Solana has fallen out of last week's consolidation zone after failing to maintain its upward momentum, slowing down the recovery towards the $150 mark. Currently, SOL is trading cautiously, awaiting stronger confirmation signals.

Recent on-chain and institutional activity suggests investors are preparing for a rebound, potentially paving the way for a price increase again by the end of the year or early January 2024.

Solana investors are being limited by ETFs.

The Solana ecosystem is gaining new momentum through on-chain “Creator ETFs,” also known as Bands, launched on Bands.fun. These products differ from traditional ETFs because they operate directly on the Solana blockchain as portfolios programmed by creators, analysts, or influencers.

Creator ETFs can combine multiple Token or Non-Fungible Token and automatically rebalance based on predefined rules. With more users, Solana 's on-chain activity and volume can increase. As the network becomes more robust, this often supports price recovery as demand for SOL increases.

Organizations see potential

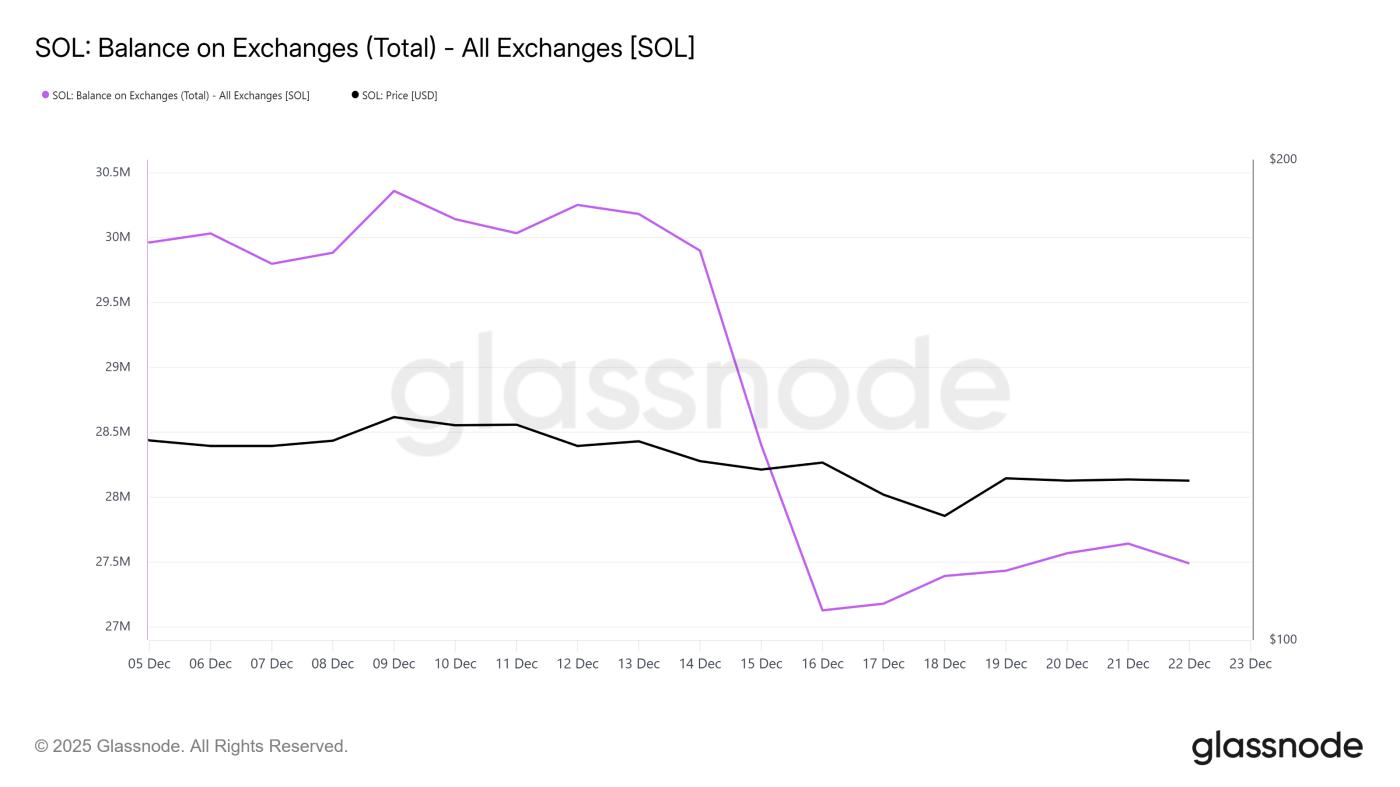

Data on the number of SOL tokens on exchanges also sends a positive signal. The amount of Solana on centralized exchanges has decreased sharply over the past 10 days. During this period, investors bought approximately 2.65 million SOL, worth about $345 million.

