By Eric, Foresight News

Original title: A token with a daily trading volume of nearly $10 billion actually comes from Cardano ?

Recently, NIGHT, a token that was listed on Bitget, Binance, OKX, and Bybit for spot or futures trading at the beginning of the month, saw its 24-hour trading volume exceed $9 billion, approaching $10 billion. Bybit even surpassed Binance in spot trading volume within 24 hours thanks to NIGHT.

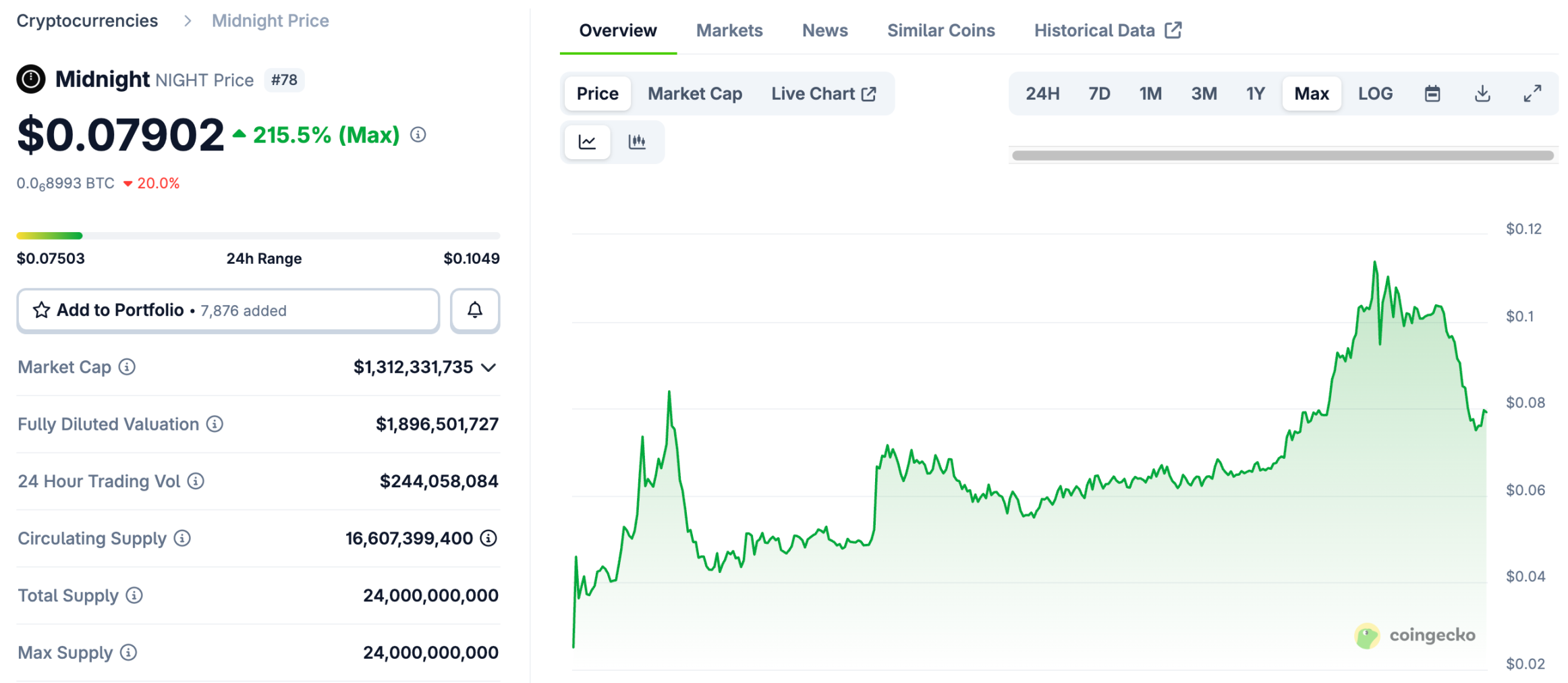

NIGHT officially launched on December 9th. According to CoinGecko data, the token price surged from around $0.025 to nearly $0.114 in less than two weeks, an increase of over 3 times. Its FDV also briefly exceeded $2.5 billion, placing it among the top 50 in market capitalization. As of this writing, the price of NIGHT has fallen back to around $0.08.

The performance of a token that is simultaneously listed on several top exchanges is not surprising, but what is interesting is that NIGHT is the token of Cardano's privacy sidechain Midnight. The explosive growth of a project that is simultaneously labeled "Cardano" and "privacy" is truly beyond most people's expectations.

What makes Midnight so "expensive"?

Midnight is a sidechain developed by Input Output Global (IOG, the parent company of Cardano) with "programmable data protection" as its core selling point. It presents zero-knowledge proofs (ZKP) as an out-of-the-box TypeScript API, allowing Web2 developers to implement "selective disclosure" on-chain without needing to learn cryptography. The entire network uses Cardano as its consensus platform and Halo2 as its ZK backend, employing a dual-token model (NIGHT + DUST). Its goal is to first implement the "data usable but not visible" principle, which is of utmost importance to enterprises, and then gradually expand to DeFi, RWA, on-chain compliant identity, and other scenarios.

Overall, there's nothing particularly special about it. The privacy technology uses ZKP, but it doesn't natively protect privacy. Instead, it makes privacy features optional to meet actual needs.

IOG first publicly announced its plans to develop Midnight in November 2022, but the testnet wasn't launched until October 2024, nearly two years later. This is indeed typical of IOG; it took almost five years from announcing Cardano would introduce smart contracts to actually implementing them, and smart contract functionality wasn't available until September 2021—by then, the bull market had already cooled down.

In May of this year, Midnight established a foundation, chaired by Fahmi Syed, former CFO of the Polkadot development team Parity, signaling that TGE had taken its first step. Just two days after the official announcement of the foundation's establishment, Cardano founder Charles Hoskinson announced a plan to airdrop tokens to 37 million addresses across eight major blockchains, stating that the airdrop was only for retail investors and that no venture capital firms would participate in the project.

Perhaps what truly ignited market sentiment was Midnight's massive cash giveaway. In addition to airdrops, Midnight partnered with Binance, OKX, and Bybit to distribute nearly 3 billion NIGHT tokens. This bold move, quite different from the recent ICO trend, generated a positive market response.

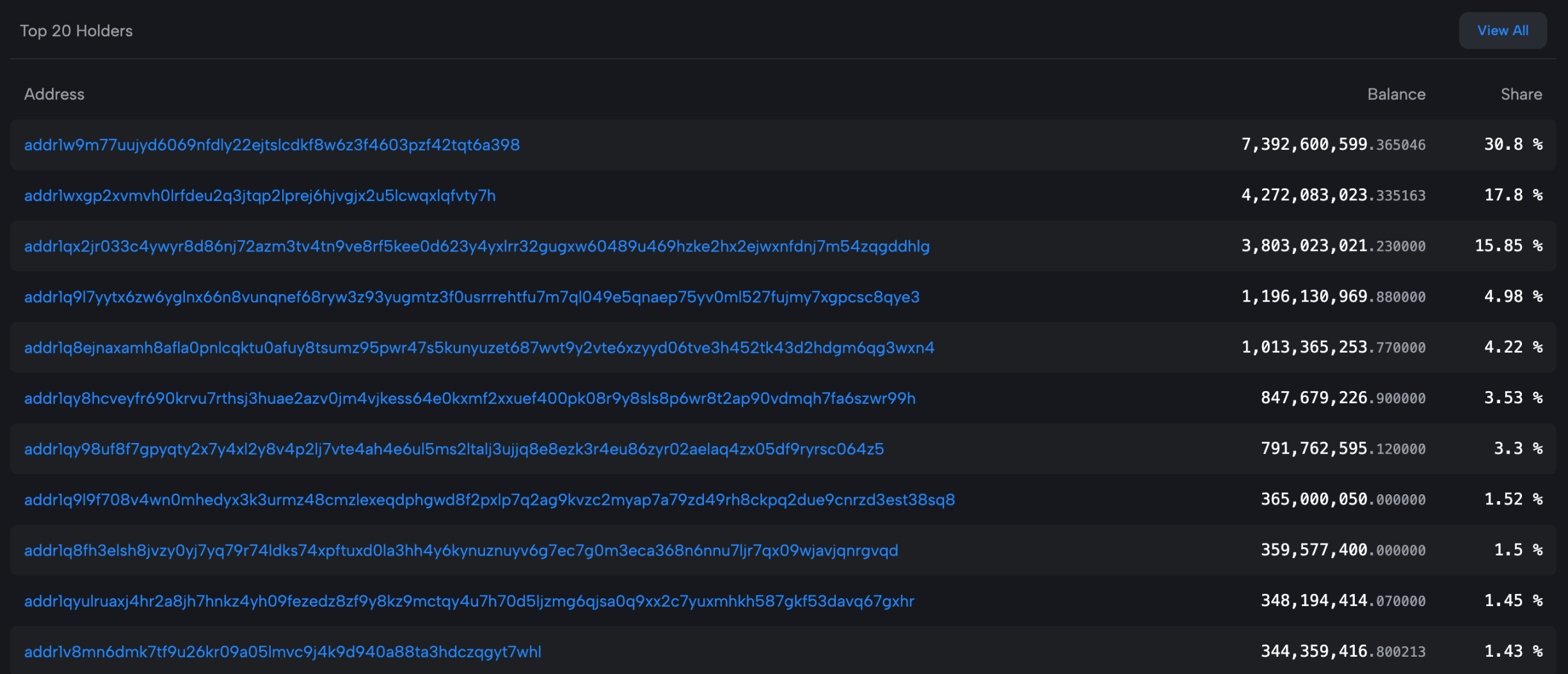

According to the block explorer, apart from the top three addresses which may belong to IOG or the Midnight Foundation, the holdings of the remaining addresses are relatively dispersed. Based on data provided on the official website, I estimate that NIGHT's own airdrops and activities in cooperation with exchanges have distributed nearly one-third of the total supply (24 billion tokens), which is indeed a significant amount.

