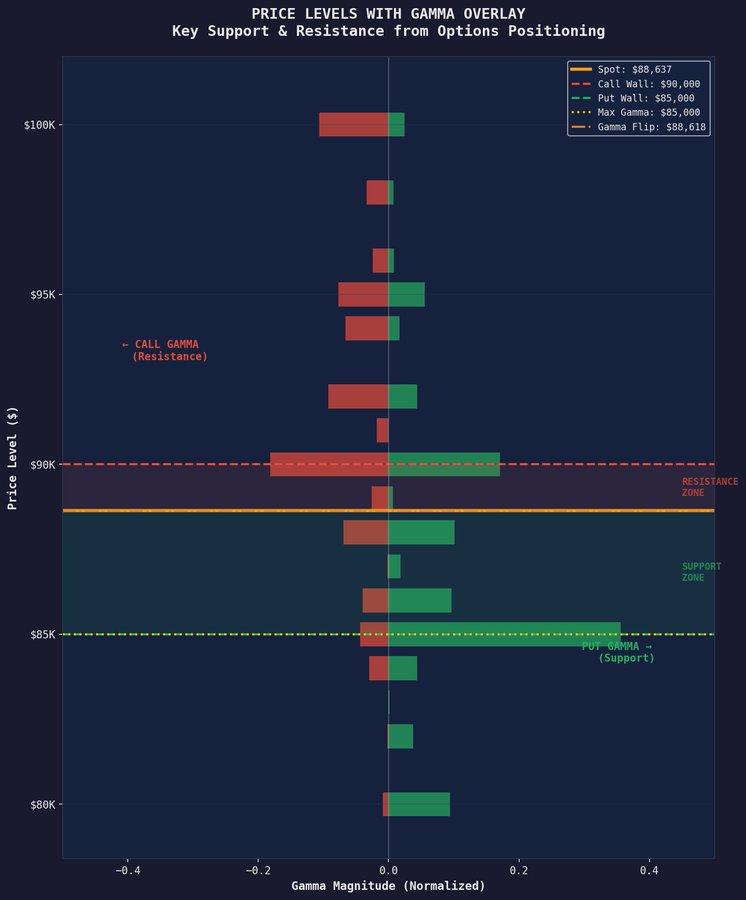

Bitcoin has disappointed both buyers and sellers recently, fluctuating between $85,000 and $90,000 without any clear breakout. The reason isn't a lack of buying interest or macroeconomic factors, but rather the options market.

Derivative data suggests that market makers' gamma is currently reducing Bitcoin's price volatility through mechanical hedging activities. This very structure has kept Bitcoin's price moving sideways within a narrow range, but these forces will expire on December 26, 2024 .

Gamma Flip Level

At the heart of this development is what's being called the " gamma flip ," currently hovering around $88,000.

When the price is above this level, market makers holding Short gamma positions are forced to sell when the price rises and buy when the price falls to maintain delta equilibrium. This action reduces volatility and brings the price closer to the middle of the trading range.

When prices fall below this level, the opposite mechanism occurs. Selling pressure increases as dealers hedge against the price trend, leading to more volatile movements instead of being contained.

$90,000 was repeatedly rejected while $85,000 remained unclaimed.

The $90,000 level has repeatedly acted as a strong resistance threshold, primarily due to the large concentration of call Call Option at this level.

Dealers are holding a large number of Call Option with a strike price of $90,000. As the price of Bitcoin approaches this level, they are forced to sell Bitcoin to hedge against risk. This creates selling pressure that seems natural but actually stems from hedging operations using Derivative.

Every time the price approaches $90,000, this hedging flow is triggered, explaining why breakout attempts always fail.

Source: NoLimitGains on X

Source: NoLimitGains on XOn the downside, the $85,000 level has also proven to be a sustainable support level thanks to the opposite mechanism.

The large volume of put options at this price level forces dealers to buy Bitcoin when the price falls to this level. This forced buying pressure helps absorb selling pressure and prevent the price from falling further.

Thus, the Bitcoin market appears stable on the surface, but in reality, it is being artificially balanced by conflicting hedging flows.

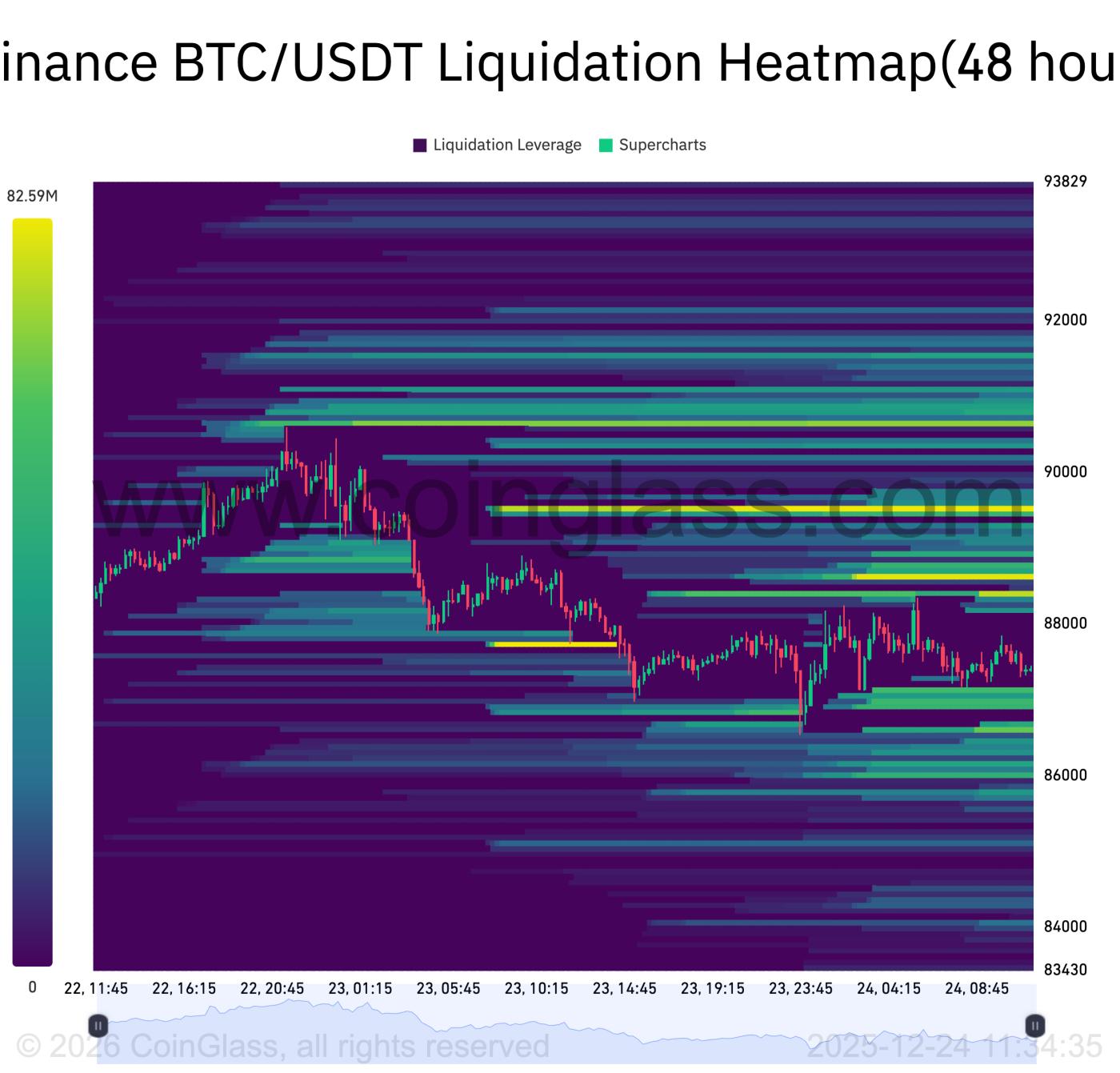

Futures Contract liquidation orders are reinforcing the sideways price range.

The price range triggered by options trading is not self-generated. Liquidation heatmap data on Coinglass shows that leveraged futures positions are also concentrated around these price levels, creating additional pull that keeps the price within the $85,000-$90,000 range.

Above $90,000, the risk of liquidation for Short positions is very high. If the price breaks above this level, closing Short positions will trigger a massive influx of buy orders. Conversely, the liquidation zone for Longing is concentrated below $86,000. If the price falls to this level, the "burned" Longing positions will put pressure on the price, pushing it down even faster. Currently, both the hedging mechanisms of options dealers and the liquidation activity in the futures market are geared towards keeping Bitcoin within the current price range.

Source: Coinglass

Source: CoinglassOptions traps await ahead.

The options expiration date of December 26, 2024, is expected to be the largest in Bitcoin history, with a total notional value of approximately $23.8 billion.

Compared to the past, annual maturities reached approximately $6.1 billion in 2021, $11 billion in 2023, and $19.8 billion in 2024. This growth reflects the increasing participation of institutions in the Bitcoin Derivative market.

According to experts at NoLimitGains, approximately 75% of the current gamma radiation will disappear after this expiration date. The mechanical factors driving the price in the $85,000-$90,000 range will almost certainly vanish.

Dealer gamma dominates ETF Capital flows.

Dealer hedging activities currently far exceed actual demand in the spot market. Analysis shows dealer gamma reaching $507 million, while total daily ETF transactions are only $38 million — a difference of 13 times.

This divergence explains why Bitcoin doesn't seem to react to good news. Until Derivative pressures subside, the mathematics of hedging will be the deciding factor, not stories about institutional money flows or retail investor participation.

What will happen next?

After the expiration date of December 26, 2024, the volatility control mechanism will no longer be in place. This doesn't guarantee a specific price direction — it simply means Bitcoin is free to move again.

If buyers hold the $85,000 support level through the expiration date, a breakout to $100,000 is entirely possible. Conversely, if the price falls below $85,000 amidst declining gamma, the decline could be faster and more severe.

Investors should prepare for significant volatility in early 2026 as new positions gradually form. The sideways movement of Bitcoin in recent weeks is essentially a temporary phenomenon driven by Derivative and does not reflect genuine market confidence.