Author: Stepan | squads.xyz

Original title: Random end of year shower musings on the state of the stablecoin economy and its participants

Compiled and edited by: BitpushNews

2025 has clearly demonstrated one thing: stablecoins have gained a foothold, and their underlying infrastructure will become the cornerstone of the financial services industry over the next decade.

As the year draws to a close, I've been reflecting on where we are, the lessons learned in 2025, and where we're headed. Here are some observations on the stablecoin economy as we enter 2026 .

A few points to note beforehand:

Claude and Deni also contributed to this article.

Squads is a fintech company, not a bank or digital asset custodian.

The contents of this article do not constitute financial advice.

The charts and images in this article were generated by Nano Banana and are styled with inspiration from Tom Sachs's aesthetic, which I greatly admire.

Data Overview

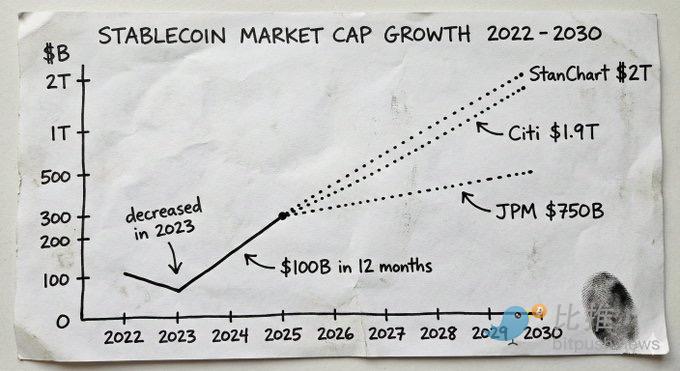

In 2025, the stablecoin market size exceeded $300 billion, compared to only $205 billion at the beginning of the year. In less than twelve months, the new supply was nearly $100 billion.

In contrast, total supply increased by $70 billion in 2024, while it actually declined in 2023.

These forecasts reflect the institutions' strong conviction. JPMorgan Chase predicts that the market capitalization of stablecoins will reach $500 billion to $750 billion in the coming years. Citigroup's base case forecast is $1.9 trillion by 2030. Standard Chartered predicts it will reach $2 trillion by 2028. Currently, stablecoin issuers are among the top ten holders of US Treasury bonds globally.

This is no longer primarily a cryptocurrency story. It's a story about money. And the infrastructure, services, and products that capture this growth will be among the most valuable things built over the next decade.

What did we learn from the Synapse incident?

Part of the driving force behind this shift is the growing recognition that the underlying infrastructure of stablecoins offers fundamentally different assumptions of trust. This is not only because building on stablecoins is cheaper and faster (though that's true), but more importantly, because you trust the math and code, not the centralized entity's "trust me" promises about "where your money is."

To understand why this is important, look at what happened with Synapse.

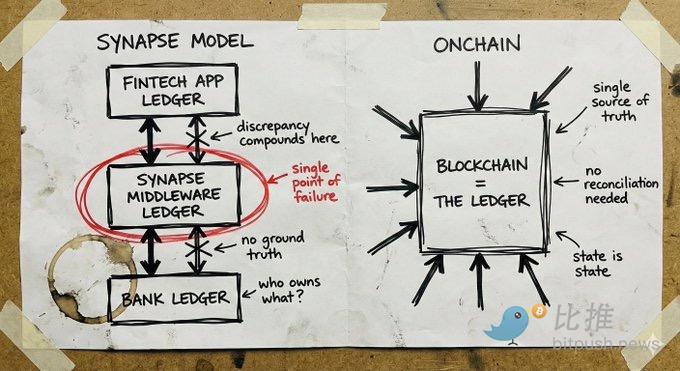

Synapse Financial Technologies was once a model Bank-as-a-Service (BaaS) company. Backed by top investors, it connected over 100 fintech partners with FDIC-insured banks, serving approximately 10 million end users. Its marketing was brilliant: fintech companies gain banking capabilities without becoming banks; banks gain distribution channels without developing apps; and consumers enjoy a modern experience while receiving traditional protection.

