2025 is almost over, and the crypto market hasn't seen any miraculous price movements. Instead, it has brought back the exaggerated price predictions of the past two years.

First, let's talk about the current prices: As of 8:00 AM Beijing time on December 27th, Bitcoin was approximately $87,423 and Ethereum was approximately $2,926.

With the numbers laid bare, previous predictions like "Bitcoin will hit $200,000" and "Ethereum will break $10,000" seem rather embarrassing. Market fluctuations, policy shifts, international situations... everything reminds us: predictions are predictions, and market conditions are market conditions.

Let's take a look at those "predictions" that we used to idolize, which have since been proven wrong by reality .

BTC: Major institutions are collectively bullish.

In 2023–2024, with the approval of ETFs , the shift in US political climate, and the improvement in macro liquidity, almost all major institutions and opinion leaders publicly gave clear BTC price anchors for 2025.

Michael Saylor ( Strategy ): Reaching six figures by 2025, and eventually $1 million.

BTC $100,000 (2025)

Long-term goal: $1,000,000

Saylor's assessment is not merely a price prediction, but rather a comprehensive long-term narrative of "Bitcoin as a digital capital network." He repeatedly emphasizes that BTC will not fall below $60,000 before 2025.

BTC did indeed maintain a stable high level for a long period in 2025, but the "certain outcome" of $100k did not materialize as expected.

Mark Yusko (Morgan Creek CEO): 2025 150,000

Prediction : BTC $150,000 (2025)

Logical basis : Network effects/FOMO-driven/New capital inflow

This is a typical "cycle top pricing model," which assumes that the current bull market will completely replicate the historical magnitude.

However, the problem is that ETFs bring about "structural changes" rather than simply "leveraged cycles".

Tom Lee (Fundstrat co-founder): $250,000

Prediction : BTC $250,000 (2025)

Key Catalyst : He believes that changes in the US political landscape and the potential for government ownership of Bitcoin are key catalysts. He states that these developments indicate Bitcoin is becoming a legitimate alternative to traditional stores of value such as gold.

Tom Lee's prediction for 2024 was highly influential, but it also heavily relied on the premise of "the simultaneous resonance of policy, sentiment, and funding."

It's worth noting that Tom Lee repeatedly lowered his BTC forecasts in 2025, but still emphasized at the end of the year that a new high was possible in the short term. In the past week, Sean Farrell, head of digital asset strategy at Fundstrat, predicted in an internal report that BTC could fall to $60,000-$65,000 in the first half of 2026 (baseline scenario). This contrasts with Tom Lee's public optimism, which the company explains as a difference in perspective across different timeframes.

Standard Chartered: Nearly $200,000

Prediction : BTC $200,000 (2025)

Logical Benchmark : Historical gains of gold ETFs since their listing. The bank expects that a large influx of funds into Bitcoin spot ETFs will drive this growth, similar to the fourfold increase in gold prices after the first ETF was launched.

Unlike gold, Bitcoin did not enter a one-way trend after the launch of ETFs, but instead experienced more frequent pullbacks and repricing.

AllianceBernstein: $200,000

Predicted timeframe : September 2025

Additional judgment :

$500k in 2029

$1M+ by 2033

This is one of the few institutional forecasts that provides a clear monthly anchor . However, reality shows that the time anchor is the most prone to error in all forecasts.

InvestingHaven: 115,200 (Bull Market) / 75,000 (Bear Market)

Prediction method : Scenario analysis

This is one of the few models that simultaneously provides both bull and bear market ranges . Even so, its bull market target was not fully achieved in 2025, while the bear market range was repeatedly validated by the market.

Tim Draper (Venture Capital): $250,000 (revised)

As an early investor in companies such as Tesla, Skype, Baidu, and Twitch, Draper previously predicted that Bitcoin would reach this price in 2022, later revising his prediction to 2025.

Matthew Sigel (VanEck Research Director): $180,000

Prediction : BTC will reach $180,000+ in 2025.

logic :

ETF inflows

US political cycle changes

But the reality is that ETFs tend to raise the bottom more than they trigger a breakout at the top.

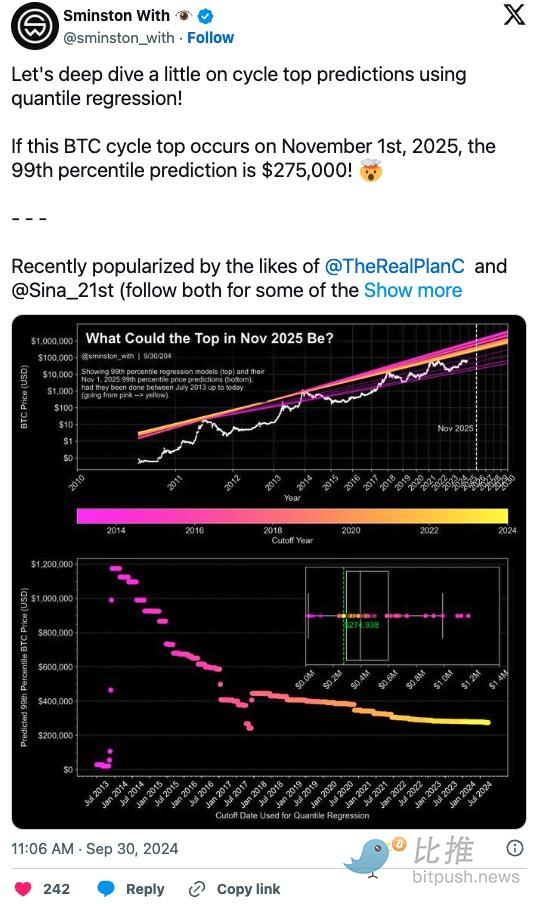

Sminston With (Crypto Researcher, PhD): $275,000 USD

Bitcoin researcher Sminston With used quantile regression to predict the cycle top, which he believes will arrive on November 1, 2025, at which time the price of Bitcoin will reach $275,000.

