Silver has become one of the top-performing assets in 2025, far surpassing both gold and Bitcoin.

This price surge is not solely driven by speculation but also reflects a rare combination of macroeconomic changes, industrial demand, and geopolitical pressures. This trend could continue into 2026.

Silver performance in 2025 in the context of

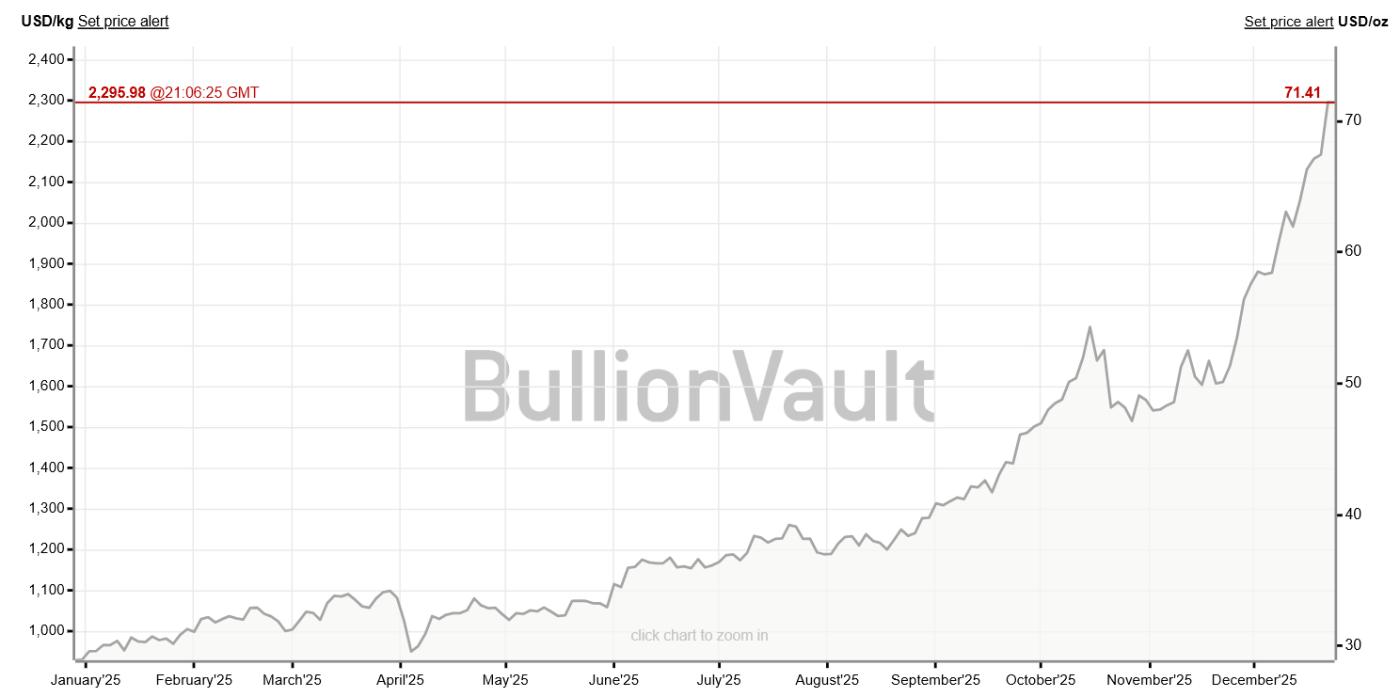

By the end of December 2025, silver was trading near $71 per ounce , up more than 120% for the year. Gold also rose about 60% during the same period, while Bitcoin ended the year lower after a period of volatility and peaked in October. Silver started 2025 around $29 per ounce and steadily increased throughout the year. The upward momentum intensified in the second half of the year as supply shortages and industrial demand surged.