In April 2024, Synapse filed for Chapter 11 bankruptcy protection. More than 100,000 people lost access to their funds. The court-appointed trustee found a gap of $65 million to $96 million between the amount customers were entitled to and the amount the bank actually held. At a hearing in December 2024, the trustee (former FDIC chairperson) compared the situation to her father's experience of losing all his savings when Yugoslavia broke up.

The root cause lies in the failure of accounting records and reconciliation collapses at the middleware layer. Synapse is responsible for recording the ownership of assets between fintech companies and banks. When this system fails, there is no traceable "truth." Banks blame each other. Fintech companies have no direct relationship with customer funds. Ordinary people watch helplessly as their savings vanish amidst the uncertainty of the bureaucratic system.

The cryptocurrency space has also seen its own catastrophic failures: FTX , Celsius , and Terra /Luna. But these failures stemmed from centralized custodians using deposited assets for high-risk bets. Their reasons for failure are the same as Synapse's: opaque systems where it was too late for anyone to see what was actually happening.

The failures of traditional fintech and the crypto space teach us the same lesson: when you can't see where your money is, you can't know if it's safe .

Self-custody and Insurance Issues

Self-custodied stablecoin accounts alter the risk model in some way, making FDIC insurance less necessary in many use cases.

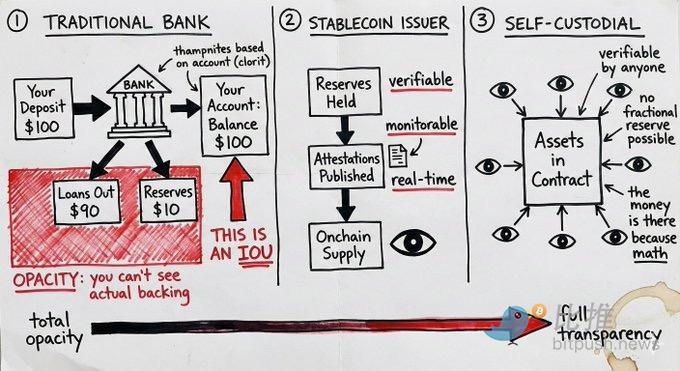

Traditional banking operates on a fractional-reserve basis. When you deposit funds, the bank lends out the majority, keeping only a small portion on hand. Your "balance" is essentially an IOU. If enough people simultaneously demand withdrawals, or if the bank's loans become bad debts, the money is no longer there. FDIC insurance is designed to protect against this failure mode. It insures against mismanagement of your funds by banks.

Self-custodied stablecoin accounts operate differently. Assets reside within smart contracts. Anyone can verify the presence of funds at any given time. They are not promissory notes or claims on fractional reserves, but rather actual assets under user control. There is no counterparty risk arising from bank lending decisions.

However, this argument often overlooks one crucial point: stablecoins inherently carry issuer risk. A smart contract filled with USDC offers no benefit if its issuer, Circle, faces a regulatory crisis or a reserve run. Holding USDT is essentially a bet on Tether's ability to manage its reserves. Self-custody eliminates intermediary risk, but not issuer risk.

The difference lies in the fact that issuer risk is monitorable. You can view the reserve certificates. You can observe on-chain fund flows. You can diversify across different issuers. In contrast, traditional banking risk remains hidden in the institution's black box until a catastrophic event occurs.

This does not mean that self-custody is suitable for everyone. Large institutions may still require regulatory frameworks and insurance products. However, for many use cases, a self-custody model with monitorable issuer risk is superior to an opaque institutional trust model that requires insurance coverage.

Global Reach and the Last Mile Problem

Stablecoins offer something that traditional fintech cannot: true global reach from day one.

A wallet can be used anywhere. Smart contracts don't care which jurisdiction their users are in. Transactions between stablecoins are inherently borderless. This infrastructure can operate instantly and globally for businesses paying remote contractors, managing funds across entities, or settling accounts with suppliers that accept stablecoins.

Compare this to the traditional model of international expansion: you need local banking partners, local licenses (often different licenses for different businesses), a local compliance team, and a local legal entity. Each country is essentially a new startup. This is why most digital banks either operate only domestically or spend years expanding to only a few markets.

Revolut has been working on this for nearly a decade, but has yet to achieve full coverage.

The bottleneck of stablecoin infrastructure lies in the "last mile": connecting to fiat currency . Fiat currency deposits and withdrawals still require local licenses and local partners. You can't completely get rid of this.

