The cryptocurrency industry is becoming increasingly institutionalized, with institutions becoming key players. Consequently, funds are shifting away from short-term price fluctuations and toward projects with real potential for profit and sustainable business models. Based on this trend, Tiger Research forecasts ten key changes in the cryptocurrency market for 2026.

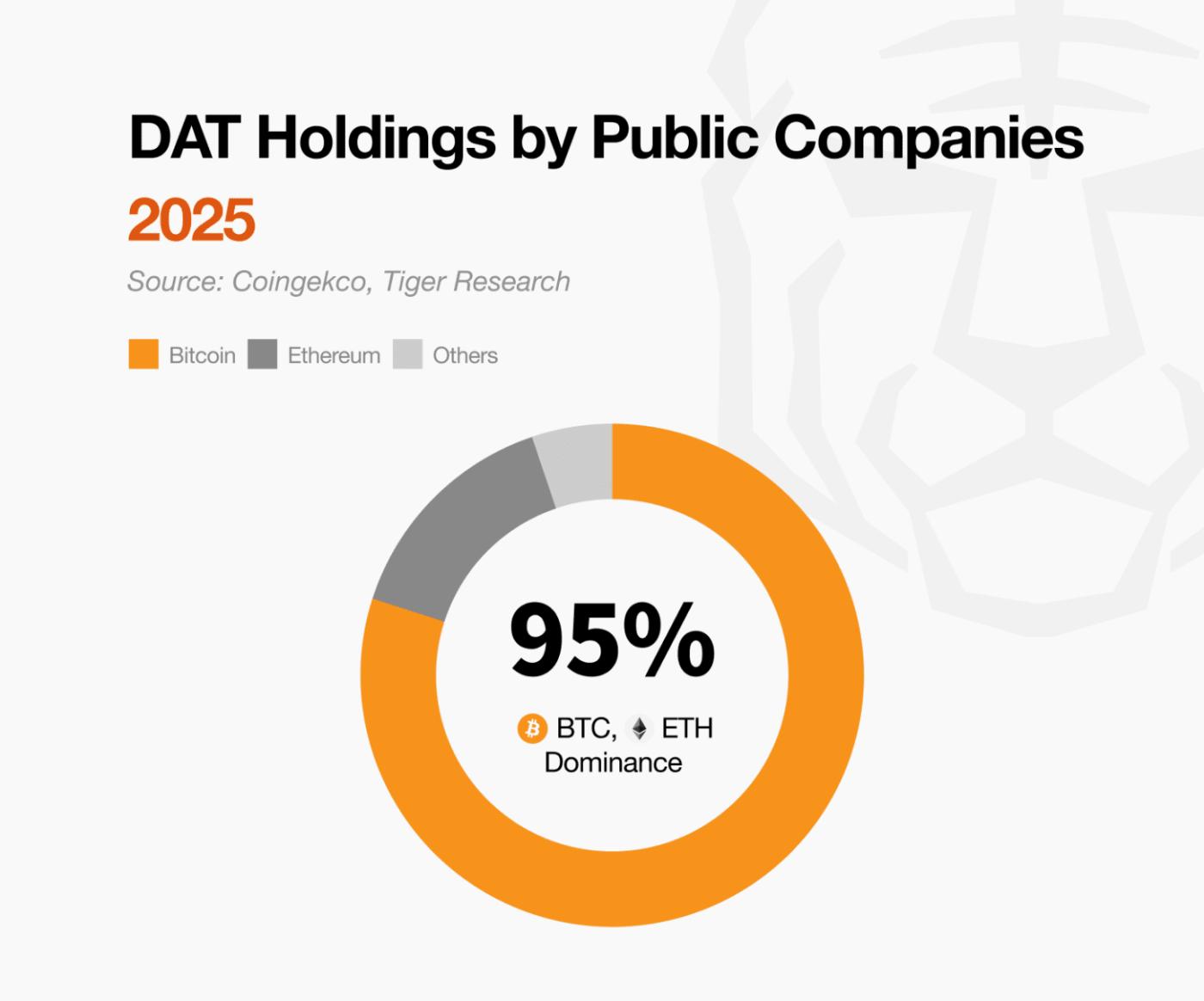

1. Institutional funds will only be focused on Bitcoin, and there will be no trickle-down effect.

As the cryptocurrency market reorganizes around institutions, capital flows have become more conservative. Institutions are avoiding unproven assets and focusing solely on major assets like Bitcoin and Ethereum. The trickle-down effect of Bitcoin's rise followed by altcoins, as in the past, is no longer expected. Going forward, altcoins will face fierce competition to gain institutional adoption.

