Bitcoin has barely reacted to macroeconomic signals that should have supported its price. The US CPI fell to 2.7% in December, reinforcing expectations of interest rate cuts, but Bitcoin showed no clear movement. Instead of attracting new capital, Bitcoin's price remained relatively flat while funds shifted elsewhere.

It is this lack of synchronization that has led to the topic of Bitcoin's bear market being discussed even more.

Fidelity's Global Macro Director, Jurrien Timmer, recently warned that Bitcoin's most recent four-year cycle may have ended in October, both in terms of price and timing. on-chain data and subsequent market developments have further reinforced this assessment.

Data suggests Bitcoin may have entered a bear market.

Several independent indicators now point to the same conclusion: Money is flowing out, long-term investors are starting to sell, and Bitcoin is taking on risk without real demand.

Inflows into stablecoins have fallen sharply since the peak of the cycle.

The flow of Capital into stablecoins often acts as a "backup weapon" to give the crypto market a boost. But that momentum has now disappeared.

The total amount of ERC-20 stablecoins deposited on exchanges peaked at approximately $10.2 billion on August 14th. By December 24th, this figure had fallen to around $1.06 billion, a decrease of nearly 90%.

Want to stay updated on Token like this? Sign up for the daily Crypto Newsletter from editor Harsh Notariya here .

Stablecoin flow: CryptoQuant

Stablecoin flow: CryptoQuantNotably, the surge in stablecoins that peaked in August occurred just before Bitcoin reached its price peak above $125,000 in October, a point Timmer believes could very well be the peak of the cycle.

Since then, no new Capital has flowed back into Bitcoin, further indicating that the market has entered a distribution phase rather than an accumulation phase after the price peak.

Long-term investors have shifted to aggressive selling.

Long-term investors have changed their strategy after October.