A decrease in the amount of SOL on the exchange typically indicates an accumulation rather than distribution trend. Owners appear to be moving SOL to personal wallets, thereby reducing immediate selling pressure. This action reflects confidence in Solana 's long-term prospects and contributes to price stability after recent corrections.

Want to stay updated on the latest news and knowledge about Token? Sign up for editor Harsh Notariya's daily Crypto Newsletter here .

Amount of Solana on the exchange. Source: Glassnode

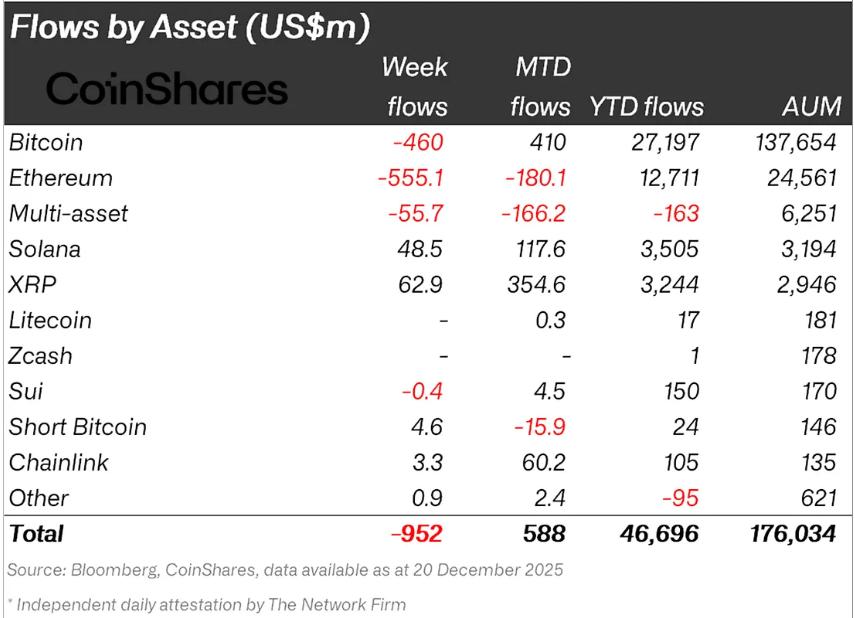

Amount of Solana on the exchange. Source: GlassnodeInstitutional sentiment toward Solana remains quite optimistic despite the overall market volatility. According to CoinShares' weekly report, SOL recorded Capital of $48.5 million in the week ending December 20, 2023. Total Capital from the beginning of the month to date have reached $117.6 million.

These investments demonstrate sustained institutional interest. Professional investors typically accumulate during periods of market consolidation. If this inflow continues, it will help offset selling pressure from retail investors, laying the groundwork for a recovery when the market improves.

Institutional Capital flows into Solana. Source: CoinShares

Institutional Capital flows into Solana. Source: CoinSharesSOL prices are heading towards recovery.

Solana is trading around $124 at the time of writing, below the $126 resistance level. Considering on-chain innovation, SOL outflows from exchanges, and institutional capital inflows, SOL may attempt a recovery by the end of December 2023 or early January 2024.

If SOL surpasses the $126 mark, it will be the first confirmation signal. If it regains $130, market sentiment will become even more positive. The next upside target is around $136. If it breaks through this level, Solana will show signs of recovering losses from the beginning of the month.

Solana price analysis. Source: TradingView

Solana price analysis. Source: TradingViewHowever, downside risk remains if selling pressure returns or the overall market declines. If Solana falls below $123, the $118 support zone could be tested. If this level is also breached, the positive outlook will lose its validity and the price recovery will be delayed, despite momentum from the ecosystem or institutional Capital inflows.