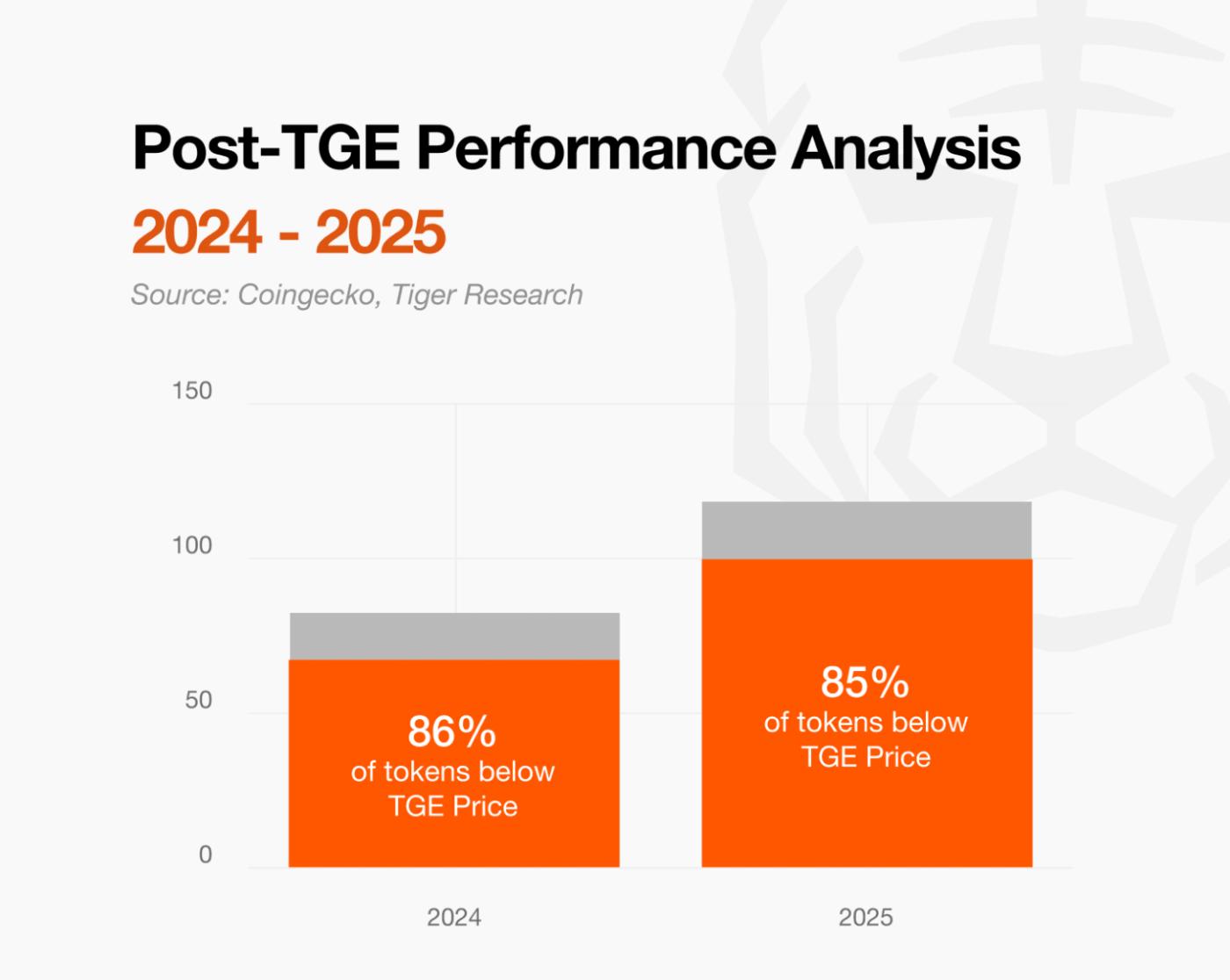

This year, over 85% of listed projects experienced price declines, proving that "narratives" alone are insufficient. Projects that rely solely on short-term trends are quickly being pushed out by new trends, and this shift will only accelerate. Ultimately, only projects that generate real profits and demonstrate solid fundamentals will survive in the market.

