Author: Prathik Desai

Original title: 2025: Ethereum Won, ETH Didn't

Compiled and edited by: BitpushNews

As someone who has been bullish on ETH for a long time, I must admit that I've developed an annoying habit this year: I open the ETH chart and do a little mental calculation to gauge how much my portfolio has lost. After looking at it, I close the chart, secretly hoping to see it recover its losses in the near future.

As the year draws to a close, I anticipate that most ETH holders who bought at the beginning of the year will be disappointed. However, Ethereum, as a blockchain , has outperformed its token ETH in terms of price movement and wealth effect over the past 12 months.

Today's story is about how Ethereum and ETH have performed this year.

If you define "good" as "making money", then this year certainly isn't good.

However, if you disregard the returns of the native token ETH, ETH actually became easier to "hold" in 2025—mainly thanks to market-driven "wrappers," such as exchange-traded funds ( ETFs ) and digital asset bonds (DATs).

Meanwhile, Ethereum's two major upgrades—Pectra and Fusaka—have made it simpler and faster to use the chain at scale.

This quantitative analysis will show how 2025 presents a very different picture for Ethereum as a “network” and ETH as an “asset”, and what this means for both as they enter 2026 .

Ethereum "listed" on mainstream platforms

For most of the past two years, the idea of " institutionalized ETH" seemed like a distant dream. As of June 30, 2024, the ETH ETF had seen inflows of just over $4 billion since its launch a year earlier. At that time, publicly traded companies were just beginning to show interest in the idea of "including ETH on their balance sheets."

However, the second half of 2025 brought a turning point in their fate.