By the end of 2025, this assessment will have clearly become invalid.

Cathie Wood (ARK Invest): $1 million

Benchmark: $650,000 USD (2030)

Optimistic: $1 million+

Strictly speaking, this prediction has not yet been proven wrong, but it represents a long-term version of the same logic.

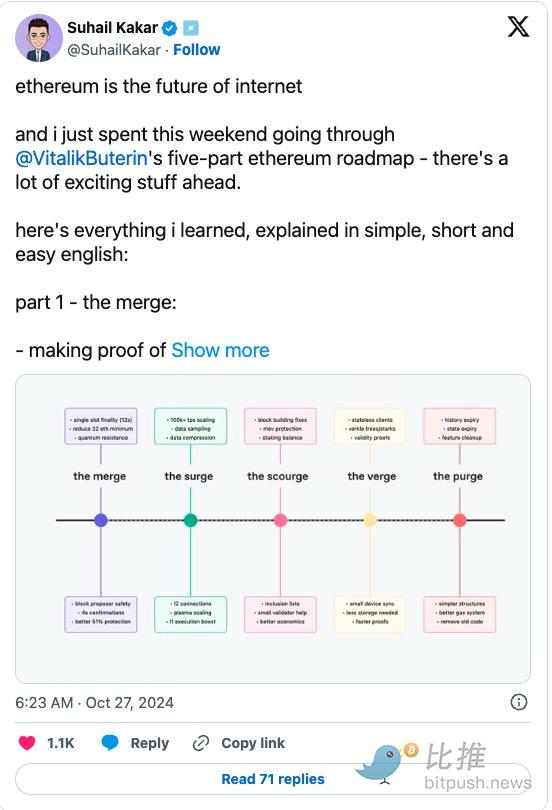

ETH: Predictors bet on "upgrade payout"

In 2025, ETH's fundamental narrative did not fail, but the price refused to pay for the narrative.

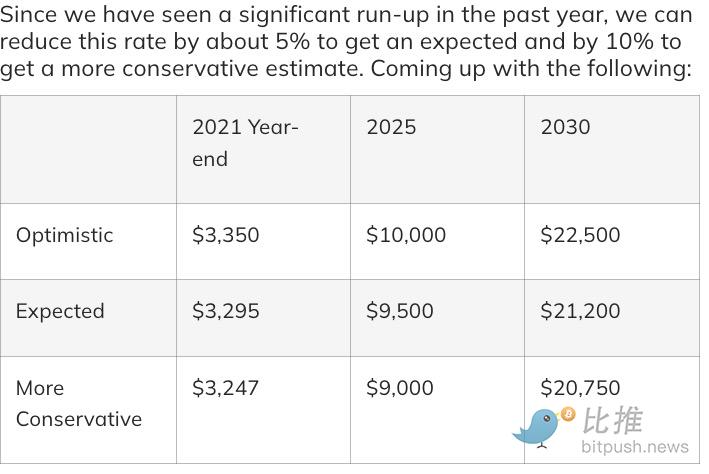

2025: Optimistic $10,000 / Expected $9,500 / Conservative $9,000 .

Standard Chartered Bank: A $14,000 "ETF + Upgrade" Path

In 2024, Standard Chartered predicted that ETH could reach $14,000 (in 2025) , with one of the key catalysts being ETFs. However, by 2025, Standard Chartered had revised its year-end ETH forecast upward to $7,500.

Finder Analysts: In February 2024, the average forecast of ETH by 50 analysts was $6,105 (2025).

VanEck predicts that Ethereum will reach $11,800 by 2030, citing network growth and adoption.

Bitwise predicts Ethereum will reach $7,000 by the end of 2024 and will be on par with new highs for BTC and SOL in 2025.

Bankless : After believing that Ethereum will realize its potential in 2025, the pessimistic price level is $10,000 and the fair price level is $15,000.

summary

The market rally in 2025 has indeed prompted reflection—relying on past experience to predict the future is increasingly ineffective in the crypto market. The once-held "four-year cycle theory" has lost much of its explanatory power due to the impact of large-scale ETF fund flows and a complex macroeconomic environment.

Market forecasting is essentially about finding an anchor point amidst uncertainty. But when the anchor point itself is drifting, who can guarantee accuracy every time? Facing 2026, perhaps what we need is not to rush to find the next "prophet," but to remain patient and flexible—the market will always follow its own trajectory; what we need to do is prepare for it, not obsessively guess.

It's important to clarify that this article does not deny the value of professional analysis. In a market saturated with information, rigorous research remains invaluable. Ultimately, the market will provide the answer, and what we need to do is learn to coexist with predictions while maintaining independent thinking. After all, in this field, there can be many viewpoints, but the true answer is always singular—the market itself.

Author: Seed.eth

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush