In the past 24 hours, approximately $122.2 million (about 1.66 trillion won) of leveraged positions in the cryptocurrency market have been liquidated.

According to the current data, among the liquidated positions, short positions account for approximately 78.7% and long positions account for approximately 21.3%.

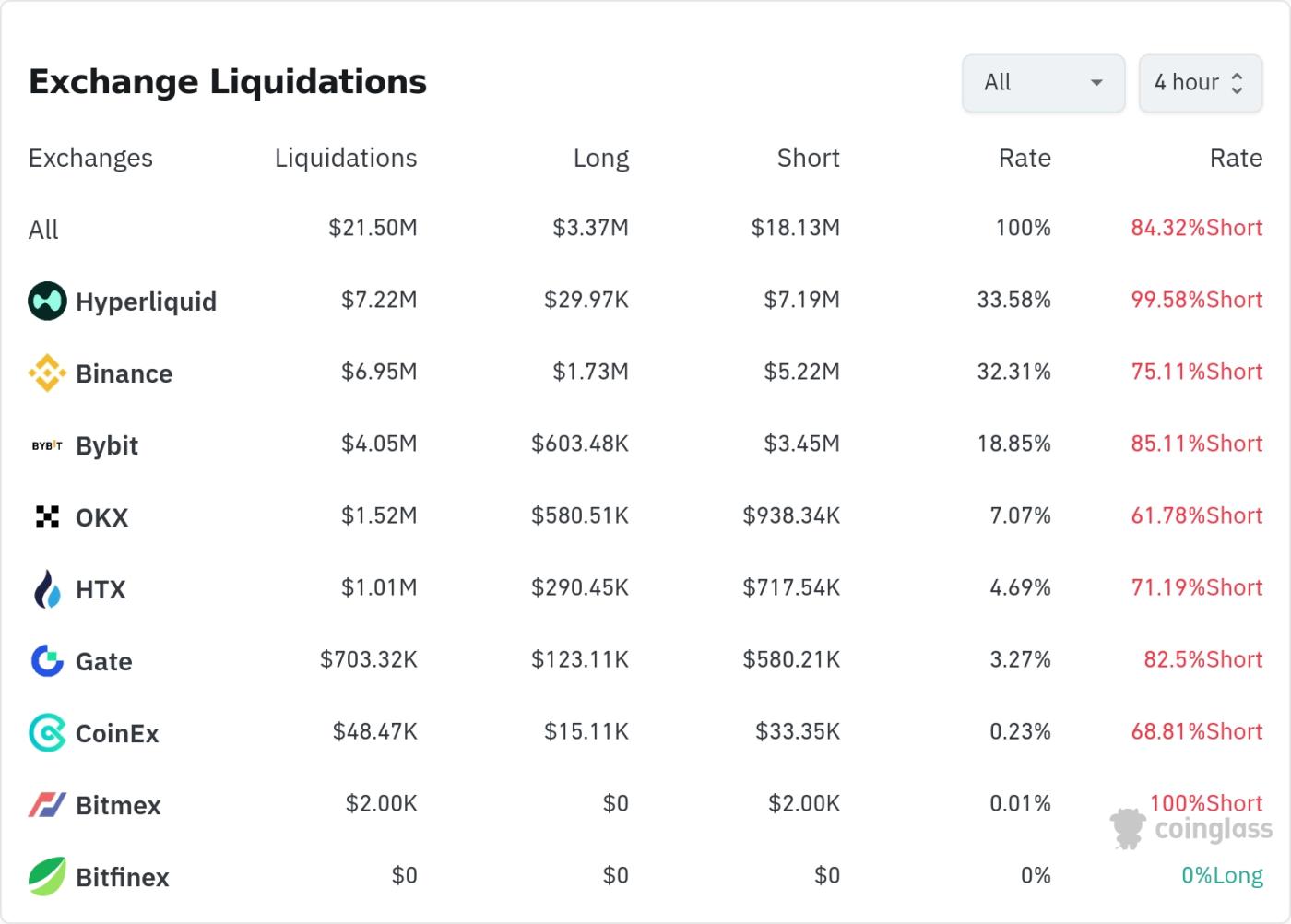

In the past four hours, Hyperliquid experienced the most position liquidations, totaling $72.2 million (33.9% of the total). Of these, short positions accounted for $71.9 million, or 99.58%.

Binance had the second-highest number of liquidations, with $69.5 million (32.7%) of positions liquidated, including $52.2 million (75.11%) of short positions.

Bybit experienced approximately $40.5 million (19%) of liquidation, with short positions accounting for 85.11%.

It is worth noting that BitMEX showed that only 100% of short positions were liquidated, while Bitfinex showed no liquidation.

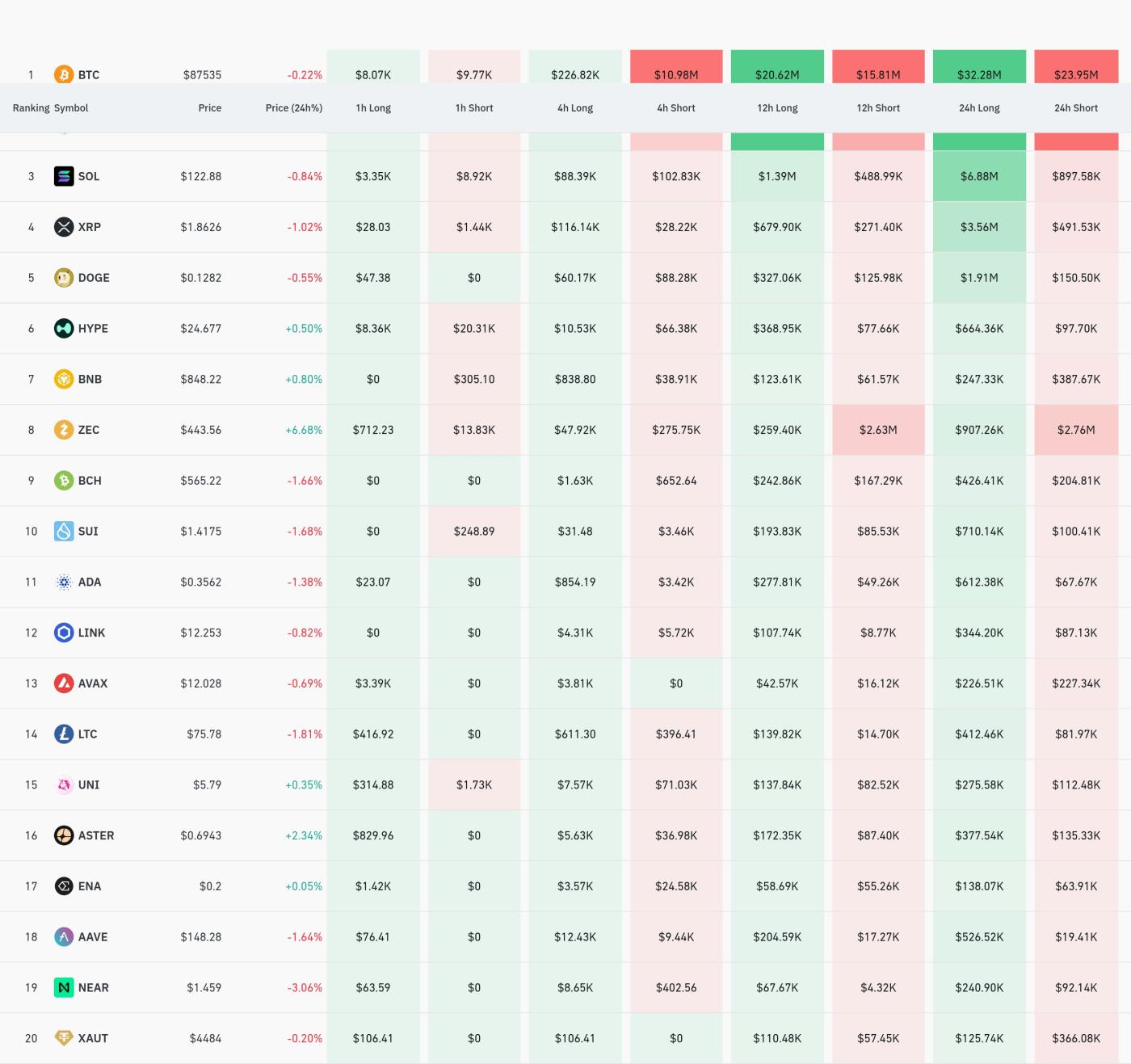

By currency type, Bitcoin (BTC) related positions saw the most liquidation. In the past 24 hours, approximately $56.22 million in Bitcoin positions were liquidated; on a 4-hour basis, long positions saw $226,820 liquidation, while short positions saw $10.98 million liquidation.

Ethereum (ETH) positions worth approximately $46.68 million were liquidated within 24 hours.

Solana (SOL) liquidated approximately $7.71 million in 24 hours. On a 4-hour basis, long positions were liquidated by $88,390 and short positions by $102,830.

In particular, Pippin (PIPPIN) and Beat (BEAT) tokens also experienced massive liquidations of $10.74 million and $6.07 million, respectively.

Zcash (ZEC) saw $47,920 in long positions liquidated and $275,750 in short positions liquidated within 4 hours, indicating a high proportion of short liquidations.

Dogecoin (DOGE) also saw a $60,170 long position liquidation and a $88,280 short position liquidation within 4 hours.

In this market volatility, short position liquidation dominated in most exchanges, indicating that the recent market rebound was unfavorable to traders holding short positions.

Article summary by TokenPost.ai

🔎 Market Analysis

- Approximately $122.2 million in leveraged positions were liquidated within 24 hours.

- Of the liquidated positions, short positions accounted for 78.7%, representing an overwhelming proportion.

This indicates that the recent market rebound is unfavorable for short sellers.

💡 Key Strategies

- Short selling liquidation concentrated on major exchanges such as Hyperliquid, Binance, and Bybit

In addition to BTC, ETH, and SOL, Altcoin such as PIPPIN and BEAT also experienced large-scale liquidations.

- The liquidation pattern with short positions dominating suggests that short-term upward momentum may continue.

📘 Terminology Explanation

Liquidation: The forced liquidation of a trader's leveraged position when the trader fails to meet margin requirements.

- Long positions: Positions bought in anticipation of price increases.

- Short positions: Positions sold in anticipation of a price decline.

TokenPost AI Notes

This article uses the TokenPost.ai language model to generate an article summary. The main content may be omitted or may differ from the facts.