Silver price chart for 2025. Source: BullionVault

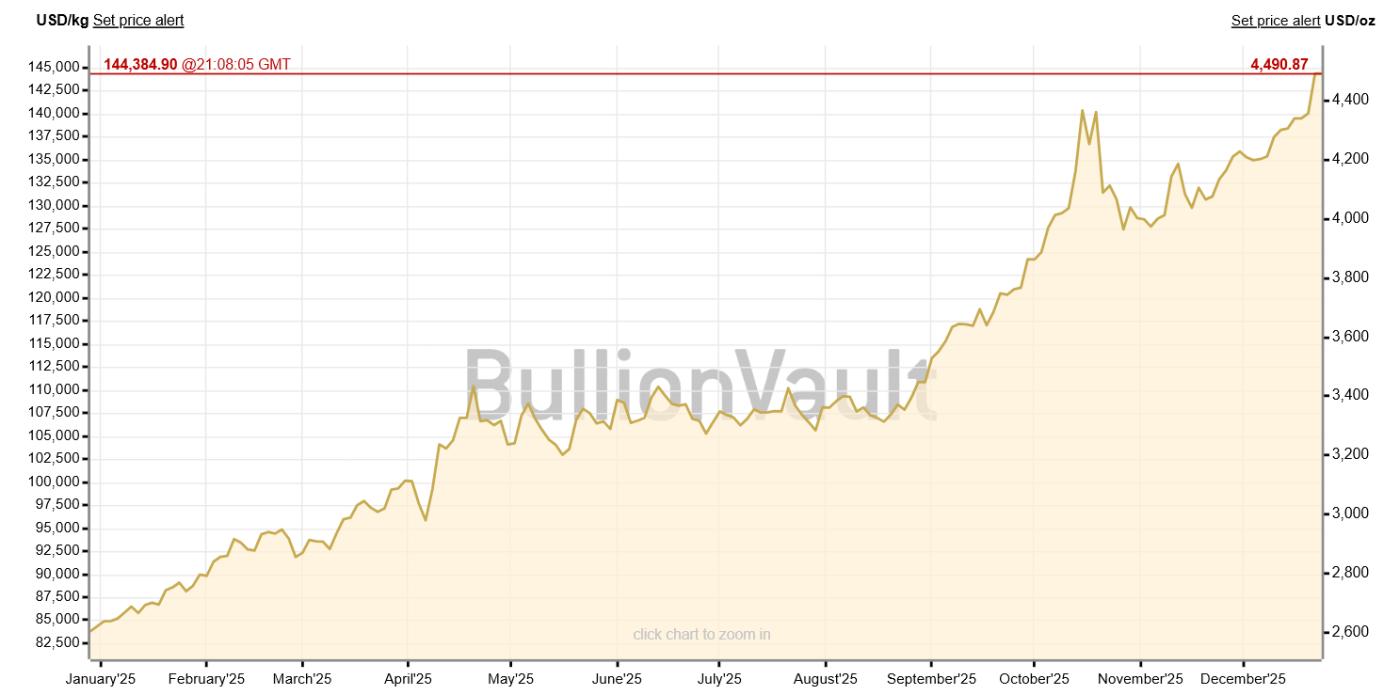

Silver price chart for 2025. Source: BullionVaultGold also surged in price , from around $2,800 to over $4,400 per ounce, driven by falling real yields and demand from central banks.

However, silver has still outperformed gold, which is consistent with historical trends where silver often drives bull cycles in precious metals.

Gold price chart for 2025. Source: BullionVault

Gold price chart for 2025. Source: BullionVaultBitcoin, however, took a different turn. Its price surged to a record high of nearly $126,000 in early October 2025 before plummeting sharply, closing December at around $87,000.

Unlike precious metals, Bitcoin failed to retain its safe-haven appeal as risk sentiment rose towards the end of the year.

Macroeconomic conditions favor tangible assets.

In 2025, several macroeconomic factors strongly supported silver. Most notably, global monetary policy began to ease. The US Federal Reserve (Fed) cut interest rates multiple times towards the end of the year, causing real yields to fall and the US dollar to weaken.

At the same time, concerns about inflation remain unresolved. Taken together, history shows that tangible assets are often preferred, especially those with both monetary and industrial value.

Unlike gold, silver also directly benefits from economic growth. This dual Vai has helped silver achieve remarkable breakthroughs in 2025.

Industrial demand became the main driving force.

The upward price momentum of silver is increasingly driven by actual demand rather than investment Capital . Industrial demand accounts for nearly half of total silver consumption, and this proportion is increasing.

The energy transition plays a huge Vai . Solar power is the biggest new source of demand, and electrification of transportation and infrastructure is also putting pressure on the Capital limited supply of silver.

The global silver market is expected to continue experiencing a supply-demand deficit for the fifth consecutive year in 2025. Supply is unlikely to increase because most silver is mined as a byproduct of base metal mining, rather than as the primary source of silver production.

Electric vehicles create additional structural demand.

Electric vehicles have significantly increased the demand for silver by 2025. Each electric vehicle uses 25 to 50 grams of silver, nearly 70% more than traditional gasoline-powered vehicles.

As global electric vehicle sales increase at double-digit rates, the demand for silver in the automotive industry has reached tens of millions of ounces annually.

Fast charging stations also fuel this demand. High-power chargers use kilograms of silver in their electronic components and connectors.

Unlike cyclical investment needs, the demand for silver in the electric vehicle industry is structural. Actual consumption will increase at the rate of electric vehicle production.

Defense spending quietly tightens supply.

The demand from the military sector is becoming an increasingly important, albeit often overlooked, factor. Modern weapons utilize large amounts of silver for guidance systems, radar, secure communications, and drones.

A cruise missile can contain hundreds of ounces of silver, and all of this would be destroyed during use. Therefore, for defense purposes, silver cannot be recycled.

Global military spending reached a record high in 2024 and is expected to continue rising in 2025 as conflicts in Ukraine and the Middle East persist.

Europe, the United States, and Asia are all increasing their purchases of modern ammunition, quietly stockpiling physical cash.

Geopolitical shocks reinforce the trend.

Geopolitical tensions further reinforce the Vai of silver. Prolonged conflicts lead nations to increase their defense reserves, while the Chia of global trade makes the supply of crucial materials like silver even more concerning.

Unlike gold, silver lies at the intersection of national security and industrial policy. Many governments have begun to XEM silver as a strategic material, highlighting its Vai in both civilian and military technology.

This reality creates an unusual feedback loop: geopolitical risk both fuels demand for safe-haven investments and dramatically increases the amount of physical silver used in industrial production.

Why could 2026 extend the winning streak?

Looking ahead, most of the factors driving a sharp rise in silver prices in 2025 remain intact. Electric vehicle sales are steadily increasing. Expanding the power grid and investing in renewable energy continue to be priorities for many policies. Defense budgets show no signs of decreasing.

Furthermore, the supply of silver remains limited. Many new mining projects take years to implement, and recycled silver is insufficient to offset the increasing demand from the military.

Gold may still perform well if real interest rates are low. Bitcoin could rebound if risk appetite increases. However, neither combines the Vai of a hedge against currency value with direct exposure to global electrification and military spending like silver does.

This explains why many experts believe that silver will hold a very special position in 2026.

The surge in silver prices in 2025 is not just a temporary speculative bubble. It is the result of fundamental and long-term changes in how the global economy consumes this metal.

If current trends continue, silver's dual Vai as a monetary hedge and an indispensable material for industrial production could help it once again outperform gold and Bitcoin by 2026.