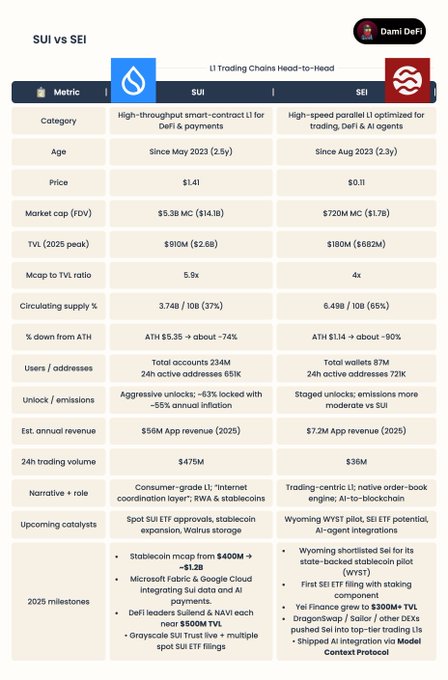

Everyone throws $SUI and $SEI into the same basket, the numbers say they’re not even close.

$SUI vs $SEI

[Head to Head Series #5]

$SUI to me feels like the more grown up play.

Bigger mcap, way higher app revenue, almost $1B TVL (after peaking at $2.6B), and a serious stablecoin + RWA push.

You’ve got ETF filings, Grayscale trust, big DeFi names (Suilend/NAVI), and real volume.

The flip side is heavy unlocks and ~37% of supply circulating, so dilution is the main thing to respect.

$SEI is more of a niche, trading-first chain.

Smaller mcap, lower mcap/TVL ratio, and much lower revenue today, but it’s jammed with active addresses, growing gaming + perp activity, the Wyoming stablecoin pilot angle, and AI integrations.

It looks more like a higher-risk, higher-reward bet that they can become the main chain for trading and AI.

Verdict:

Fundamentals winner for me is $SUI, bigger revenue engine, deeper TVL, stronger stablecoin/RWA story.

$SEI is the leaner, higher-beta underdog, but if I had to pick one to back for this cycle, I’d personally lean $SUI and treat $SEI as the smaller bet.

for me... $SEI > $SUI

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content