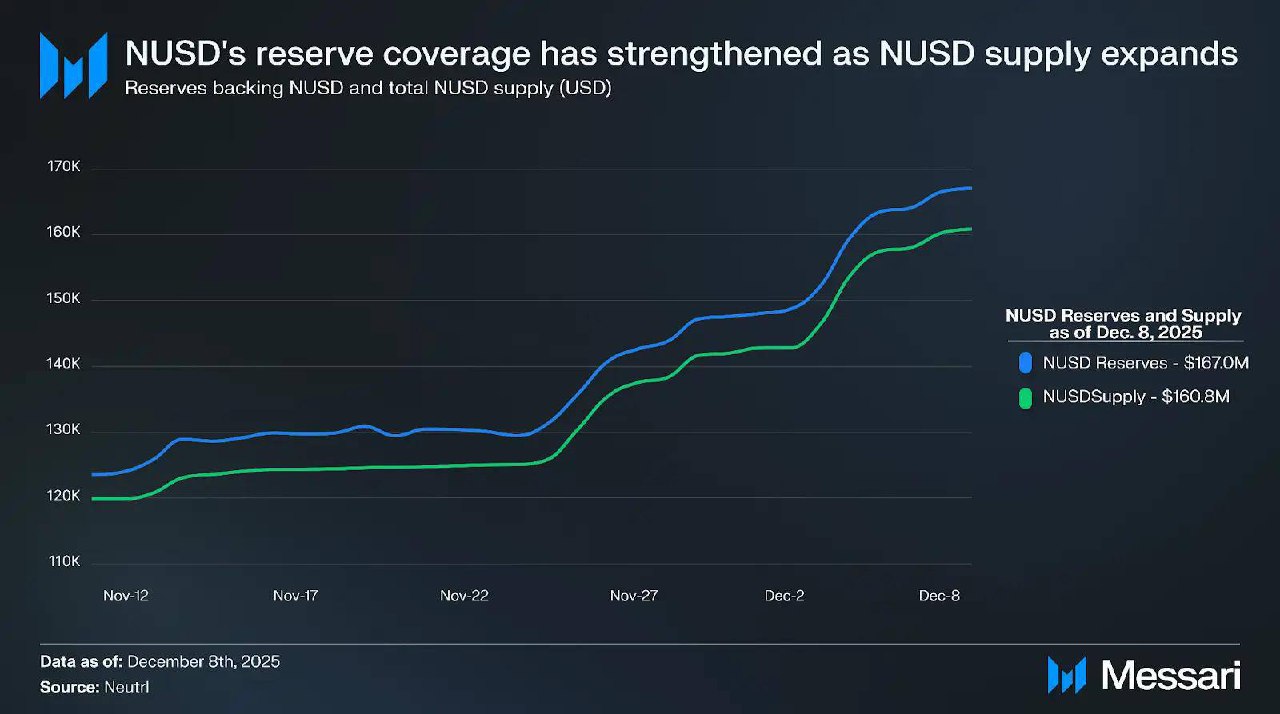

For synthetic dollars, solvency is simple: reserves vs circulating supply. Neutrl kept reserves consistently above NUSD throughout expansion, with the buffer widening as OTC tranches vested and hedges accrued funding. As of Dec 8, 2025, reserves sit ~3.9% above supply — conservative by design, with locked and illiquid assets deliberately undercounted.

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content