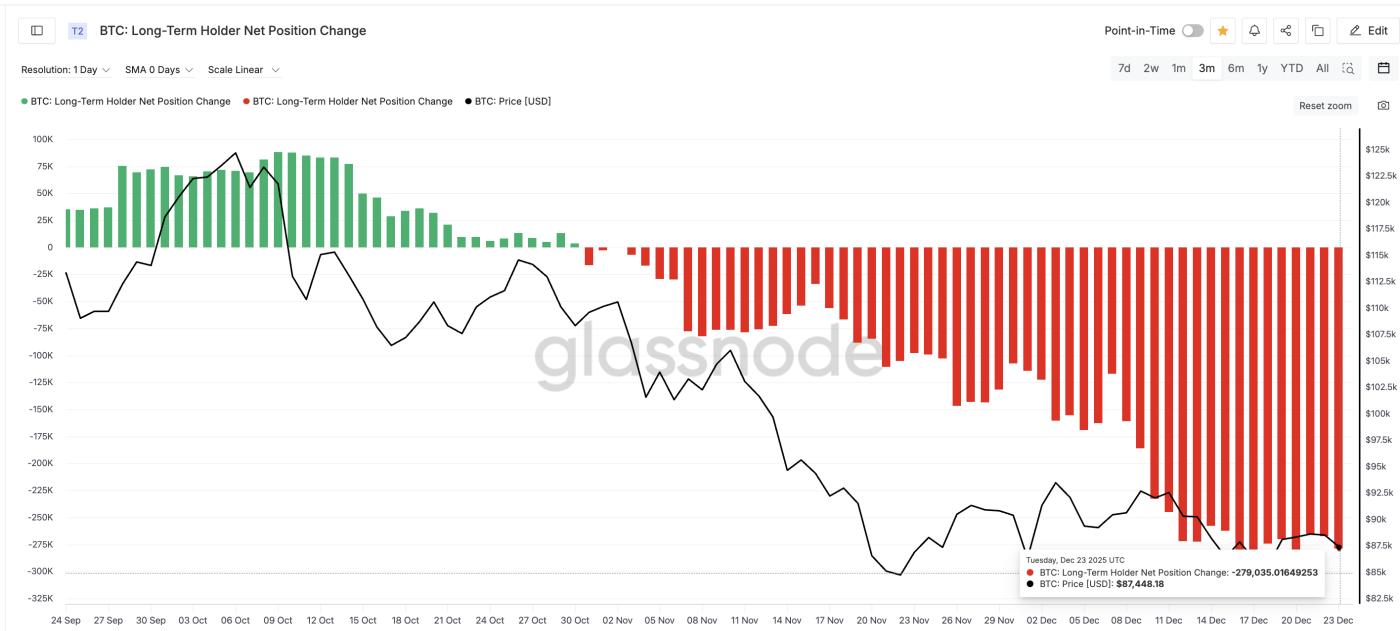

The net position change index for long-term Bitcoin holder turned negative immediately after the price peaked in the cycle. Selling volume surged, from around 16,500 BTC per day at the end of October to approximately 279,000 BTC recently. This means daily selling pressure increased by more than 1,500%.

Long-term holder Dump their holdings: Glassnode

Long-term holder Dump their holdings: GlassnodeThis aligns perfectly with Timmer's view that the four-year halving cycle may have ended in October. Long-term holder clearly expressed their position, choosing to reduce risk rather than try to hold onto prices.

Bitcoin's influence is growing, but not for a positive reason.

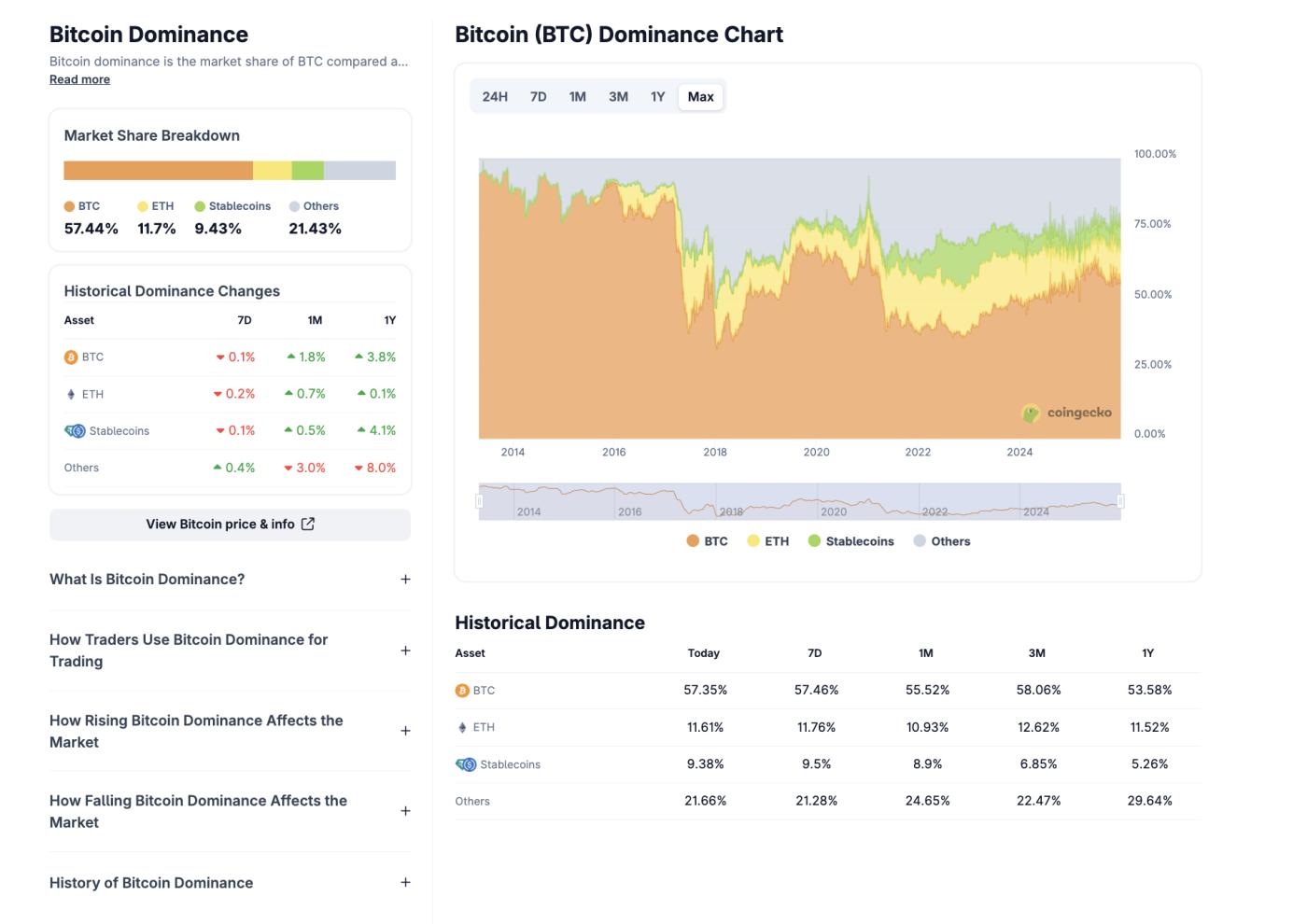

Bitcoin's market dominance has risen back to the 57–59% range, but this is not a sign of "risk-on" behavior.

BTC Dominance Rate: CoinGecko

BTC Dominance Rate: CoinGeckoAfter the CPI index fell, money didn't flow into Bitcoin but instead shifted towards traditional "safe haven" assets. Over the past year, the price of silver has increased by more than 120%, and gold by about 65%. Conversely, the crypto market as a whole hasn't performed as well.

This move suggests that Bitcoin's increased dominance isn't due to a new wave of risk-taking, but primarily to Capital flowing into relatively safe havens within the crypto sector.

This view was also Chia by Ray Youssef, founder and CEO of NoOnes, in a separate comment to BeInCrypto. He emphasized why gold is leading the wave of safe-haven investments in 2025, while Bitcoin is mostly trading sideways in a price range.

“While gold is clearly leading the wave of risk-averse investments in 2025, this comparison obscures the more complex reality of the market. Gold reaching new highs and rising 67% YTD reflects classic defensive investor sentiment, as Capital seeks safety amidst a market dominated by loose fiscal policies, geopolitical tensions, and macroeconomic instability. Increased gold purchases by central banks, a weakening US dollar, and persistent inflation further reinforce gold's Vai as the number one safe-haven asset,” he Chia .

Youssef also stated that Bitcoin's behavior this year is actually quite different from the "digital gold" narrative.

"Conversely, Bitcoin has recently failed to demonstrate Vai as a hedge against risk. This asset is not expected to perform like digital gold in 2025, mainly because Bitcoin is increasingly influenced by macroeconomic factors. The potential for BTC 's price increase now depends heavily on capital flows, macroeconomic policies, and risk appetite, rather than simply on monetary inflation," he emphasized.

Mega-whale addresses are quietly declining.

The large sharks are also retreating.

The number of Bitcoin wallets holding over 10,000 BTC has decreased from 92 at the beginning of December to 88. This decline coincided with a drop in Bitcoin's price, rather than being due to further accumulation.

The massive BTC whale distribution: Glassnode

The massive BTC whale distribution: GlassnodeThese wallets typically belong to large institutional investors. Their reduction in holdings suggests that smart money is not currently heavily betting on an upward trend.

Bitcoin remains below key long-term Medium averages.

Bitcoin is still trading below its 365-day moving Medium around $102,000. This is a level that was definitively breached at the beginning of the 2022 bear market.

This moving Medium serves as both a technical support level and carries significant psychological importance. Failure to reclaim this level could lead to a shift from an uptrend to a potential sharp correction. If the price remains below this level, history suggests a deeper correction is possible, potentially heading towards the Medium buying price of traders around $72,000.

These combined signals further reinforce Timmer's warning that Bitcoin may have actually entered or is about to enter a bear market phase, although the current price doesn't fully reflect this. Investment flows are declining, long-term investors are selling off, BTC 's dominance is increasing defensively, while positive macroeconomic factors are being overlooked.

However, not all long-term support indicators have been broken. Contrarian signals and price levels that will determine whether the market is entering a full-blown bear market or merely in a prolonged transitional phase will be analyzed further.

Why the Bitcoin bear market isn't completely over yet.

Although much data suggests the Bitcoin market is entering a bear market, two long-term cyclical indicators still show that the market structure has not been completely broken.

Furthermore, one reason why the Bitcoin bear market scenario remains uncertain is how the market is reacting to the gradually declining CPI inflation figures. Normally, when inflation eases, it benefits risky assets; however, currently, investors prioritize safety and liquidation over growth.

This doesn't mean the CPI signal is wrong, but it may be coming early, because historically, Bitcoin tends to react more slowly than traditional hedges, only reacting when expectations of liquidation actually translate into investment flows.

These factors and subsequent indicators do not rule out the bearish signal above, but explain why the current phase may also be merely a prolonged transition rather than a full-blown bearish cycle.

The Pi Cycle Top indicator has not been activated.

One of Bitcoin's most reputable cycle indicators – the Pi Cycle Top – has yet to signal a peak. This indicator compares the 111-day moving Medium to a doubled 350-day moving Medium .

Historically, when these two lines intersect, it usually marks the peak of a major cycle for Bitcoin.

Currently, these two lines are still far apart, indicating that Bitcoin has not yet entered a state of overheating or euphoria, even after peaking in October.

Pi Cycle Top Indicator: Coinglass

Pi Cycle Top Indicator: CoinglassThis contradicts the assessment of Jurrien Timmer, Fidelity's Global Macro Director, who previously pointed out that the October peak around $125,000 was consistent with the timing of previous cycles.

In previous cycles, a true bear market only began when there was a clear confirmation signal from the Pi Cycle indicator. This signal has yet to appear.

The 2-year SMA remains the most important factor.

The second, and most influential, counter-argument right now relates to structural factors: Bitcoin is still trading near its 2-year simple moving Medium , currently around $82,800.

This price level has repeatedly Vai as a long-term trend boundary for Bitcoin. Monthly candle closing above the 2-year moving Medium often indicates that Bitcoin is maintaining its bullish cycle.

Conversely, candlesticks closing below this line for an extended period typically correspond to prolonged downtrends.

To date, Bitcoin has yet to Unconfirmed a monthly candle close below this level.

Therefore, the closing price of the December candle is crucial. If Bitcoin holds above $82,800 until the end of the year, the market is likely still in the final transition phase of its cycle, rather than entering a true bear market. Bitcoin bear market.

This opens up the possibility that 2026 could be a year of slowed recovery, rather than a prolonged period of price decline.

However, if the December candle closes significantly below the 2-year Medium , the bearish predictions of a sharp decline to the $65,000–$75,000 range, as mentioned by Timmer, will become even more firmly established.

Summary — Key Bitcoin Price Levels to Watch Right Now

The bearish market framework also has clear price levels to confirm the opposite. If the price reclaims the 365-day moving Medium around $102,000, this would significantly weaken the bear market prediction. This scenario also aligns with Tom Lee's year-end Bitcoin price prediction.

This price level marked the beginning of the 2022 bear market when it was broken, and a return to the top would indicate a return of trend strength.

Simply put:

- Prices above $82,800 by the end of December: the transition period remains intact.

- Prices below $82,800 on the monthly chart: increased risk of a bear market.

- Price returns above $102,000: bullish structure begins to re-establish.

Currently, Bitcoin is caught between intense selling pressure and a long-term cyclical support zone. The market Unconfirmed a strong trend, but it is not yet in a complete downturn either.

The closing price of the December candle will determine which story will continue into 2026.