Zcash price has just dropped sharply, losing over 6% in the last 24 hours. However, compared to last week, the Token is still up about 9%. This drop, however, is not random. The market is reacting to a technical signal that has appeared several times in recent months.

Currently, ZEC is reaching a point where the trend, trading positions, and selling pressure are all beginning to converge. If this pattern is confirmed by today's closing price, the downside risk will become much more apparent.

A long-held technical threshold is under threat.

Zcash is breaking out of a stable trend after losing a crucial support level that has kept the price sideways for the past few months. This is the 50-day exponential moving Medium , or 50-day EMA. This trend indicator helps smooth price fluctuations and often acts as dynamic support in strong or stable uptrends.

For ZEC, this EMA line is really important. On November 30, 2023, when Zcash closed below the 50-day EMA, the price dropped nearly 30% in just a few days. A similar situation repeated itself on December 14, 2023. When the price closed below this level, ZEC continued to lose about 8% in the following sessions.

Key support for ZEC: TradingView

Key support for ZEC: TradingViewWant to stay updated on Token? Sign up for the daily newsletter from editor-in-chief Harsh Notariya here .

Now, Zcash is trading below this EMA line again. If today's candle closes below that level, based on history, the downtrend has not stopped. Therefore, this current drop is more significant than a typical red session in the market, as it is signaling a clearer shift from an accumulation phase to a bearish phase.

Both the Derivative market and spot flows shifted to a downward trend simultaneously.

The reaction from traders was clearly demonstrated through their buying and selling behavior.

Data from perpetual Futures Contract shows that most tracked groups have leaned towards Short positions over the past 24 hours. Large traders, whales, and influencers (potentially KOLs) have all increased their Short positions, demonstrating a belief that prices may continue to fall.

"Smart money" traders are being somewhat more cautious, slightly reducing their Short positions. However, this change isn't significant enough to reverse the overall trend, as Derivative data currently suggests traders are preparing for a continued decline rather than a rapid recovery.

Zcash Perps: Nansen

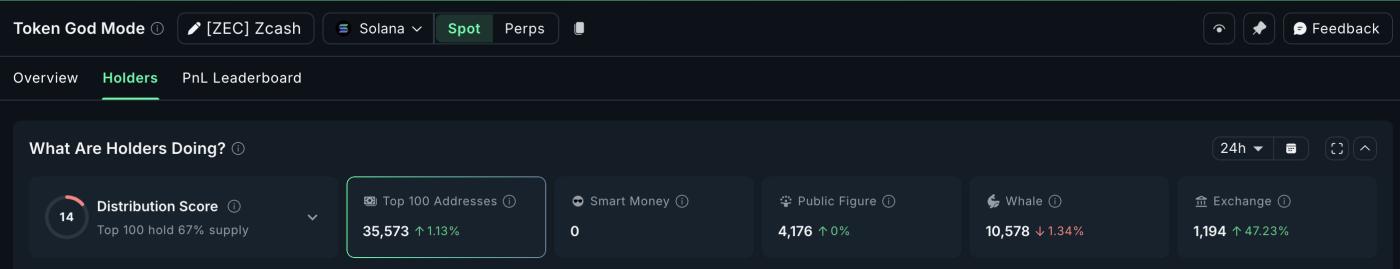

Zcash Perps: NansenSpot market data also reinforces this observation. On ZEC exchanges within the Solana system, the amount of coins deposited increased by over 47% in just one day. A strong influx of coins into exchanges is often a warning sign of impending selling pressure, although the amount this time wasn't exceptionally large.

When both Derivative positions and spot cash flows are skewed in one direction, the signal becomes even stronger.

Spot sales continue: Nansen

Spot sales continue: NansenOverall, these cash flows suggest that the loss of trend support is not a "false breakout." The market is bracing as if the risk of a deeper decline is entirely real.

What are the Zcash price levels and the 10% risk?

If Zcash confirms a break of support , the first critical price level will be around $410. This is a zone that has held the price during previous short-term corrections. If ZEC fails to hold this zone, the downward momentum could be much stronger.

Further down, the next significant downside target would be the $371 region. If ZEC falls from its current level to this point, the drop would be approximately 10%, similar to the previous declines before breaking through the EMA. If selling pressure intensifies, deeper areas around $295 could also be the next target, based on previous accumulation zones on the chart.

Zcash price analysis: TradingView

Zcash price analysis: TradingViewThe "invalidation" level is very clear: Zcash needs to break back above the 50-day EMA and continue to break through the $470 price level to show that the downtrend has failed. Only when the price stabilizes there will the market structure show signs of stabilization, and $549 will be the next milestone to overcome.

Until this happens, the balance of risk remains tilted toward the downside. Zcash has just lost a crucial trend signal, traders are on the defensive, and the coin listings also indicate a ready supply to Dump onto the market. If today's closing price confirms this pattern, the likelihood of further declines remains very high.