Bitcoin is currently trading around $87,820, virtually flat for the day and still down about 4% over the past 30 days. Buyers often appear when Bitcoin prices fall, but each recovery has failed to break out of the narrow price range. The chart now clearly shows why rallies are so easily stalled.

The short answer: Bitcoin's "13% misfortune" problem. A key resistance level on the chain is 13% away from the current price, and until this threshold is breached, price rallies quickly weaken before they can build enough momentum.

Short-term investors create an upper threshold with a cost of Capital barrier.

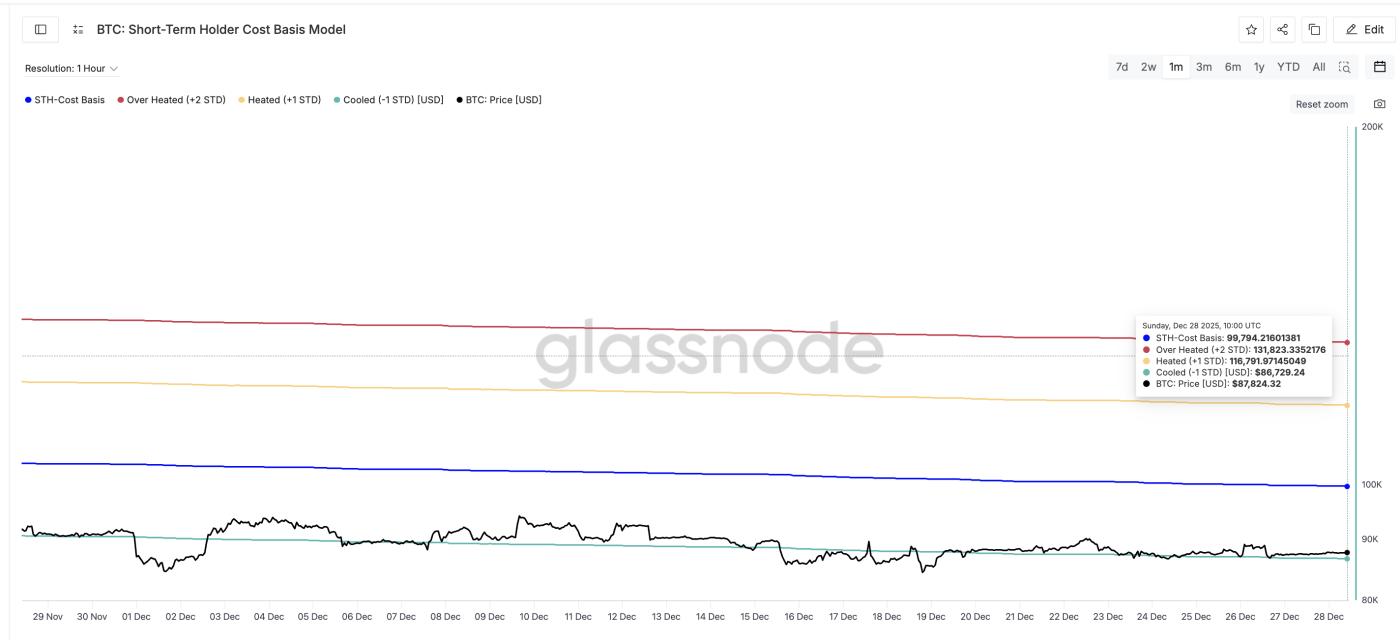

Glassnode 's Short-Term Investor Holding Cost model tracks the Medium price at which recent new buyers are holding Bitcoin. Short-term investors often react quickly to volatility. When the price falls below their entry point, they sell to avoid further losses. This creates an automatic layer of selling pressure, acting like a "price ceiling" on the chart.

Currently, the cost of holding is at $99,790, which is about 13% higher than the current price. At the current price of $87,820, most recent buyers are incurring losses. This is why every time Bitcoin's price surges , it weakens before breaking out of the previous price range: sellers appear consistently early on.

Cost of Holding Model: Glassnode

Cost of Holding Model: GlassnodeWant to read more Token analysis? Sign up for the daily Crypto newsletter from Editor Harsh Notariya here .

HODL Waves data, an indicator that categorizes holding time, also confirms this behavior. The 1-day to 1-week group (short-term investors) reduced their holdings from 6.38% of the total supply on November 27, 2023, to 2.13% on December 27, 2023. These recent buyers are selling Token, rather than holding them, which increases resistance for Bitcoin even before the price reaches $99,790.

Short-term investors reduce their holdings: Glassnode

Short-term investors reduce their holdings: GlassnodeThis makes the $99,790 level the most important resistance for Bitcoin in the short term. However, note that this on- chain resistance level may change as the price fluctuates. Therefore, investors should also confirm this on the technical chart.

If the price breaks above this level, short-term investors will start taking profits, the sell-off may stop, and the supply pressure that has been holding back previous rallies will gradually ease.

The momentum suggests investors are trying to buy in, but not enough to break through.

On the 12-hour timeframe, Bitcoin's price is moving within an isosceles triangle pattern. An isosceles triangle forms when each subsequent peak is lower than the previous peak and each subsequent Dip is higher than the previous Dip , signaling a tug-of-war between buyers and sellers. This is a neutral pattern, requiring a clear breakout to confirm the next direction.

The Chaikin Money Flow (CMF) indicator measures XEM large amounts of money are flowing into or out of the market by monitoring volume pressure. Currently, the CMF is rising along with the price, meaning there is still buying pressure, but the indicator remains below zero.

Buying pressure is not strong enough : TradingView

Buying pressure is not strong enough : TradingViewA CMF below 0 indicates that the inflow of money is not strong enough to confirm an uptrend; therefore, at this rate, it is not yet possible to break through the upper trend line of the triangle.

This explains the current market hesitation. Buyers are present, but they haven't been able to gain the upper hand. Until the CMF crosses above 0 and the price breaks out of the triangle pattern, this triangle pattern only shows an attempt but lacks the strength to completely control the market. The price of BTC continues to be pushed into a sideways range due to selling pressure from short-term investors.

Bitcoin's price levels also highlight the 13% barrier and why it matters.

Bitcoin was largely stuck in the price range of $84,370 to $90,540 for most of the end of December 2023. Each time the price approached $90,540, losing investors would sell to minimize their losses. This perfectly aligns with the "price ceiling" of the holding cost for short-term investors.

Currently, market developments are quite easy to understand.

If the price surpasses $94,600, this will be the first signal that buying pressure is gaining the upper hand. If the price continues to rise and reclaims $99,820 (nearly equal to the short-term investor holding cost zone mentioned above), the "13% black barrier" will be broken, short-term investors will recover, and the selling pressure that hampered previous rallies will significantly weaken. At that point, Bitcoin's price action will shift to bullish .

Bitcoin Price Analysis: TradingView

Bitcoin Price Analysis: TradingViewFrom here, the $107,420 level will be the next target to watch. If buyers fail to maintain the upward momentum, the $84,370 area will be the first support level the market needs to pay attention to. If the daily closing price falls below $80,570, this would be a strong breakout signal, causing trend expectations for January to be adjusted and the price range to potentially decrease.