Tom Lee recently predicted that Bitcoin's price could still surpass $100,000 before the end of 2025. This is quite bold, especially considering Bitcoin's current sideways movement and weakening upward momentum. On the surface, the market doesn't seem truly ready. Large capital flows are decreasing, long-term investors are selling, and the price remains confined within a narrow range.

However, there is still one scenario that could help make Lee's prediction a reality for Bitcoin. This scenario doesn't rely on new buying activity, but rather on how investors are placing orders.

Large capital flows and steadfast investors remain a drag.

The first major problem with Tom Lee's Bitcoin price prediction , as highlighted by CNBC, is the flow of investment capital.

The Chaikin Money Flow (CMF) indicator, which tracks large amounts of money flowing into or out of the market, continues to show weak momentum. From December 17th to 23rd, 2023, the price of Bitcoin edged up slightly, but the CMF indicator declined. This is a negative signal, indicating that large investors are withdrawing Capital even though the price remains stable.

The CMF index also fell sharply after December 21st, dropping more than 200% before recovering by about 68%. Despite signs of recovery, the CMF remains below zero. This indicates that the inflow of money into the market is weak and not strong enough.

Want to read more about Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Weak cash flow: TradingView

Weak cash flow: TradingViewThe second source of pressure comes from long-term investors. These are the wallets that typically only start selling when the market is overheating.

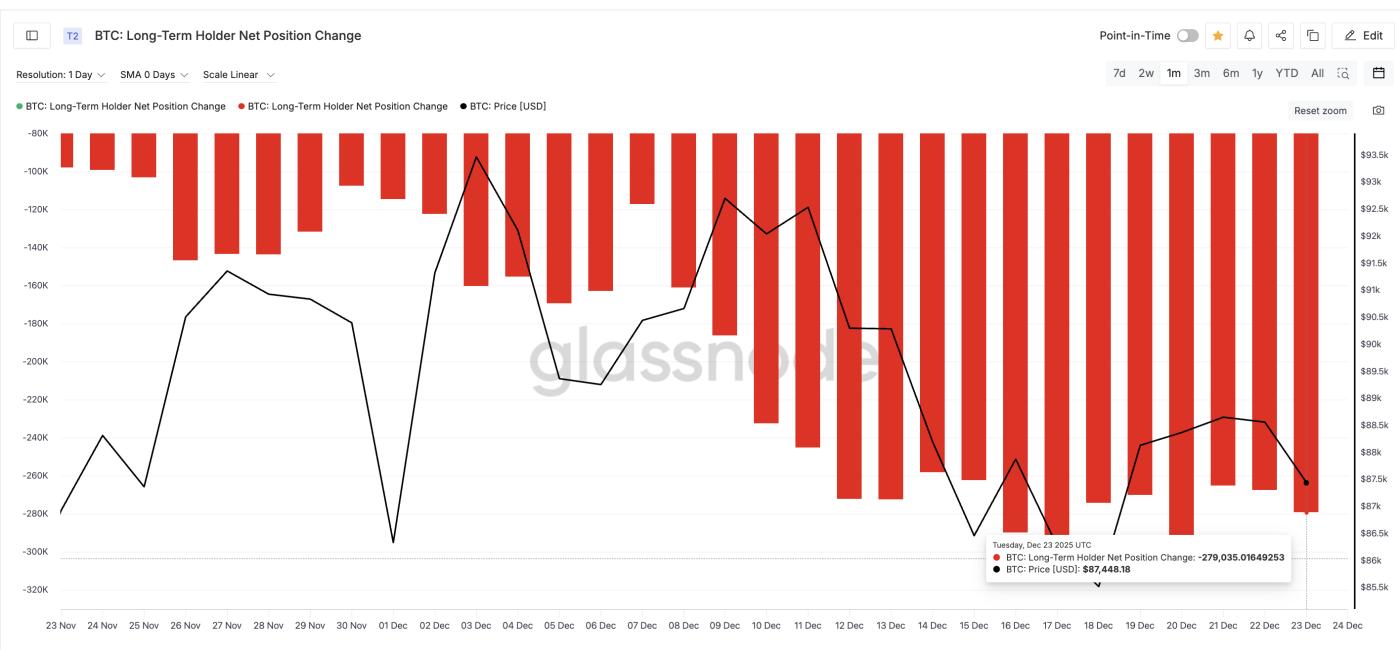

Over the past month, the net position of long-term investors has consistently been in the red. On November 23, 2023, they sold approximately 97,800 BTC per day. By December 23, 2023, this figure had skyrocketed to nearly 279,000 BTC in a single day. That's an increase of 185%.

Holders continue to sell: Glassnode

Holders continue to sell: GlassnodeThis represents a massive sell-off from investors who have strong faith in Bitcoin. With both large capital flows and long-term investors "Dump " their holdings, the likelihood of Bitcoin's price continuing to rise will be significantly reduced.

