Selected News Highlights

1. Some memes on the Solana blockchain saw significant price increases, with PIPPIN rising by 35%.

2. Binance launches USD1 flexible investment product with an annualized return of up to 20%.

4. Binance Wallet will be releasing an Alpha airdrop at 9 PM today, with a minimum of 226 points.

5. The yield on Japan's 30-year government bonds rose 2 basis points to 3.445%, a record high.

Trending topics

Source: Overheard on CT (tg: @overheardonct), Kaito

The following is a Chinese translation of the original text:

[STBL]

With a significant upgrade to its brand image and transformation into "Stablecoin 2.0" infrastructure, STBL has seen a marked increase in market attention. This transformation focuses on institutional-grade reliability, Real-World Asset (RWA) integration, and compliance. Community discussions are centered around the protocol snapshot vote, expected to launch on December 28th, and active social interactions driving its rise on the Kaito leaderboard. Users are highlighting the protocol's unique architecture, including its ecosystem-specific stablecoin (ESS), Money-as-a-Service (MaaS) framework, and its three-token system (USST, YLD, $STBL) that separates principal and returns through non-fungible tokens (NFTs), while also acknowledging the high returns of its multi-factor staking mechanism. (References: ref0 - ref6)

[ZAMA]

Today's community discussion revolved around the major announcement of exclusive benefits for early non-fungible token (OG NFT) holders of Zama. Holders will gain the exclusive right to purchase $ZAMA tokens at a fully diluted valuation (FDV) of $55 million, significantly lower than the rumored $1 billion valuation, with no lock-up period. This news has generated a strong response from the community, with members estimating potential returns as high as 18x. Furthermore, Zama's joining the x402z A2A Payment Alliance and its nomination for "Best Privacy Project" have further fueled market interest. (Reference sources: ref0 - ref4)

[LIGHTER]

Community discussions surrounding Lighter ($LIT) are focused on the strong anticipation surrounding its upcoming Token Generation Event (TGE) and airdrop, widely expected to launch on December 29th. The protocol has garnered significant attention since its pre-trading listing on major exchanges like Binance and MEXC, and its current implied fully diluted valuation (FDV) is between $3 billion and $5 billion. While most community members are focused on its valuation comparison with Hyperliquid and its zero-fee trading model, some discussions have pointed to metadata issues in the Binance pre-trading marketplace, with some users reporting that it incorrectly displays information related to the older project, Literacy. (References: ref0 - ref4)

[AAVE]

Aave is currently embroiled in a major governance conflict, described by the community as a "civil war" between Aave Labs and the Aave DAO. The core of the dispute revolves around the ownership of protocol intellectual property, brand assets, and front-end revenue. The conflict was sparked when Aave Labs transferred transaction fees to its own wallet without the DAO's consent. This has ignited debate about whether the DAO (supported by an independent service provider) maintaining the protocol's core "engine" should also have its own "face" (interface and brand). Furthermore, the two sides disagree on the strategic transition from V3 to V4. This series of internal frictions has led to a sharp drop in the AAVE token price and raised significant concerns about the alignment of interests between private equity and token holders. (References: ref0 - ref4)

[OPENMIND]

OpenMind (OPENMIND) has garnered widespread attention due to its OM1 system upgrade announcement, which introduces privacy-oriented features such as identity management and fall detection for home robots. Investors and tech enthusiasts are particularly focused on the project's strategic integration with the NEAR Protocol AI cloud and the launch of "BrainPacks" based on the NVIDIA Jetson Thor chip, further solidifying the platform's leading position in "physical AI" and decentralized robotics. (References: ref0 - ref4)

Featured Articles

1. Are those projects that received substantial funding in 2021 still around?

According to Venture Capital analysis, crypto startups raised $25.2 billion that year, a 713% surge from $3.1 billion in 2020. However, four years later, looking back at the top 400+ highly funded projects, only a tiny fraction remain standing. The majority have vanished: some have ceased operations, others have transitioned to other projects, some have been hacked and crumbled, others have suffered significant negative impacts from the collapse of FTX, and still others have become dormant zombie projects.

Over the past 24 hours, the crypto market has unfolded simultaneously across multiple dimensions. Mainstream topics have focused on renewed discussions of macroeconomic policies and the monetary system, including the outlook for the Federal Reserve and the strengthening of safe-haven assets. In terms of ecosystem development, Solana continues to advance its developer tools and transaction efficiency, Ethereum strengthens its "public goods" narrative, and the Perp DEX sector is accelerating its differentiation, driven by projects such as Hyperliquid and Lighter.

On-chain data

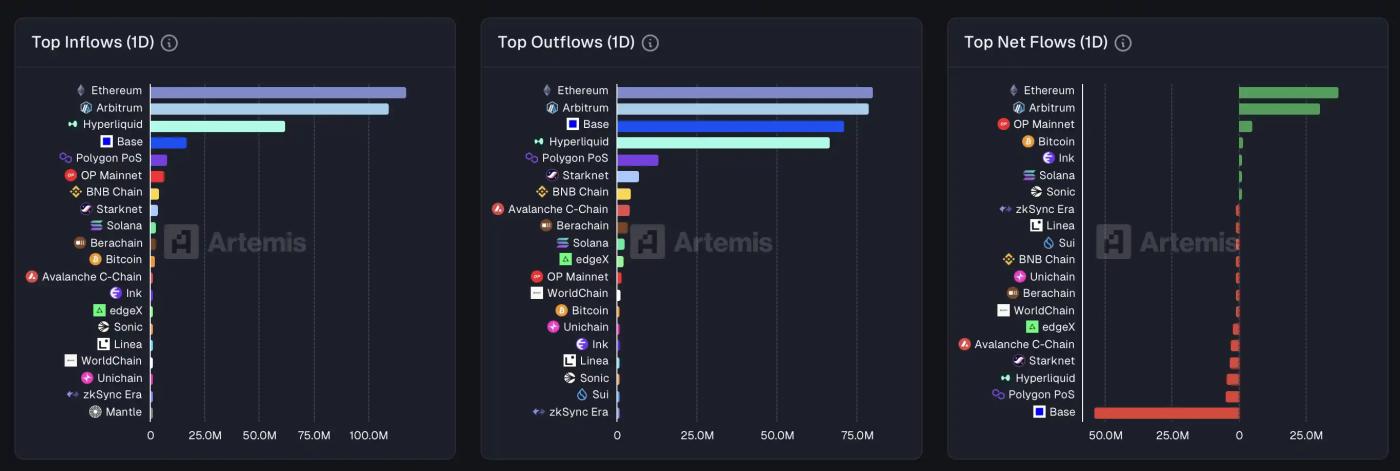

On-chain fund flow on December 24