However, there's a world of difference between "we need to solve the fiat currency connectivity problem in this market" and "we need to completely rebuild the entire banking technology stack in this market." The "last mile" is modular. You can partner with local coordination service providers for fiat currency exchange without rebuilding your core infrastructure from scratch. You can reach most of the world through stablecoin channels and then gradually integrate fiat currency partners where needed.

Traditional fintech companies simply cannot launch services without establishing a complete technology stack in every market. Native stablecoin companies, on the other hand, are global from their inception, gradually solving the last-mile problem based on demand. This is a fundamentally different expansion equation.

The debate over blockchains built for specific purposes

Several well-funded teams are building new blockchains specifically for stablecoin payments. Their core idea is that existing blockchains are optimized for transactions, not payments, while a specially built infrastructure will provide better throughput, lower latency, and compliance tools tailored to specific payment needs.

This is a sound idea, proposed by a group of bright people. Stripe and Paradigm are building Tempo, and Circle is building Arc.

However, there is a counterargument worth considering.

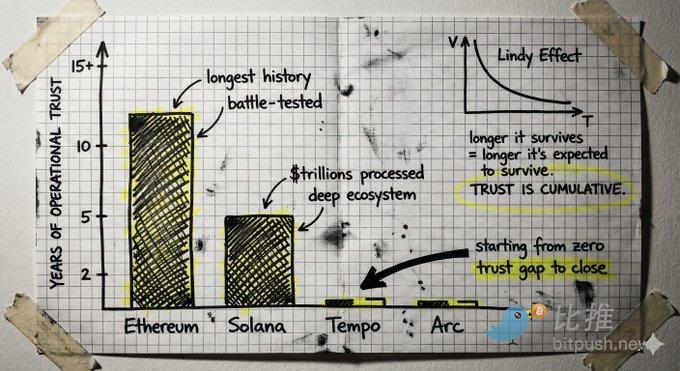

Building a new Layer 1 from scratch means rebuilding trust from zero . Blockchain is a trust machine, and trust is accumulated through operation. It stems from years of no catastrophic failures, from protecting billions of dollars without vulnerabilities, from a developer ecosystem with a deep understanding of boundary conditions, and from code that has withstood attacks. This is the Lindy effect applied to infrastructure.

Mature chains possess this accumulated trust. Solana has processed trillions of dollars in transaction value and boasts well-established tools, wallets, bridges, and integrations. Ethereum has an even longer operational history. The question is whether the gap between the functionality these chains currently offer and the specific needs of payment is greater than the trust gap that new chains must bridge.

There is also the consideration of neutrality. Chains controlled by large payment companies, regardless of their perceived "neutrality," have the company's interests embedded in their architecture. Building on truly neutral public infrastructure offers different levels of security.

Agentic Finance

Today, when people talk about Agentic Finance, they often imagine intelligent agents that can manage your financial life: making investment decisions, managing your portfolio, and optimizing your overall financial existence on your behalf.

That's not a real opportunity yet, at least not now.

The real opportunity lies in the mundane and tedious tasks. It's about having agents handle the routine financial processes that currently require manual intervention: monitoring invoices, comparing them with purchase orders, initiating payments, processing expense reimbursements, and executing recurring transactions. It's not about replacing human judgment on critical decisions, but rather automating those time-consuming and logistically challenging tasks.

The question is: How do intelligent agents actually move funds?

Traditional payment channels are designed for humans. They assume that the transaction is initiated by a person with credentials. Providing intelligent agents with bank login credentials is both a security nightmare and a compliance violation. Intelligent agents may become delusional, manipulated, or err at machine speed.

This is precisely where stablecoin channels and smart contracts become truly important. The agent doesn't receive credentials; instead, it receives a set of restricted permissions encoded in the smart contract: a maximum movement of X dollars per transaction, funds can only be transferred to pre-approved addresses, and permissions can only be used at specific times or for specific purposes. These constraints are enforced by the code. The agent is architecturally incapable of overstepping its authority because the permission definitions are an integral part of its architecture.

The verifiable, bounded, and transparent trust assumptions provided by blockchain are precisely the core elements needed when software autonomously moves funds. Traditional systems require you to trust that the agent will not misbehave. Smart contract systems, on the other hand, are architecturally designed to prevent misbehavior within predefined constraints.