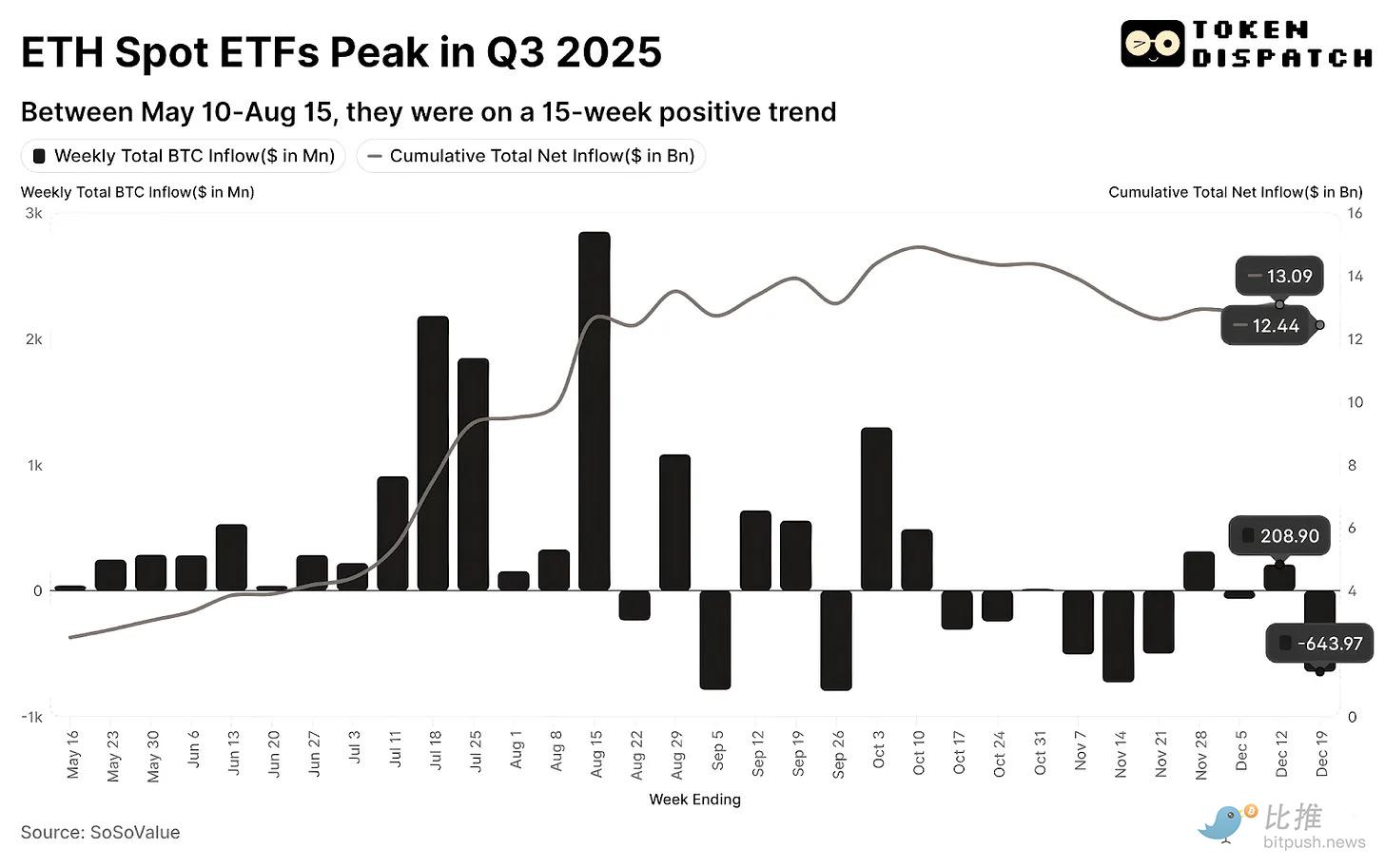

Between June 1 and September 30, 2025, the cumulative inflow into the ETH ETF increased nearly fivefold, surpassing the $10 billion mark.

The surge in these ETFs has brought about a psychological shift. It has significantly lowered the barrier to entry and expanded ETH's audience from simply "developers" and "traders" to a third group—those seeking exposure to the world's second-largest cryptocurrency. This leads to the second major development this year.

New buyers of Ethereum

Over the past five years, thanks to Michael Saylor's Strategy (formerly MicroStrategy), corporate treasuries have appeared to be the most natural form of corporate holdings.

At least before the cracks appeared, this argument seemed to be the cleanest way for companies to gain exposure to cryptocurrencies: publicly traded companies buy scarce cryptocurrencies, drive up prices, boost company stock prices, and then use the premium to raise further funds through share issuance.

So when the concept of an "Ethereum vault" first emerged in June of this year, it did indeed leave many people puzzled. What truly makes it special is that Ethereum can do things that Bitcoin vaults cannot.

Especially after Ethereum co-founder and ConsenSys founder and CEO Joe Rubin announced that he would serve as chairman of the board of SharpLink Gaming and oversee its $425 million Ethereum vault strategy—this move appears to be meticulously calculated.

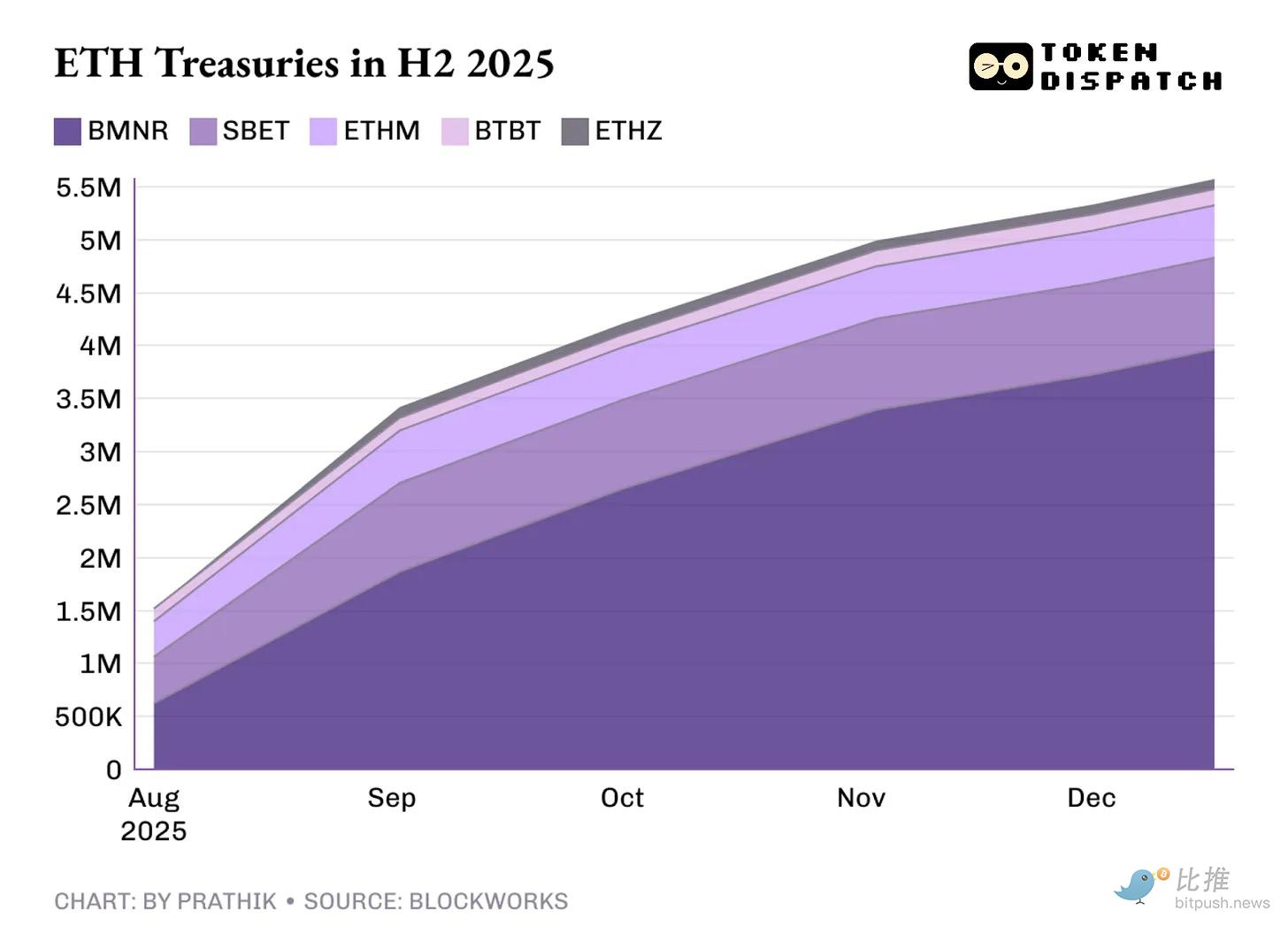

Soon, more companies followed in SharpLink's footsteps.

Currently, the top five Ethereum treasury companies hold a total of 5.56 million ETH, accounting for more than 4.6% of the total Ethereum supply. At current prices, this is worth over $16 billion.

When investors allocate an asset through "packagers" such as ETFs and vaults, that asset begins to function as a standard item on the balance sheet. This triggers a series of corporate governance actions: it requires regular reporting, comes to the board's agenda, appears in quarterly financial statements, and is subject to review by the risk management committee.

Ethereum's staking yield feature allows the "Ethereum Treasury" to offer something that the Bitcoin Treasury cannot—an asset structure that can generate a continuous cash flow.

The staking angle gives ETH Treasury bonds an advantage that its BTC competitors cannot offer:

Bitcoin treasuries can only profit when a company sells Bitcoin at a high price, while holding Ethereum itself allows companies to earn more ETH through staking, while also contributing to cybersecurity.

If a company can find a way to combine pledge income with its main business revenue, its treasury business can generate sustainable cash flow.

Only then did the market truly begin to pay attention to this model.

Elusive Marketing

Those who have followed Ethereum's development know that its market popularity often goes hand in hand with its own growth. More often than not, it seems quite "ordinary" until an external event—such as a product "packager," a cycle shift, or the emergence of a new narrative—forces people to re-examine Ethereum's potential.

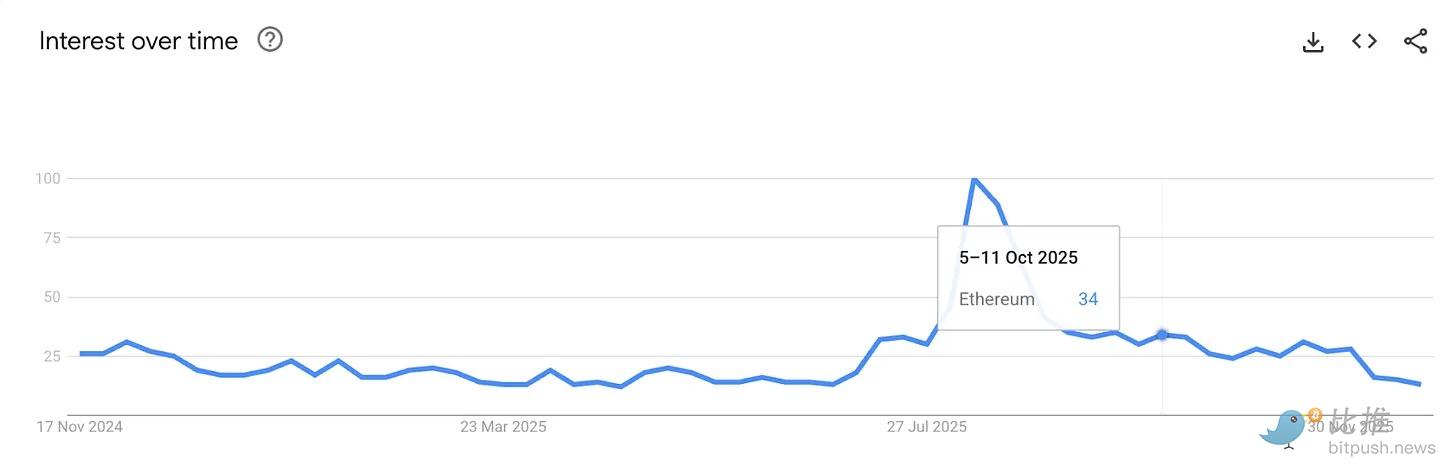

This time, with the rise of ETH DATs and increased inflows into ETH ETFs, market attention is gradually heating up. I used the most intuitive way to measure this attention: observe whether ordinary users who don't usually care about the blockchain technology roadmap have started talking about Ethereum.

Google Trends surged between July and September, perfectly coinciding with the momentum of ETH DATs and ETFs.

Traditional channels that possess Ethereum have piqued the curiosity of retail investors, and this curiosity has led to increased attention.

But attention alone is far from enough. It comes and goes quickly, perhaps as fast as it rose. This leads to a key reason why Ethereum believers see this year as a huge success, yet it's been largely underestimated by outsiders—

"On-chain dollars" for the managed internet

If you take a long-term view from any price chart, those highs and lows seem to be just products of fluctuating sentiment.

However, stablecoins and tokenized real-world assets (RWAs) are different. They are rooted in strong fundamentals and bridge the gap between traditional finance and decentralized finance.

