Despite strong buying activity from Bitcoin ETFs and DATs this year, Bitcoin's price has yet to attract the same level of retail investor participation as in previous cycles.

Prominent market experts such as Ki Young Ju (CEO of CryptoQuant) and veteran trader Peter Brandt have recently released their latest insights on Bitcoin. Their perspectives help readers better understand Bitcoin's potential for growth in the short, medium, and long term.

Short-term outlook

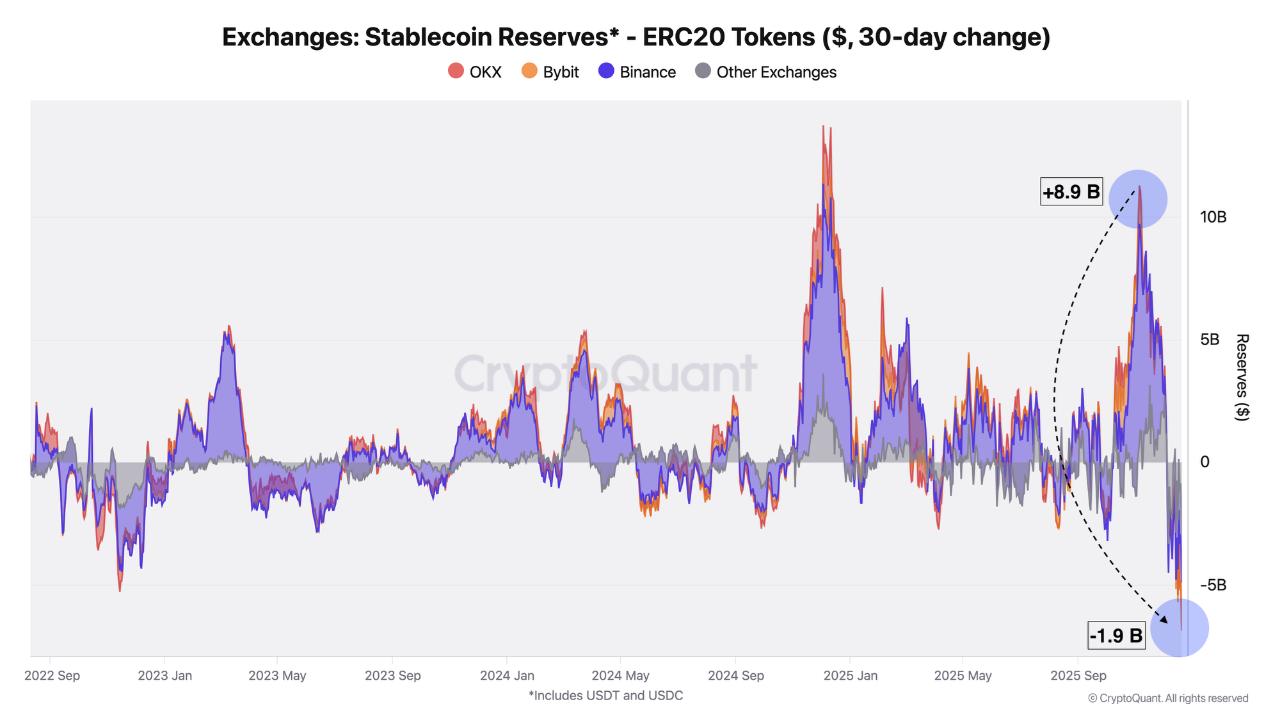

In the short term, Bitcoin is likely to continue struggling to recover. This is evident in the declining reserves of stablecoins.

Data from CryptoQuant shows that the amount of stablecoins on major exchanges has dropped sharply. In the past 30 days, Capital outflows from the market have reached nearly $1.9 billion.

Stablecoin (ERC20- Token) reserves on exchanges. Source: CryptoQuant .

Stablecoin (ERC20- Token) reserves on exchanges. Source: CryptoQuant .Binance, a leading exchange in terms of liquidation , typically reflects investor willingness to buy through stablecoin balances. However, data shows a significant decrease in the amount of ERC-20 stablecoins on Binance and other centralized exchanges. This also indicates that retail investors are withdrawing from the market.

"This volatility clearly shows a lack of investor interest in entering trades right now. Instead of holding stablecoins on the exchange waiting for an opportunity, some have decided to withdraw," commented a Darkfost analyst.

Therefore, in the short term, Bitcoin lacks sufficient buying power, limiting its potential for price increases .

Medium-term outlook

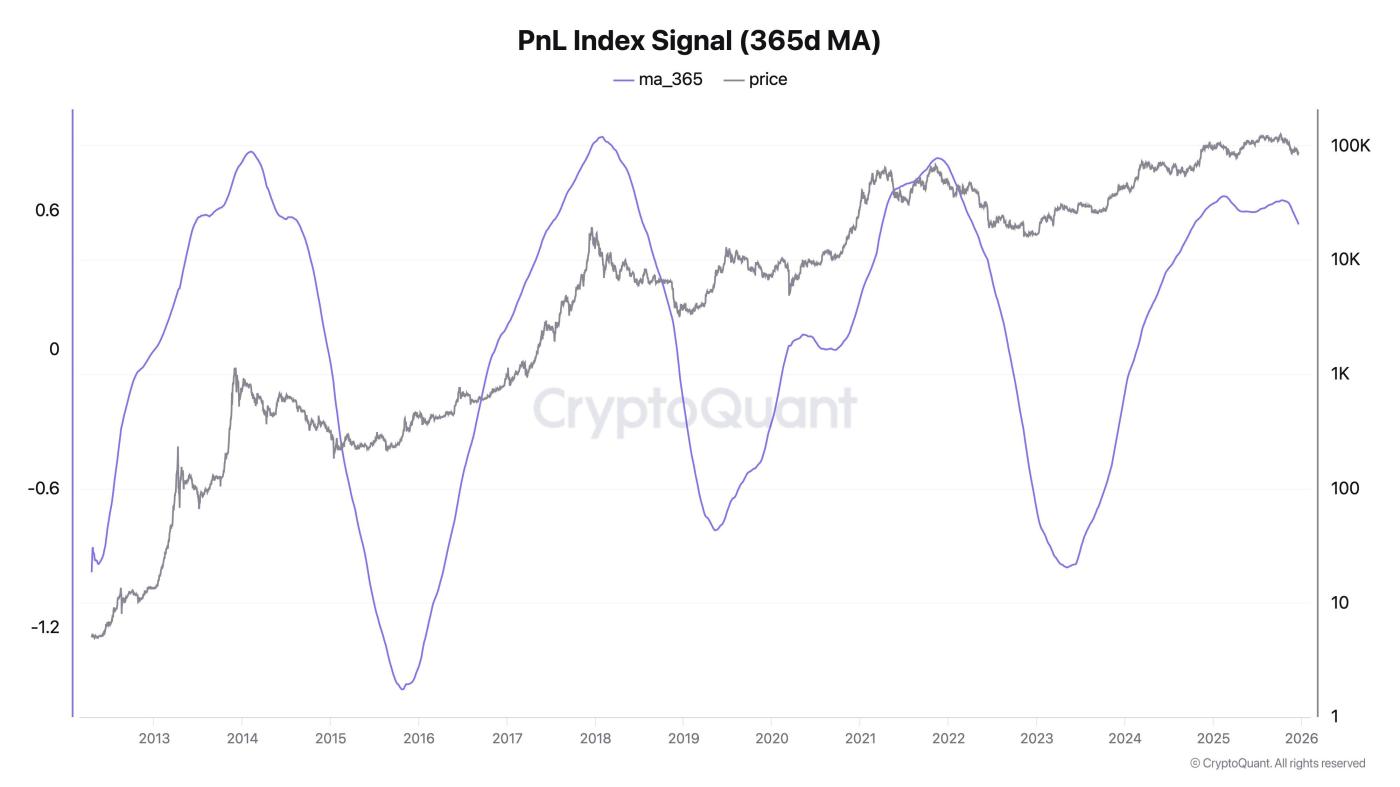

In the medium term, Ki Young Ju (founder of CryptoQuant) also noted that the flow of Capital into Bitcoin on-chain is gradually weakening.

He explained that, after about 2.5 years of continuous growth, the “realized cap” has remained almost unchanged over the past month. This is an indicator that measures the total Capital capitalization of Bitcoin based on the final purchase price of each Bitcoin.

PnL indicator signal. Source: CryptoQuant .

PnL indicator signal. Source: CryptoQuant .The data also indicates that the PnL Index Signal, which tracks profits and losses based on the Capital basis of all wallets, has been flat since the beginning of 2025. The index is trending downwards towards the end of the year, suggesting that investors' losses are increasing.

"Market sentiment may take several months to recover," Ki Young Ju predicted .

Long-term outlook

In the long term, most experts remain optimistic. Peter Brandt, a veteran trader since 1975, maintains a positive view of Bitcoin.

In a recent post on X, Brandt stated that Bitcoin has experienced five parabolic bull runs on a logarithmic scale over the past 15 years, followed by price drops of at least 80%. He argues that the current cycle is not yet over.

When asked about the timing of the next Dip , Brandt did not give a specific number. However, he predicted that the next peak of the Bull market could occur in September 2029.

His argument is based on historical trends, where later cycles tend to last longer and have lower percentage growth rates than earlier cycles.

In summary, experts predict that Bitcoin will need several more months to recover . Therefore, it is unlikely that Bitcoin will reach a new All-Time-High soon.