Approximately $160.13 million worth of leveraged positions were liquidated in the cryptocurrency market over the past 24 hours.

According to currently aggregated data, long positions accounted for 81.76% of the total liquidated positions, or $130.92 million, while short positions accounted for 18.24%, or $29.21 million.

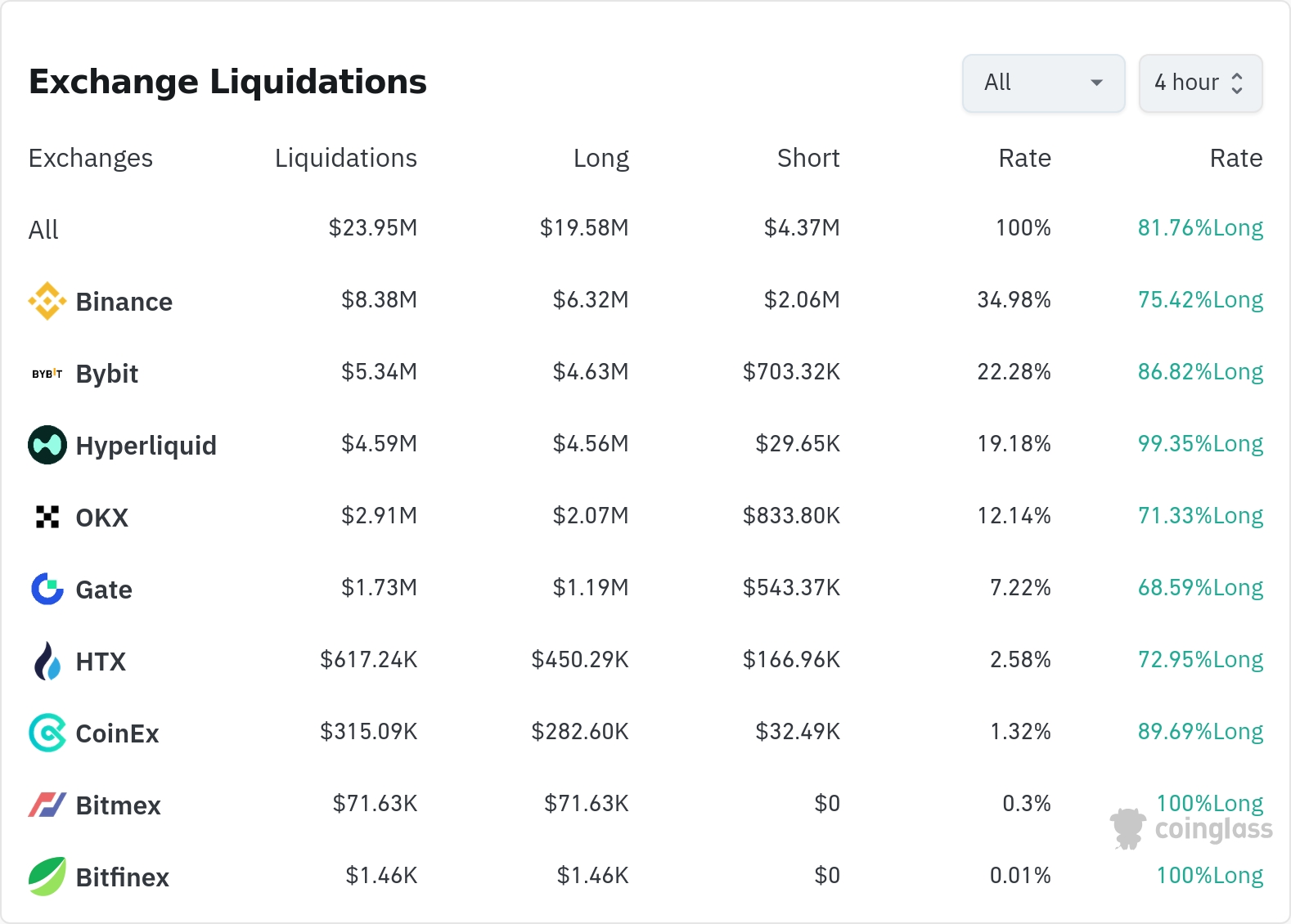

A total of $23.95 million in positions were liquidated over the past four hours. Binance saw the most liquidations, with $8.38 million (34.98% of the total) liquidated. Of these, long positions accounted for $6.32 million, or 75.42%.

The second exchange with the most liquidations was Bybit, where $5.34 million (22.28%) of positions were liquidated, of which long positions accounted for $4.64 million (86.82%).

Hyperliquid saw liquidations of approximately $4.59 million (19.18%), with a long position ratio of 99.35%, meaning almost all of the positions were liquidated.

OKX saw liquidations of approximately $2.91 million (12.14%), with a long position ratio of 71.33%.

Notably, Bitmex and Bitfinex saw liquidations of $71,630 and $1,460 respectively, with both positions being 100% long.

