Ethereum holding company Bitmine has officially begun Staking Ether after depositing nearly $219 million worth of ETH into Ethereum's Proof-of- Stake (PoS) system.

Ethereum holding company Bitmine has officially begun Staking Ether after depositing nearly $219 million worth of ETH into Ethereum's Proof-of- Stake (PoS) system.

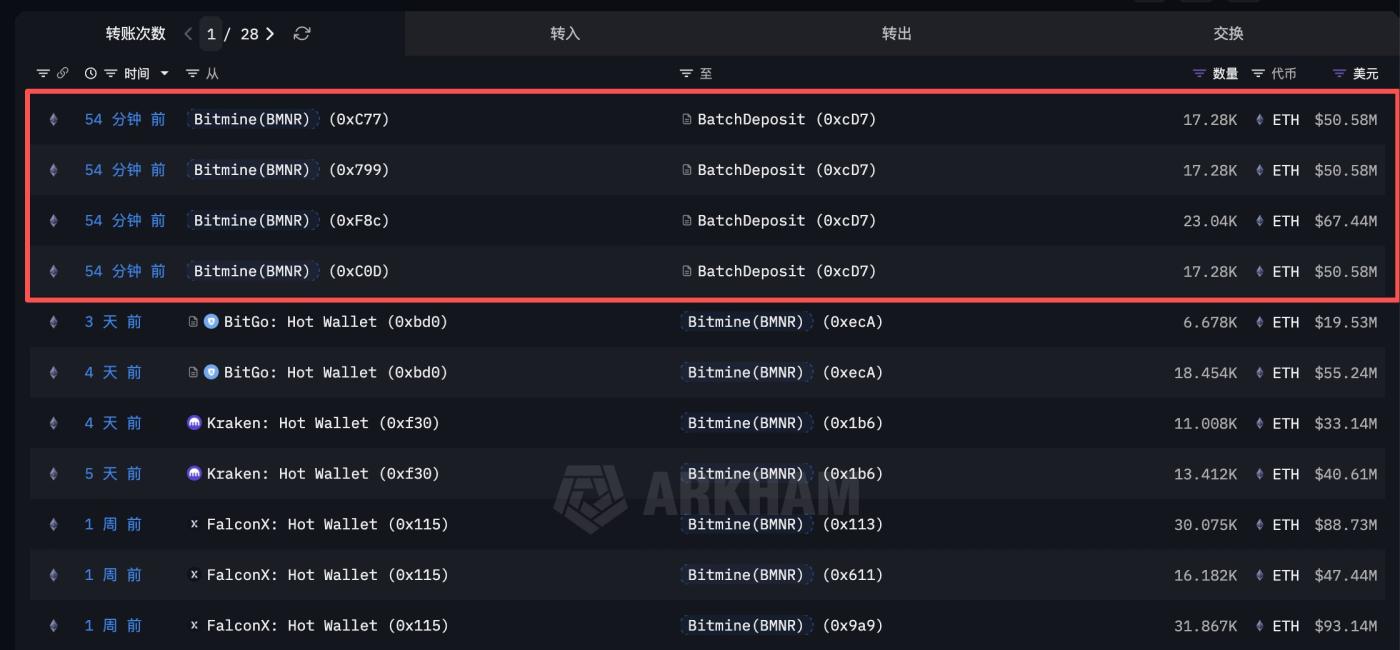

According to on-chain data from Arkham, on Sunday, multiple wallets associated with Bitmine executed transactions transferring large amounts of ETH into a contract labeled “BatchDeposit”. A total of 74,880 ETH were sent — a pattern commonly seen in institutional-scale Staking setups, where Capital are pooled before validator creation.

“The company currently holding the largest amount of Ethereum, Bitmine (BMNR), has finally started Staking its ETH holdings to generate interest income,” on-chain analyst EmberCN wrote on X.

“This is their first time Staking, and Bitmine currently holds approximately 4.066 million ETH with an estimated yield of around 3.12% per year. If all of this ETH were Staking, they could earn approximately 126,800 ETH in interest per year, equivalent to about $371 million at the current price of $2,927/ ETH,” EmberCN added.

Bitmine's ETH holdings surpass 4 million ETH.

The Staking move comes as Bitmine's ETH reserves surpass 4 million Token for the first time. The company confirmed earlier this week that its total holdings had exceeded 4.06 million ETH after an additional purchase worth $40 million.

In just the past week, Bitmine added nearly 100,000 ETH to its balance sheet at an Medium purchase price of approximately $2,991 per ETH.

Earlier in November, Bitmine announced that it expected to officially launch Ether Staking in Q1 2026 through its internal system called the Made-in-America Validator Network (MAVAN) . At that time, the company revealed that it had selected three institutional Staking providers to run a pilot program, using a small amount of ETH to evaluate performance, security, and operational capabilities before scaling up.

Ethereum's TVL could increase tenfold by 2026.

According to Joseph Chalom, co-CEO of Sharplink Gaming, the Total Value Locked on Ethereum could increase tenfold by 2026 as institutional participation deepens and new on-chain Use Case continue to develop. Sharplink is currently the second-largest publicly traded Ethereum holder, with nearly 798,000 ETH worth approximately $2.33 billion.

Chalom emphasized that stablecoins are a key growth driver, forecasting the stablecoin market size will reach $500 billion by the end of next year, an increase of approximately 62% from the current size. With more than half of stablecoin activity taking place on Ethereum, continued expansion of issuance and trading could significantly boost the network's TVL.