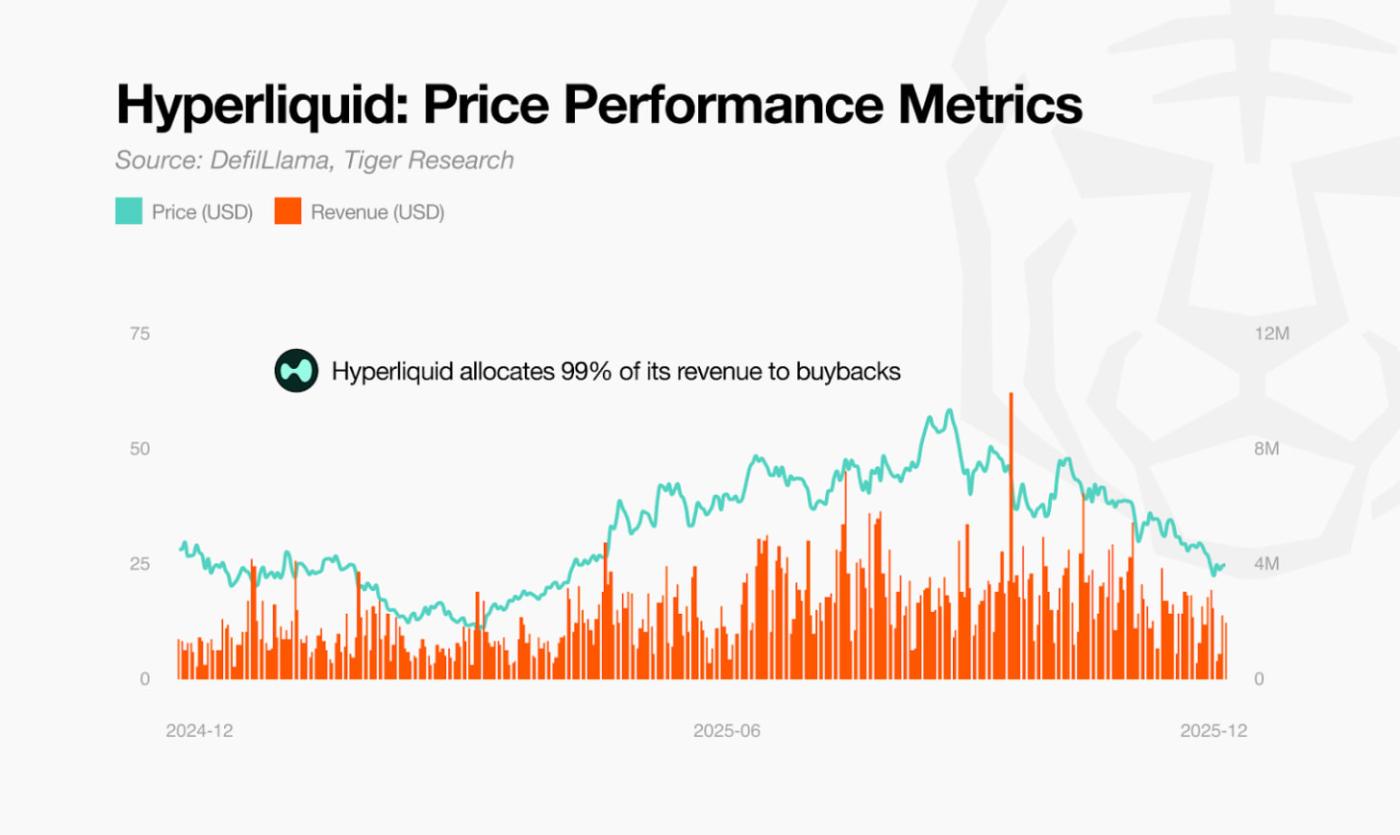

Utility-centric tokenomics has failed. Governance voting rights failed to convince investors, and complex structures were unsustainable. The market now demands a clear return on value. Only direct returns through buybacks and burns, or a structure where protocol growth is immediately reflected in token prices, will survive. New and unique models will emerge to achieve this.

