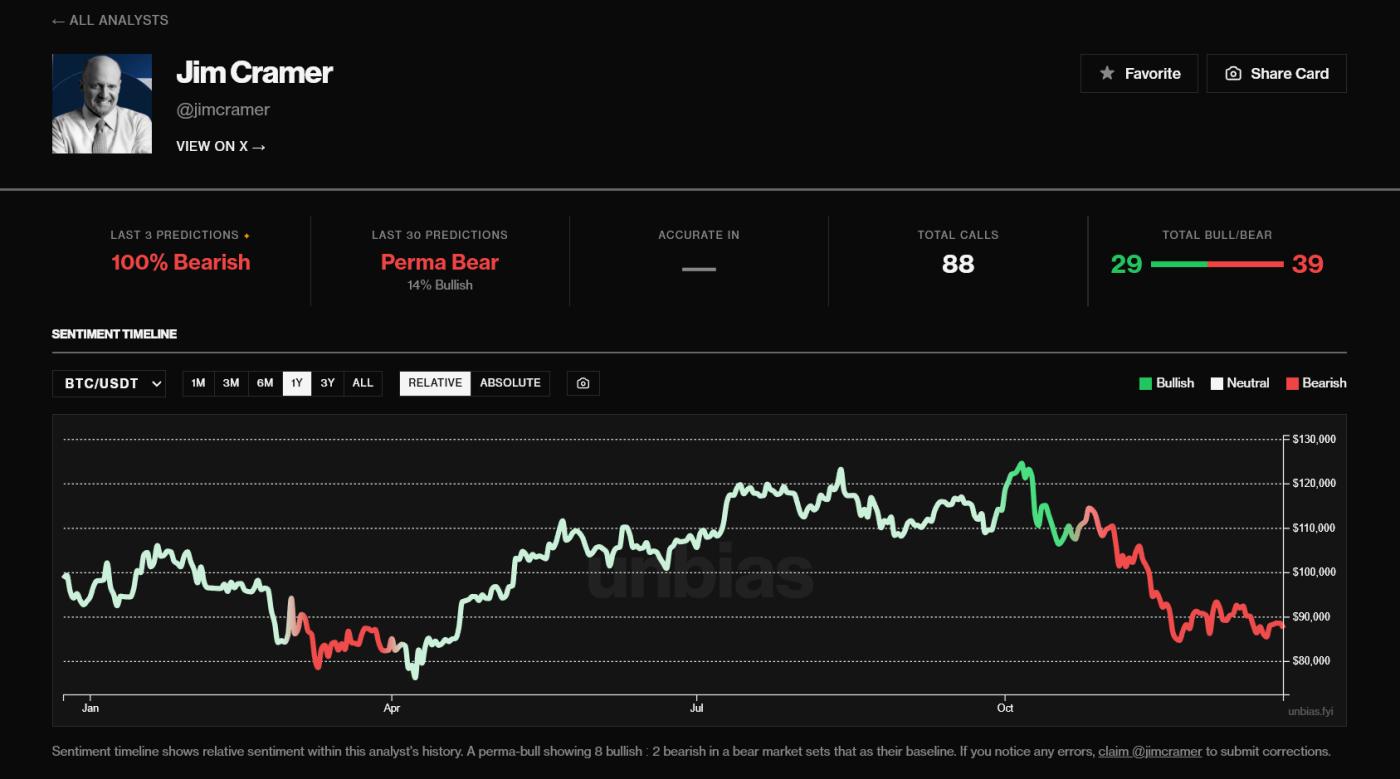

Jim Cramer's latest view on Bitcoin has shifted to a completely pessimistic one, according to sentiment tracking data from Unbias.

This shift immediately drew attention from the crypto trading community, not because Cramer could control the direction of Bitcoin, but because his predictions were often XEM as an unofficial indicator of market sentiment.

Is the inverse Cramer story really going strong?

Data shows that Cramer's three most recent Bitcoin predictions have all been bearish, placing his short-term outlook in the "long-term pessimism" category according to Unbias' classification.

Jim Cramer's Bitcoin prediction. Source: Unbias

Jim Cramer's Bitcoin prediction. Source: UnbiasTypically, moments like these easily spark heated debates on crypto social media platforms, where Cramer's comments often lead the community to recall the famous "Inverse Cramer" story.

This reversal occurred while Bitcoin was fluctuating around the $80,000 mark .

Since the price crash on October 10, 2023 , Bitcoin's price has mostly moved sideways, with a defensive trend prevailing.

Analysts believe the market is currently fluctuating within a range, with resistance near $90,000–$93,000 and support around $81,000–$85,000.

The inability to regain higher price levels before the end of the year has negatively impacted short-term sentiment.

All signs point to Bitcoin entering a bear market?

Market indicators also suggest that cautious sentiment remains dominant. The Crypto Fear & Greed Index recently fell into the “ Extreme Fear ” zone, reflecting risk aversion rather than panic buying.

Meanwhile, spot Bitcoin ETFs also recorded continuous outflows during Christmas week, indicating a decrease in institutional demand as they took profits and rebalanced their portfolios for the year-end season.

Bitcoin ETFs in the US continue to experience Capital. Source: SoSoValue

Bitcoin ETFs in the US continue to experience Capital. Source: SoSoValueIn that context, Cramer's shift to a completely pessimistic view is quite consistent with market sentiment – and explains why his views continue to attract attention within the Bitcoin community.

Jim Cramer, the longtime host of Mad Money, has become a familiar cultural role model for crypto traders.

However, his bold, short-term views often contradict Bitcoin's cyclical nature, so his comments are often XEM more as "reverse indicators" than traditional analysis.

This has been repeated across many market cycles. When Jim Cramer shows excessive confidence in one direction, crypto traders often XEM it as an extreme of sentiment rather than a prediction of the market trend.

Looking ahead to the first week of the new year, many experts believe liquidation will be low and price volatility high. Bitcoin's direction may depend on whether ETF inflows recover and whether the price can surpass the $90,000 mark again after options-related positions are released.

Until then, Cramer's 100% pessimistic outlook probably doesn't say much about Bitcoin's fundamentals – it more clearly reflects the market's caution ahead of 2026.