Markets continue to move sideways as wait-and-see attitudes flow in ahead of option expiration.

Tether dominance approaches 6.27%, trend assessment suspended

Investor sentiment is weakening amidst altcoin differentiation.

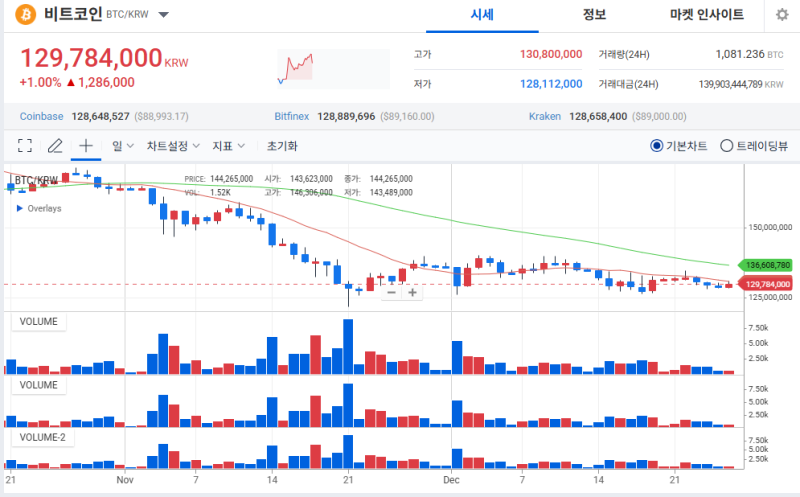

Bitcoin has been unable to establish a clear direction since its morning surge, with a wait-and-see attitude influx, wary of increased volatility before options expiration, and is continuing to fluctuate only slightly around the $88,800 level as of 3:30 p.m.

In the market, Tether dominance is attempting to break below 6.27%, but no clear signs of a breakout have yet been confirmed. Consequently, capital flows into risky assets across the board are not yet in full swing. In the Sigbit futures market, long positions remain dominant at 62.70%, but prices remain sideways, limiting active trend betting.

In the altcoin market, Ethereum (ETH) defended the $2,900 level and showed a relatively stable trend compared to Bitcoin.

Despite options expiration risk, Ethereum maintained a range-bound trend with limited spot selling pressure. Meanwhile, XRP's collapse of a key support line and concerns over whale selling dampened investor sentiment. Overall, the altcoin market continues to experience a differentiated trend, with no clear buyer.

The prevailing market analysis is that Bitcoin's short-term trend is likely to be determined by the direction of Tether dominance after options expiration, and whether it breaks below 6.27% is identified as a key variable for future rebound attempts.

◇ Bitcoin = As of 4:00 PM today, Bitcoin (BTC) was trading at 129,591,000 won on Upbit, with Bitcoin dominance at 57.78%. Based on Sigbit, the long-short ratio in the futures market was 62.70% long and 37.30% short, indicating a bullish bet, but the price remained in a downward trend.

◇ Rising Coins = As of 4:00 PM today, the coin with the largest increase on Upbit was Clearpool (CPOOL), soaring 22.42% compared to the previous day. Clearpool (CPOOL) is a project that provides a decentralized credit marketplace that supplies uncollateralized credit to crypto-native institutions. It aims to build a new form of credit infrastructure by bridging traditional finance and decentralized finance.

◇ Fear and Greed Index = Alternative's Fear and Greed Index stood at 20 points, indicating "extreme fear." As the index remains at this level of extreme fear, investor sentiment remains conservative, and the potential for increased volatility remains.

◇ RSI = RSI 58 Stochastic 70.6 is a clear oversold signal, so there is still room for a short-term technical rebound.

Lee Jeong-seop ljs842910@blockstreet.co.kr