Midnight's tokens are not limited to NIGHT; instead, they employ a dual-token model of "NIGHT + DUST." This unusual design is not based on any "brilliant idea," but rather ensures compliance with regulatory requirements. NIGHT can be used for network governance, incentives, and the generation of another token, DUST. NIGHT itself is privacy-neutral and supports on-chain auditing.

DUST, generated from holding NIGHT tokens, is used to pay transaction fees, similar to the role of gas. Additionally, DUST is used to pay privacy fees; that is, if you want to add optional privacy features to on-chain transactions, you need to pay DUST as a fee. DUST is automatically distributed to NIGHT holders' accounts with each block and "decays" over time to prevent malicious hoarding and cyberattacks.

Thus, Midnight's "equity," NIGHT, does not participate in the payment of on-chain transaction fees, but exists solely as a governance token and generates DUST, the actual on-chain fuel. DUST itself, as a "renewable resource," is generated by NIGHT and will continuously decrease over time. From a regulatory perspective, it is considered a resource rather than an asset, thus meeting the regulatory requirements of various regions.

Cardano will invest heavily in its on-chain ecosystem next year.

According to Cardano's roadmap, next year will be a year of significant growth in on-chain activity.

First and foremost, Cardano will undergo a network upgrade, increasing throughput to 1,000 to 10,000 TPS through parallel block processing and a hierarchical structure for vertical scaling, while maintaining security and decentralization. Next is the main focus of this article, the mainnet launch of Midnight. Cardano believes that Midnight's launch will drive more DeFi activity and TVL through its optional privacy features. Furthermore, the Cardano treasury will allocate funds to support the native issuance of major stablecoins such as USDT and USDC on Cardano.

Finally, and this is what I think is the most important point, Cardano plans to focus on interoperability, but not simply cross-chain functionality. Instead, it aims to allow users on other chains to interact directly with DApps on Cardano by consuming Gas tokens from the source chain.

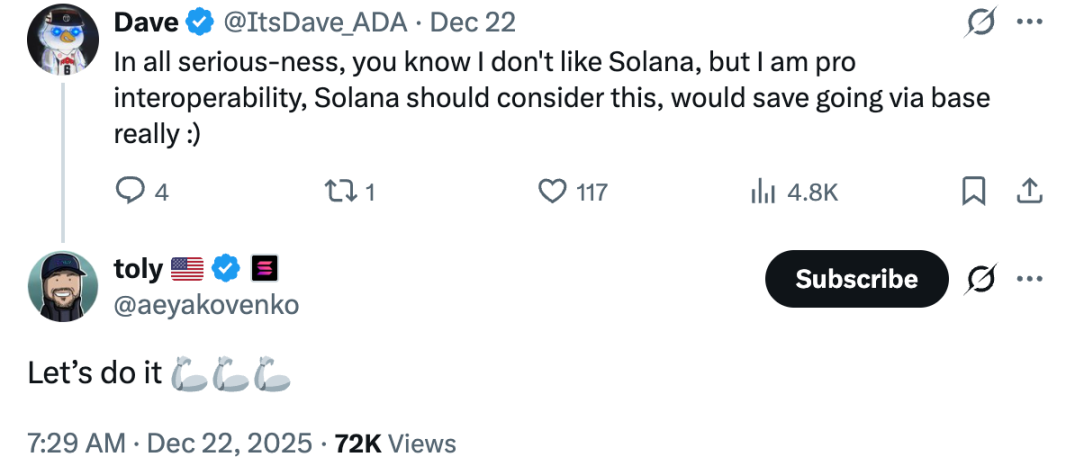

Last week, Cardano implemented atomic transactions between BTC and ADA via Fluid, not through cross-chain bridges, encapsulated tokens, or centralized custody, but directly through script-to-script transactions. This is partly due to Cardano's UTXO ledger model. Two days ago, an interaction between Cardano's staking pool operators and Solana co-founders on X also confirmed this development direction.

Accompanying the strategy and product plans is the investment of funds. The Cardano Foundation plans to increase its marketing budget by 12% and make appearances at events such as TOKEN2049 and Consensus. Venture Hub will also invest 2 million ADA to support startups and ecosystem projects. In addition, the Cardano Foundation plans to inject tens of millions of ADA into on-chain DeFi to increase liquidity and attract institutional participation.

In this light, the price increase of NIGHT may just be an appetizer for Cardano's series of plans. Perhaps in 2026, we should really pay attention to this project that launched mainnet in 2017 and has been almost forgotten by the mainstream Web3 market.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush