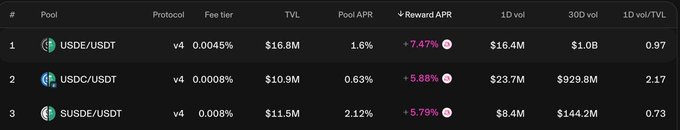

Scenario B is already in progress Uniswap strategically incentivizes the pools where they have completely lost the competition (see screenshot). The issue is that the competition will only increase from here, while Uni's focus in recent years has been on Unichain and v4, and neither of them was successful, in my opinion. Curve is doing similar volumes on BTC now, @0xfluid is about to launch DEX v2 which we believe will become the biggest DEX by volumes in 2026 (yes, I am saying "about to launch" for the past 6 months, but this time it is real. The delay is happening only due to our paranoid approach to security and countless audits and reaudits of v2). Uniswap has the lindy effect (which is further amplified with the recent hacks of other DEXes), but overall, DEX TVL is much easier to rotate, and users quickly migrate to more profitable venues (eg it took Fluid only 3 months to dominate stablecoin volumes on Ethereum with 0 incentives). The strategy of incentivizing a few markets where you lose works if you only need to run it for a few pools, but it won't work if you need to incentivize all of them.

GEE-yohm LAMB-bear

@guil_lambert

12-21

My predictions for the UNIfication proposal, once activated:

- Uni v3 pools become unprofitable despite the FPDA, LPs migrate to Uni v4

- some LPs leave the Uniswap ecosystem entirely, net TVL goes down

- fees collected on v3 compress to zero, with some coming from v2

Scenario

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content