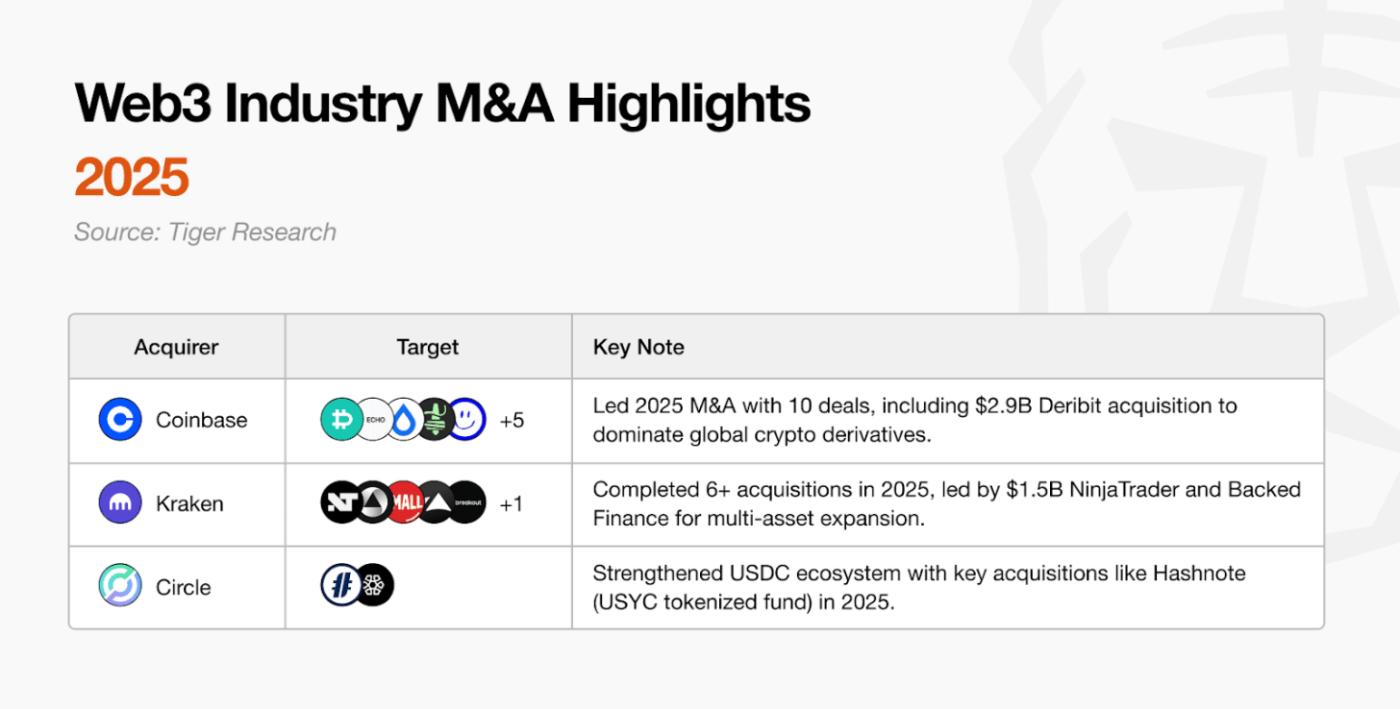

As the Web3 industry matures, competition to secure market dominance is intensifying. During this period, the most effective way for companies to rapidly expand and strengthen their competitiveness is through mergers and acquisitions. Going forward, M&A, led by winners, will accelerate, and the market will be reshaped by entrepreneurs who generate tangible profits.