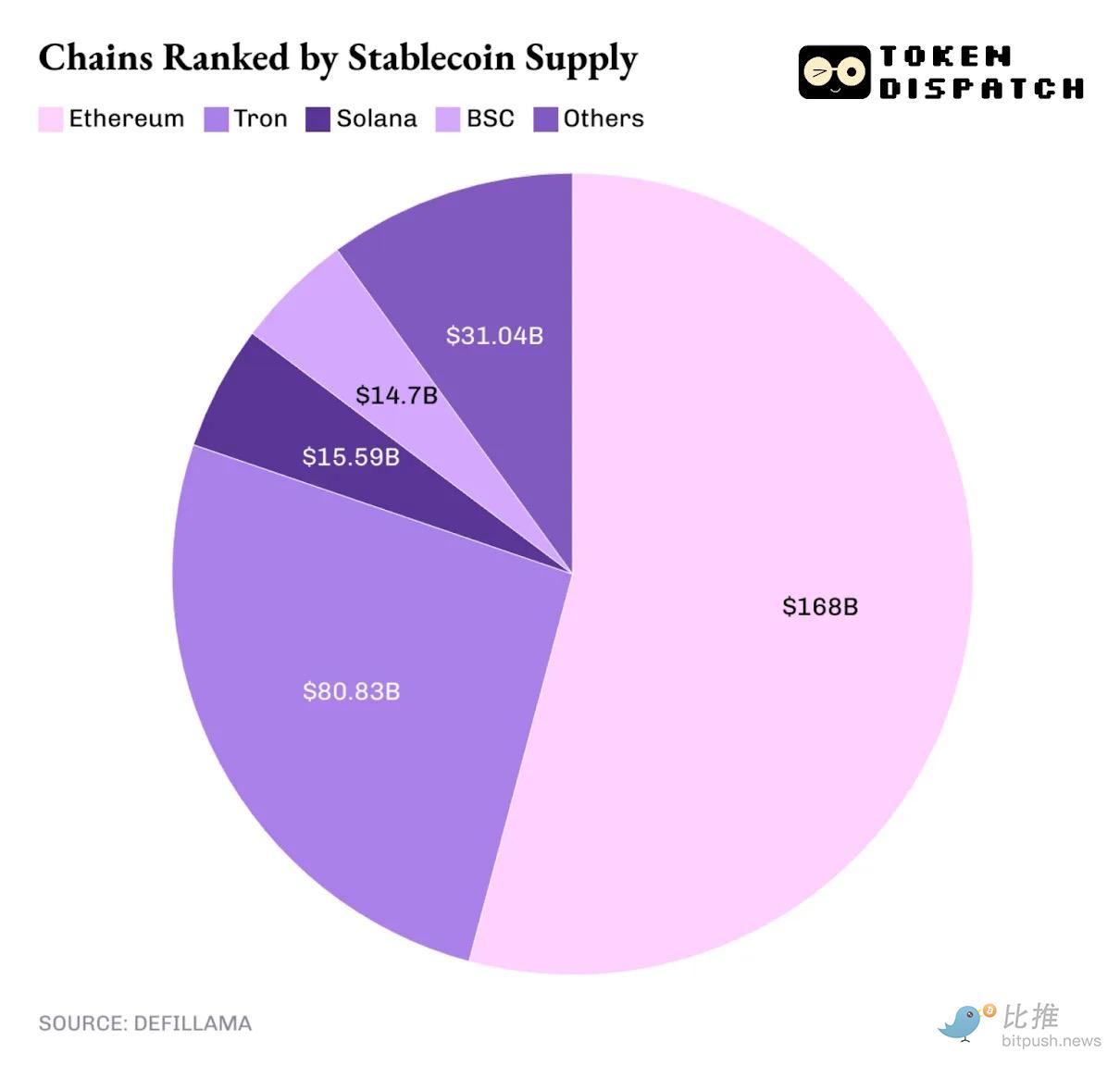

In 2025, Ethereum will remain the most favored platform in the "Dollar Layer," supporting the circulation of stablecoins and the tokenization of real-world assets.

