If the Federal Reserve pauses rate cuts in the first quarter of 2026 and inflationary pressures persist, BTC could fall to $70,000 and ETH could fall to $2,400.

Key points:

The Fed's pause in action may put pressure on cryptocurrencies, but "hidden QE" may buffer downside risks.

Liquidity is more important than interest rate cuts and will determine the trend of BTC and ETH in the first quarter of 2026.

The Federal Reserve cut interest rates three times in 2025, mainly in the fourth quarter, as the unemployment rate rose slightly and inflation showed more obvious signs of cooling.

However, the crypto market reacted contrary to intuition. Bitcoin, Ethereum, and major Altcoin did not rebound under the dovish policy; instead, they experienced a sell-off, with their total market capitalization evaporating by more than $1.45 trillion from their all-time high in October.

TOTAL crypto market cap monthly chart. Source: TradingView

Let’s examine the direction of central bank policies before March 2026 and their potential impact on the broader crypto market.

If the Federal Reserve pauses interest rate cuts, Bitcoin and Ethereum could experience even more significant declines.

Despite three consecutive interest rate cuts of 0.25% each, most Federal Reserve officials, including New York Fed President John Williams, emphasized inflation risks and data-dependent approaches, without signaling a clear path to further easing.

“Personally, I don’t feel there’s an urgent need for further action on monetary policy right now, because I think the rate cuts we’ve already made put us in a very good position,” Williams said on December 19, adding:

"I would like to see inflation fall back to 2% without causing excessive damage to the labor market. That would be a balance."

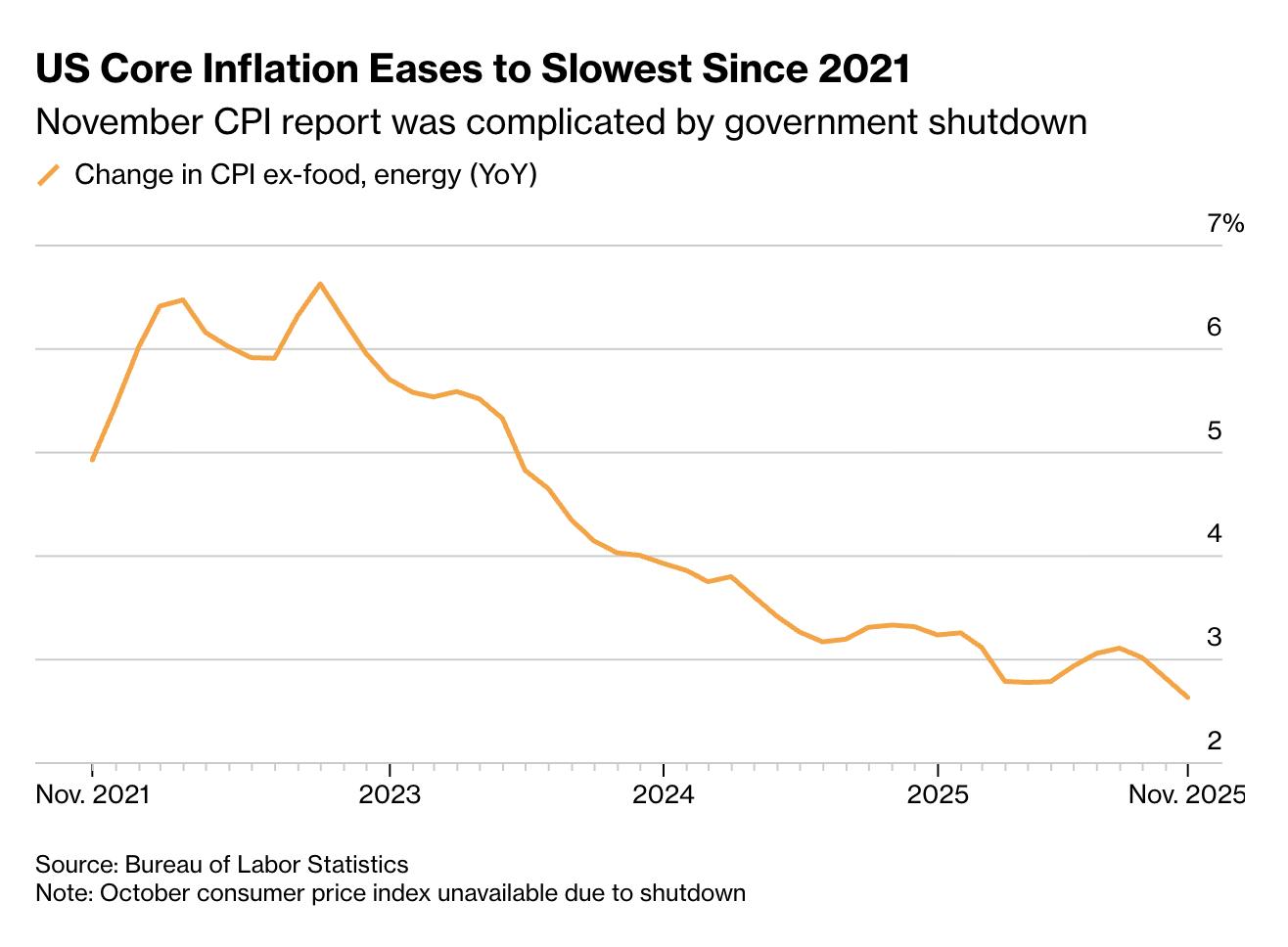

US core inflation. Source: Bureau of Labor Statistics/Bloomberg

US core inflation. Source: Bureau of Labor Statistics/Bloomberg

Therefore, the 2.63% CPI in November should increase the probability of an interest rate cut in the first quarter of 2026.

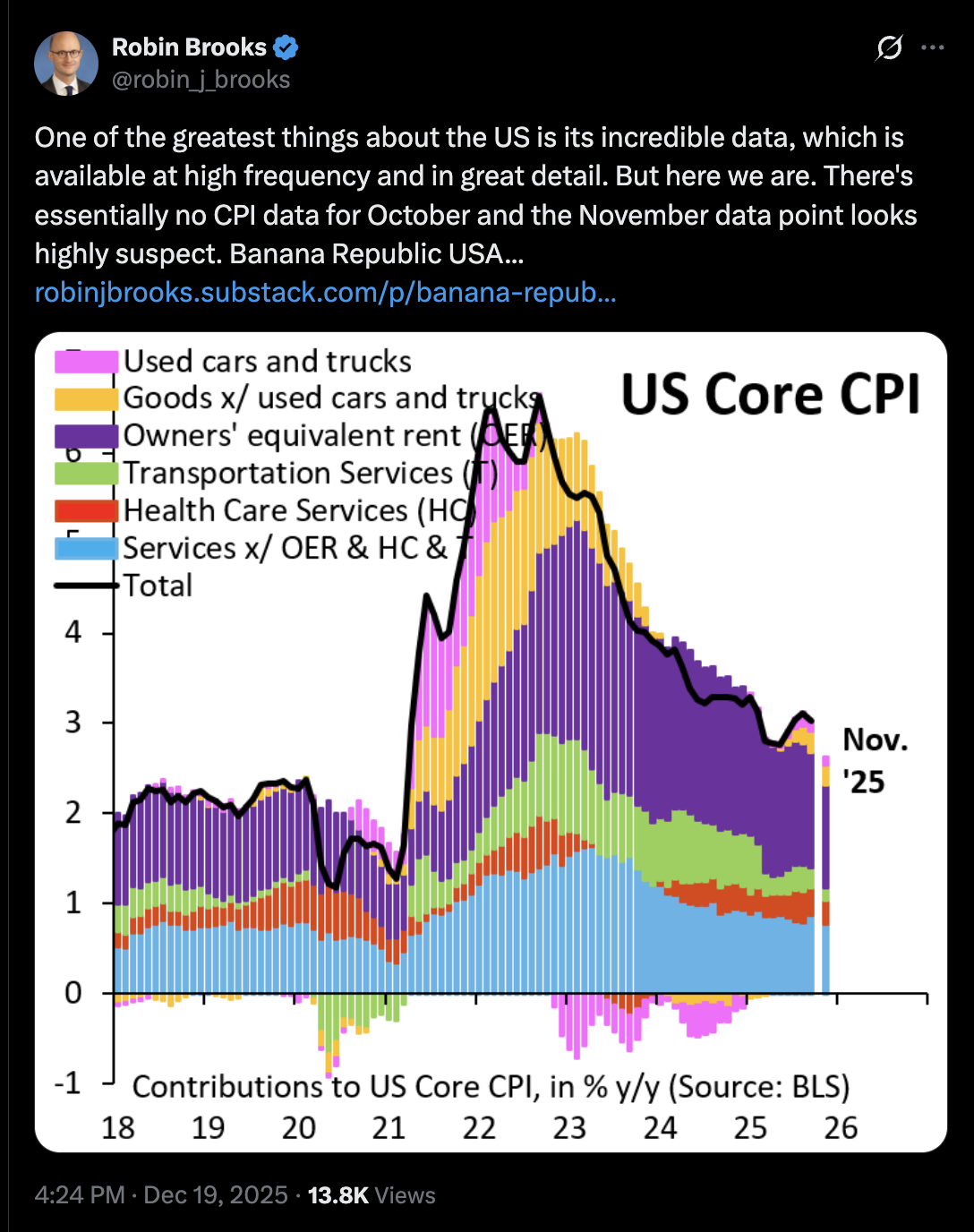

However, the record-breaking U.S. government shutdown disrupted data collection by the Bureau of Labor Statistics. Some economists, including Robin Brooks, worry that this could potentially distort the November annual inflation readings.

Source: X

This uncertainty helps explain why cryptocurrencies have not rebounded in the past few months despite the interest rate cuts themselves.

Jeff Mei, COO of crypto exchage BTSE, said that if the Federal Reserve keeps interest rates unchanged throughout the first quarter of 2026, BTC could fall to $70,000, while ETH could drop to $2,400.

The Federal Reserve's "hidden QE" may stabilize cryptocurrency prices.

On December 1, the Federal Reserve officially ended quantitative tightening and instead fully rolled over maturing Treasury bonds and mortgage-backed securities to prevent further loss of reserves.

Subsequently, the Federal Reserve launched Reserve Management Purchases (RMPs), purchasing approximately $40 billion in short-term Treasury bills to stabilize bank reserves and ease pressures in the money market. Some analysts have described this move as a form of quantitative easing, or "hidden QE."

In contrast, during the quantitative easing period of 2020–2021, the Federal Reserve’s balance sheet increased by about $800 billion per month, while the total market capitalization of the crypto market swelled to more than $2.90 trillion.

TOTAL crypto market cap vs. the Fed balance sheet monthly performance chart. Source: TradingView

If RMPs continue at a slower pace into the first quarter of 2026, they could quietly inject liquidity, supporting risk appetite and stabilizing crypto prices without aggressive rate cuts.

"This means Bitcoin could climb to $92,000–$98,000, supported by continued ETF inflows exceeding $50 billion and increased institutional holdings," Mei wrote, adding:

"Ethereum could move toward $3,600, benefiting from recent Layer 2 scaling improvements and restaking rewards that attract DeFi users."