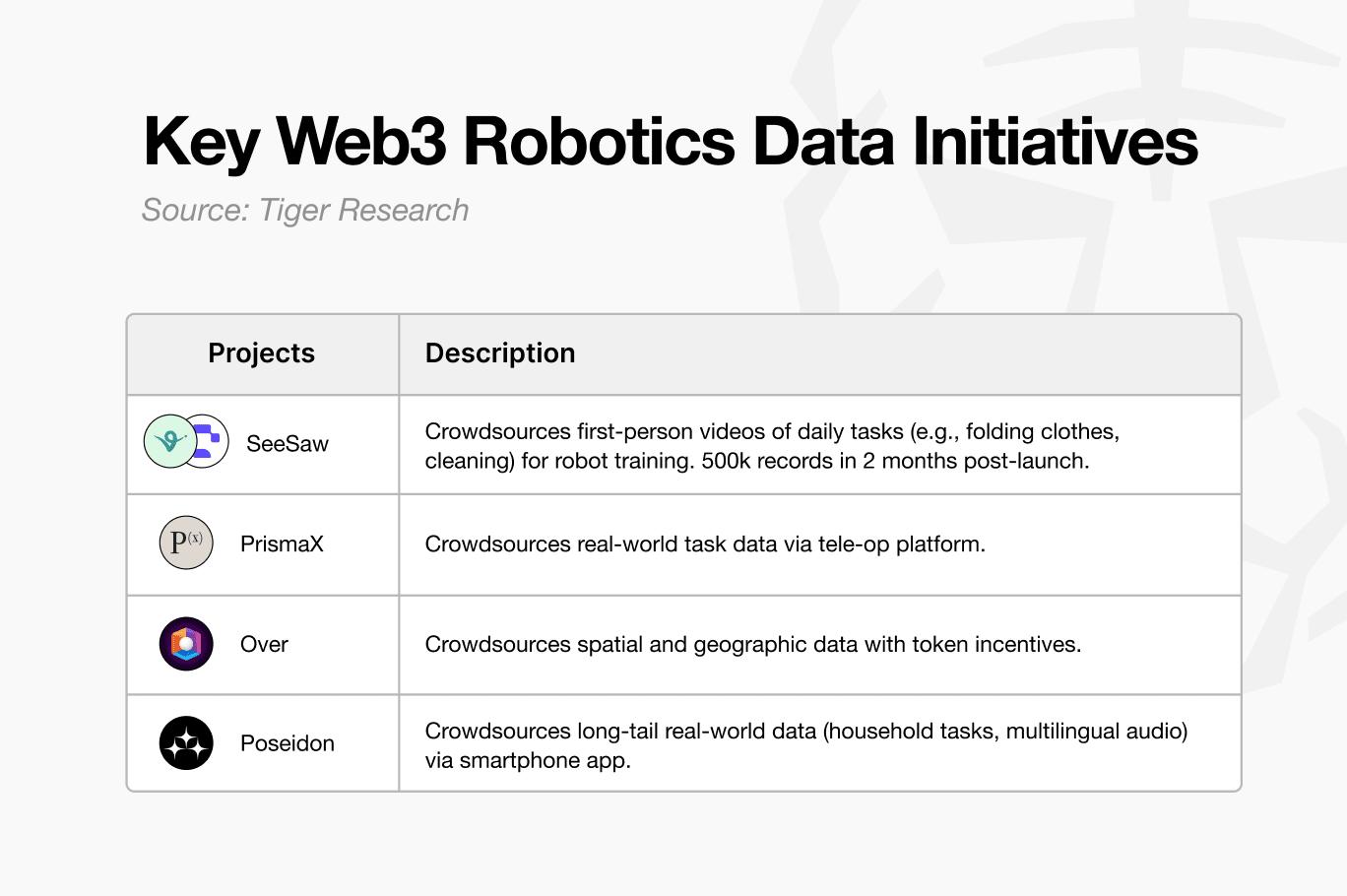

As the robotics industry develops, securing field data for robot training has become a key challenge. Collecting massive amounts of data is difficult using existing centralized methods. Blockchain-based decentralized crowdsourcing can efficiently collect large amounts of data from individuals around the world and transparently compensate them. As the structure where individuals contribute data and receive immediate compensation becomes more established, a new gig economy centered around robotics will emerge.

