Dogecoin price remains under pressure. The Token has fallen by approximately 2% in the last 24 hours and over 12% in the past month. The price trend is weakening, but the rate of decline has slowed.

Although the chart structure still leans toward a downtrend, on-chain signals suggest the current downward momentum is uncertain. The next few trading sessions will determine whether Doge will fall into a deeper decline or maintain its current price.

Dogecoin price pressure increases as short-term supply withdraws.

Dogecoin is trading near the Dip of a bearish price pattern, forming a bear flag. This leaves downside risk, especially if the support zone around $0.124-$0.120 is broken. However, it's noteworthy that Token holding behavior has shifted as the price has gone down.

Want to receive Token analysis like this? Sign up for the Harsh Notariya Editor's Daily Newsletter here .

A bearish flag is forming: TradingView

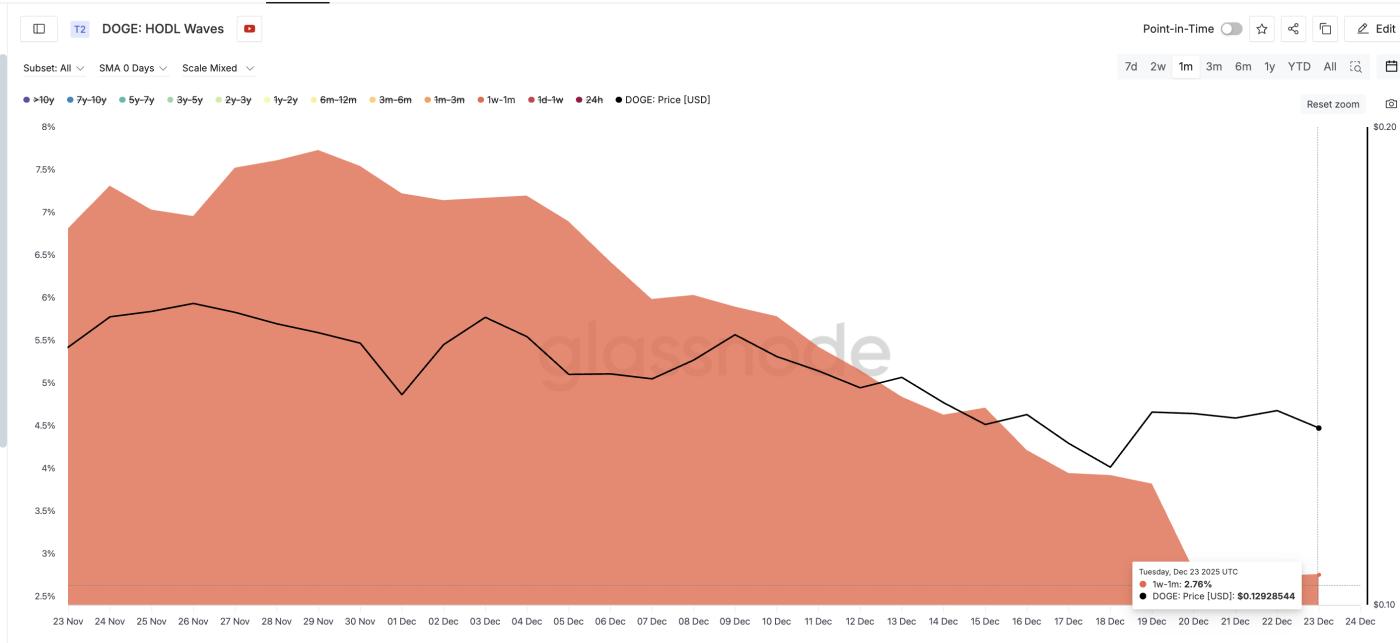

A bearish flag is forming: TradingViewThe amount of Token held by the group for a period of one week to one month – the group that typically engages in the most aggressive swing trading style – has decreased significantly, according to the HODL Waves tool. This index categorizes holders based on the length of time they have held the Token.

On November 29, 2023, this group controlled approximately 7.73% of the total Dogecoin supply. By December 23, 2023, that number had dropped to around 2.76%. This represents a significant decrease in the amount of speculative Token held in such a short period.

Doge speculative group Dump assets: Glassnode

Doge speculative group Dump assets: GlassnodeThis makes sense because this group often triggers sharp market sell-offs when they panic. Once they've sold, the forced selling pressure near key support levels will likely ease.

Long-term investors quietly buy more as coin activity slows down.

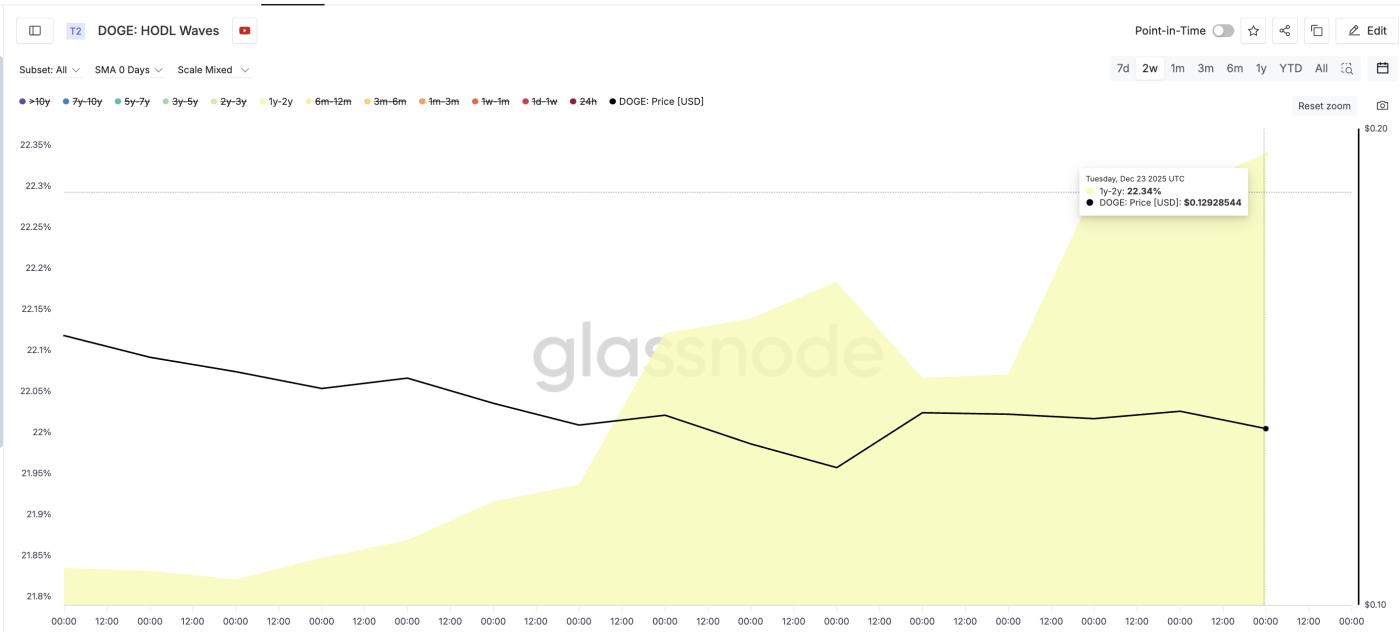

While speculative Token holdings have plummeted, long-term holders are beginning to show signs of accumulation. Those holding for 1 to 2 years have increased their Dogecoin holding percentage from approximately 21.84% to 22.34%. Although the increase is small, this is a significant signal.

These people typically only buy more when they believe the downside risk has begun to lessen.

Long-term investors accumulating: Glassnode

Long-term investors accumulating: GlassnodeToken Migration activity across the network, measured by spent coins, also supports this observation. This chart shows that the amount of spent coins has decreased sharply – from 251.97 million Doge to 94.34 million Doge. This means Token movement has decreased by more than 60%.

Token transfer activity has decreased: Santiment

Token transfer activity has decreased: SantimentThe decrease in Token conversion activity suggests that fewer retail investors are rushing to sell. Historically, such periods of decreased activity often signal a short-term rebound for Dogecoin . In early December 2023, this slowdown led to a price surge from $0.132 to $0.151, equivalent to a nearly 15% increase in just three days.

While this doesn't guarantee a sharp price increase, it suggests that selling pressure is easing rather than intensifying.

Key Dogecoin price levels determine whether the trend will be downward or upward.

Currently, technical analysis shows Doge is maintaining within a fairly narrow price range. The $0.120 level remains the most important support in the short term. If the closing price of any day falls below this level, Dogecoin price is likely to continue falling to the $0.112 region or even lower if selling pressure intensifies.

Conversely, if the price recovers, Doge needs to break through the nearest resistance levels. When the price regains the $0.133 mark, the market will perceive that selling pressure has eased. Especially if Doge surpasses $0.138, this will confirm that the buyers have regained the upper hand, and the recent decline was only a temporary correction, not the start of a larger downtrend.

Dogecoin Price Analysis: TradingView

Dogecoin Price Analysis: TradingViewSimply put, Dogecoin is currently in a critical phase. The price structure remains quite risky, but on-chain data suggests speculative supply is leaving the market, long-term investors are starting to participate, and overall coin activity is gradually decreasing. If the price holds the support zone, these factors could help stabilize Dogecoin price. Conversely, if the price loses support, the downtrend will be further confirmed.