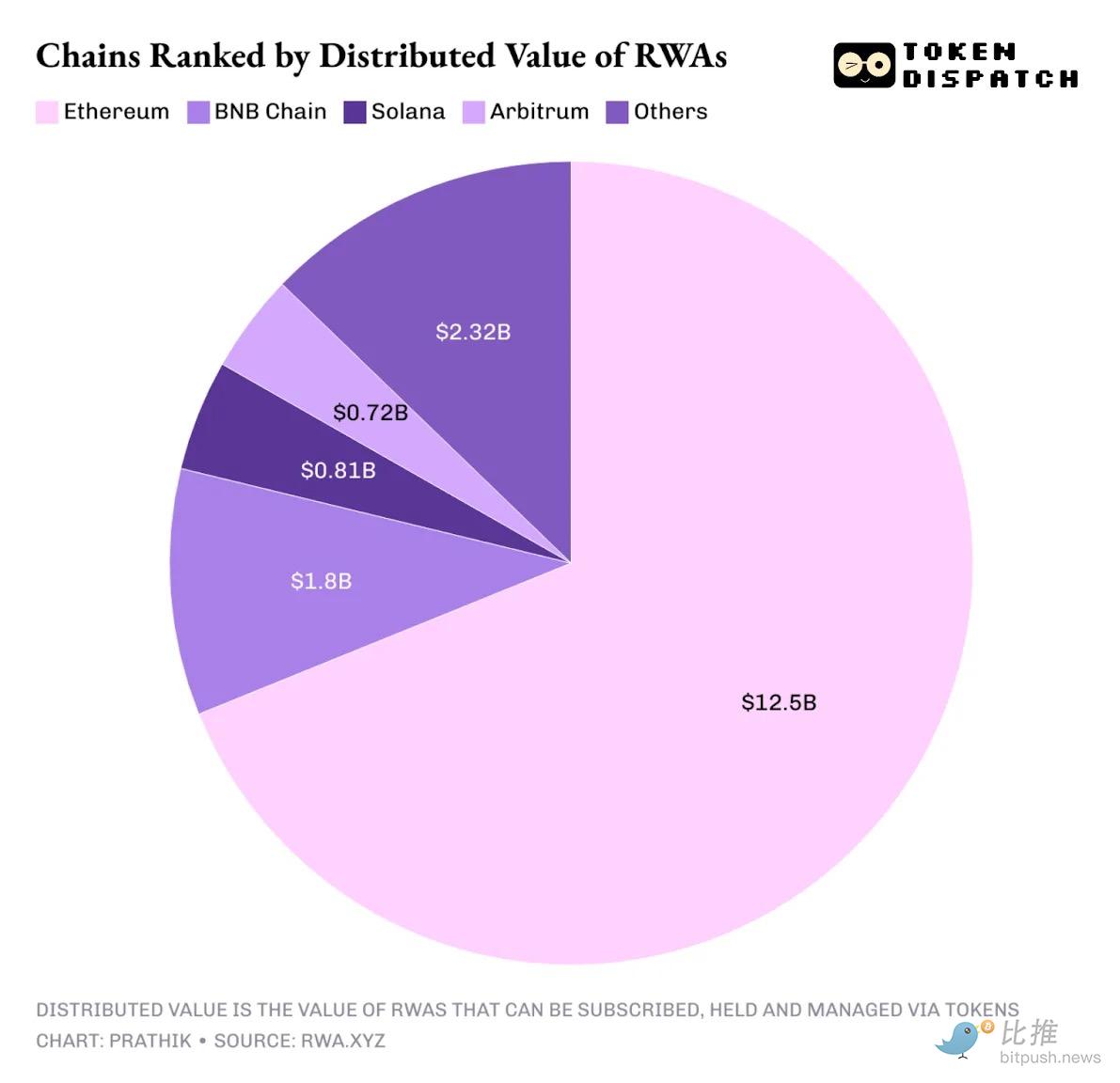

You've seen the same phenomenon in the tokenized RWA space.

At the time of writing, Ethereum still accounts for the majority of the value of “distributed” tokenized assets. This means that more than half of the tokenized RWAs that allow holders to buy, manage, and hold are issued on the Ethereum blockchain.

Therefore, while ETFs make buying ETH easier, bond-like structures allow buyers to hold ETH through a regulated Wall Street path, gaining leveraged ETH exposure. All of this further integrates Ethereum into traditional capital markets, where people are already comfortable holding assets in a regulated environment.

Dual upgrade

Ethereum underwent not one, but two major upgrades in 2025. These upgrades made the network feel less congested and more stable, and made it more usable as the underlying protocol for those seeking to settle transactions on a trusted platform.

The Pectra upgrade, launched in May, expands blob capacity for improved scalability and reduces L2 transaction costs by providing more space for publishing compressed data to Layer-2 (L2). It also delivers higher transaction throughput, faster confirmation speeds, and better overall Rollup application efficiency.

Later that year, Fusaka was upgraded, further expanding its scale and enhancing the user experience.

Overall, Ethereum focused on optimizing its performance in 2025 to function like a reliable financial infrastructure. Upgrades prioritized predictability in runtime, throughput, and cost. These qualities are crucial for rollups, stablecoin issuers, and institutional users settling value on-chain. These choices make Ethereum more reliable at scale, even if they don't significantly boost the correlation between network activity and ETH price in the short term.

Current situation and future

If you're looking for a simple, black-and-white conclusion about this year—"Ethereum is good" or "Ethereum is bad"—2025 may not give you a definitive answer. Instead, it presents a more interesting, but also unsettling, reality.

In 2025, Ethereum successfully entered the ledgers of fund issuers (ETFs) and the balance sheets of listed companies (DATs), gaining attention consistent with institutional allocations.

However, ETH holders have endured a year in which price movements have failed to reflect the progress of the blockchain.

Those who bought ETH on January 1st are still down at least 15%. ETH did reach an all-time high of nearly $4,953 in August this year, but that rally failed to hold. It is currently trading near its lowest level in almost five months.

Ethereum will continue to grow steadily into 2026 with a massive influx of stablecoins and tokenized RWA. If the network can capitalize on this momentum and transform it into long-term growth, then a true revaluation may have only just begun.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush