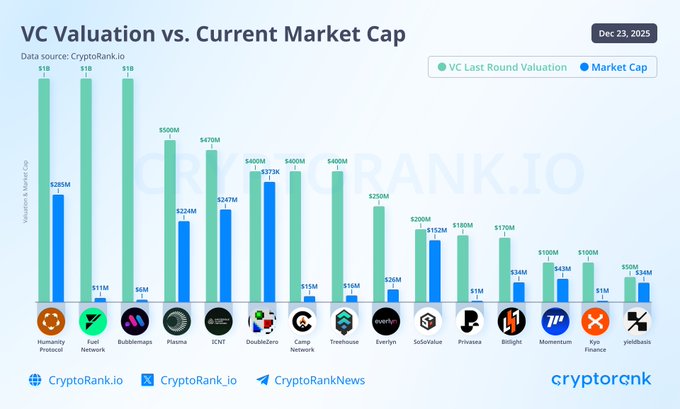

At first glance, this chart looks bad. (Tbh it is bad only)

Projects down 70-99% from their VC valuations but there's a problem with how it's set up.

The chart compares VC valuation (FDV, counting ALL tokens) and current mcap (only tokens actually circulating) which are mixing metrics.

Say a project raises at $1B FDV.

» Only 10% of tokens circulating = 100M tokens

» Token price = $1

» Mcap = $100M

» Here FDV = 1B tokens × $1 = $1B

Six months later unlocks happens, now.

» 20% circulating = 200M tokens

» Since demand didn't double with supply, so price drops to $0.75

» Mcap = 200M tokens × $0.75 = $150M

» FDV = 1B tokens × $0.75 = $750M

The chart shows a 85% drop ($150M market cap vs $1B VC valuation) but actually FDV went from $1B ➝ $750M which is a 25% decline and token price went from $1 to $0.75 (25% decline)

The drop looks massive because you're comparing today's mcap (circulating only) to the original FDV (all tokens) which is not the same thing. Tho some projects did experience genuine near-total losses in due to poor performance.

The correct way👇

1. FDV at raise vs FDV now

2. Token price at launch vs token price now

Most retail investors who bought at launch got crushed as 84.7% of all token launches in 2025 ended up below their launch price.

It's mainly because of 3 reasons...

1. VCs bought early at prices far cheaper than public launch. When retail buys at TGE, they're paying FDV while VCs hold cheap tokens. Here retail loses unless explosive growth happens and it didn't

2. Token unlocks flooded the market. Most projects launched with 10-30% circulating supply. The rest was locked and scheduled to release over time and that dilution killed any chance of holding launch valuations

3. When the market corrected, projects without real revenue or adoption got liquidated. Capital rotated to Bitcoin

The market stopped rewarding narrative alone. Projects needed actual revenue, real adoption and liquidity. If you had none of that, you got repriced 80-90% down regardless of VC backing.

This is healthier longterm, but painful short term for anyone caught holding these tokens.

Fundraising Digest

@CryptoRank_VCs

12-23

VC Valuation vs. Current Market Cap

During bull runs and narrative hype, VCs tend to overprice projects and assign aggressive valuations.

However, once sentiment fades or the narrative loses traction, most projects get a reality check and the market resets those euphoric

Yesserrrr

biggest lesson for VCs

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content