The only way Bitcoin can still reach $100,000.

Despite numerous obstacles, Bitcoin still has opportunities. But the remaining path lies in a rather unexpected factor.

The market is currently heavily skewed towards short positions.

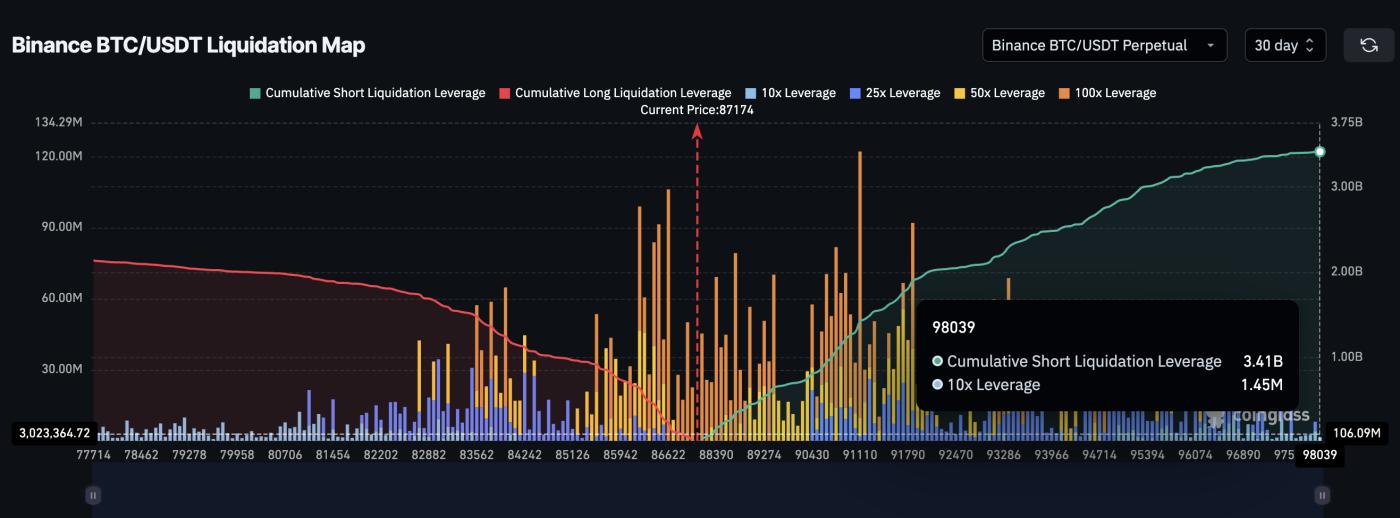

Looking at the liquidation chart for the last 30 days, the total leverage for short selling orders reached approximately $3.41 billion. Meanwhile, leveraged buy orders amounted to only about $2.14 billion. Thus, over 60% of the leveraged Capital is betting that prices will fall.

This is important because even when buying pressure is weak, prices can still rise thanks to short-selling blockades, as in the past . Simply put, Bitcoin doesn't necessarily need new money inflows. The market just needs misdirected short-selling orders.

BTC liquidation map: Coinglass

BTC liquidation map: CoinglassIf a sharp price surge occurs, short positions are forced to close, creating automatic buying pressure. These buy orders can then trigger further liquidations, even when underlying demand isn't yet strong.

This is almost the only remaining mechanism for a rapid price breakout. The largest cluster of short selling positions is currently in the range of $88,390 to $96,070. Let's wait and XEM if the BTC price can enter this zone.

Bitcoin price levels will determine whether Tom Lee was right.

For a Short squeeze to occur, the price of Bitcoin needs to break through certain key levels.

The first zone is around the $91,220 mark. If the price remains stable above this zone, many low-leverage short positions will be liquidated, thereby creating good momentum for the short-term trend.

The real trigger lies at the $97,820 level. This area has been a strong resistance zone for the price since mid-November 2023, and is also where the largest concentration of Short liquidations is located. If the price breaks through this zone, a large portion of the $3.41 billion in short leverage will be at significant risk.

If a chain liquidation begins, the price of Bitcoin could easily break through the psychological threshold of $100,380 without significant Capital inflow or support from long-term investors. However, if it fails to surpass these levels, the bullish scenario will be invalidated.

Bitcoin Price Analysis: TradingView

Bitcoin Price Analysis: TradingViewIf Bitcoin fails to reclaim the $91,220 mark and continues to trade sideways, the weakness in the CMF indicator, coupled with selling pressure from long-term investors, will remain dominant. In that case, a Short squeeze scenario will not materialize, and Tom Lee's predicted Bitcoin price target will become increasingly distant. Currently, Bitcoin is caught between strong selling pressure and leveraged positions.

This forecast depends on only one thing: whether short sellers are forced to close their positions.