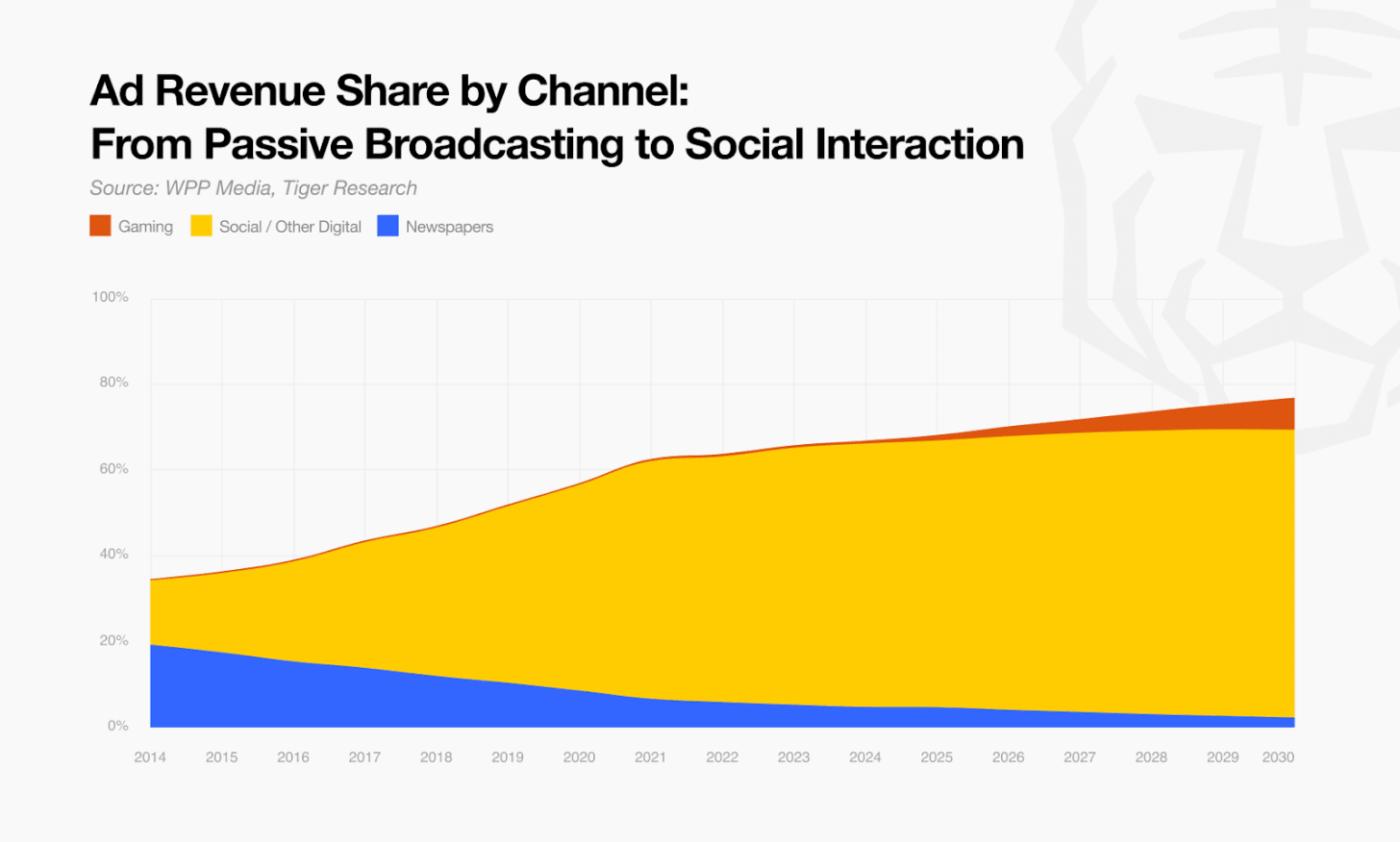

Media outlets facing limitations in diversifying their revenue models will find a new breakthrough by introducing prediction markets. Readers will go beyond simply consuming articles and engage directly by betting on news outcomes. This will be a powerful tool for improving media outlets' revenue structures while also driving reader engagement.

