Zcash has been experiencing rather mixed price movements in recent sessions, alternating between short corrections and slight recoveries. Price volatility remains high, however, the overall technical structure is still leaning towards an uptrend.

Despite cautious spot market sentiment, the long-term trend for ZEC suggests the potential for a sustained price increase if key conditions are met.

Zcash holders step in to rescue the situation.

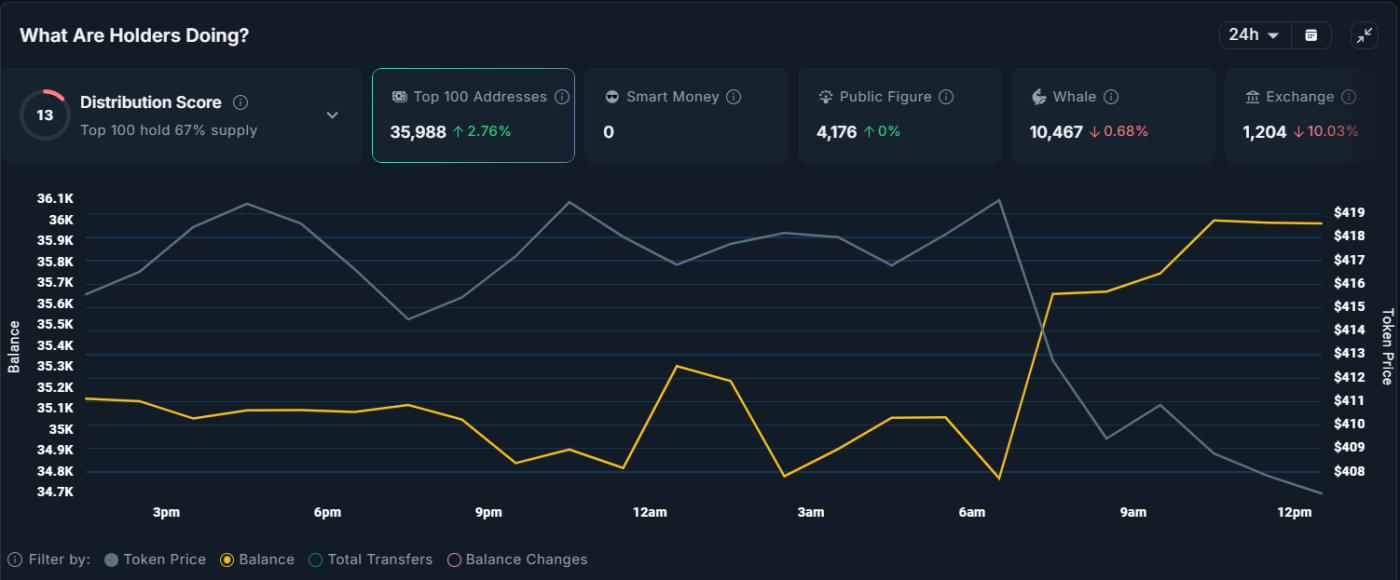

on-chain data shows that confidence among Zcash largest investors is increasing. Wallets in the top 100 largest addresses have increased their accumulated ZEC holdings by 2.7% in just the last 24 hours. This occurred even as the price dropped nearly 6%, suggesting they are strategically accumulating rather than selling off impulsively.

This action reflects long-term optimism. Typically, large holder buy when prices fall sharply because they believe in the potential for future price increases. This move helps solidify demand for ZEC, supporting the price during a period of overall market volatility.

Want to receive more information about Token like this? Sign up for the daily Crypto Newsletter compiled by editor Harsh Notariya here .

Data on Zcash holdings of the 100 largest addresses. Source: Nansen

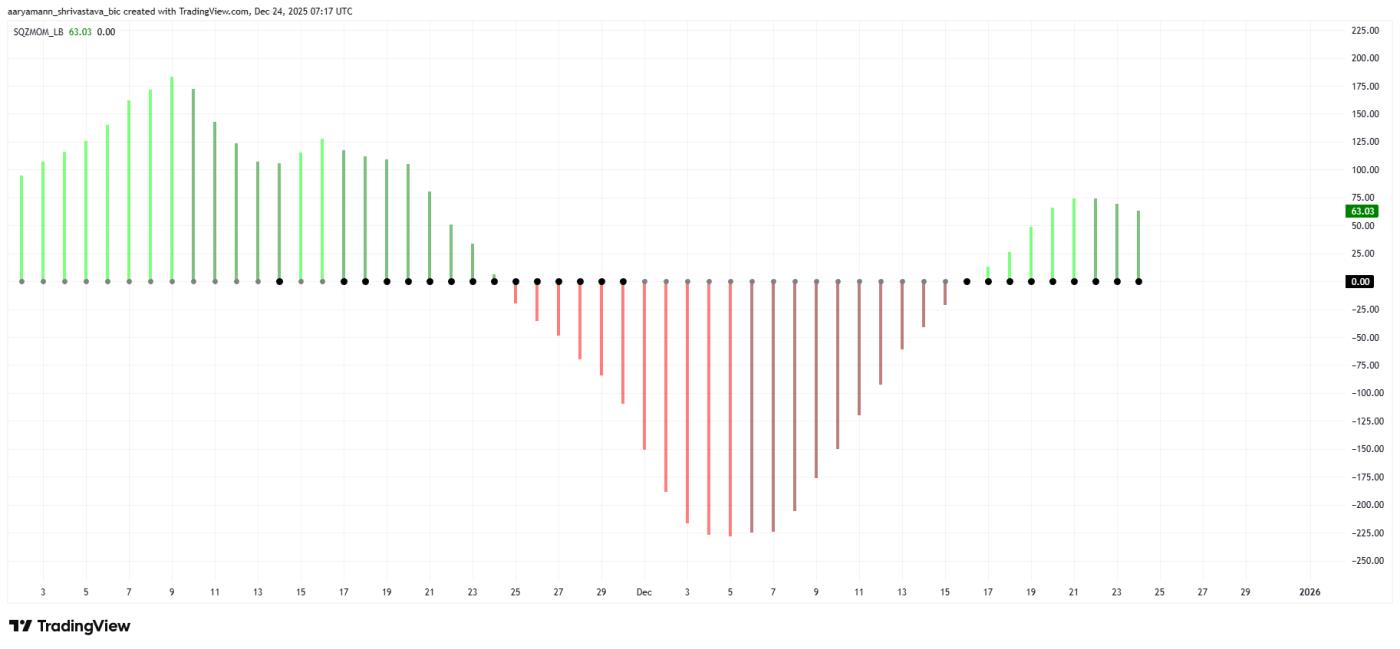

Data on Zcash holdings of the 100 largest addresses. Source: NansenTechnical indicators are currently supporting this positive outlook. The Squeeze Momentum Indicator is signaling the formation of a "squeeze" phase. This is a state that often occurs before more significant price movement after a period of sideways consolidation.

Specifically, the histogram shows that buying pressure is still prevailing. If the "squeeze" ends while the upward momentum is still strong, ZEC could surge sharply when volatility erupts again. However, the overall market trend remains a crucial factor influencing the likelihood of this breakout.

Squeeze Momentum indicator on ZEC. Source: TradingView

Squeeze Momentum indicator on ZEC. Source: TradingViewZEC prices are heading towards an increase.

ZEC is forming an ascending triangle pattern, a very common bullish continuation pattern. This structure indicates that buying pressure is gradually increasing towards the horizontal resistance zone above. Based on the pattern, if the breakout is successful, ZEC could rise by up to 50%, targeting $670.

If the price successfully bounces up from the $403 support zone, the pattern will be further strengthened. Holding firm at this level also gives Zcash the potential to break through the $442 resistance level. If it surpasses $442, the ascending triangle pattern will officially break out, opening up the opportunity to conquer the $500 zone. Once this level is breached, the bullish trend of ZEC will be more strongly confirmed.

ZEC price analysis. Source: TradingView

ZEC price analysis. Source: TradingViewHowever, downside risk remains if the upward momentum weakens. If ZEC falls below the $403 support zone, the ascending triangle pattern will be broken. In that case, the price of ZEC could drop to the $340 region, erasing much of this month's gains and rendering the bullish pattern invalid.