This doesn't eliminate all the problems. What happens when an agent makes a mistake within its limited permissions? Who is responsible when an agent approves an invoice that is technically compliant with all coding standards but is actually fraudulent? These questions need answers.

However, this starting point for enforcing permission boundaries through the architecture is inherent in blockchain systems, and modifying it for traditional channels is extremely difficult. Autonomous finance will eventually arrive. And the infrastructure that ensures its security will inevitably be native to stablecoins.

Reflections on Security Issues

The gold rush in the stablecoin space is attracting teams with vastly different security philosophies. Unfortunately, this won't end well for some of these teams (and their clients as well).

A pattern is emerging: act quickly, acquire users, and solve problems later. Teams use a vague definition of "self-hosting" to obscure the actual trust model. They rush into integration without proper security and vendor vetting. They take shortcuts in key management. They treat operational security as a cost center.

Some of the reasons are understandable. The market is developing rapidly. Competitive pressure is immense. Spending an extra X months on security work could mean competitors gain market share.

This trade-off makes sense in most industries. But it's not the case in the financial infrastructure sector.

Building a bank, or any institution like a bank, means spending decades, not quarters, building trust. It means managing risk conservatively, even if an aggressive approach might lead to faster growth. It means creating systems capable of handling unforeseen edge cases.

The teams that will win in 2026 and beyond will be those with genuine domain expertise and a safety-first philosophy.

Privacy issues

One of my less mainstream views is that, so far, privacy in the cryptocurrency space has largely been just a concern to tick. The lack of substantial privacy hasn't been a hindrance to trading, DeFi, and speculation. The entire ecosystem functions largely well with pseudonyms and public transaction history.

However, this will change as stablecoin infrastructure brings real business and productive economic activities onto the blockchain.

Privacy becomes paramount when legitimate companies utilize stablecoin channels for their financial operations. Competitive intelligence leaks are a real concern: your suppliers, customers, and cash flow are readily available to anyone willing to look. No serious company wants its financial operations exposed to competitors, and no CFO would willingly relocate critical financial activities to a channel where every transaction is publicly analyzable.

This is a problem we need to solve today so that it doesn't become a bottleneck for future adoption.

The good news is that stablecoin privacy models don't require a full-fledged cypherpunk vision to become a reality. We don't need complete anonymity. What we need is selective disclosure, which is a fundamentally different goal.

Selective disclosure means proving what needs to be proven without revealing everything else. Proving you have sufficient funds without showing your balance; proving a transaction is compliant without disclosing counterparty details; proving your identity is compliant without submitting documentation. The fund owner sees everything, the system verifies everything required for compliance, while others only see the deliberately disclosed information.

We have the technology to solve this problem. I have spoken with many outstanding teams that are building excellent privacy infrastructure.

The problem is that this technology is still in its early stages. These codebases are massive, difficult to audit, difficult to formally verify, and untested in real-world scenarios. They require trust and security assumptions that are entirely different from the infrastructure we have already built. The cryptocurrency ecosystem has spent years reinforcing its core protocols, accumulating the kind of operational trust that can only be gained through attacks and edge cases. Adding a new, unproven layer of privacy has the potential to undermine this foundation.

The real challenge lies in how to add privacy features without making significant compromises to security. This might mean embedding privacy features deeper into the first-layer protocol, or finding a way to avoid relying on new encryption systems on a large scale.

Looking to the future

The growth story of stablecoins in 2025 mainly revolves around migrating existing fintech offerings to better infrastructure: payments, yields, spending, and card services. Think of globalized Mercury or on-chain Revolut. This is great. It's faster, cheaper, and allows access to markets that traditional fintech has struggled to reach for years.

However, stablecoin channels unlock far more than simply doing the same thing more efficiently. You gain programmable money. You gain access to the internet capital markets, where truly novel financial primitives are being constructed every day. You gain the ability to enable intelligent agents to manage funds under truly secure conditions, not just by trusting that they won't do evil.

This is an opportunity for us to rethink what financial services should truly look like.

I haven't seen enough teams pursuing this yet. The opportunity is right in front of us, but most players in the industry are still just running the 2015 fintech game on a new track. I hope to see this change by 2026.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush