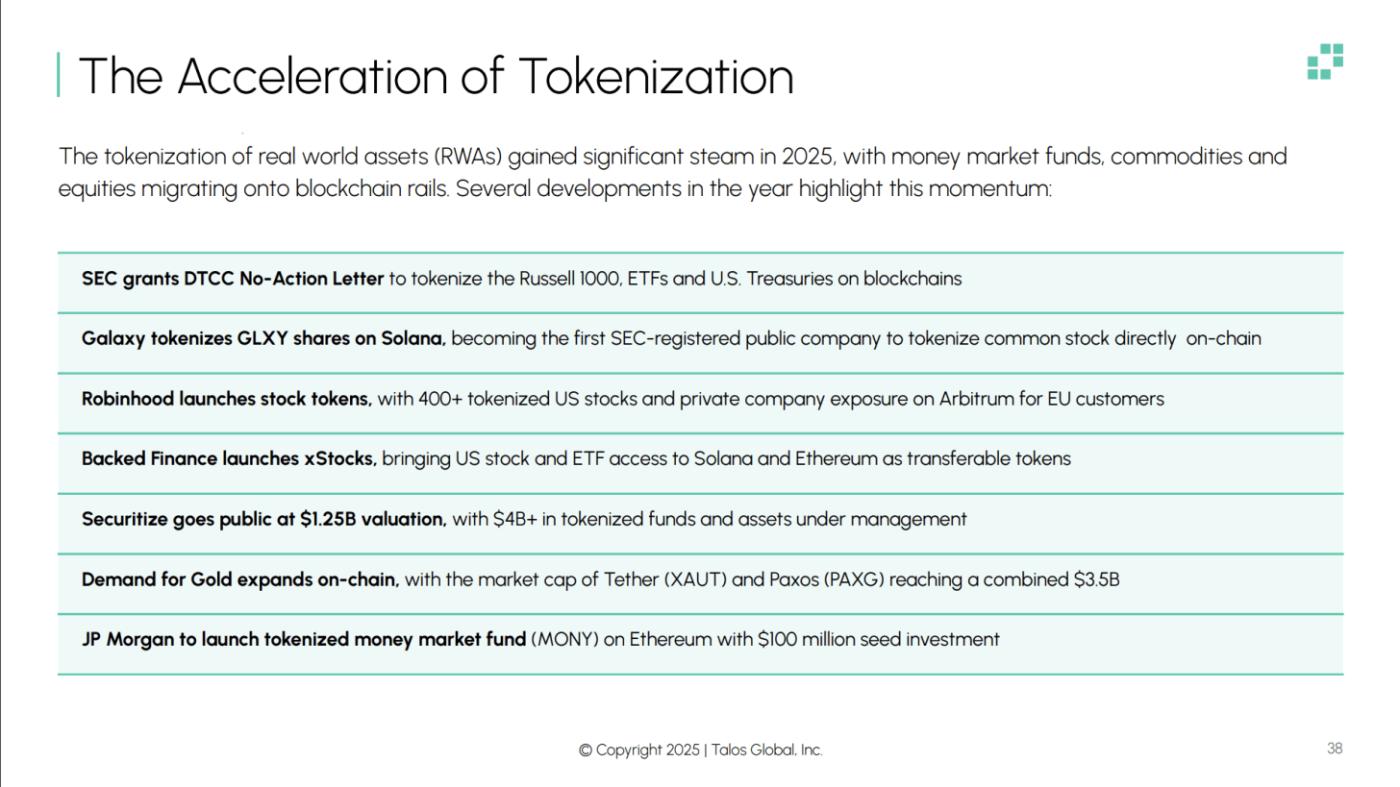

Tokenization Moves to Production Scale

Real-world asset tokenization is moving from experimentation to production. The DTCC received SEC permission to tokenize the Russell 1000, ETFs, and Treasuries on public blockchains. Galaxy tokenized equity on Solana, while Robinhood and Backed Finance brought 400+ U.S. stocks onchain.

Source: Talos and FactSet 2025 Digital Assets Report

The migration of assets onto blockchains continues to widen, from money market funds from JPMorgan, BlackRock, and Franklin Templeton, tokenized Treasuries as yield-bearing alternatives, commodities like gold at $3.5B market cap and equities in multiple forms from native issuance to perpetuals. The building blocks of regulatory clarity, technological maturity, and institutional participation are starting to fall into place, setting 2026 up for an acceleration of tokenization.

Subscribe and Past Issues

Coin Metrics State of the Network is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.