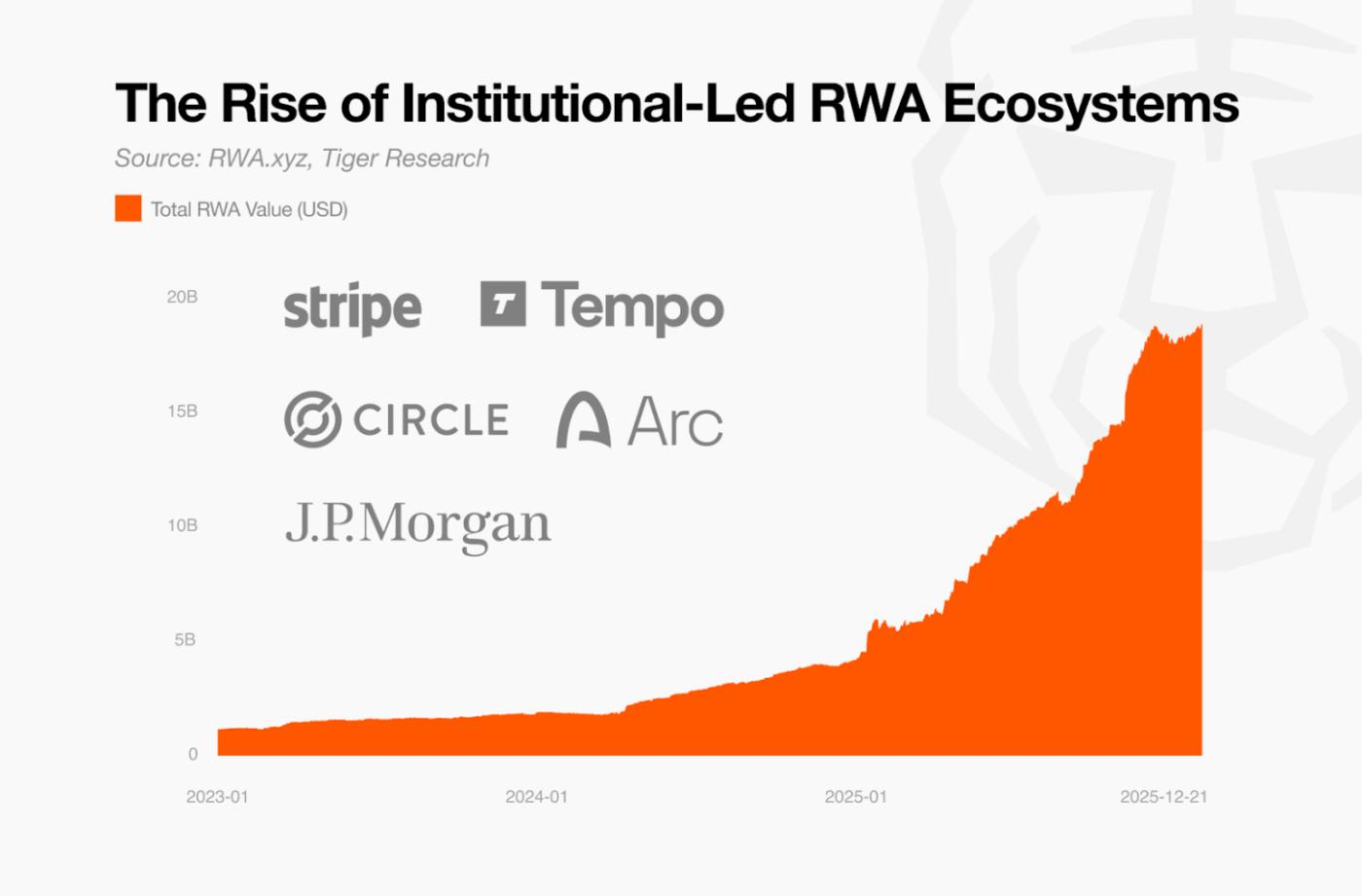

Ultimately, traditional financial institutions are the key players supplying products to the RWA market. From the perspective of financial institutions, who must directly control and secure their assets, there's little practical benefit to borrowing from external blockchain platforms. Ultimately, they're likely to build their own chains and lead the market. RWA projects without the ability to independently supply products will lose competitiveness and be marginalized in the market.

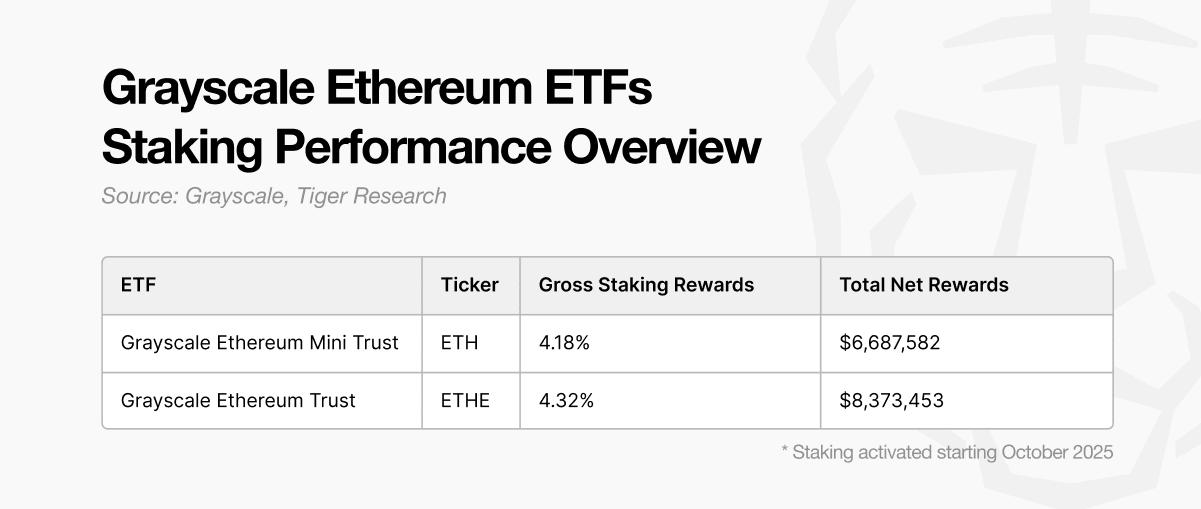

As Ethereum staking ETFs become established in the market, demand for additional returns will intensify among Bitcoin ETF investors. Bitcoin finance (BTCFi) services are the solution to this. Ultimately, the demand to increase the usability of the large assets inflowing through Bitcoin ETFs will become the driving force behind the revitalization of the BTCFi industry.