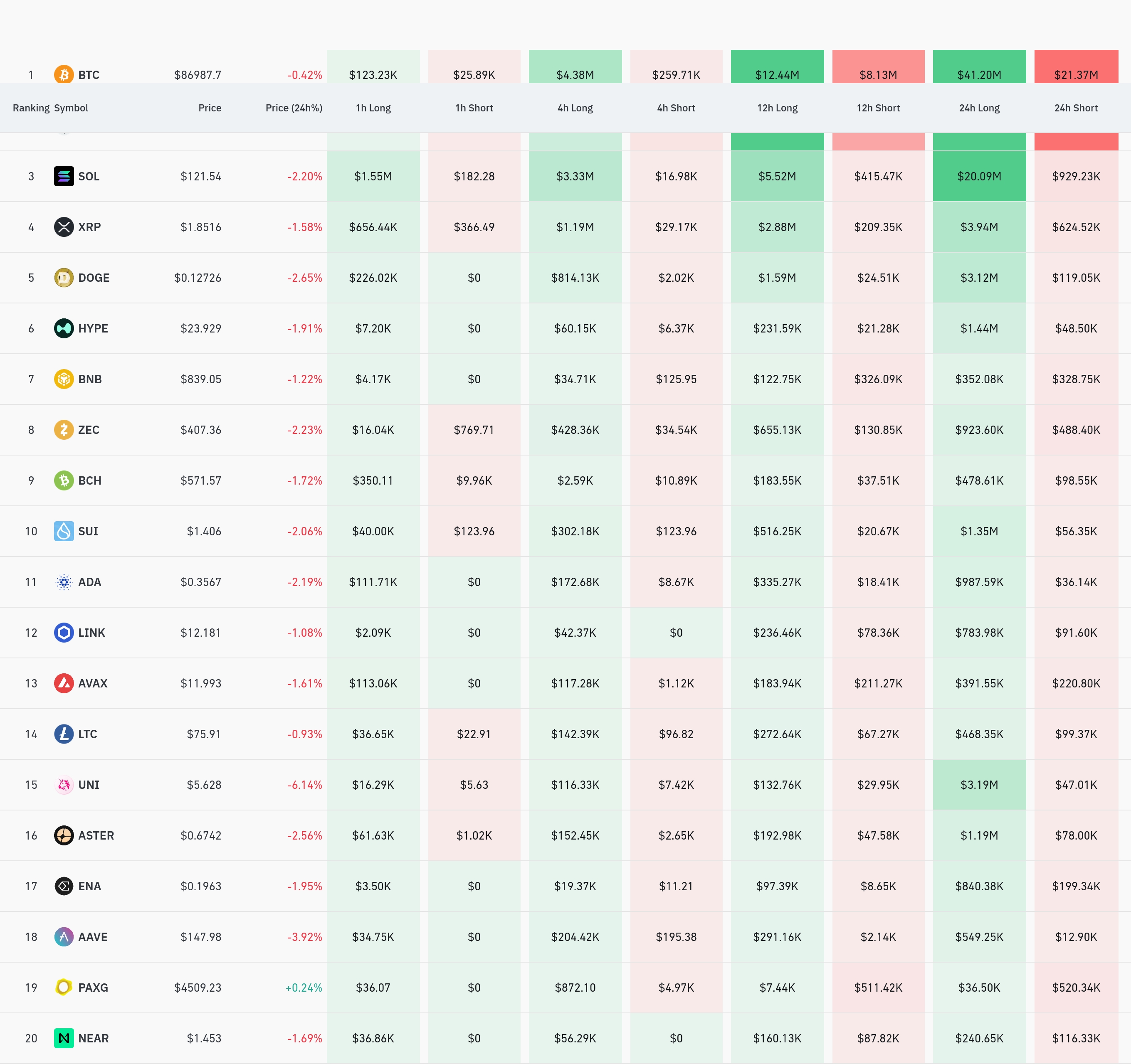

By coin, Bitcoin (BTC) positions saw the most liquidations. Approximately $62.56 million worth of Bitcoin positions were liquidated over the past 24 hours, and approximately $4.64 million over the past four hours. The current Bitcoin price is $68,987.

Ethereum (ETH) saw approximately $58.26 million worth of positions liquidated over the past 24 hours.

Over the past 24 hours, approximately $21.02 million in Solana (SOL) positions were liquidated. Over the past four hours, $3.35 million worth of long positions and $17,000 worth of short positions were liquidated. The current SOL price is $121.54.

XRP saw $4.56 million in liquidations over the past 24 hours, with $1.19 million worth of long positions and $29,000 worth of short positions liquidated over the past four hours. The current price is $1.8516.

Dogecoin (DOGE) has seen $814,000 worth of long positions and $2,000 worth of short positions liquidated over the past 4 hours, with the current price at $0.12726.

In addition, BEAT and FARTCOIN tokens, which are newly gaining attention, are attracting market attention by recording high liquidation volumes of $5.02 million and $4.97 million, respectively, over 24 hours.

Notably, AAVE saw a similar level of long position liquidations ($204,000) and short position liquidations ($195,000) over a four-hour period, suggesting a polarization in market sentiment regarding the token.

In the cryptocurrency market, "liquidation" refers to the forced closure of leveraged positions when traders fail to meet margin requirements. This liquidation data demonstrates that pressure on long positions is increasing in the current market.

Article Summary by TokenPost.ai

🔎 Market Interpretation

- Approximately $160.13 million worth of leveraged positions were liquidated over 24 hours.

- Long position liquidations (81.76%) are overwhelmingly more numerous than short position liquidations (18.24%), indicating strong downward pressure.

- Most liquidations occurred on Binance and Bybit, with Hyperliquid in particular seeing 99.35% of long position liquidations.

💡 Strategy Points

Liquidations concentrated in Bitcoin, Ethereum, and Solana suggest the need for caution regarding the volatility of these assets.

- The fact that AAVE's long/short liquidation ratio is nearly equal indicates that market opinion is divided, so caution is required when trading.

- High liquidation volumes of new tokens such as BEAT and FARTCOIN indicate a concentration of speculative trading.

📘 Glossary

Liquidation: A situation where a position is forcibly closed when the margin maintenance requirement is not met in a leveraged transaction.

- Long Position: A position purchased in anticipation of an increase in asset prices.

- Short Position: A position sold in anticipation of a decline in asset prices.

- Leverage: A method of borrowing money to trade with an amount larger than one's own capital.

TokenPost AI Notes

This article was summarized using a TokenPost.ai-based language model. Key points in the text may be omitted or inaccurate.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.