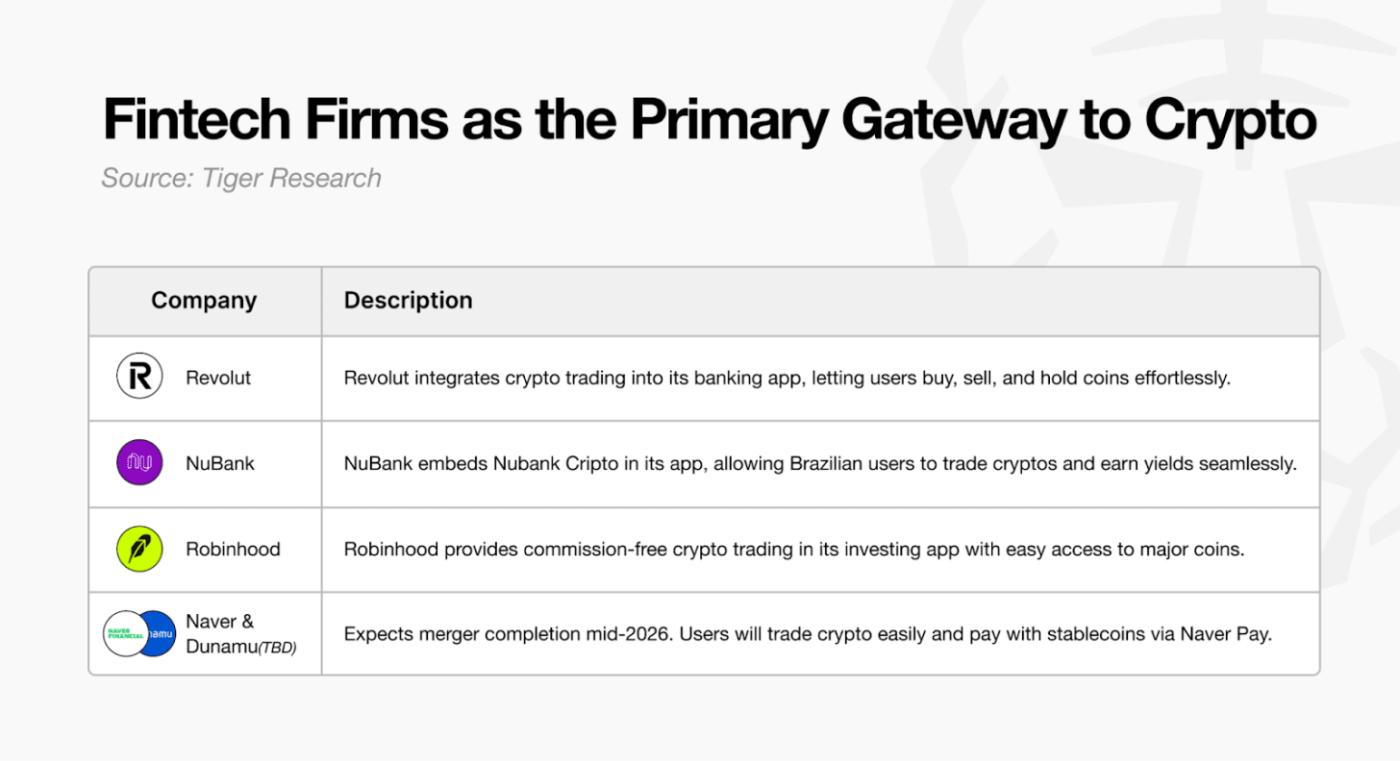

As cryptocurrency regulations become clearer, cryptocurrency trading within accessible fintech apps is becoming more common. New users no longer need to install unfamiliar exchange apps. Instead, they can simply trade cryptocurrencies through the fintech apps they already use. This is the era of fintech services.

The transparent disclosure of all transaction details on blockchain presents a vulnerability for institutional investors, exposing their investment strategies. Institutions that manage massive amounts of capital do not want their transaction history to be publicly disclosed in real time. Therefore, privacy technologies that enable the safe management of large sums of money are expected to become essential infrastructure for institutions to enter the market with confidence. Only by maintaining the security of transaction information can significant institutional capital flow be fully realized.

이번 리서치와 관련된 더 많은 자료를 읽어보세요.

Disclaimer

This report has been prepared based on reliable sources. However, we make no express or implied warranties as to the accuracy, completeness, or suitability of the information. We are not responsible for any losses resulting from the use of this report or its contents. The conclusions, recommendations, projections, estimates, forecasts, objectives, opinions, and views contained in this report are based on information current at the time of preparation and are subject to change without notice. They may also differ from or be inconsistent with the opinions of other individuals or organizations. This report has been prepared for informational purposes only and should not be construed as legal, business, investment, or tax advice. Furthermore, any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Tiger Search Report Usage Guide

Tigersearch supports fair use in its reports. This principle allows for the broad use of content for public interest purposes, provided it does not affect commercial value. Under fair use rules, reports may be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo must be included. Reproducing and publishing materials requires separate agreement. Unauthorized use may result in legal action.